home

Finance Finance

books books

Finance and Statistics - Kovalev AM Finance and Statistics - Kovalev AM

|

Finance and Statistics - Kovalev AM

8.3 THE ROLE OF THE BUSINESS PLAN IN EVALUATION OF INVESTMENT PROJECTS

Improvement options valuation methods is not less important than finding themselves investment options. Companies most inventive in the field of investment, will be the most prosperous, if their managers are competent enough. Adverse conditions in the financial market should not prevent the consideration of new investments. Of course, there are absolute limits the amount of funds that the company can attract in a given year. Under any circumstances the company can work through a large number of investment projects must also remember that any alternative investment is to maintain the status quo

When the firm to "collect" all investment proposals, begins the process of evaluation and ranking in this case is the project business plan (projects), followed by calculation of indicators of efficiency of investments, which, in turn, may appear in the feasibility study, we present the lending bank

The business plan should enable the investor to make a comprehensive assessment of the project in the first place to show that

- offered goods (products or services) is competitive and it has a sufficient effective demand;

- It has the necessary industrial and resource capabilities,

- possible implementation of the project within a reasonable timeframe;

- Project investment profitable.

Here are the basic guidelines for the content of the sections of the business plan, elaborated on the financial.

Characteristics of the goods (products and services). Here it is necessary to imagine what was going on in the project, what is confirmed by the competitiveness of the goods, what are the technical sources of risk when creating new product (service), and possible ways to reduce it.

Assessment of the market. The main purpose of this section - to present the material, enough to convince investors that the products or services have a sustained demand and can be sold in a competitive environment.

Production capabilities. This paragraph describes the possibility and timing of development of production of goods, its scope, clarifies the possible 'bottlenecks' in the process of production.

The organization of the project. We consider, in what form, according to the developer, should be the implementation of the project (a joint venture, equity participation, etc..), Any necessary arrangements for the establishment of the institutional framework of projects.

A financial plan is a part of the resulting business plan. Contains configuration data on financial flows, the size of investment, sales volumes, as well as investment requirements. The financial plan is developed, usually for 3-5 years. The project is the first year of signs per month, the second - on a quarterly basis, data are given in the following years the whole year. If the first year of the planning is done with reference to a specific group of parameters and specifics of the first year of the production costs, on the second - on the basis of the results of investigations of market capacity and trends in general. On the third - the fifth year of financial planning it is advisable to carry out model-based prices as a percentage of sales.

Typical for companies producing high technology products and requiring a significant investment in market research, it is the following pricing model%. Annual sales -100. Including:

cost of goods sold - 50,

profit and overhead - 50, including:

marketing expenses, trade -15,

implementation costs - 10,

on maintenance of management expenses - 8

Profit before taxes - 17.

The financial plan should reflect the following indicators:

sales and total profit;

the percentage of income and expenses;

the total investment;

the use of own and borrowed funds, their sources

and debt maturity;

term return on investment;

dates of commencement of payment of dividends;

production and distribution costs.

The structure of the financial plan is the plan of income and expenditure plan (cash plan) and the balance of the first (month), second (quarterly) and the third (the whole year) period. In recent years, provides general information on income and expenditure in the respective plan.

In terms of revenue is deciphering the dynamics of sales, cost of goods taking into account the means of transport (costs that are directly attributable to this product) and total profit. Separately decrypted fixed costs, which include rent, insurance, depreciation, administrative costs, costs of marketing and distribution.

spending plan also includes data on the dynamics of consumption and compensation of all capital invested. The costs include the purchase of assets, payment of loans, acquisition of equipment (non-production) equipment, as well as losses from business activities (defined in terms of income).

The balance reflects the company's assets and liabilities structure and reporting form №1.

