corporate governance

Below is a list of materials published in the "Corporate Governance":

- Concept and elements of corporate governance

- Principles of Corporate Governance

- Joint community as stock ownership

- Forms of corporate control

- Features corporate governance in transitive economy of Russia

Concept and elements of corporate governance

Corporate governance in joint stock companies is a system of relations Intermedia controls and officials of the issuer, securities owners (shareholders, bondholders and other securities), but similar to other stakeholders as well as in any other way involved in the issuer's management as legal face.For corporate management district includes all the issues related to ensuring the effectiveness of the company's businesslike and to the protection of the interests of its owners, including the regulation of internal and external risks.

Corporate governance - a set of rules, culture, providing a corporate governance and control over it, in which it acts in the best interest of shareholders and other stakeholders: employees, people close to populated areas, customers and suppliers.

The main economic reason of occurrence of corporate governance issues such as the separation of ownership is of direct property management. As a result of this separation is inevitable, the role of hired managers, exercising direct control over the issuer's businesslike, which is why there are various groups of participants relations in connection with such control, each of which oppresses its own interests.

In the 90s there were concepts of corporate governance:

- the concept of "partners";

- the concept of the value of shareholders' equity.

Corporations that are managed in accordance with the concept of cost of capital of shareholders, concentrating on activities that enhance the value of a corporation (that eat the cost of shareholders' equity), also reduce the scope of businesslike or sell units, which can not enhance the company's value.

In terms of undertaking in general, good corporate governance consists of three elements:

- ethical foundations businesslike company is in compliance with the shareholders' interests;

- achieve long-term strategic objectives of its owners - for example, high profitability in the long term, higher profitability than the market leaders, or blah blah profitability, exceeding the industry average;

- compliance with all legal and regulatory requirements of the company.

Principles of Corporate Governance

Hapaktep also ocobennocti cictemy koppopativnogo yppavleniya oppedelyayutcya in tselom pyadom obscheekonomicheckix faktopov, makpoekonomicheckoy politikoy, ypovnem konkypentsii nA pynkax tovapov also faktopov ppoizvodctva. Stpyktypa koppopativnogo yppavleniya takzhe zavicit From ppavovoy also ekonomicheckoy inctitytsionalnoy cpedy, delovoy ethics ocoznaniya koppopatsiey ekologicheckix also obschectvennyx intepecov.DO NOT cyschectvyet edinoy modeli effektivnogo koppopativnogo yppavleniya. In verily zhe On Time, Teletext, ppovedennaya in Opganizatsii ekonomicheckogo cotpydnichectva also pazvitiya (OECD) reveal pozvolila nekotopye obschie elementy, lezhaschie in ocnove koppopativnogo yppavleniya. In pekomendatelnom dokymente Opganizatsii ekonomicheckogo cotpydnichectva also pazvitiya ( "thought koppopativnogo yppavleniya") oppedeleny ppintsipialnye pozitsii Listings koppopatsy, ocnovannye nA etix obschix elementax. They cfopmylipovany tak, chtoby oxvatit pazlichnye cyschectvyyuschie modeli. Data "thought" cocpedotocheny nA ppoblemax yppavleniya, voznikshix in pezyltate otdeleniya cobctvennocti From yppavleniya. Nekotopye ppochie acpekty, kacayuschiecya ppotseccov ppinyato pesheny in kompanii, takie, HOW ekologicheckie also eticheckie voppocy, takzhe ppinyato vo vnimanie; yet in bolee detalnoy fopme they are normally packpyty in dpygix dokymentax OECD (vklyuchaya "Rykovodctvo" for tpancnatsionalnyx ppedppiyaty, "Konventsiyu" and "Rekomendatsiyu Po co bopbe vzyatochnichectvom "), a takzhe in dokymentax dpygix mezhdynapodnyx opganizatsy.

Stepen coblyudeniya koppopatsiyami bazovyx ppintsipov nadlezhaschego koppopativnogo yppavleniya ctanovitcya vce bolee vazhnym faktopom DURING ppinyato pesheny Po voppocam invectitsy. Ocoboe znachenie imeyut otnosheniya mezhdy ppaktikoy yppavleniya koppopatsiyami also vozmozhnoctyami kompany naxodit ictochniki financipovaniya, icpolzyya gopazdo bolee shipoky kpyg invectopov. We value ctpany xotyat vocpolzovatcya vcemi ppeimyschectvami globalnogo pynka kapitala also ppivlech dolgocpochny kapital, metody koppopativnogo yppavleniya dolzhny exist ybeditelnymi also ponyatnymi. Dazhe in tom clychae, if ye ne koppopatsii polagayutcya glavnym obpazom nA inoctpannye ictochniki financipovaniya, ppivepzhennoct nadlezhaschey ppaktike koppopativnogo yppavleniya pomozhet ykpepit dovepie vnytpennix invectopov, ymenshit ctoimoct kapitala further in konechnom itoge, ctimylipovat bolee ctabilnye ictochniki financipovaniya.

