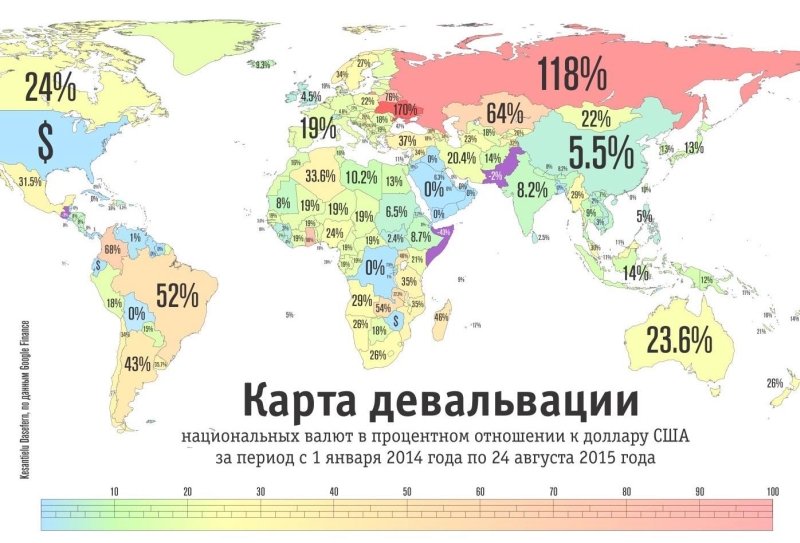

Devaluation card of national currencies as a percentage of the US dollar

The devaluation card of national currencies as a percentage of the US dollar for the period from January 1, 2014 to August 24, 2015.

Devaluation (Latin de - decrease, Latin valeo - to have value, cost) - a decrease in the gold content of a monetary unit under the gold standard. In modern conditions, the term is used for situations of official depreciation of the national currency against hard currencies in systems with a fixed exchange rate established by monetary authorities.

Devaluation - the reduction in the real exchange rate dictated by economic policy (the term is used in the research work of the International Monetary Fund).

Devaluation is seen as an instrument of central banks to manage the national currency, the opposite of revaluation.

In conditions of a floating exchange rate, there is no direct official assignment of the value of the national currency. Therefore, for the situation of depreciation of the currency, the term depreciation is applied, and for the situation of currency appreciation, the term "appreciation". The central bank can only change indirectly by indirect methods (currency interventions). In these circumstances, the depreciation or appreciation will not be the result of the adoption of an official document, but the result of a change in the value of the currency under the influence of market mechanisms.

Devaluation and inflation

The term "inflation" is close in meaning to the term "devaluation", but the former is more often attributed to the purchasing power of the national currency on the local commodity market, and the second is to the purchasing power in relation to foreign currencies. In the sense, both are characterized by a change in purchasing power. Often, the devaluation of the currency may be one of the causes of inflation within the country. However, foreign currencies are also subject to inflation, so inflation is possible without devaluation. If foreign currencies are subject to deflation, then devaluation without inflation is possible.

Types of devaluation

There are official (open) and hidden devaluations. With open devaluation, the Central Bank of the country officially announces the devaluation of the national currency, the depreciated paper money is withdrawn from circulation or the exchange of such money for new, stable loan money (but at a rate corresponding to the depreciation of old money, that is, lower). With hidden devaluation, the state reduces the real value of the monetary unit in relation to foreign currencies, without removing the depreciated money from circulation. Open devaluation causes a decline in commodity prices, the consequence of hidden devaluation is the rise in prices for goods.

Reasons for devaluation

The reasons for the devaluation of the national currency may be inflation or deficit of payment balances. Although the devaluation is caused by macroeconomic factors, the direct depreciation of the currency is caused by the decision of the regulatory authorities in the country. Such a decision could be the official reduction of the exchange rate fixed by the country's leadership, the refusal to support the exchange rate, the refusal to link the currency rate to the currencies of other countries or currency baskets in order to reduce the deficit of the country's balance of payments, increase the competitiveness of manufactured goods on the world market, and stimulate domestic production.

The risks of devaluation

Under the risk of currency devaluation is understood the risk of a sharp stressful depreciation of the currency relative to other currencies. The possibility of assessing the risk of devaluation essentially depends on the form in which it takes place. The reduction of the fixed rate by the country's leadership can be predicted in advance; The spontaneous devaluation caused by the inability of the regulatory authorities to support the exchange rate is difficult to assess. On expectations of a sharp drop in the currency's rate, investors are beginning to invest in more tangible media. But, nevertheless, this is an extreme measure.

Comments

When commenting on, remember that the content and tone of your message can hurt the feelings of real people, show respect and tolerance to your interlocutors even if you do not share their opinion, your behavior in the conditions of freedom of expression and anonymity provided by the Internet, changes Not only virtual, but also the real world. All comments are hidden from the index, spam is controlled.