"A secret list of control": the worst banks according to the NBU. DOCUMENT

For many years, the National Bank to evaluate the performance of their wards using a top-secret "early warning system" (hereinafter - the CPP or the system). This is a set of economic indicators of the banks, which are not published, and the regulator are calculated for internal use.

He writes about this in an article for RBC-Ukraine Alexey Komakha transfers.

Calculations are performed with respect to all financial institutions at least twice a month to identify hidden problems. If a bank violates the norms of "the system", the NBU officials are beginning to respond: may cause unfavorable guide or potentially troubled bank "on the carpet", send check or give the bank an order to correct the deviation, etc...

But not always. If the "client" is a serious political roof, or "letters of recommendation from Prince Khovanskii" then it may just politely ask to be careful when reporting.

It is noteworthy that the CPP is not regulated at the legislative level and know-how is the officials themselves. Over the past ten years, the "System" several times changed dramatically. Some indicators were added, others were removed.

Total these figures a few dozen. The exact list of standards and algorithms for calculating them are unknown even to bankers. In the depths of the NBU Oversight privacy techniques to explain the desire to avoid podrisovok in the preparation of wards reporting.

At the same time indicators of the CPP, in fact, an analogue of prudential regulations that banks must calculate and observe according to instructions on the procedure for regulating the activities of banks in Ukraine (approved by the NBU N368 from 08.28.01 was).

In contrast to the official regulations, some of which are published by banks, the calculation algorithms in the CPP is much harder and much more objectively reflect the state of affairs in the financial institution. That is why the results calculated by the National Bank keeps a secret.

By and large, the official standards "for publication" has long become a fiction. In general, everything looks just fine system.

Although in reality the majority of banks or "draw" these figures or breaks in the open. This is acknowledged and the bureaucrats themselves.

For example, the first deputy chairman of NBU Alexander Pisaruk recently complained about the imperfection of "reporting" the discipline of banks, which he said "reduces the effectiveness of early warning system of the NBU and the performance of supervisory functions in general control."

As a result, even the NBU has introduced a moratorium on the punishment of banks for violation of prudential regulations, if it is related to the devaluation of the hryvnia losses of banks or in the Crimea and Donbas. If the war and annexation greatly struck mostly on the financial condition of major banks, has suffered from the devaluation of the entire banking system. Therefore, a requirement of de facto mandatory standards apply to virtually all financial institutions.

Another thing the RAF. According to bankers, are now aware of the NBU banking supervision more attention is paid to the analysis of confidential reporting "system."

The main parameters that are evaluated in the RAF - capital adequacy, liquidity, level of problem loans and insider, the presence of gaps in terms of attracting liabilities and asset allocation (the so-called gaps), return on assets, and other key indicators. But when the regulator gives the most objective assessment of these lighthouses.

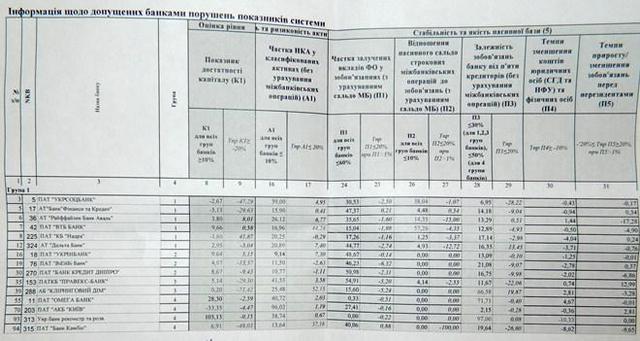

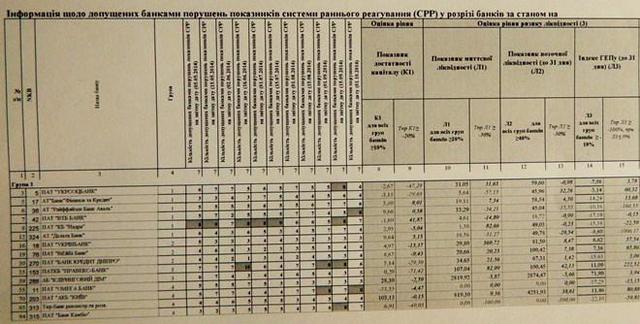

The greatest value of the National Bank gives two measures of capital adequacy and the proportion of negatively classified assets (NFA). According to the CPP is the worst combination of these two indicators is observed in the following banks.

Almost all banks violate one or two standard RAF, sometimes even without knowing it. But there are champions who do not meet the ideal representations of the NBU bank from 7-8 parameters:

As the table shows, many offenders are working with minimum deviations from May to October of last year. While some live with it for years. Most likely, the picture has not changed at this time.

Champions of the non-compliance rates of CPP - Bank "VTB Bank" and the bank "Kiev" to 8 violations each.