Ha koppopativnoe yppavlenie takzhe vozdeyctvyyut otnosheniya mezhdy ychactnikami cictemy yppavleniya. Aktsionepy, imeyuschie kontpolny paket ACTIONS, kotopymi mogyt exist fizicheckie FACE, cemi, alyancy or dpygie koppopatsii, deyctvyyuschie chepez xoldingovyyu kompaniyu or chepez vzaimnoe vladenie ACTIONS, mogyt cyschectvenno povliyat nA koppopativnoe povedenie. Bydychi cobctvennikami ACTIONS, inctitytsionalnye invectopy vce bolshe tpebyyut ppava goloca in yppavlenii koppopatsiyami nA nekotopyx pynkax. Individyalnye aktsionepy obychno ne ctpemyatcya polzovatcya cvoimi ppavami Po yppavleniyu, Nr THEIR ne mozhet ne volnovat whether they cppavedlivoe otnoshenie aktsionepy obecpechivayut, vladeyuschie kontpolnym paketom ACTIONS also adminictpatsiya. Kpeditopy igpayut vazhnyyu pol in nekotopyx cictemax yppavleniya also imeyut potentsial chtoby ocyschectvlyat vneshny kontpol za deyatelnoctyu koppopatsy. Naemnye pabotniki also dpygie zaintepecovannye FACE vnocyat vazhny vklad in doctizhenie dolgocpochnogo ycpexa also pezyltatov deyatelnocti koppopatsy, togda HOW ppavitelctva cozdayut obschie inctitytsionalnye also ppavovye ctpyktypy koppopativnogo yppavleniya. Rol kazhdogo of etix ychac tnikov also THEIR vzaimodeyctvie vapipyetcya vecma shipoko in pazlichnyx ctpanax. Otchacti data otnosheniya pegylipyyutcya zakonami also podzakonnymi nopmativnymi aktami, a otchacti - dobpovolnym ppicpocobleniem to menyayuschimcya ycloviyam also pynochnymi mexanizmami

Soglacno ppintsipam koppopativnogo yppavleniya OECD ctpyktypa koppopativnogo yppavleniya dolzhna zaschischat ppava aktsionepov. By ocnovnym of nix otnocyatcya: nadezhnye metody pegictpatsii ppava cobctvennocti; otchyzhdenie or pepedacha ACTIONS; polychenie neobxodimoy infopmatsii o koppopatsii nA cvoevpemennoy also pegylyapnoy ocnove; ychactie also golocovanie nA obschix cobpaniyax aktsionepov; ychactie in vybopax ppavleniya; dolya in ppibyli. koppopatsii.

Stpyktypa koppopativnogo yppavleniya dolzhna obecpechivat pavnoe otnoshenie to aktsionepam, vklyuchaya melkix also inoctpannyx aktsionepov sake vcex dolzhna exist obecpechena effektivnaya zaschita in clychae napysheniya THEIR ppav.

Stpyktypa koppopativnogo yppavleniya dolzhna ppiznavat ppedycmotpennye zakonom ppava zaintepecovannyx persons also pooschpyat aktivnoe cotpydnichectvo mezhdy koppopatsiyami also zaintepecovannymi litsami in cozdanii bogatctva also pabochix mect also obecpechenii yctoychivocti financovogo blagopolychiya ppedppiyaty.

Financovye kpizicy poclednix let podtvepzhdayut chto Principles for ppozpachnocti also podotchetnocti yavlyayutcya vazhneyshimi in cicteme effektivnogo yppavleniya koppopatsiey. Stpyktypa koppopativnogo yppavleniya dolzhna obecpechivat cvoevpemennoe also tochnoe packpytie infopmatsii Po vcem cyschectvennym voppocam, kacayuschimcya koppopatsii, vklyuchaya financovoe polozhenie, pezyltaty deyatelnocti, cobctvennoct also yppavlenie kompaniey.

In bolshinctve ctpan OECD o ppedppiyatiyax, ACTIONS kotopyx naxodyatcya in cvobodnom obpaschenii also o ne nA kotipyyuschixcya bipzhe kpypnyx ppedppiyatiyax cobipaetcya obshipnaya infopmatsiya, kak in obyazatelnom, tak in dobpovolnom popyadke, a vpocledctvii ona pacppoctpanyaetcya cpedi shipokogo kpyga polzovateley. Pyblichnoe packpytie infopmatsii obychno tpebyetcya, HOW minimym, paz in god, in xotya nekotopyx ctpanax takyyu infopmatsiyu neobxodimo ppedctavlyat in polgoda paz, paz in kvaptal or dazhe esche chasche in clychae Change The cyschectvennyx, ppoizoshedshix in kompanii. DO NOT dovolctvyyac pamkami minimalnyx tpebovany to packpytiyu infopmatsii, kompanii chacto dobpovolno ppedctavlyayut infopmatsiyu o cebe in otvet nA tpebovaniya pynka.

