home

Finance Finance

books books

Finance and Statistics - Kovalev AM Finance and Statistics - Kovalev AM

|

Finance and Statistics - Kovalev AM

6.4 EXCISE

Excise duties - indirect taxes is included in the price of the goods and paid by the buyer.

Excises are usually installed on the scarce, highly profitable products and goods intended for the public and is a state monopoly. The state uses the excise tax to regulate supply and demand, as well as to replenish the state budget.

Excise duties are subject to the realization of wine and spirits and tobacco products, beer, cars, jewelry (including diamond jewelry), as well as gasoline, oil, etc.

In 1993, there were changes in the list of excisable goods, It excludes caviar sturgeon and salmon, delicatessen products made of valuable species of fish and seafood, chocolate, as well as porcelain. On February 1, 1993 introduced excise taxes on imported goods. Included in this list and trucks carrying up to 1.25 m. In 1994, introduced excise taxes on gasoline, ethyl alcohol of all kinds of raw materials (except the released for the development of vodka, alcoholic beverages, wine and other alcoholic products subject to excise duty ), tires and tubes for tires for passenger cars, guns, hunting, yachts and boats (except for special purposes).

Excise taxes are:

a) produce and sell excisable goods companies and organizations, regardless of ownership and departmental affiliation, as well as individual entrepreneurs;

b) imported into the territory of the Russian Federation goods - companies and other persons determined in accordance with the customs legislation of the Russian Federation.

In 1994 he introduced the addition which indicates that the payers of excise taxes on all excisable goods produced from raw materials, are companies and organizations that produce these goods (including performing refining and bottling of alcohol, vodka, alcoholic beverage and wine products). This tolling considered as raw materials, production, transfer them to the owner without payment to other companies for further processing, including filling.

The object of taxation and excise duties on goods of domestic production are the enterprises:

in producing excisable goods used by them for the production of products not subject to excise duty, - the price used excisable goods, determined on the basis of actual cost and the amount of excise tax on the prescribed rates;

• producing excisable goods and products from raw materials, - the cost of these goods and products, which is determined on the basis of the received in the enterprise maximum selling prices of such goods and products at the time of the transfer of finished products, and in their absence - on the basis of market prices prevailing at the same or similar goods and products in the region during the reporting period.

In the case of use as raw materials of excisable goods for which the Russian Federation has been paid the excise tax, the amount of excise duty payable on excisable goods and ready products, reduced by the amount previously paid excise duty.

The object of excise taxation on excisable products not sold on the side of businesses and used for the production of other products not subject to excise duty (ie, in-plant turnover), stands the cost of excisable products' determined based on the actual cost, taking into account the amount of excise taxes.

Bids excises on excisable goods (except for excisable types of mineral resources), including imported into the territory of the Russian Federation, are uniform throughout the territory of the Russian Federation and shall be established in the following amounts:

1) as a percentage of the value of goods at sale prices, excluding excise taxes, such as jewelry - 5%, passenger cars - 10%;

2) in rubles per unit (specific rates), such as wine grape - 35 rubles. for 1 liter, sparkling wines and champagnes - 9 rubles. 1 l etc.

Specific excise rates are revised by amending the federal law.

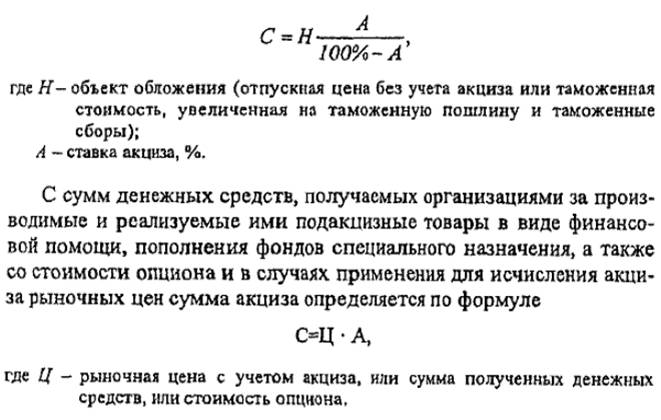

The amount of excise tax on excisable goods (including goods imported into the territory of the Russian Federation), which set rates of excise duty as a percentage, is defined by the payer

Currently installed the following benefits on excise payments. Excise duties are exempt excise exported goods (beyond the countries - members of the CIS), as well as excisable goods in the Russian Federation, received from the territory of the CIS countries, the importation into the territory of the Russian Federation.

By following excise payment deadlines established in the budget. Taxpayers twice a month (on the 16th of the reference month and the 1st day of the month following the reporting period) to the tax authorities information on the shipment of excisable goods. Excise taxes are paid to the budget in the following terms:

not later than 30 (in February - not later than the 29th or 28th) day of the month following the reporting month - for excisable goods, implemented from 1 st to 15 th day of the reporting month, inclusive;

not later than the 15th day of the second month following the reporting month - for excisable goods sold to 1b-th to the last day of the reporting month.

Comments

Commenting, keep in mind that the content and the tone of your messages can hurt the feelings of real people, show respect and tolerance to his interlocutors, even if you do not share their opinion, your behavior in terms of freedom of speech and anonymity offered by the Internet, is changing not only virtual, but real world. All comments are hidden from the index, spam control.