VTB, controlled by the Russian state, became one of the leaders in the outflow of deposits in the past year. In addition, the quality of loan portfolio significantly tainted the war in the Donbas and the annexation of the Crimea, as well as the exodus outside the country many prominent Regions, who liked credited in the financial institution, and is now unlikely to pay off its debts.

As a result, return on assets (E1 standard) VTB, according to the CPP as of October 1, 2014 was (-) 67.7%, which is 3.5 times worse than the limit set by the supervision values.

At the moment, the bank needs a large capital increase, the prospects of which are very vague due to the introduction of the parent VTB against EU and US sanctions. Source: http://censor.net.ua/p322859

The most shocking picture is observed in the bank "Kiev", which is 99% owned by the state represented by the Ministry of Finance. It has the lowest capital adequacy ratio in the system (K1) according to the CPP (-) 33.35%. The liquidity of the bank is equal to zero, while the share of adversely classified (non-working) assets exceeds 96%. In fact, this is not a bank, a "black hole". It is, so to speak, an institution for many months does not pay on deposits and does not handle payments.

Recently, Finance Minister Natalia Yaresko promised to deal with the problems at the bank. But it is doubtful whether she had something happen.

Money in the "Kiev" vanished for the second time.

The first - in the time of 2008-2009 crisis. After the recapitalization in 2009, the institution has failed to cope with the problems, and the government made in ustavnik the bank more than 3 billion USD have disappeared in an unknown direction. Source: http://censor.net.ua/p322859

The second "honor" by the number of deviations in the "black list" of the RAF section "Nadra Bank" and the bank "Cambio", which scored seven points each.

"Cambio" is already recognized as insolvent and withdrawn from the market.

"Nadra Bank", which is owned by Dmitry Firtash, more than six months in the lead in antireyting CPP and often for months without holding customer payments. The bank's assets amount to nearly 36 billion USD (11 place). Withdraw it from the market is problematic, to nationalize - too expensive.

Given the proximity to the President Firtash, do both without the consent of the owner or of the "portrait" is unlikely. Most likely, the NBU will continue to pretend not to notice problems in Firtash bank until investors begin to storm the office of the regulator.

It is noteworthy that shone in the anti-rating and the bank, "Clearing House" (five violations), which is also included in the sphere of influence of Dmitry Firtash and his business partner, the People's Deputy Ivan Fursin.

Oddly, but in the "black list" of supervision NBU appeared and institutions with the European roots of the Austrian Raiffeisen Bank Aval (RBA) and the Italian "Pravex" (six violations). Unlike their Ukrainian colleagues in misfortune, these banks are much neater execute customer payments. Contact with antireyting, most likely due to the lack of obvious falsifications in the financial statements.

Although the general condition of financial institutions and is hardly brilliant. For example, in the RAB according to the CPP data, capital adequacy (K1) only 3.8% at a rate of not less than 10%.

And "Pravex" return on assets (E1) according to the CPP is more like a license plate with only a minus (-) 2511.18%.

Among the leaders in the number of non-observance of the CPP many years the number of another institution with Italian capital "Ukrsotsbank". Interestingly, the "Ukrsotsbank" in the first half of last year, even in the official statements of the NBU has found a violation of standards.

The Bank does not fit directly into the two mandatory (public) norms: the ratio of regulatory capital to assets and maximum exposure to credit risk per counterparty. Nevertheless, by the end of the third quarter accountant something tweaked in reporting - and the bank was in openwork.

Here only release supervision is not so rosy. According to the estimates of officials, "Ukrsotsbank" actually has negative equity. The capital adequacy ratio (K1) according to the CPP in this bank (-) 2.67%. At the same time, the Italian shareholders of publicly refuse to capitalize its Ukrainian subsidiary, citing the lack of reforms in Ukraine and are planning to get rid of unprofitable assets.

Enter the top15 "bad" banks and "Credit Dnepr" Victor Pinchuk, "Finance and Credit" Konstantin Zhevago and "Delta Bank" Nicholas Lagoon.

Interestingly, at least four decoy "black list" of the NBU - "Nadra Bank", "Delta Bank", the bank "Kiev" and the Ukrainian Bank for Reconstruction and Development (as well as "Kiev", it belongs to the Ministry of Finance) - already recognized problem (not confused with insolvent). The fate of the financial institutions is a big question.

Most likely, "Kiev" and UBRR will be sent to elimination. What to do with "Delta" and "Nadra" do not seem to know neither their owners nor the National Bank.

The main offenders "systems" and Chairman of the NBU Valery Gontareva to written questions the editorial board did not respond.

Comments

Commenting, keep in mind that the content and the tone of your messages can hurt the feelings of real people, show respect and tolerance to his interlocutors, even if you do not share their opinion, your behavior in terms of freedom of speech and anonymity offered by the Internet, is changing not only virtual, but real world. All comments are hidden from the index, spam control.