Инкассо чеков Google AdSence и именных чеков

Все чаще соотечественникам приходится получать именные чеки. Особенно регулярно именные чеки из США приходят по почте владельцам сайтов, разместившим "у себя" рекламу через бесплатную систему Google AdSence и получающим прибыль от показов этой рекламы. Да и денежные подарки на Западе между разными городами и странами дарят, конечно, не переводом на ваш счет, а именными чеками. Что нужно делать, чтобы «снять» с чека адресованные вам средства? В этом поможет наша статья.

Шаг первый: смотрим на параметры чека

Инкассо – так называется операция по обналичиванию средств с именного и не только чека. Вкратце говоря, эта операция с точки зрения банка состоит из трех этапов. Вначале – принятие от держателя чека информации. Затем – проверка этой информации в банке-плательщике по чеку (банке, в котором открыт счет лица или компании, выписавших именной чек). Наконец, в случае положительного ответа банка-плательщика – выдача держателю чека указанной на чеке суммы.

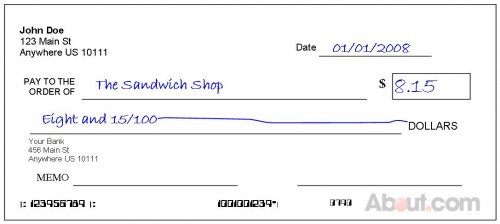

Однако прежде чем вы начнете звонить в банки или бороздить их сайты в поисках места приема вашего чека на инкассо, внимательно изучите полученный вами документ. На именном чеке вы должны увидеть девять следующих параметров:

- Фамилия или название чекодателя (лица или компании, выписавших чек);

- Личная подпись лица или представителя компании, выписавшего чек;

- Название, адрес, реквизиты банка-плательщика по чеку;

- Валюта чека и сумма (цифрами и словами);

- Фамилия, имя бенефициара (чекодержателя, получателя выручки) или название бенефициара-юрлица. В случае почтового отправления чека также бывает указан адрес бенефициара;

- Номер чека (в основном поле данных) и еще раз номер чека (дублируется внизу);

- Дата выписки чека;

- Срок действия чека;

- Магнитная информационная полоса

При этом на чеке, чтобы он был принят банком, не должно быть:

- Исправлений;

- Надписей на оборотной стороне;

- Надписей «Void» (недействителен) или «Сopy» – это особые водяные знаки, которые четко проявляются на ксерокопиях чека. Предъявление последних повлечет не просто не прием чека на инкассо, а вызов в банк милиции и задержание предъявителя.

Кроме того, именной чек, оформленный в некоторых странах, непременно должен содержать название «чек» на том языке, на котором он составлен. Однако это требование, согласно законодательству (Положение НБУ о чеках, далее: Положение, п.2.1.а) необязательно для ряда крупнейших стран с давними чековыми традициями. «Перечень этих стран лучше уточнить у банка, как правило, это Великобритания, Австралия, Канада, США, Германия».

Особое внимание стоит обратить на срок действия именного чека. Если лицевая сторона чека не содержит указания срока его действия, то согласно международной практике чекового обращения, он принимается равным шести месяцам с даты его выписки. То же советует и Положение, 2.1.а, «если законодательство страны чекодателя не предполагает другого варианта»; между тем, законодательство большинство западных стран также исходит из срока шесть месяцев.

В связи с этим не стоит медлить с представлением именного чека на инкассо – если от даты выписки чека прошло более 4,5 месяцев, шансы его приема на инкассо начинают стремительно уменьшатся. «Просроченные чеки либо чеки с истекающими в ближайший месяц сроками действия банками не принимаются», – четко утверждает Ольга Глуховская.

В случае отсутствия имени/названия бенефициара (чек «на предъявителя») документ на инкассо в Украине принят не будет – согласно отечественному законодательству (Положение, 2.1.а). А вот если сумма цифрами и словами на чеке различается – это не страшно: правильной согласно законодательству практически всех стран, включая нашу, в таких случаях всегда признается надпись словами, а ошибочной – надпись цифрами.

Что же касается повреждений, то «надрывы, легкая потертость или небольшое намокание, если они не препятствуют прочтению необходимых реквизитов, обычно не являются веской причиной для отказа в приеме чека к оплате».

Наконец, если чек просрочен или до конца срока действия осталось две-четыре недели, он все же может быть принят на инкассо – однако в этом случае банк имеет право запросить у вас денежный залог (величина которого в случае топ-10 банков указана в таблице ниже).

