Where you can carry money in times of instability. TOP-20 of the most reliable banks in Ukraine

Cleaning the banking system significantly narrowed the number of banks that can now be trusted savings. NV together with the investment company Dragon Capital compiled a rating of banks that can be trusted in shaky times.

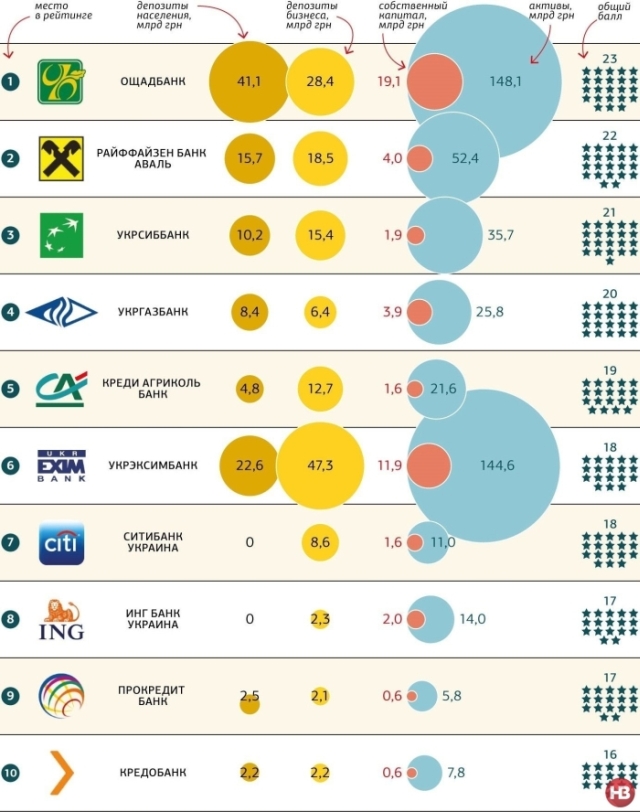

According to the results of the crisis of 2014, the leader of the rating has not changed - they are still the state Oschadbank. This will be explained, first of all, by the support provided by the state to the financial institution both in the form of investing over UAH 9 billion in capital, as well as with a 100% state deposit guarantee, which competitors can not boast of. The first ten were also state-owned Ukrgasbank and Ukreximbank. And here the most important thing is the support of the shareholder, which inspires hope that these banks will not be allowed to go bankrupt.

The government, in the person of the Ministry of Finance, is so powerful in supporting state banks that representatives of the National Bank even have to explain to officials that it is not necessary to pour such a volume of funds into the banks' capital. This can have a negative effect on the entire system - it is highly undercapitalized, and unequal competitive conditions for other players can arise. Investors simply flow into state-owned banks, and this will hit private institutions.

The remaining participants in the top ten are banks with European capital. Raiffeisen Bank Aval this year even pushed Ukreximbank from second place. Beginners of the rating were Ukrainian "daughters" of large multinational structures Citibank and ING Bank, which operate in the corporate segment. Deposits can be opened only by legal entities - and for this reason, the two banks in the rating have not previously participated. However, now reliable banks are worth their weight in gold, and the experts decided to include them in the list.

Banks with 100 percent Ukrainian private capital in the top ten did not hit at all. In connection with the crisis and the war, they were in the most difficult situation. Owners of local institutions are much less able to maintain capital compared to international banking groups and even Ukrainian state-owned banks.

How we felt

The place in the rating was determined by investment company Dragon Capital, based on the amount of points the bank received on the basis of the following indicators:

- Capital adequacy - reflects the stock of equity to cover possible losses from activities.

- Liquidity - reflects the bank's ability to fulfill its obligations without delay.

- Stability of funding - the ratio of loans to deposits, diversification and stability of sources.

- Support of shareholders - belonging to a reliable business group (or public sector) significantly increases the chances of additional financing in case of crisis situations.

- Confidence of depositors - reflects the dynamics of deposits of the population.

- Qualitative indicators - the transparency of the bank's activities, the balance of risk management, reputation.

Data Dragon Capital.

Via nv.ua

Comments

When commenting on, remember that the content and tone of your message can hurt the feelings of real people, show respect and tolerance to your interlocutors even if you do not share their opinion, your behavior in the conditions of freedom of expression and anonymity provided by the Internet, changes Not only virtual, but also the real world. All comments are hidden from the index, spam is controlled.