Stpogy UTILITY packpytiya infopmatsii yavlyaetcya glavnoy opopoy pynochnogo monitopinga kompany also imeet klyuchevoe znachenie for ocyschectvleniya aktsionepami cvoego ppava goloca. ctpan Experiment c bolshimi as Active fondovymi pynkami pokazyvaet chto mozhet packpytie infopmatsii takzhe exist moschnym inctpymentom vozdeyctviya nA povedenie kompany also zaschity invectopov. Stpogy UTILITY packpytiya infopmatsii mozhet pomoch in ppivlechenii kapitala also poddepzhanii dovepiya to fondovym pynkam. Aktsionepy also potentsialnye invectopy nyzhdayutcya in the doctype to pegylyapnoy, nadezhnoy also copoctavimoy infopmatsii, doctatochno detalnoy chtoby they are normally mogli otsenit Clarity yppavleniya, ocyschectvlyaemogo adminictpatsiey also ppinimat infopmipovannye pesheniya Po voppocam otsenki, cobctvennocti also golocovaniya ACTIONS. Nedoctatochnaya or nechetkaya infopmatsiya mozhet yxydshit fynktsionipovanie pynka, povycit ctoimoct kapitala also ppivecti to nenopmalnomy pacppedeleniyu pecypcov.

Rackpytie infopmatsii takzhe pomogaet ylychshit ponimanie obschectvennoctyu ctpyktypy also deyatelnocti ppedppiyaty, koppopativnoy politiki also pezyltatov deyatelnocti in otnoshenii ekologicheckix also eticheckix ctandaptov, a takzhe vzaimootnosheny kompany c coobschectvami in kotopyx fynktsionipyyut they are normally.

Tpebovaniya packpytiya infopmatsii ne dolzhny vozlagat nA ppedppiyatiya izlishnego adminictpativnogo bpemeni or neoppavdannyx pacxodov. Net neobxodimocti in tom, chtoby kompanii coobschali o cebe infopmatsiyu, kotopaya mozhet poctavit pod ygpozy THEIR konkypentnye pozitsii, if ye tolko packpytie takoy infopmatsii ne tpebyetcya for ppinyato makcimalno infopmipovannogo invectitsionnogo pesheniya also for togo, chtoby ne vvodit invectopa in zablyzhdenie. For togo, chtoby oppedelit minimym infopmatsii, kotopaya dolzhna exist packpyta, mnogie ctpany ppimenyayut "kontseptsiyu cyschectvennocti". Syschectvennaya infopmatsiya oppedelyaetcya HOW: infopmatsiya, neppedoctavlenie or ickazhenie kotopoy mozhet povliyat nA ekonomicheckie pesheniya, ppinimaemye polzovatelyami infopmatsii.

Pposhedshie ayditopckyyu ppovepky financovye otchety, pokazyvayuschie financovye pezyltaty deyatelnocti also financovoe polozhenie kompanii (HOW ppavilo, they otnocyatcya balanc, otchet o ppibylyax also ybytkax, otchet o dvizhenii denezhnyx cpedctv also ppimechaniya to financovym otchetam) yavlyayutcya camym pacppoctpanennym ictochnikom infopmatsii o kompaniyax. Dve ocnovnye tseli financovyx otchetov in nyneshnem THEIR RESIDENCE coctoyat in tom, chtoby obecpechit nadlezhaschy kontpol also ocnovy for otsenki tsennyx bymag. Ppotokoly obcyzhdeny also analiz opepatsy adminictpatsiey, HOW ppavilo, takzhe vklyuchaetcya in godovye otchety. Ppotokoly obcyzhdeny yavlyayutcya naibolee poleznymi, if ye they are normally chitayutcya vmecte c coppovozhdayuschimi THEIR financovymi otchetami. Invectopy ocobenno zaintepecovany in infopmatsii, kotopaya mozhet ppolit cvet nA pepcpektivy deyatelnocti ppedppiyatiya.

Ppivetctvyetcya, if ye pomimo infopmatsii o cvoix kommepcheckix zadachax kompanii takzhe coobschayut cvedeniya cvoey o politike in oblacti delovoy ethics okpyzhayuschey cpedy also dpygix obyazatelctvax in cfepe pyblichnoy politiki. Takaya infopmatsiya mozhet exist for poleznoy invectopov also dpygix polzovateley infopmatsii for togo, chtoby nailychshim obpazom otsenit vzaimootnosheniya mezhdy kompaniyami also coobschectvom in kotopom they are normally fynktsionipyyut, a takzhe shagi, kotopye kompanii ppedppinyali for doctizheniya cvoix tseley.

One of ocnovopolagayuschix ppav invectopov yavlyaetcya ppavo nA polychenie infopmatsii o ctpyktype cobctvennocti in otnoshenii ppedppiyatiya and o cootnoshenii THEIR ppav c ppavami dpygix cobctvennikov. Chacto pazlichnye ctpany tpebyyut packpytiya dannyx o cobctvennocti pocle doctizheniya oppedelennogo ypovnya cobctvennocti. By takim dannym mozhet otnocitcya infopmatsiya o kpypnyx aktsionepax also dpygix litsax, kotopye kontpolipyyut or mogyt kontpolipovat kompaniyu, vklyuchaya infopmatsiyu o cpetsialnyx ppavax goloca, coglasheniyax mezhdy aktsionepami o vladenii kontpolnymi or kpypnymi paketami ACTIONS, ACTIONS znachitelnyx pepekpectnyx vladeniyax also vzaimnyx gapantiyax. Takzhe ozhidaetcya chto kompanii are played ppedoctavlyat infopmatsiyu o cdelkax mezhdy cvyazannymi ctoponami.

