Collection of Google AdSence checks and registered checks

Increasingly, compatriots have to receive personal checks. Especially regularly, personal checks from the US come by mail to website owners who hosted "advertising" through a free Google AdSence system and receive revenue from impressions of this advertisement. And money gifts in the West between different cities and countries are given, of course, not by transfer to your account, but by registered checks. What you need to do to "take off" the funds addressed to you from the check? This will help our article.

Step One: Look at Check Parameters

Encashment - the so-called operation for cashing funds from a nominal and not just a check. In short, this operation from the perspective of the bank consists of three stages. At first - acceptance from the holder of the check information. Then - check this information in the payer bank by check (the bank in which the account of the person or company that issued the check is opened). Finally, in the case of a positive response from the payer bank, issuance of the amount indicated on the check to the holder of the check.

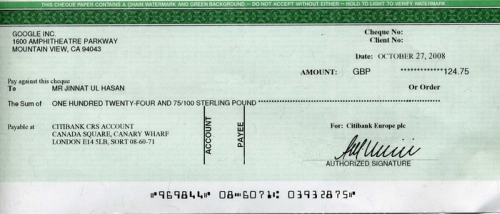

However, before you start calling in banks or plowing their sites in search of a place to receive your check for collection, carefully study the document you received. On the nominal check you should see the following nine parameters:

- Surname or name of the drawer (person or company that issued the check);

- Personal signature of the person or representative of the company issuing the check;

- Name, address, bank details of the payer by check;

- Check currency and amount (in figures and words);

- Surname, name of beneficiary (check holder, recipient of proceeds) or name of beneficiary-legal entity. In the case of a postal item, the address of the beneficiary is also indicated;

- Check number (in the main data field) and again the check number (duplicated below);

- Date of check issue;

- Term of validity of the check;

- Magnetic information strip

At the same time on the check, that it was accepted by the bank, it should not be:

- Fixes;

- Inscriptions on the reverse side;

- The inscriptions "Void" (invalid) or "Сopy" are special watermarks, which clearly appear on photocopies of the check. The presentation of the latter will entail not simply the receipt of a check for collection, but a call to the police bank and the detention of the bearer.

In addition, a nominal check issued in some countries must necessarily contain the name "check" in the language in which it is drawn up. However, this requirement, according to the legislation ( Regulations of the NBU on checks , further: Regulations, p.2.1.a) is not necessarily for a number of the largest countries with long-held check traditions. "The list of these countries is better to clarify with the bank, as a rule, this is the UK, Australia, Canada, USA, Germany."

Particular attention should be paid to the validity of the nominal check. If the front side of the check does not contain an indication of its validity, then according to the international practice of check circulation, it is accepted equal to six months from the date of its issue. The same is advised by the Regulation, 2.1.а, "if the legislation of the country of the drawee does not suggest another option"; Meanwhile, the legislation most of the Western countries also proceeds from a period of six months.

In this regard, you should not hesitate to present a personal check for collection - if more than 4.5 months have elapsed from the date of issuance of the check, the chances of accepting it for collection begin to decline rapidly. "Overdue checks or checks with banks expiring in the next month are not accepted," Olga Glukhovskaya clearly states.

In the absence of the name / name of the beneficiary (check "bearer"), the document for collection in Ukraine will not be accepted - in accordance with domestic legislation (Regulation 2.1.a). But if the amount of figures and words on the check differs - it's not scary: according to the laws of almost all countries, including ours, the inscription in words is always recognized in such cases, and the inscription is in error the figures.

As for the damage, "tears, slight abrasion or slight wetting, if they do not interfere with the reading of the requisite details, are usually not a valid reason for refusing to accept the check for payment."

Finally, if the check is overdue or there are two to four weeks remaining, it can still be accepted for collection - but in this case the bank has the right to request a cash deposit (the amount of which in the case of the top 10 banks is indicated in the table below ).

The nominal check itself can look like this:

Step two: we are looking for the bank branch that conducts the collection

This step is most easily carried out in the telephone mode. But if you intend to use personal collection of registered checks regularly (for example, you profit from Google AdSence contextual advertising on your site), it makes sense to study the feedback on the forums, where the addresses of the offices are also indicated, describing the merits and demerits of their managers.

If you are calling by phone, you can also find out in advance which department you need to contact (in other banks with checks, the department works for natural persons, in others - checks are accepted only in the department of legal entities).

