home

Finance Finance

Books Books

Finance and Statistics - Ковалева А.М. Finance and Statistics - Ковалева А.М.

|

Finance and Statistics - Ковалева А.М.

4.3 MANAGEMENT OF CASH FLOWS

One of the areas of financial management of an enterprise is the effective management of cash flows. A complete assessment of the financial condition of an enterprise is not possible without an analysis of cash flows. Currently, most enterprises have a shortage of working capital. At the same time, many of them work with profit. One of the tasks of managing cash flows is to identify the relationship between these flows and profit, i.e. Whether the profit obtained is the result of effective cash flows or is the result of any other factors.

There are such concepts as " cash flow " and "cash flow".

Cash flow means all gross cash receipts and payments of an enterprise. The cash flow is associated with a specific period of time and represents a co-

Fight the difference between all received and paid by enterprises cash for this period. The movement of money is the fundamental principle, as a result of which there are finances, i.e. Financial relations, monetary funds, cash flows.

Cash flow management involves the analysis of these flows, the recording of cash flows, the development of a cash flow plan.

In the direct method, the flow is calculated on the basis of the enterprise's accounting records; At indirect - on the basis of indicators of balance of the enterprise and the report on financial results.

As a result, with the direct method, the enterprise receives answers to questions about inflows and outflows of money resources and their sufficiency to ensure all payments. The indirect method shows the interconnection of various types of enterprise activities, as well as the impact on profit changes in the assets and liabilities of the enterprise.

In addition, the basis for calculating the direct method is the revenue from the sale of products, with indirect - profit.

Under the direct method, the cash flow is defined as the difference between all inflows of funds in an enterprise by three types of activity and their outflows.

The balance of cash at the end of the period is defined as their balance at the beginning, taking into account their flow for a given period.

With the indirect method, the basis for the calculation is retained earnings, depreciation, and changes in the assets and liabilities of the enterprise. Here, the increase in assets reduces the cash assets of the enterprise, and the increase in liabilities - increases and vice versa.

The goals for a more complete understanding of cash flows are matrix balances for a certain period of time (quarter, year, etc.). The purpose of such balances is first of all to show, on the one hand, the source of each type of property of the enterprise, and on the other hand, the specific directions of using the sources of the company's cash resources. In the matrix balance, each indicator is recorded in three types: at the beginning and end of the period, as well as changes over the period (+, -).

As a result, it is possible to get answers to a number of questions: what is the relationship between the assets and liabilities of the enterprise, what specific changes have occurred in the sources of asset financing and in the use of liabilities, what decisions should be taken to optimize assets and liabilities?

At present, the finances of enterprises are in a crisis state, which manifests itself:

- In a significant shortage of funds both for the implementation of production activities, and for investment; This is expressed in the low level of wages, the delay in its payment, as well as in the practical cessation of financing of the social sphere by enterprises;

- In the high cost of credit and the inability to sufficiently use it for the needs of the enterprise;

- In significant non-payments of enterprises to each other, which are growing at a rather high rate, which exacerbates the shortage of funds from enterprises and complicates their problems.

Therefore, at the moment, the primary task for the state and enterprises is to strengthen the finances of enterprises and, on this basis, to stabilize the state's finances. Without its implementation, other tasks, including problems of inflation, can not be solved.

The main ways to strengthen the finances of enterprises are related to the optimization of the money they use and the elimination of their deficit.

The most important directions of improving financial work at the enterprises are the following:

- Systematic and continuous financial analysis of their activities;

- Organization of working capital in accordance with existing requirements in order to optimize the financial condition;

- Optimization of the costs of the enterprise on the basis of dividing them into variables and constants and analyzing the interaction and interconnection of "costs - revenue - profit";

- Optimization of profit distribution and selection of the most effective dividend policy;

- A broader introduction of commercial credit and bill circulation in order to optimize the sources of cash and the impact on the banking system;

- The use of leasing relations for the purpose of developing production;

- Optimization of the structure of property and sources of its formation in order to prevent the unsatisfactory structure of the balance;

- Development and implementation of the strategic financial policy of the enterprise.

Finance companies - the most important category of market economy. They play a decisive role in the system of financial relations of the state, therefore professional management of them contributes to solving not only the problems of the enterprise's finances, but also such problems as inflation, budget deficit, monetary policy, development of the stock market,

Control questions

- Determine the nature and role of enterprise finance in a market economy.

- What are the financial relationships of enterprises?

- What are the funds of enterprises?

- What concerns the net assets of enterprises and what is the role of their own funds?

- What is the financial lever and how is the effect of it determined? 7

- Name the indicators of the structure of the capital of the enterprise and the methods for calculating them.

- Determine the cash flows of enterprises.

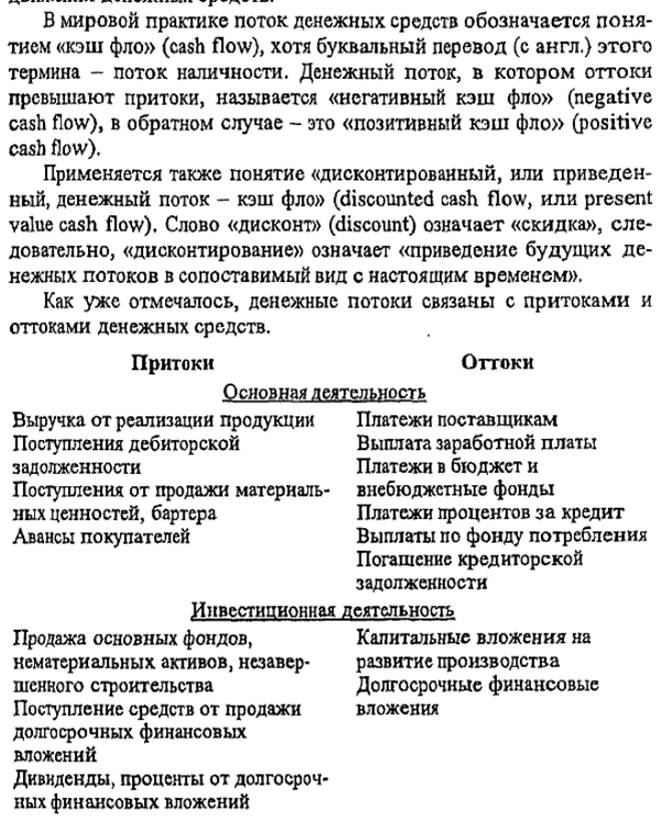

- What inflows and outflows are typical for the main, investment and financial activities of enterprises?

- What is included in the concept of "cash flow"?

- What methods are used to calculate cash flows?

- What are the main conditions and ways to strengthen enterprise finance?

Comments

When commenting on, remember that the content and tone of your message can hurt the feelings of real people, show respect and tolerance to your interlocutors even if you do not share their opinion, your behavior in the conditions of freedom of expression and anonymity provided by the Internet, changes Not only virtual, but also the real world. All comments are hidden from the index, spam is controlled.