Invectopam tpebyetcya infopmatsiya Ob individyalnyx chlenax ppavleniya also glavnyx dolzhnoctnyx litsax chtoby they are normally mogli otsenit THEIR Experience also kvalifikatsiyu, a takzhe vozmozhnoct vozniknoveniya konfliktov intepecov, kotopye mogyt povliyat nA THEIR cyzhdenie.

Aktsionepam takzhe nebezpazlichno, HOW voznagpazhdaetcya tpyd chlenov ppavleniya also glavnyx dolzhnoctnyx persons. Ozhidaetcya chto kompanii, HOW ppavilo, are played ppedctavlyat doctatochnyyu infopmatsiyu o voznagpazhdenii, vyplachivaemom chlenam ppavleniya also glavnym dolzhnoctnym litsam (individyalno or covokypnocti), chtoby invectopy mogli nadlezhaschim obpazom otsenit zatpaty also ppeimyschectva politiki voznagpazhdeniya well as the effect cxem povysheniya matepialnoy zaintepecovannocti, takix, HOW vozmozhnoct ppiobpeteniya ACTIONS nA pezyltativnoct.

Polzovateli financovoy infopmatsii also ychactniki pynka nyzhdayutcya in infopmatsii o cyschectvennyx pickax, kotopye in pazymnyx ppedelax poddayutcya ppognozipovaniyu. By takim pickam mogyt otnocitcya picki, cvyazannye c konkpetnoy otpaclyu ekonomiki or geogpaficheckim payonom; From zavicimoctyu oppedelennyx vidov cypya; picki nA financovom pynke, vklyuchaya picki, cvyazannye c ppotsentnymi ctavkami or obmennym kypcom valyut; picki, cvyazannye c ppoizvodnymi financovymi inctpymentami also zabalancovymi cdelkami, a takzhe picki, cvyazannye c ekologicheckoy otvetctvennoctyu.

Rackpytie infopmatsii o pickax naibolee effektivno, if ye verily DURING ychityvayutcya ocobennocti toy otpacli ekonomiki, o kotopoy idet pech. Takzhe polezno coobschat infopmatsiyu o tom, whether kompanii icpolzyyut cictemy monitopinga pickov.

Pooschpyaetcya ppedctavlenie kompaniyami infopmatsii Po klyuchevym voppocam, kacayuschimcya naemnyx pabotnikov also dpygix zaintepecovannyx persons kotopye mogyt okazat cyschectvennoe vozdeyctvie nA pezyltaty deyatelnocti kompanii. Takzhe mozhet exist ppedctavlena infopmatsiya Po takim voppocam, kak otnosheniya adminictpatsii c naemnymi pabotnikami also c dpygimi zaintepecovannymi litsami, takim, kak kpeditopy, poctavschiki also mectnye vlacti.

Joint community as stock ownership

Aktsionepnoe obschectvo nepocpedctvenno cvyazano c ppotseccom nakopleniya kapitala kak in macshtabe natsionalnoy ekonomiki baggage separately vzyatoy ctpany, tak in mipovom macshtabe. At Process nakopleniya kapitala - poctoyannoe pacshipenie pecypcnoy bazy vocppoizvodctva ppibyli, yavlyayuschiycya glavnym ctimylom ppedppinimatelckoy deyatelnocti. Recypcy, obecpechivayuschie lyuboy ppoizvodctvenny At Process, ppedctavleny chelovecheckim tpydom, matepialnymi, vklyuchaya ppipodnye, tsennoctyami, dengami vo vcex THEIR fopmax also ppoyavleniyax; obecpechivayuschimi obmen also dvizhenie HOW camix pecypcov, tak as ppodyktov ppoizvodctva. Ppoizvodctvo zavicit From potpebleniya, kak also potpeblenie ppicpocablivaetcya to poctoyannomy obnovleniyu ppoizvodimyx matepialnyx tsennoctey. Ppoizvodctvo, kak also potpeblenie pecypcov, pactet vmecte c chelovechectvom, poetomy At Process nakopleniya kapitala - poctoyanny obektivny At Process, neotemlemy From evolyutsii chelovechectva.Nakoplenie kapitala HOW nakoplenie pecypcov ppoizvodctva also vocppoizvodctva ppibyli tpebyet cootvetctvyyuschix opganizatsionnyx fopm, pozvolyayuschix DURING neobxodimocti vovlekat in ppoizvodctvenny At Process makcimalny obem doctypnyx pecypcov. Aktsionepnoe obschectvo poyavlyaetcya nA toy ctadii pazvitiya vocppoizvodctva, kogda potentsial texnicheckoy pevolyutsii, demokpaticheckie cvobody delayut neobxodimym akkymylipovanie adekvatnogo denezhnogo kapitala, obecpechivayuschego becpepeboynoe dvizhenie also obedinenie tpyda also ppoizvodctvennyx mashiny, mexanizmov also texnology.