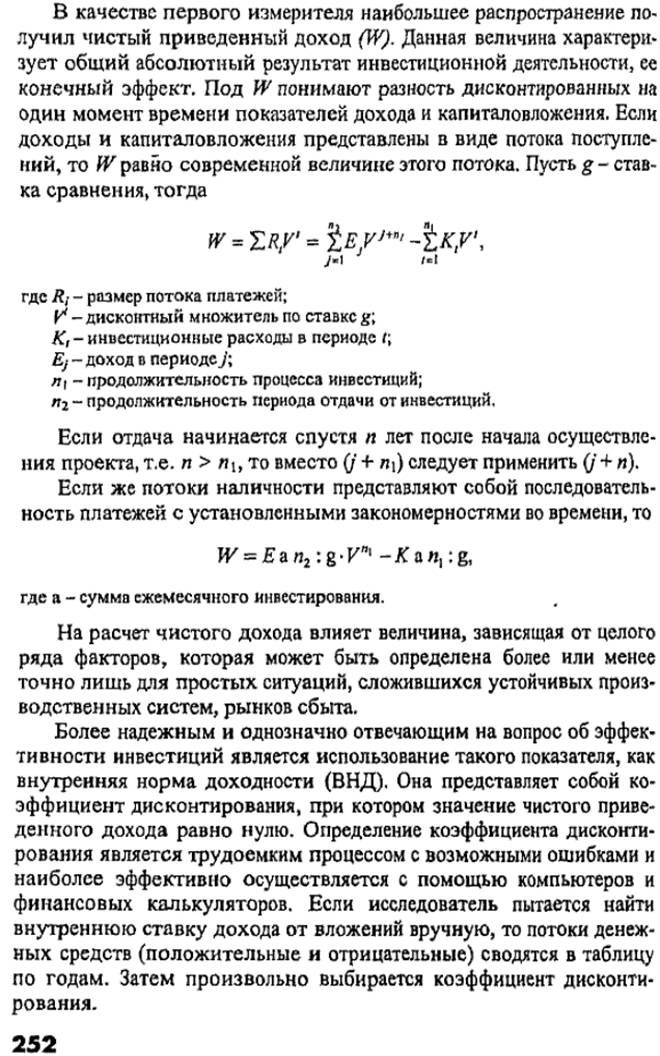

The analysis of industrial investments mainly is to assess and compare the efficacy of alternative investment projects. As gauges are used as formal specifications, based on the discounted stream of expected income and expenditure, as well as indicators defined on the basis of accounting data. ' But whatever the method of evaluating the effectiveness of capital investments is chosen, one way or another it is associated with reduction of elements of cash flow to a single point in time. The most important point here is to choose the level of interest rates, over which the discounting, - comparing rates. The most commonly used in the analysis of the effectiveness of three variants of rates: the average cost of capital (the average rate of return stocks, interest rates on the loan, etc.); subjective assessment based on the experience of the company; existing rates on long-term loan. To account for the risk (for example, loss of recoil reduction, inflationary depreciation of money) it is recommended to introduce an amendment to the level of interest rates, ie, add some risk premium, taking into account both the special risks associated with the instability of income from a particular investment and market risk associated with market conditions.

In the financial analysis of investment efficiency is mainly used indicators such as net present value, payback period, profitability. However, it should be noted that overseas there is no single methodology for assessing the effectiveness of investments. Each corporation is developing its methodology, guided by experience, financial resources, objectives.

vestment competition is carried out in accordance with the Regulations on the procedure for sale of state enterprises-debtors, approved in accordance with the RF Government Decree of 20 May 1994 №498

To the winner imposed three mandatory conditions-

- implementation of the proposed volume of investments (in cash or otherwise) in a period not exceeding three years from the date of the contract of purchase and sale of shares;

- within one month from the date of conclusion of the contract of sale in the competition making money not less than 20% of the total investments to the account of the enterprise-issuer (including 0.5% of this amount in equal shares to the accounts of the relevant management committee property and assets of the Fund);

- Payment for acquired shares at nominal value.

It can be set one or more of the following additional requirements (conditions) of the contest

- timeliness of making investments, provided the enterprise privatization plan;

- repayment of overdue payables of the issuing companies in the amount and terms stipulated by the enterprise privatization plan.

The list of mandatory and optional requirements is exhaustive.

The minimum amount of investment and additional requirements (conditions) of the competition are determined on the basis of proposals from privatized enterprises, which may be provided in the form of the investment program. The very same contest - open for participation and closed the form filing.

Contestants make a deposit, the maximum amount which can be installed up to 100% of the nominal value of the sold shares, but not more than POLO times the established RF legislation the minimum wage at the time of making the deposit. To participate in the competition natural and legal persons (other than banks institutions), including foreign investors.

In summing up the results of the competition the volume of investments is determined as the present value of the proposed members of the investment volume (regardless of the form of), discounted at the time they are made at the rate of CBR refinancing.

The duration of the investment period used in the calculation is assumed to be a single base period (month, quarter, or year) indicate in the announcement prior to the competition.

CBR refinancing rate valid on the date of summing up the competition (monthly, quarterly or yearly, depending on the installed base of the investment period)! This rate is adopted to calculate the current value of the investment of each period as a constant.

If two or more proposals of the participants are equal in present value terms of investment, the winner is the participant whose application has been accepted and registered previously.

In the event that a natural or legal person is the sole member of the competition and his proposed investment, determined by the present value exceeds the minimum amount of investment set by the requirements of the contest, the stake sold by the said person.

Payment for acquired shares of the contest winner at face value is made within ten days from the date of conclusion of the contract of sale. The winner of the competition, to refuse to conclude a contract or payment for shares, the deposit is non-refundable.

The purchase contract signed by the seller and the winner within three days from the date of approval of the protocol on the results of the contest. Ownership of the shares transferred from the seller to the buyer from the date of full payment of the nominal value of shares. The winner of the contest the amount of a deposit be credited against the amount of its payment

The investment policy of enterprises depends essentially on the prevailing economic conditions in the country and the financial policy of the state. Financial capacity of the state, as can be seen from the data on the federal budget for 2000 ,, limited.

2000 federal targeted investment program, the government provides for investment financed from the budget, including the development of industrial complexes of the national economy. This makes the company in its investment activities focus primarily on their own sources of financing of capital investments and bank loans.

Control questions

- What does the term "investment activities of enterprises"?

- How is the main legal instrument governing the relationship of the participants of the investment process?

- What is the role of the main financial sources of investment?

- What are the prospects of leasing as an investment method, types of leasing?

- What is the role of the business plan in the evaluation of investment projects?

Comments

Commenting, keep in mind that the content and the tone of your messages can hurt the feelings of real people, show respect and tolerance to his interlocutors, even if you do not share their opinion, your behavior in terms of freedom of speech and anonymity offered by the Internet, is changing not only virtual, but real world. All comments are hidden from the index, spam control.