In addition, if you live near a city with a head office or regional office of your bank by phone, find out whether your check will be sent to the main / regional office and whether its transfer will be paid for you. For if the transfer costs 50 hryvnias (the users on the network call this amount), and you live in Brovary and apply to the Kyiv branch of the bank, it may be cheaper and more convenient for you personally to reach such a Kiev office, from which the transfer will not be required.

And, of course, it is necessary to name the bank-payer, the country of registration of your check, its currency and the amount - to find out whether the bank will work with such a foreign institution as one of the first questions. In the case of a period of less than one and a half months before the expiration of the check, ask about this parameter too - perhaps some banks will categorically refuse to accept a nominal check for collection, but other institutions will agree to this action.

Step three: learn about the documents

This step can be carried out either by phone or by personal call at the bank branch (if this is convenient for you). We note at once that according to the legislation (Regulation, 4.1) the identification code and other documents for accepting a check for collection are not required - just a passport. In most cases, the package of documents for filing a personal check for collection is, indeed, limited to a passport.

In passing, we note that if you have a passport, it is advisable to take this document to the bank immediately (as in your passport, as well as in the check, your name and surname are written in Latin) - we hope you indicated the writing of your data to the drawer). But together with the foreign one, one should not forget the civil passport (according to the law, all banking operations are carried out on the basis of the internal passport, the driver's license and other documents with or without photo are not sufficient).

We will mention that if the check with the address specifies another place of your actual residence (according to which you received the check by check) than the place of passport registration - this is not a problem; For the bank, the parameter "address" on the check is not decisive. But in the application for filing a check with the address for collection it is necessary to indicate the same address that was on the check - and not the place of registration of the passport.

And only if the check holder is a minor or has died, then the receipt of a personal check for collection is carried out by the parents / guardians in the first case or by the heirs in the second case, with the presentation of a large package of documents, which will be reported to you in the bank.

Step Four: find out about expenses

Ask the manager of the bank by phone or in private conversation to inquire the size of the commission for accepting checks. At the same time, please note that there may be two commissions: the Ukrainian bank to which you are applying, and the foreign, payer bank. However, a large commission may be appointed from a domestic institution, which for the bank "covers" any commission of a foreign bank - that is, the latter is not collected from the check holder. This point should be clarified in advance.

Secondly, find out whether the commission is paid to a domestic institution immediately upon accepting a nominal check for collection - or it is calculated from the amount specified in the check only when the latter is paid.

Finally, in the third turn, do not forget to ask whether you will need to deposit a cash deposit with such parameters of your check, and what such a security can be equal.

Of course, it's worth choosing banks that make sense to call for clarifying the nuances, it's worth the size and "simplicity" of their commissions for collection (but, again, it's a good idea to promote reviews of users on the network). In the study of possible commissions you will be helped by the table of conditions for accepting a check for collection by banks of 10 leaders by assets at the end of the article.

Step five: go to the office and think about how to take money: into the account or in cash

When accepting a personal check for collection in the office, you will:

- Fill out the application (indicating the contact phone number);

- In case of need to pay commissions precisely when accepting a check or making a pledge - to make these payments to the bank

- Put personal painting on the back of the check (do not do it in advance, though the law allows it!) - banks require this action only in the presence of the financial institution manager)

- Give the application and check,

- Receive a receipt for accepting a receipt for collection

After that, in a month or two, the phone will call you and, if the payer's bank responds positively, will be informed of the possibility to pay you the amount indicated in the check. If you paid a commission to a Ukrainian bank upon receipt of a check, then the commission of the payer bank will be removed from you when you pay the check, otherwise both of the commissions will be deducted from the amount.

If you have a foreign currency account in any bank, you can indicate the account in the application - and receive a check amount on it. "At the request of the client, the money will be transferred to a foreign currency account, the number of which will be indicated by the recipient in the application for receipt of the check for collection, irrespective of which account (current, card account) and in which bank it is opened."

Please note that in some banks, if you open a currency current account or a card account in this institution for receipt of funds by check, the commission for accepting the check for collection will significantly decrease (for example, in Raiffeisen Bank Aval - from 2% to 1%). You can receive a notification about receipt of funds from a check to an account either by phone or by Internet banking. In case of a positive outcome and payment of money, the check is not returned to the check holder.

If the registered check is accepted by the bank for collection, then the bank can refuse to pay for it only in one case - if the payer bank has refused to pay this check. "Then the client is returned a check with a" refusal "and provide a letter-notification from the correspondent bank, where the reason for the refusal is indicated," Olga Glukhovskaya says. In this case, in further negotiations about non-payment of checks, the bank to which you applied and the Ukrainian legislation are no longer involved. Such disputes are resolved only "between the check holder and the drawer in accordance with the law of the country of the payer".

