Шпаргалка ФЛП-единщика на 2017 год

Чтобы вам проще было ориентироваться в налоговых дебрях с учетом всех новаций от законотворцев, предлагаем воспользоваться данными материалами. Все ФЛП-единщики (кроме пенсионеров по возрасту и инвалидов) должны уплачивать ЕСВ «за себя». Базу начисления единщики определяют самостоятельно в пределах установленного законодательством минимума и максимума (см. табл. 1).

Закон № 1774 (Закон Украины «О внесении изменений в некоторые законодательные акты Украины» от 06.12.2016 г. № 1774-VIII) в этой части привнес новации:

- ФЛП-единщики групп 2 и 3, как и ранее, платят ЕСВ в размере не ниже минимального (ЕСВмин = 22 % от МЗП);

- для ФЛП-единщиков группы 1 минимальная планка по ЕСВ с 2017 года составляет 50 % минимального страхового взноса. При этом в страховой стаж такие месяцы будут зачисляться пропорционально уплаченному ЕСВ. То есть если ФЛП группы 1 хочет, чтобы месяц был полностью зачтен в страховой стаж, такое лицо должно платить ЕСВ в размере ЕСВмин (иначе в страховой стаж зачтут половину месяца).

Таблица 1. Размер ЕСВ «за себя» (грн/мес.).

| Показатель | Период 2017 года | ||

| январь–апрель | май–ноябрь | декабрь | |

| 1. Минимальный размер ЕСВ «за себя» | |||

1.1) для ФЛП групп 2, 3 (22 % от МЗП : 22 % x 3200,00) |

704,00 | ||

1.2) для ФЛП группы 1 (стр. 1.1 x5 0 %): |

352,00 | ||

| 2. Максимальная база (25 ПМТЛ) | 40000,00 | 42100,00 | 44050,00 |

| 3. Максимальный размер ЕСВ «за себя» (стр. 3 x 22 %) | 8800,00 | 9262,00 | 9691,00 |

Таблица 2. ЕН и ЕСВ «за себя»: отчетность и уплата

| ОТЧЕТНОСТЬ | УПЛАТА | |

| ЕН |

1. Налоговый период (п. 294.1 НКУ):

|

|

| ЕСВ |

|

|

Таблица 3. Календарь ФЛП-единщика на 2017 год

| Дата | Группа 1 | Группа 2 | Группа 3 | |

| Январь | 19 Чт | Уплата ЕСВ «за себя» за IV квартал 2016 года (сумма — 990,00) 1 |

||

| 20 Пт | Уплата ЕН за январь 2017 года (сумма до 160,00 грн 2) |

Уплата ЕН за январь 2017 года (сумма до 640,00 грн) |

— | |

| Февраль | 09 Чт | Подача налоговой декларации по ЕН ФЛП-единщиками групп 1–2, которые должны отчитываться в квартальные срокинюанс 1 | Подача налоговой декларации по ЕН за 2016 год | |

| Подача отчета по ЕСВ «за себя» за 2016 год по форме Д5 | ||||

| 17 Пт3 | Хнюанс 2 | Уплата ЕН за ІV квартал 2016 года 4 | ||

| 20 Пн |

Уплата ЕН за февраль 2017 года (сумма до 160,00 грн) |

Уплата ЕН за февраль 2017 года (сумма до 640,00 грн) |

Х | |

| Март | 01 Ср | Подача налоговой декларации по ЕН за 2016 годнюанс 3 | Х | |

| 20 Пн |

Уплата ЕН за март 2017 года (сумма до 160,00 грн) |

Уплата ЕН за март 2017 года (сумма до 640,00 грн) |

Х | |

| Апрель | 19 Ср | Уплата ЕСВ «за себя» за I квартал 2017 года (сумма — 1056,00 грн) |

Уплата ЕСВ «за себя» за I квартал 2017 года (сумма — 2112,00 грн) |

|

| 20 Чт |

Уплата ЕН за апрель 2017 года (сумма до 160,00 грн) |

Уплата ЕН за апрель 2017 года (сумма до 640,00 грн) |

Х | |

| Май | 10 Ср | Подача налоговой декларации по ЕН ФЛП-единщиками групп 1–2, которые должны отчитываться в квартальные срокинюанс 1 | Подача налоговой декларации по ЕН за I квартал 2017 года | |

| 19 Пт3 |

Уплата ЕН за май 2017 года (сумма до 160,00 грн) |

Уплата ЕН за май 2017 года (сумма до 640,00 грн) |

Уплата ЕН за I квартал 2017 года | |

| Хнюанс 2 | Х | |||

| Июнь | 20 Вт |

Уплата ЕН за июнь 2017 года (сумма до 160,00 грн) |

Уплата ЕН за июнь 2017 года (сумма до 640,00 грн) |

Х |

| Июль | 19 Ср | Уплата ЕСВ «за себя» за IІ квартал 2017 года (сумма — 1056,00 грн) |