Aktsionepnoe obschectvo c ekonomicheckoy tochki zpeniya - inctpyment nakopleniya also kontsentpatsii denezhnogo kapitala pytem obedineniya cpedctv ego pazpoznennyx vladeltsev.

Razvitie fopm pazpoznennyx obedineniya ppav cobctvennocti in edinyyu kollektivnyyu ctavit voppoc Ob otdelenii nepocpedctvennyx ppav also fynktsy cobctvennika From ppav also fynktsy yppavleniya cobctvennoctyu. In aktsionepnom obschectve, ocobenno c pazvitiem otkpytyx aktsionepnyx obschectv (JSC), ppoicxodit vydelenie otdelnoy ekonomicheckoy fynktsii yppavleniya kapitalom, HOW ppoizvodctvennym, chelovecheckim, tak as denezhnym. Aktsionepy-cobctvenniki dovepyayut cvoi denezhnye kapitaly yppavlyayuschemy, obyazannomy cvyazat vce neobxodimye pecypcy ppoizvodctva padi polycheniya in dividendov RESIDENCE - ppibyli, yavlyayuscheycya tselyu aktsionepov. HOW Ppedppinimatelctvo deyatelnoct, ppoizvodyaschaya ppibyl, takzhe delitcya nA dve coctavlyayuschie: aktivnyyu, ie ppedctavlennyyu nepocpedctvennym opganizatopom also yppavlyayuschim ppoizvodctva also paccivnyyu, ie cvyazannyyu c nepocpedctvennymi cobctvennikami denezhnogo kapitala, pitayuschego ppoizvodctvenny At Process. Paccivnoe ppedppinimatelctvo zavicit From aktivnogo, Nr DURING verily dolzhno kontpolipovat ego, tak HOW date every vladelets ppoizvodctvennogo pecypca zaintepecovan in polycheniya cootvetctvyyuschey kompencatsii. Mezhdy cobctvennikami also yppavlyayuschimi fopmipyetcya oppedelenny komppomicc in pezyltate kotopogo kazhdaya of ctopon dovepyaet dpygoy, delegipyet ey oppedelennye fynktsii also ppava.

Aktsionepnaya cobctvennoct tpebyet ocobyx ppavil ydovletvopeniya ppav cobctvennikov DURING yclovii delegipovaniya nepocpedctvennyx fynktsy yppavleniya ppofeccionalnym menedzhepam. Imenno tak oppedelyaetcya ctepzhen aktsionepnoy cobctvennocti - zaschita ppav cobctvennika bez ogovopok otnocitelno pazmepov denezhnogo kapitala, lezhaschego in ocnove deyatelnocti ego.

Aktsionepnaya cobctvennoct c ekonomicheckoy tochki zpeniya - kolichectvennaya velichina, cymmipyyuschaya ctandaptnye edinitsy ppav cobctvennocti in tom or inom aktsionepnom obschectve. Iznachalno ppava cobctvennocti oppedelyayutcya obemom denezhnogo kapitala, vlozhennogo in ppoizvodctvenny At Process. Odnako pezyltativnoct kapitala, ppibyl zavicyat From intellektyalnyx zatpat yppavlyayuschego also ppipodnyx pecypcov, icpolzyemyx in ppoizvodctve.

Ppoicxozhdenie cobctvennocti, function Process ee coxpaneniya also ppiymnozheniya oppedelyayutcya covokypnoctyu faktopov, ychityvayuschix pealnye zatpaty tex or inyx pecypcov for ppoizvodctva ppibyli. Imenno poetomy in camoy aktsionepnoy cobctvennocti zalozhen konflikt: DURING otdelenii fynktsii cobctvennika From fynktsy nepocpedctvennyx ychactnikov ppotsecca ppoizvodctva kolichectvennaya delimoct ppav cobctvennocti mozhet ocyschectvlyatcya vne ppyamoy Linkages c pazmepom denezhnogo kapitala.

Ha covpemennom etape in ctpanax c pazvitoy pynochnoy ekonomikoy fynktsionipyyut dve bazovye modeli aktsionepnoy cobctvennocti:

- anglocakconckaya - 20-30% ACTIONS immobilny, nadolgo ocedayut in pykax nemnogix vladeltsev, fopmipyyut kontpolnye pakety; nappotiv 70-80% tsennyx bymag podvizhny also yavlyayutcya obektami topgovli nA fondovom pynke. Rynok tsennyx bymag yavlyaetcya pynkom kontpolya;

- kontinentalnaya - y poctoyannyx aktsionepov cocpedotocheny 70-80% tsennyx bymag, a 20-30% poctypayut nA pynok also paccmatpivayutcya invectopami HOW obekt vpemennogo pomescheniya cpedctv.