Step six: and maybe without going to the office?

Recently, there was an opportunity to reduce the time (2-3 weeks) for waiting for the payment of funds by check, and without going to the department and without presenting a passport - and all this practically "for the same money." This is about the systems of Internet banking, as well as about online payment services.

In the event that the Internet banking system or payment service that you use contains in the interface the choice of "collection of checks" (or something similar) - for example, the Privat24 system or the LiqPay service - you have to photograph or scan the front and back sides of your Check and download them according to the interface. This completes the work on the network.

Then you should send by regular mail a registered letter or a letter with a notification (if you check for a large amount and you are afraid for its safety, you can arrange delivery with the help of a specialized agency) to the address that is certainly indicated in the same interface (in the case of Privat24 and LiqPay - Dnipropetrovsk address of PrivatBank).

Money on arrival of the original check at the specified address will be credited to your card (for this time the bank sends images of your checks to the payer bank and verifies them). According to user feedback, for example, in the case of checks Google AdSence (payer - American Citybank) cashing with online collection takes place twice or three times faster than when a personal check is entered into the office - literally in 10-14 days.

This seemingly risky way, in fact, is fraught with monetary losses only in one case - with the simultaneous interception by the attackers and the original of your check, and your password / login to enter the online system, which together is not realistic. To request the same in phone mode or in e-mail mode (assuming that your password for the last attackers is known), your login and password, in the guise of forgetting them for most online systems, is only possible by answering a secret question, which is also an additional security factor.

Conditions for accepting registered checks for collection by banks as of September 30, 2010

| Bank | Customer's fee for accepting checks for collection | ||

|---|---|---|---|

| Commission,% of the check amount | The minimum commission | Additional costs, excluding commission | |

| PrivatBank | 3% | 20 UAH. | |

| Ukreximbank | 2% | 79,5 UAH ($ 10) | For a dubious check, the customer deposits a deposit of $ 10 (check up to $ 100,000), € 55 (check up to € 10,000), € 150 (check above € 10,000). By registered checks in other currencies, the deposit is paid in the amount of $ 20 |

| Oschadbank | 2% | 31.8 UAH. ($ 4) | The client makes a mandatory deposit of $ 20 or € 20 |

| Raiffeisen Bank Aval | 2% (on a foreign currency account in a bank 1%) + commission for a cut. bank | 39.75 UAH. ($ 5) | - |

| UkrSibbank | No services | ||

| Ukrsotsbank | In $: on checks drawn on American banks, 1%, at least $ 35 and not more than $ 200. In $: on checks issued to banks that are not in the US 1%, but not less than $ 100. In €: on checks drawn on German banks, 1%, not less than $ 35 and not more than $ 200. €: on checks issued on banks that are not in Germany 1%, but not less than $ 100. In other currencies 1%, at least $ 35 and not more than $ 200 | ||

| OTP Bank | 3.6% | 500 UAH. | Payment of compensation - 1,5% (min 30 UAH). |

| VTB Bank | 2% | 39.75 UAH. ($ 5) or 53.75 UAH. (€ 5) | The client shall pay a mandatory deposit of € 50 plus 2% of the check amount |

| Alfa Bank | No services | ||

| Finance and Credit | 2% | 39.75 UAH. ($ 5) | |

What checks are accepted for collection

Checks that you can cash in the bank, basically, are of two types: personal and road.

Nominal checks are written orders of the account holder to issue a certain amount specified in the check to an individual or legal entity. The one on whom the check is issued is called the check holder.

Receive by personal check the money can usually be for six months, unless another period is specified in the check itself. Usually, banks are recommended to handle a check for money no later than four and a half to five months after the date of its issue. Checks without a date most banks do not accept.

To cash on a personal check money, you need to come to the bank in time with a document proving your identity, and sign the application. Then wait for two weeks to two months. In addition to you, any other person can cashed the check by proxy, notarized. Most often Ukrainians have to deal with registered checks issued by foreign banks. In our country, they are already cashed through intermediaries - Ukrainian banks. Such checks are usually received from relatives or sponsors, by mail or by any other means.

Traveler's checks are payment documents, which allow you to get money quickly and conveniently during travel. Unlike registered ones, travelers' checks are bought from financial organizations in order to save money in this way and easily cash them in case of need. That is, you come to the bank and buy from the issuing company a certificate-obligation to pay you the amount indicated in the check. And abroad get money by signing the traveler's check issued on you for the second time at the time of its sale, and paying a commission of 1-2% of the check value or a fixed amount for each check.