Уплата ЕСВ «за себя» за IІ квартал 2017 года (сумма — 2112,00 грн) |

|

| 20 Чт |

Уплата ЕН за июль 2017 года (сумма до 160,00 грн) |

Уплата ЕН за июль 2017 года (сумма до 640,00 грн) |

Х | |

| Август | 09 Ср | Подача налоговой декларации по ЕН ФЛП-единщиками групп 1–2, которые должны отчитываться в квартальные срокинюанс 1 | Подача налоговой декларации по ЕН за I полугодие 2017 года | |

| 18 Пт3 |

Уплата ЕН за август 2017 года (сумма до 160,00 грн) |

Уплата ЕН за август 2017 года (сумма до 640,00 грн) |

Уплата ЕН за IІ квартал 2017 года | |

| Хнюанс 2 | Х | |||

| Сентябрь | 20 Ср |

Уплата ЕН за сентябрь 2017 года (сумма до 160,00 грн) |

Уплата ЕН за сентябрь 2017 года (сумма до 640,00 грн) |

Х |

| Октябрь | 19 Чт | Уплата ЕСВ «за себя» за IІІ квартал 2017 года (сумма — 1056,00 грн) |

Уплата ЕСВ «за себя» за IІІ квартал 2017 года (сумма — 2112,00 грн) |

|

| 20 Пт |

Уплата ЕН за октябрь 2017 года (сумма до 160,00 грн) |

Уплата ЕН за октябрь 2017 года (сумма до 640,00 грн) |

Х | |

| Ноябрь | 09 Чт | Подача налоговой декларации по ЕН ФЛП-единщиками групп 1 – 2, которые должны отчитываться в квартальные срокинюанс 1 | Подача налоговой декларации по ЕН за три квартала 2017 года | |

| 17 Пт3 | Хнюанс 2 | Уплата ЕН за III квартал 2017 года | ||

| 20 Пн |

Уплата ЕН за ноябрь 2017 года (сумма до 160,00 грн) |

Уплата ЕН за ноябрь 2017 года (сумма до 640,00 грн) |

Х | |

| Декабрь | 20 Ср |

Уплата ЕН за декабрь 2017 года (сумма до 160,00 грн) |

Уплата ЕН за декабрь 2017 года (сумма до 640,00 грн) |

Х |

|

нюанс 1 ФЛП-единщики групп 1 – 2 отчитываются в квартальные сроки, если:

нюанс 2 Также следует уплатить ЕН из сумм доходов, которые облагаются налогом по ставке 15 % и задекларированы плательщиками ЕН групп 1 и 2, соответственно в IV квартале 2016 года, I, II, или III кварталах 2017 года

нюанс 3 Те единщики, которые отчитались в квартальные сроки, от подачи годовой декларации освобождены.

|

||||

|

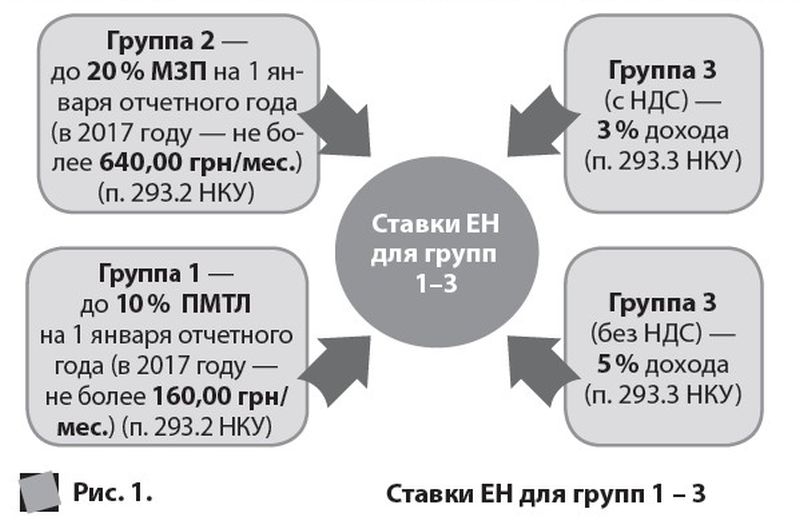

1 Рассчитывается исходя из МЗП за октябрь-ноябрь 2016 года (1450,00 грн) и за декабрь 2016 года 1600,00 грн.(1450 x 22 % x 2 мес. + 1600 x 22 %). 2 У единщиков группы 1 ставка ЕН с 01.01.2017 г. привязана к ПМТЛ, установленному на 1 января отчетного года. 3 Налоги и сборы (предусмотренные НКУ), последний срок уплаты которых приходится на нерабочий (выходной или праздничный) день, следует уплатить накануне. 4В зависимости от ставки 3 % или 5 % дохода. |

||||

Via epodatok.com.ua, Статья взята из газеты “Плательщик единого налога” № 2/2017

Created/Updated: 25.05.2018