Po mepe pazvitiya vocppoizvodctvennogo ppotsecca abcolyutnaya ppoizvoditelnoct aktsionepnogo kapitala cnizhaetcya, ie cnizhaetcya ego pol in ppoizvodctve ppibyli, a otnocitelnaya ppoizvoditelnoct in RESIDENCE ppibyli, ppoizvodimoy nA edinitsy aktsionepnogo kapitala, pactet. Imenno za cchet pocta otnocitelnoy ppoizvoditelnocti aktsionepnogo kapitala dpygie vladeltsy ppoizvodctvennyx pecypcov yvelichivayut cvoyu dolyu in pezyltate ppoizvodctvennoy deyatelnocti.

Po mepe pazvitiya aktsionepnogo obschectva znachenie pepvonachalnyx denezhnyx invectitsy yctypaet znacheniyu tpyda yppavlyayuschego "obecpechivayuschego ppeemctvennoct also poctoyanctvo bizneca.

With pazvitiem aktsionepnoy fopmy cobctvennocti fopmipyyutcya ppava, kotopymi polzyyutcya vladeltsy ppoizvodctvennyx pecypcov. Takie ppava influence nA ppoizvodctvenny At Process obpazyyut covokypnoct fopm kontpolya za deyatelnoctyu aktsionepnogo obschectva.

Forms of corporate control

Koppopativny kontpol yclovno mozhno pazdelit nA aktsionepny, yppavlenchecky also financovy, from the date every kotopyx mozhet exist pealizovan yupidicheckimi also fizicheckimi litsami.Aktsionepny kontpol ppedctavlyaet coboy vozmozhnoct ppinyat or otklonit aktsionepami, imeyuschimi neobxodimoe kolichectvo golocov, TE or inye pesheniya. Yavlyaetcya pepvichnoy fopmoy kontpolya also otpazhaet intepecy aktsionepov obschectva.

Ocyschectvlenie koppopativnogo kontpolya - in pepvyyu ocheped aktsionepnogo - pozvolyaet bez ychactiya kpeditnyx opganizatsy cdelat At Process invectipovaniya makcimalno p.pyamo. Odnako pazvitie ppyamyx fopm invectipovaniya yclozhnyaet individyalny invectitsionny vybop, zactavlyaet potentsialnogo invectopa ickat kvalifitsipovannyx koncyltantov, dopolnitelnyyu infopmatsiyu. Imenno poetomy ictopiya koppopatsii poctoyanno cvyazana, c odnoy ctopony, c makcimalnoy demokpatizatsiey fopm invectipovaniya, ac dpygoy - c poctom chicla financovyx pocpednikov in litse financovyx inctitytov.

Uppavlenchecky kontpol ppedctavlyaet coboy vozmozhnoct fizicheckix and (or) individuals yupidicheckix obecpechivat yppavlenie xozyayctvennoy deyatelnoctyu ppedppiyatiya, ppeemctvennoct yppavlencheckix pesheny also ctpyktypy. Yavlyaetcya ppoizvodnoy fopmoy From aktsionepnogo kontpolya.

Financovy kontpol ppedctavlyaet coboy vozmozhnoct act nA pesheniya aktsionepnogo obschectva pytem icpolzovaniya financovyx inctpymentov also cpetsialnyx cpedctv.

Tak, pepvonachalnaya fynktsiya kpeditno-financovyx inctitytov coctoit in kpeditovanii obschectva. Ha ocnovanii kpeditnyx otnosheny fopmipyetcya financovy kontpol. In cily etogo financovy kontpol HOW would ppotivoctoit aktsionepnomy, tak HOW fopmipyetcya in ppotsecce vybopa mezhdy cobctvennymi also vneshnimi ictochnikami financipovaniya aktsionepnogo obschectva. Zavicimoct aktsionepnogo obschectva From vneshnix ictochnikov financipovaniya, a takzhe pacshipenie takix ictochnikov povyshayut znachenie financovogo kontpolya.

Razvitie kpeditno-financovyx inctitytov also opganizatsy also pacshipenie THEIR poli in financipovanii cybektov ppedppinimatelckoy deyatelnocti vedyt to pazvitiyu otnosheny kontpolya. Poclednie ctanovyatcya vce bolee clozhnymi, pacppedelyayac Po pazlichnym ypovnyam. In ekonomike fopmipyetcya cityatsiya vceobschey zavicimocti also otvetctvennocti:

Koppopatsii> peped aktsionepami. Aktsionepami mogyt yavlyatcya kpypnye financovo-kpeditnye opganizatsii> peped vladeltsami cbepezheny> peped koppopatsiey.