Traveler's checks have no time restrictions - you can take them with you on a journey and in a couple of years. In many shops, restaurants and hotels abroad such documents are accepted on a par with cash. In general, they are quite convenient - they can be easily recovered in the event of theft or loss: by calling the worldwide reimbursement service of the issuing company on the phone indicated on the check receipt, you block the lost check and get another one within 24 hours. Buy these checks in cash at check-in, presenting a passport, signing a contract and paying a commission of 0.5-1% of the purchase amount. Export abroad and import such checks to Ukraine can be up to 10 000 euros. A large amount must be declared in writing to the customs authority, confirming that you have withdrawn it from your bank account. In addition, you will not be able to buy traveler's checks for more than 10,000 euros for one business day, as this is prohibited by law.

You can exchange both travel and personal checks only for the full amount of money indicated in them. Partial "cashing" does not happen.

The scheme of collection of checks

When you receive money on a personal check, and in some cases on a road check, you will meet with the collection procedure. The fact is that the bank, in which you go to cash a check, will not pay you the amount specified in the document directly from your funds, but appeal to the financial institution in which the account of the person who wrote the check is opened. And only after checking the check and getting money from that institution, the bank will transfer it to you. Other ways to cash a nominal check of a foreign bank - not through calculations for collection - in Ukraine does not exist.

As the scheme of collection is rather rare, it was not automated, but carried out manually. Therefore, to get money by check is quite expensive. The cost of the procedure includes the receipt of the check for collection, followed by sending it to the collecting bank by mail (for example, 4% of the nominal value of the check, at least $ 20 - a maximum of $ 300); As well as correspondence with the bank - to clarify or find the amount of refunds on checks (upon the request of the check holder). And the payment is charged for each check separately.

There are special Internet services with which you can cheaper and faster to collect personal checks. To do this, you must send a check to a country where such a procedure is more common, respectively, it occurs faster and costs less. Usually, you can cash a check with this service within a week, and the commission will be up to 3% (minimum $ 5). However, there is no guarantee that the service you contact will actually give you money.

As for the traveler's check, you can expect to "cash" money on it without delay for collection, if it refers to the following types: American Express (common in the US); Thomas Cook and Visa (common in Europe); City Corp (common in Asian countries). The reason is that if banks make payments on familiar types of checks at once, then for other types they will want to conduct collection, and the procedure will take time. In addition, not every foreign bank will accept for collection checks of unfamiliar systems.

If you gave or presented your traveler's check to another person by putting a transfer inscription (endorsement) on his back side, the bank will also accept the document for payment only on conditions of collection. Often you have to wait for a response - confirmation of the solvency of the check from the issuing bank to five weeks.

In addition to the so-called "clean collection", which deals with financial documents - checks and bills - there is still a documentary collection. It concerns financial documents accompanied by accounts, transport, insurance and other commercial documents. For example, in international trade for documentary collection means the obligation of the bank to receive from the importer the amount of payment under the contract on behalf of the exporter and transfer it to the latter along with the transfer of all commodity documents.

Disadvantages of the settlement scheme for collection

In addition to the fairly tangible cost of collection of checks to receive money on personal checks, the main shortcoming of such a procedure for cashing money can be considered a long time for collection. One of the banks that accept personal checks, in his proposal noted that such a procedure he has "a short payment period - about one and a half months." Such a term is not yet the limit. In addition, there are cases when a correspondent bank requires an additional period for checking a check. So be prepared to wait.

In addition, the check may prove insolvent upon its arrival in a foreign bank. In this case, the bank you applied to will not return the minimum commission you paid at the time of receipt of the check for collection.

To revoke a personal check the person who wrote it out can not by law. But if the bank refuses to cash it - it should indicate on the check the reasons for the refusal and the date of presentation of the check for payment. Be afraid that at the time of cashing a check on the account from which funds are withdrawn, there will not be enough money, it is not necessary - for the person who wrote the check, the bank can conduct this procedure on credit.

Regulates all issues related to travel and personal checks. Decree of the National Bank N520 of 29.12.2000 "On approval of the Regulation on the procedure for carrying out transactions with checks in foreign currency on the territory of Ukraine" .

Comments

Commenting on, remember that the content and tone of your message can hurt the feelings of real people, show respect and tolerance to your interlocutors even if you do not share their opinion, your behavior in the conditions of freedom of expression and anonymity provided by the Internet, changes Not only virtual, but also the real world. All comments are hidden from the index, spam is controlled.