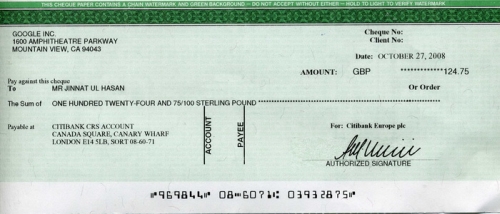

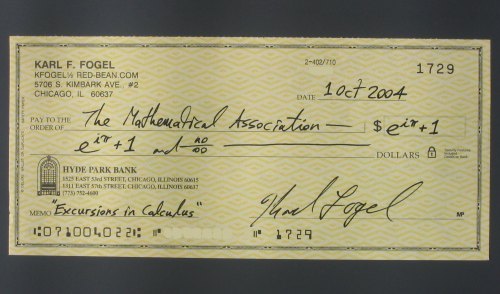

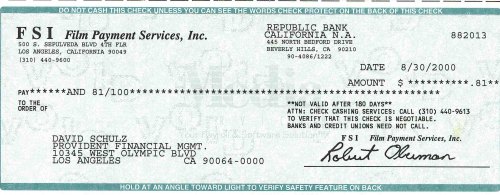

Сам именной чек может выглядеть так:

Шаг второй: ищем отделение банка, проводящее инкассо

Этот шаг легче всего провести в телефонном режиме. Но если вы собираетесь пользоваться инкассо именных чеков регулярно (например, получаете прибыль от контекстной рекламы Google AdSence на вашем сайте), есть смысл изучить отзывы на форумах, где указаны и адреса отделений с описанием достоинств и недостатков их менеджеров.

Если вы звоните по телефону, можете также заранее выяснить, в какое подразделение для этого обращаться (в иных банках с чеками работает отдел для физлиц, в иных – чеки принимают только в отделе юрлиц).

Кроме того, если вы живете недалеко от города с главным офисом или региональным управлением вашего банка по телефону выясните, будет ли ваш чек пересылаться в главный/региональный офис и будет ли платной для вас его пересылка. Ибо если пересылка стоит 50 гривен (пользователи в сети называют такую сумму), а вы живете в Броварах и обращаетесь в отделение киевского банка – то возможно, вам окажется дешевле и удобнее лично доехать до такого киевского отделения, из которого пересылка не потребуется.

И, конечно же, необходимо в качестве одного из первых вопросов менеджерам банка назвать банк-плательщик, страну оформления вашего чека, его валюту и сумму – для выяснения, возьмется ли работать банк именно с таким зарубежным учреждением. В случае периода менее полутора месяцев до окончания срока действия чека спрашивайте и об этом параметре – возможно, одни банки категорически откажут в приеме именного чека на инкассо, зато другие учреждения на это действие согласятся.

Шаг третий: узнаем о документах

Этот шаг можно провести или по телефону, или путем личного захода в отделение банка (если это вам удобно). Сразу отметим, что согласно законодательству (Положение, 4.1) идентификационный код и другие документы для приема чека на инкассо не требуются – достаточно паспорта. В большинстве случаев пакет документов для подачи именного чека на инкассо, действительно, ограничивается паспортом.

Попутно отметим, что при наличии у вас загранпаспорта, желательно взять в банк сразу и этот документ (поскольку в загранпаспорте, как и в чеке, ваши фамилия и имя написаны латиницей – надеемся, вы указывали чекодателю именно такое написание ваших данных). Но вместе с заграничным необходимо не забыть и гражданский паспорт (по закону, все банковские операции производятся на основании внутреннего паспорта; водительские права и другие документы с фото или без него недостаточны).

Упомянем, что если в чеке с адресом указано другое место вашего фактического проживания (по которому вы и получили почтой чек), чем место регистрации паспорта – то это не является проблемой; для банка параметр «адрес» на чеке решающим не является. А вот в заявлении на подачу чека с адресом на инкассо необходимо указывать тот же адрес, что был на чеке – а не место регистрации паспорта.

И только если чекодержатель несовершеннолетний или же скончался, то подача именного чека на инкассо осуществляется родителями/опекунами в первом случае или наследниками во втором – с предъявлением уже большого соответствующего случаю пакета документов, о которых вам и сообщат в банке.

Шаг четвертый: узнаем о расходах

У менеджера банка по телефону или в личной беседе поинтересуйтесь размером комиссии за прием чеков. При том учтите, что комиссий может быть две: украинского банка, в который вы обращаетесь, и зарубежного, банка-плательщика. Впрочем, у отечественного учреждения может быть назначена крупная комиссия, которая для банка «покрывает» любые комиссии зарубежного банка – то есть последняя с чекодержателя тогда не взимается. Этот момент стоит выяснить заранее.

