home

Finance Finance

Books Books

Finance and Statistics - Ковалева А.М. Finance and Statistics - Ковалева А.М.

|

Finance and Statistics - Ковалева А.М.

5.3 COMPOSITION OF GROSS PROFITS OF THE ENTERPRISE

Profit as the main result of entrepreneurial activity provides the needs of the enterprise and the state as a whole. Therefore, first of all, it is important to determine the composition of the profit of the enterprise. The total profit of the enterprise is a gross profit . The amount of gross profit is influenced by a combination of many factors that depend and are not dependent on entrepreneurial activity.

Important factors of profit growth, depending on the activities of enterprises, are: growth in the volume of products produced in accordance with contractual conditions; Decrease in its cost price; Improvement of quality; Improvement of assortment; Increase of efficiency of use of production assets; Increase in labor productivity.

Factors that do not depend on the activities of enterprises include: changes in government regulated prices for products sold; Influence of natural, geographical, transport and technical conditions on the production and sale of products, etc.

Under the influence of both those and other factors, the gross profit of enterprises is formed.

In the gross profit is taken into account the profit from all activities First of all, gross profit includes the profit from the sale of goods, calculated by deducting from the total amount of revenues from the sale of this product (work, services) value added tax, excise and production and sales costs, Included in the cost price. Profit from sales of commodity output is the main part of gross profit.

Secondly, the composition of gross profit includes profit from the sale of other products and services of a non-commodity nature, i.e. Profit (losses) of subsidiary agricultural holdings, auto-farms, logging and other farms on the balance of the main enterprise.

The gross profit also includes profit from the sale of fixed assets and other property.

Finally, non-operating income and expenses are reflected in the composition of gross profit. Results of non-operating transactions.

• Due to the fact that the overwhelming part of gross profit (95-97%) enterprises receive from the sale of marketable products, this part of profit should be given the main attention. The above factors, depending and independent of the activities of the enterprise, mainly affect the profit from the sale of products. The main of these factors are subject to detailed study and analysis.

Previously, it should be noted that the profit from sales of commodity products is affected by a change in the balances of unrealized products. The more of these residues, the less profit the enterprise will receive from the sale of products. The amount of unrealized production depends on a number of reasons stipulated by commercial activities and conditions for the sale of products. An enterprise can produce more products than it can realize.

In addition, in the unrealized balances of finished products, the share of more profitable products may increase, which will entail a total increase in these balances. In order to increase profits, the enterprise must take appropriate measures to reduce the balances of unrealized products in both quantitative and summary terms.

The most important factor affecting the amount of profit from the sale of products is the change in the volume of production and sales of products The greater the volume of sales in the long run, the more profit the enterprise will receive, and vice versa. The dependence of profit on this factor, other things being equal, is directly proportional.

The fall in output under the current economic conditions, not counting a number of counteracting factors, such as rising prices, inevitably leads to a reduction in the volume of profit. Hence the conclusion about the need to take urgent measures to ensure the growth of the volume of production on the basis of its technical renewal and increase production efficiency. In turn, the improvement of settlement and payment relations between enterprises will help improve the conditions for the sale of products, and consequently, the growth of profits.

An equally important factor affecting the amount of profit from the sale of marketable products is the change in the level of production costs. If the change in sales volume affects the amount of profit directly proportional, the relationship between the amount of profit and the cost level is inverse. The lower the cost of production, determined by the level of costs for its production and sale, the higher the profit, and vice versa. This factor is influenced by many factors. Therefore, when analyzing changes in the cost level, the reasons for its reduction or increase should be identified in order to develop measures to reduce the level of costs for the production and sale of products, and consequently, to increase profits.

The factor directly determining the amount of profit of the enterprise from the sale of products is the applied prices. Free prices in the conditions of their liberalization are established by enterprises depending on the competitiveness of this product, the demand and supply of similar products by other producers. Therefore, the level of free prices for products to a certain extent is a factor that depends on the enterprise. Government-independent regulated prices that are set on the products of monopoly enterprises are not dependent on the enterprise. Obviously, the level of prices is determined primarily by the quality of the products produced, depending on the technical perfection of its production, the performance of modernization works, and the like.

In addition to these factors, the amount of profit from sales is undoubtedly affected by changes in the structure of manufactured and sold products. The higher the share of more profitable products (calculated as the ratio of profits to the total cost of this product), the more profit the enterprise will receive. An increase in the share of unprofitable products will entail a reduction in profits.

Thus, the main factors that affect the volume of profit from the sale of marketable goods, both upward and downward, should be the subject of careful analysis.

In addition to profits from the sale of products, gross profit includes, as noted earlier, profits from the sale of other products and services of a non-commodity nature. This share of profits accounts for several percent of gross profit. Results from other implementations can be positive and negative. Enterprises of transport, subsidiary agricultural enterprises, trade organizations on the balance sheet of an enterprise may have not only profits, but also losses, from the sale of their products, works and services, which, accordingly, will affect the volume of gross profit.

A separate component of the gross profit is allocated to the profits from the sale of fixed assets and other property. Excessive material values can arise from enterprises as a result of changes in the volume of production, shortcomings in the supply system, implementation and other reasons. Long-term storage of these values in the conditions of inflation leads to the fact that the proceeds from their sale will be lower than the purchase prices. Therefore, from the realization of unnecessary commodity-material values, not only profit, but also losses are formed.