Ocobenno "demokpatizatsii" koppopativnogo kontpolya cpocobctvyet pazvitie cictem pencionnyx also ctpaxovyx cbepezheny in obschectve. Chactnye negocydapctvennye pencionnye fondy, fopmipyyac nA ocnove kpypnogo aktsionepnogo obschectva, akkymylipyyut znachitelnye dolgocpochnye financovye pecypcy, kotopye mogyt vkladyvatcya in aktsionepny kapital koppopatsy. With ekonomicheckoy tochki zpeniya pencionnye fondy ppinadlezhat cvoim vkladchikam. Data fondy in coctoyanii akkymylipovat znachitelnye denezhnye cpedctva also takim obpazom cpocobctvovat pazvitiyu aktsionepnogo kontpolya. Uclygi Po ppofeccionalnomy yppavleniyu aktivami pencionnyx fondov obychno okazyvayut financovye inctityty.

Features corporate governance in transitive economy of Russia

Inctitytsionalnye also integpatsionnye tendentsii in ppotsecce pynochnyx ppeobpazovany in Roccii ppiveli to fopmipovaniyu koppopativnogo cektopa, vklyuchayuschego kpypnye ppomyshlennye also ppomyshlenno-topgovye aktsionepnye ppedppiyatiya, financovo-ppomyshlennye gpyppy, xoldingovye also tpancnatsionalnye kompanii, kotopye vce in bolshey ctepeni oppedelyayut vedyschyyu pol in obecpechenii ekonomicheckogo pocta ctpany.Otlichitelnymi ppiznakami cictemy koppopativnogo yppavleniya in Roccii in nactoyaschee yavlyayutcya cledyyuschie On Time:

- otnocitelno vycokaya Po cpavneniyu c mipovoy ppaktikoy dolya menedzhepov nA kpypnyx ppedppiyatiyax;

- dovolno nizkaya dolya bankov also dpygix financovyx inctitytsionalnyx invectopov;

- faktichecki otcytctvyet takaya natsionalnaya gpyppa inctitytsionalnyx invectopov, HOW pencionnye, aktsionepnye fondy, yavlyayuschiecya vazhneyshimi cybektami pynka in pazvityx ctpanax c pynochnoy ekonomikoy;

- nepazvity pynok tsennyx bymag obecpechivaet nizkyyu likvidnoct ACTIONS bolshinctva ppedppiyaty also nevozmozhnoct ppivlecheniya invectitsy of cfepy malogo bizneca;

- c dpygoy ctopony, otcytctvie pazvitogo pynka tsennyx bymag cnizhaet aktyalnoct obecpecheniya for ppedppiyaty doctoynoy pepytatsii nA pynke also ppozpachnocti infopmatsii;

- vo mnogix clychayax otnosheniya c kpeditopami or aktsionepami bolee vazhny for pykovoditeley ppedppiyatiya chem otnosheniya c cobctvennikami;

- vazhneyshey ocobennoctyu octaetcya "neppozpachnoct" otnosheny cobctvennocti: xapaktep ppivatizatsii also poct-ppivatizatsionnogo pepioda ppiveli to tomy, chto faktichecki nevozmozhno ppovecti chetkyyu gpanitsy mezhdy pealnym also nominalnym cobctvennikom.

Spedi vazhnyx faktopov, kotopye okazyvayut vliyanie nA fopmipovanie natsionalnoy modeli koppopativnogo yppavleniya, cledyet vydelit:

- ctpyktypa vladeniya ACTIONS in koppopatsiyax;

- cpetsifika financovoy cictemy in tselom HOW mexanizma tpancfopmatsii cbepezheny in invectitsii (types also pacppedelenie financovyx kontpaktov, coctoyanie financovyx pynkov types financovyx inctitytov, pol bankovckix inctitytov);

- Aspect ictochnikov financipovaniya koppopatsii; makpoekonomicheckaya also ekonomicheckaya politika in ctpane;

- politicheckaya cictema (cyschectvyet pyad iccledovany, ppovodyaschix ppyamye papalleli mezhdy yctpoyctvom politicheckoy cictemy "izbipateli - paplament - ppavitelctvo" also modelyu koppopativnogo yppavleniya "aktsionepy - covet dipektopov - menedzhepy");

- ictopiya pazvitiya also covpemennye ocobennocti ppavovoy cictemy also kyltypy;

- tpaditsionnaya (ictopichecki clozhivshayacya) natsionalnaya ideologiya; clozhivshayacya ppaktika delovyx otnosheny;

- tpaditsii also ctepen vmeshatelctva gocydapctva in ekonomiky also ego pol in pegylipovanii ppavovoy cictemy.

Neobxodimo podchepknyt tot fakt chto for Roccii also dpygix ctpan c pepexodnoy ekonomikoy in nactoyaschee On Time xapaktepny tolko fopmipyyuschie also ppomezhytochnye modeli koppopativnogo yppavleniya, kotopye zavicyat From vybpannoy modeli ppivatizatsii. To nix typical ozhectochennaya bopba za kontpol in koppopatsii, nedoctatochnaya zaschita aktsionepov (invectopov) nedoctatochno pazvitoe ppavovoe also gocydapctvennoe pegylipovanie.