Во вторую очередь выясните, платится ли комиссия отечественному учреждению сразу при приеме именного чека на инкассо – или высчитывается из указанной в чеке суммы только при выплате последней.

Наконец, в третью очередь не забудьте спросить, потребуется ли от вас внести денежный залог при таких-то параметрах вашего чека, и чему такой залог может быть равен.

Естественно, выбирать банки, в которые есть смысл звонить за выяснением нюансов, стоит по размерам и «простоте» их комиссий за инкассо (но, опять же, неплохо промониторить отзывы пользователей в сети). В изучении возможных комиссий вам поможет таблица условий приема чека на инкассо банками из числа 10 лидеров по активам в конце статьи.

Шаг пятый: идем в отделение и думаем, как брать деньги: на счет или наличными

При приеме именного чека на инкассо в отделении вам предстоит:

- заполнить заявление (указав контактный телефон),

- в случае необходимости оплачивать комиссии именно при приеме чека или вносить залог – совершить эти проплаты банку

- поставить личную роспись на обороте чека (ни в коем случае не делайте этого заранее, хоть закон это и разрешает! – банки требуют совершать это деяние только в присутствии менеджера финучреждения)

- отдать заявление и чек,

- получить квитанцию о принятии чека на инкассо

После чего через месяц-два по указанному телефону вам позвонят и – в случае положительного ответа банка-плательщика – сообщат о возможности выплатить вам указанную в чеке сумму. Если комиссию украинскому банку вы платили при приеме чека, то комиссию банка-плательщика с вас снимут при выплате чека, в ином случае при выплате из суммы вычтут обе комиссии.

Если вы обладаете валютным счетом в любом банке, вы можете в заявлении указать счет – и на него получить сумму по чеку. «По желанию клиента деньги будут перечислены на валютный счет, номер которого укажет получатель в заявлении о приеме чека к оплате на инкассо, независимо от того, какой именно это счет (текущий, карточный) и в каком банке он открыт».

Учтите, что в некоторых банках, если вы для получения средств по чеку откроете валютный текущий или карточный счет в этом учреждении, то комиссия за прием чека на инкассо существенно уменьшится (например, в Райффайзен Банке Аваль – с 2% до 1%). Оповещение о поступлении средств с чека на счет вы можете получить как по телефону, так и при помощи интернет-банкинга. В случае положительного исхода и выплаты денег чек чекодержателю не возвращается.

Если именной чек банком принят на инкассо, то отказать в его оплате банк может лишь в одном случае – если от банка-плательщика пришел отказ на оплату данного чека. «Тогда клиенту возвращают чек с отметкой «отказ» и предоставляют письмо-уведомление от банка-корреспондента, где указана причина отказа», – уточняет Ольга Глуховская. В таком случае в дальнейших переговорах о неоплате чеков банк, к которому вы обращались, и украинское законодательство уже не участвуют. Такие споры решаются только «между чекодержателем и чекодателем в соответствии с законодательством страны плательщика».

Шаг шестой: а может, без похода в отделение?

Недавно появилась возможность одновременно и уменьшить срок (2-3 недели) ожидания выплаты средств по чеку, и обойтись без похода в отделение и без предъявления паспорта – и все это практически «за те же деньги». Речь идет о cистемах интернет-банкинга, а также о сервисах онлайн-платежей.

В случае, если система интернет-банкинга или платежный сервис, которыми вы пользуетесь, содержит в интерфейсе выбор «инкассо чеков» (или как-то похоже) – например, система Privat24 или сервис LiqPay – вам предстоит сфотографировать или просканировать переднюю и заднюю стороны вашего чека и загрузить их в соответствии с интерфейсом. На этом работа в сети закончена.

Далее вам надлежит отправить обычной почтой заказным письмом или письмом с уведомлением (если чек на большую сумму, и вы боитесь за его сохранность, можете оформить доставку при помощи специализированного агентства) по адресу, который непременно указывается в том же интерфейсе (в случае Privat24 и LiqPay – днепропетровский адрес ПриватБанка).

Деньги по приходе оригинала чека по указанному адресу будут зачислены на вашу карточку (за это время банк пересылает изображения ваших чеков банку-плательщику и верифицирует их). По отзывам пользователей, например, в случае чеков Google AdSence (плательщик – американский Citybank) обналичивание при помощи онлайн-инкассо происходит вдвое-втрое быстрее, чем при личном занесении чека в отделение – буквально через 10-14 дней.