With regard to the sale of surplus fixed assets, the profit from this sale is calculated as the difference between the selling price and the original (or residual) value of the funds, which increases by the corresponding index, which is legislatively established depending on the rate of inflation.

The last element of gross profit is non-operating income and expenses, that is, those that are not directly related to the production and sale of products. As part of these non-sales results, the following incomes (expenses) are taken into account: income from equity participation in the activities of other enterprises; Income from leasing property; Dividends, interest on shares, bonds and other securities owned by the enterprise; The amount of received and paid economic sanctions (fines, penalties, forfeits, etc.). In those cases when the amount of sanctions is paid to the budget, they are not included in the composition of expenses from non-operating transactions and are reimbursed at the expense of profits remaining at the disposal of the enterprise.

Other non-operating incomes (expenses) that are not related to the production and sale of products (works, services) may occur. Thus, the exchange rate differences (positive and negative) for foreign currency accounts, as well as for operations in foreign currency, are taken into account.

Until 1991, in the composition of non-operating income and expenses, the amounts of penalties, fines, penalties and other sanctions paid and received were taken into account. At present, in conditions of transition to a market economy, new elements related to entrepreneurial activity have appeared in the composition of non-sales results. These are income from equity participation in the activities of other enterprises, income from leasing property, dividends and interest on shares, bonds and other securities owned by the enterprise.

The receipt of these revenues is due to the process of denationalization and formation of enterprises of various forms of ownership - leased, joint-stock, joint and other types. When some enterprises participate on a share basis in the activities of other enterprises, then, with the successful functioning of the latter, they have a certain share of the income accounted for as part of non-sales results.

With the development of leasing relations, many enterprises for the purpose of obtaining income hand over part of their property, including premises, facilities, equipment, etc., for rent for a more or less long period. Lease of property in rent can take as a result a form of rent with a buy-out. As a result, the company receives income that increases non-operating income, and therefore, gross profit,

With the development of joint-stock ownership, enterprises issue shares, bonds and other securities that promote profitability and profitability of enterprises. The level of return on the issued shares, bonds takes the form of dividends and interest. Depending on the type of shares, the level of dividends is formed on them. When issuing ordinary (ordinary) shares, the amount of dividends depends on the amount of profit received, on the possibility of sending a part of this profit to pay dividends, taking into account other costs from profit, the proportion of preferred shares in their total number and the declared dividend level, And the total number of shares issued in circulation,

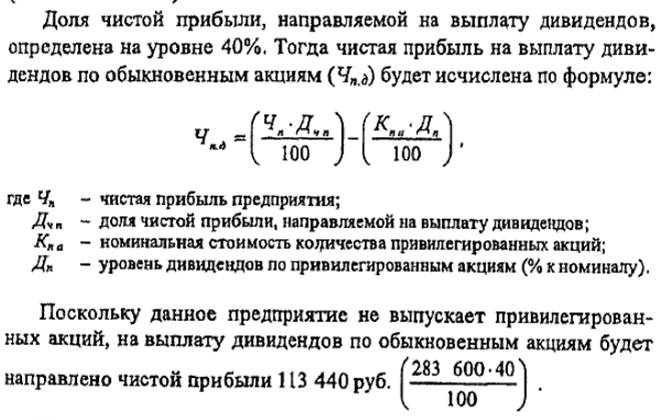

Example. Consider the calculation of the level of dividends per common share. Let's say that the company issued 32 022 shares with a face value of 1 ruble. Each. All shares are ordinary. Revenues from sales of products for the year minus VAT, excises and sales tax amounted to 1485 556 rubles. The gross profit of the enterprise for the year is 385,574 rubles, the total amount of payments from profits to the budget is -101,974 rubles.

Hence the company's net profit will reach 283,600 rubles. (385 574-101974).

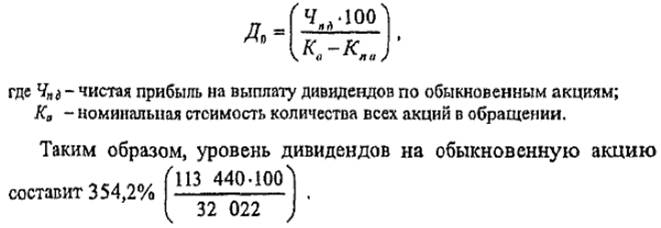

Proceeding from this, the level of dividends on ordinary shares (Do) is determined by the formula:

The dividends calculated in this way are included in the composition of non-operating income.

Traditionally included in the composition of non-operating income and expenses, fines, penalties and forfeits are of a non-permanent nature. In this case, fines, penalties and penalties paid may exceed those received. Then losses are formed, which reduce non-operating profit. If the amount of economic sanctions received by the given enterprise exceeds the paid, the non-operating income is increased. Everything will depend on the nature of the activity of the enterprise, observance of payment and settlement discipline, fulfillment of obligations on deliveries, payments to the budget, suppliers and banks.

So, the analysis of the gross profit structure of the enterprise has shown the leading value of profit from the sale of products (works, services), a relatively small role of profits from other sales, as well as from the sale of fixed assets and other assets, and the value of non-operating income and expenses that is growing in the conditions of business development.

Comments

Commenting on, remember that the content and tone of your message can hurt the feelings of real people, show respect and tolerance to your interlocutors even if you do not share their opinion, your behavior in the conditions of freedom of expression and anonymity provided by the Internet, changes Not only virtual, but also the real world. All comments are hidden from the index, spam is controlled.