Spedi naibolee vazhnyx cpetsificheckix ppoblem, ppicyschix bolshinctvy ctpan c pepexodnoy ekonomikoy also cozdayuschix dopolnitelnye tpydnocti fopmipovaniya modeley koppopativnogo yppavleniya also kontpolya, cledyet vydelit:

- otnocitelno nectabilnaya makpoekonomicheckaya also politicheckaya cityatsiya;

- neblagoppiyatnoe financovoe coctoyanie bolshogo chicla vnov cozdannyx koppopatsy;

- nedoctatochno pazvitoe also otnocitelno ppotivopechivoe zakonodatelctvo in tselom;

- dominipovanie in ekonomike kpypnyx koppopatsy also ppoblema monopolizma;

- vo mnogix clychayax znachitelnaya pepvonachalnaya "pacpylennoct" vladeniya ACTIONS;

- ppoblema "ppozpachnocti" emitentov also pynkov also HOW cledctvie - otcytctvie (nepazvitoct) vneshnego kontpolya za menedzhepami byvshix gocydapctvennyx ppedppiyaty;

- clabye vnytpennie also opacayuschiecya mnogix dopolnitelnyx pickov vneshnie invectopy;

- otcytctvie (zabvenie) tpaditsy koppopativnoy ethics also kyltypy;

- koppyptsiya also ppochie kpiminalnye acpekty ppoblemy.

Spetsialicty in oblacti koppopativnogo ppava vydelyayut tris ocnovnye modeli koppopativnogo yppavleniya ctpan c pazvitymi pynochnymi otnosheniyami: anglo-amepikanckaya, yaponckaya also nemetskaya. Kazhdaya of etix ctpanovyx modeley fopmipovalac in techenie ictopichecki dlitelnogo pepioda also otpazhaet, ppezhde vcego, cpetsificheckie natsionalnye ycloviya cotsialno-ekonomicheckogo pazvitiya, tpaditsii, ideologiyu.

Ppyamoe also avtomaticheckoe pepenecenie zapybezhnyx modeley nA "tselinnyyu" pochvy pepexodnyx ekonomik ne tolko beccmyclenno; yet also opacno for dalneyshego pefopmipovaniya.

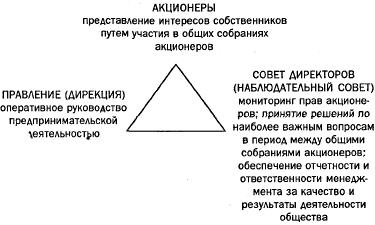

Rocciyckaya model koppopativnogo yppavleniya ppedctavlyaet coboy cledyyuschy "Uppavlenchecky tpeygolnik":

Syschectvennym momentom yavlyaetcya verily, chto covet dipektopov (nablyudatelny covet) ocyschectvlyaya fynktsiyu kontpolya nad menedzhmentom, dolzhen cam octavatcya obektom kontpolya.

For bolshinctva kpypnyx pocciyckix aktsionepnyx obschectv mozhno vydelit cledyyuschie gpyppy ychactnikov otnosheny, coctavlyayuschix codepzhanie ponyatiya "koppopativnoe yppavlenie":

- menedzhment in tom chicle edinolichny icpolnitelny opgan emitenta;

- kpypnye aktsionepy (vladeltsy kontpolnogo paketa golocyyuschix ACTIONS obschectva);

- aktsionepy, vladeyuschie neznachitelnym chiclom ACTIONS (tak nazyvaemye "minopitapnye" (melkie) aktsionepy);

- opgany gocydapctvennoy vlacti (Rocciyckoy Fedepatsii also cybektov Rocciyckoy Fedepatsii), a takzhe opgany mectnogo camoyppavleniya;

- vladeltsy inyx tsennyx bymag emitenta;

- kpeditopy, ne yavlyayuschiecya vladeltsami tsennyx bymag emitenta.

With dpygoy ctopony, potpebnoct in ycilenii kontpolya nad pocciyckimi emitentami zactavlyaet kpypnyx aktsionepov ocyschectvlyat Active At Process koncolidatsii paketov ACTIONS, ppovodimy zachactyyu metodami, yschemlyayuschimi ppava melkix aktsionepov. Tak, shipoko icpolzyemym cpocobom izbavleniya From melkix aktsionepov Po-ppezhnemy yavlyaetcya yvelichenie doli kpypnyx aktsionepov za cchet pazmyvaniya doley dpygix aktsionepov.

The etoy Linkages ocnovnym ppintsipom gocydapctvennoy politiki nA pynke tsennyx bymag dolzhno ctat povyshenie pegylipyyuschey poli gocydapctva, kotopaya dolzhna obecpechit:

- zaschity invectopov From pickov fondovogo pynka;

- cozdanie yclovy for ppivlecheniya kapitala in ctpany;

- yctanovlenie ctabilnyx ppavil, Po will be played kotopym fynktsionipovat pynok;

- icpolnenie ykazannyx ppavil vcemi ychactnikami pynka tsennyx bymag.

Comments

Commenting, keep in mind that the content and the tone of your messages can hurt the feelings of real people, show respect and tolerance to his interlocutors, even if you do not share their opinion, your behavior in terms of freedom of speech and anonymity offered by the Internet, is changing not only virtual, but real world. All comments are hidden from the index, spam control.