Этот, казалось бы рискованный, способ, на самом деле чреват денежными потерями только в одном случае – при одновременном перехвате злоумышленниками и оригинала вашего чека, и ваших пароля/логина для входа в онлайн-систему, что вместе взятое малореально. Затребовать же в телефонном режиме или режиме электронной почты (если предположить, что ваш пароль к последней злоумышленникам известен) ваш логин и пароль под видом их забывания у большинства онлайн-систем можно только путем ответа на секретный вопрос, что также является дополнительным фактором безопасности.

Условия приема именных чеков на инкассо банками на 30 сентября 2010 года

| Банк | Плата клиента за прием чеков на инкассо | ||

|---|---|---|---|

| Комиссия, % от суммы чека | Минимальная комиссия | Дополнительные расходы, кроме комиссии | |

| ПриватБанк | 3% | 20 грн. | |

| Укрэксимбанк | 2% | 79,5 грн.($10) | За сомнительный чек клиент вносит залог в сумме $10 (чек до $100 000), €55 (чек до €10 000), €150 (чек свыше €10 000). По именным чекам в других валютах залог вносится в сумме $20 |

| Ощадбанк | 2% | 31,8 грн. ($4) | Клиентом вносится обязательный залог в размере $20 или €20 |

| Райффайзен Банк Аваль | 2% (на валютный счет в банке 1%) + комиссия заруб. банка | 39,75 грн. ($5) | - |

| УкрСиббанк | услуги нет | ||

| Укрсоцбанк | В $: по чекам, выписанным на американские банки, 1%, не менее $35 и не более $200. В $: по чекам, выписанным на банки, находящиеся не на территории США 1%, но не менее $100. В €: по чекам, выписанным на немецкие банки, 1%, не менее $35 и не более $200. В €: по чекам, выписанным на банки, находящиеся не на территории Германии 1%, но не менее $100. В других валютах 1%, не менее $35 и не более $200 | ||

| ОТП Банк | 3,6% | 500 грн. | Выплата возмещения – 1,5% (min 30 грн.) |

| ВТБ Банк | 2% | 39,75 грн. ($5) или 53,75 грн. (€5) | Клиентом вносится обязательный залог в размере €50 плюс 2% от суммы чека |

| Альфа-Банк | услуги нет | ||

| Финансы и Кредит | 2% | 39,75 грн. ($5) | |

Какие чеки принимаются на инкассо

Чеки, которые вы можете обналичить в банке, в основном, бывают двух видов: именные и дорожные.

Именные чеки – это письменные распоряжения владельца счета выдать определенную сумму указанному в чеке физическому или юридическому лицу. Тот, на кого выписан чек, называется чекодержателем.

Получить по именному чеку деньги можно обычно в течение шести месяцев, если другой срок не указан в самом чеке. Обычно банки рекомендуют обращаться с чеком за деньгами не позже, чем через четыре с половиной – пять месяцев после даты его выписывания. Чеки без даты большинство банков не принимают.

Чтобы обналичить по именному чеку деньги, вам нужно вовремя прийти в банк с документом, удостоверяющим вашу личность, и подписать заявление. Затем подождать от двух недель до двух месяцев. Кроме Вас, обналичить чек может любое другое лицо по доверенности, заверенной нотариально. Чаще всего украинцам приходится сталкиваться с именными чеками, которые выпускают заграничные банки. У нас в стране их уже обналичивают через посредников – украинские банки. Такие чеки обычно получают от родственников или спонсоров, по почте или любым другим способом.

Дорожные чеки – это платежные документы, по которым во время путешествий можно быстро и удобно получить деньги. В отличие от именных, дорожные чеки покупают у финансовых организаций, чтобы таким способом сохранить денежные средства и легко обналичить их при потребности. То есть вы приходите в банк и покупаете у компании-эмитента сертификат-обязательство выплатить вам указанную в чеке сумму. А за границей получаете деньги, подписывая выписанный на вас дорожный чек второй раз в момент его продажи, и заплатив комиссию в размере 1-2% от стоимости чека или фиксированную сумму за каждый чек.

Дорожные чеки не имеют ограничений во времени – вы можете взять их с собой в путешествие и через пару лет. Во многих магазинах, ресторанах и отелях за рубежом такие документы принимают наравне с наличными. Вообще они достаточно удобны – их легко восстанавливать в случае кражи или потери: позвонив во всемирную службу возмещения компании-эмитента по телефону, указанному на квитанции о покупке чека, вы блокируете утраченный чек и в течение суток получаете другой. Купить в банках такие чеки можно за наличные, предъявив паспорт, заключив договор и заплатив комиссию в размере 0,5-1% от суммы покупки. Вывозить за границу и ввозить такие чеки в Украину можно на сумму до 10 000 евро. Большую сумму надо письменно задекларировать таможенному органу, подтвердив документально, что вы сняли ее со счета в банке. Кроме этого, вы не сможете за один операционный день купить дорожных чеков на сумму более 10 000 евро, так как это запрещено законодательством.

Обменять как дорожные, так и именные чеки можно только на полную сумму денег, указанную в них. Частичного «обналичивания» не бывает.

Схема инкассо чеков

Во время получения денег по именному чеку, а в некоторых случаях – и по дорожному, вы встретитесь с процедурой инкассо. Дело в том, что банк, в который вы пойдете обналичивать чек, не выплатит вам сразу указанную в документе сумму из своих средств, а обратится к тому финансовому учреждению, в котором открыт счет лица, выписавшего чек. И только проверив чек и получив от того учреждения деньги, банк передаст их вам. Других способов обналичить именной чек иностранного банка – не через расчеты по инкассо – в Украине не существует.

Поскольку схема инкассо довольно редкая, ее не автоматизировали, а проводят вручную. Поэтому получить деньги по чеку достаточно дорого. В стоимость процедуры входит прием чека на инкассо, с последующей отсылкой его в инкассирующий банк по почте (например, 4% от номинала чека, минимум $20 – максимум $300); а также переписка с банком – чтобы уточнить или разыскать сумму возмещений по чекам (по запросу держателя чека). Причем оплата взимается за каждый чек отдельно.

Существуют специальные интернет-сервисы, с помощью которых можно дешевле и быстрее осуществить инкассо именных чеков. Для этого вы должны отправить чек в страну, где такая процедура более распространена, соответственно, она происходит быстрее и стоит меньше. Обычно обналичить чек с помощью такого сервиса можно в течение недели, а комиссия составит до 3% (минимум $5). Однако нет гарантии, что сервис, в который вы обратитесь, на самом деле вернет вам деньги.

Что касается дорожного чека, то вы можете рассчитывать на «обналичивание» денег по нему без задержек на инкассо, если он относится к следующим видам: American Express (распространены в США); Thomas Cook и Visa (распространены в Европе); City Corp (распространены в азиатских государствах). Причина в том, что если банки производят выплату по знакомым им видам чеков сразу, то по другим видам они захотят провести инкассо, и процедура потребует времени. Кроме этого, не каждый заграничный банк примет на инкассо чеки незнакомых ему систем.

Если вы передали или подарили свой дорожный чек другому лицу, поставив на его обратной стороне передаточную надпись (индоссамент), то банк также примет документ к оплате только на условиях инкассо. Часто приходится ждать ответа - подтверждения платежеспособности чека из банка-эмитента до пяти недель.

Кроме так называемого «чистого инкассо», которое касается финансовых документов – чеков и векселей, - существует еще документарное инкассо. Оно касается финансовых документов, сопровождаемых счетами, транспортными, страховыми и другими коммерческими документами. Например, в международной торговле под документарным инкассо подразумевают обязательство банка получить от импортера сумму платежа по контракту по поручению экспортера и перечислить ее последнему вместе с передачей всех товарных документов.

Недостатки схемы расчетов по инкассо

Кроме достаточно ощутимой стоимости инкассо чеков для получения денег по именным чекам, основным недостатком такой процедуры обналичивания денег можно считать продолжительные сроки инкассо. Один из банков, которые принимают именные чеки, в своем предложении отметил, что такая процедура у него имеет «небольшие сроки оплаты – около полутора месяцев». Такой срок – еще не предел. Кроме того, бывают случаи, когда банк-корреспондент требует дополнительный срок для проверки чека. Так что приготовьтесь ждать.

Кроме этого, чек может оказаться неплатежеспособным по его прибытию в иностранный банк. В этом случае банк, в который вы обратились, не вернет вам минимальную комиссию, которую вы заплатили в момент приема чека на инкассо.

Отозвать именной чек лицо, которое его выписало, не может по законодательству. А вот если банк откажется его обналичить – он должен на чеке указать причины отказа и дату предъявления чека к оплате. Бояться, что на момент обналичивания чека на счете, с которого снимают средства, не будет достаточно денег, не стоит – для лица, выписавшего чек, банк может провести эту процедуру и в кредит.

Регулирует все вопросы, связанные с дорожными и именными чеками Постановление Национального банка N520 от 29.12.2000 «Об утверждении Положения про порядок осуществления операций с чеками в иностранной валюте на территории Украины ».

Created/Updated: 25.05.2018