home

Banking Banking

Books Books

Groshovo-credit systems for foreign banks - Ivanov VM Groshovo-credit systems for foreign banks - Ivanov VM

|

Groshovo-credit systems for foreign banks - Ivanov VM

Theme 1. SUBJECT I SURPRISE COURSE "Groshno-kreditnyi SYSTEM ZARUBINZHNYKH KRAYN"

1.1. Subject of course

"Groshovo-kreditnyi sistemi zarubizhnih kraine" - gagarnoeoteretichesky course, the subject of the I-vivchennia suti groshno-credit systems kraine z zavinenoyu rinkovoi ekonomikoyu, the basic stages of that specialty їx rozvitku, and takozh znaymoylennya with the prospects of becoming a penny-credit systems kraine, shcho rozvivayutsya.

Propagations course is tisno ob'yasheny in the disciplines "Groshi i kredit", "Pravoslavi bankovski spravi" and "Finansi". Tse zv'yazok prostezhuyutsya through soi kategori, yak groshni, credit, banks, groshny y creditnі sistemi. The course is an independent growth of economical science, but it is especially concerned about the accumulation of pennies, the essence of credit institutions, institutional organizations. Yogi specifika polagaye in rozglyadі cich nourishment from a look at the law of a penny's obzu, vzasomozv'yakv in grosovye, credit and monetary systems in a cost-effective way, and so vplyvu spetsialnih fenansovo-kreditnyh institutiv on the process of sushpilnogo vidvtrenennya.

Vigodachi z vikladenogo mozhno vypolnyuvati osnovnyi zavdannya course:

• Zrozumi is the essence of the basic stages of the evolution of the penny-and-credit systems in the territory of the well-funded economy;

• Be aware of the processes of integration in a penny-credit sphere;

• Show the hourly mill of the pennies and credit systems in the wake of the crisis and credit regula- tion;

• characterize the penny-and-credit policy of the territory with the well-established economy;

• to identify the differences in the growth of the penniless and credit system and the way of formulating national credit systems in the number of republics of the SRSR;

• Prostytzhiti legitsirnosti perspective that rozvitku penny-credit systems kraїn, scho rozvivayutsya.

For rozv'yana zich zavdan vikoristano method of systematic pidhodu, dialektiki ta istorizmu.

The method of the systemic approach is to distinguish the category from the category and to understand the course yak sukupnosti vidosinin, vzaimopov'yanykh z sispilnogo vіdvorennya, doslenie internal structure of the daily groshno-credit systems, analysis of the interdependence of structural elements of the systems.

The method of the dialectic is grounded on the economically viable categories and is understood in the process of rozvitka, evolitsii from the lower rivion to the wich.

Method історизму of the field is in that, to the skin of the jaw, to be rooted in the zv'yazku with a concrete and historical period.

1.2. Banking system

Banking system is a system of sukupnist banking and banking institutions, which is used to finance the tiie chien іншій країні і півний історичний період і є скла depositary credit systems, у їх взаємозв'язку.

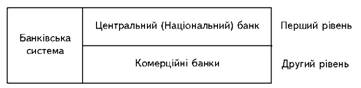

Roshglyanemo budo banking system (Figure 1).

Bankovski sistemi characterize, as a rule, two-tri-ivnevoyu structure.

Fig. 1. Budova's banking system

The first bank in the banking system becomes the central (national) bank, which is accounted for by the stability of national financial institutions and the functioning of banking systems.

On the other hand, the commercial banks, the active ones (nadnya pozhok, інвестування) and пасивні (залучення depositів) of operations, надають банківські послуги.

Protech - means, power, systems, and functions of the economy.

Banks are the foundation of the credit systems of the krai and the middlemen of the world, of keeping the grotesque, and of the time, hto їх інвестує. Deposits, secured by banks (borgovi zobov'yazannya), at once with vzasnym aktsionernym kapital to include up to passiviv. The bank rozmyschuyet in itself kosti, scho concentrate in riznomanitny activa, - pozhinki, tsinnyi paperi, penny gotivku ta reserve. Warehouse і structure of assets and liabilities to the bank vіdobrazhayut u bankіvskih звітах; They have an active dorivnyut 'sum zobov'azan' i vlasynogo kapitalu, tobto pasivam.

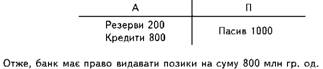

Сучасна банківська on the right ground on the system of partial reserves. The Central Bank imposes a standard of obovyazykovyh reserves, tobto part of the active, yaka u viglyadі gotivkovyh groshei i koshtiv u nogo on rahunku become reserve komercitsynogo bank. Zmіneyuchi rozmіr bankіvskih reserves, mozhna reguljuvati peretіk groshovoi masi through the bank.

Butt. Norm obovyazykovyh reserves to become 20% sumy pasivіv bank. Yaksho pasivi komercitsynogo bank dorivnume 1,000 million gr. Odes, yogo obovyazykovykh reserves, the amount of 200 million gr. Od. At the requested balance (T-rahunku), such a vigilant:

Vazhlivim ekonomichnym normulyu regulyuvannya dіyalostі bankіv є normative platospromozhnosti bank (NP). Yogo viznachayut yak spіvvidnoshennya vlasnih koshtiv (kapitalu) bank і sumnarnih active:

In the US, the standard of plate-bearing capacity is 6%, in Ukraine - 8, in active regions - 4%.

Probably vstanoviti vzajmozv'azok bankіvskoї sistemi і groshe. Bіlshість економістів vysnachayut the essence of a penny through pritamannі їм functіії - лічильної одниці, засобу обігу, засобу заощадження.

Zgіdno z traditsionnym poglyad grooshі - tspecifikny product, scho vikonuє s suspіlstvі role of the fatal eqvіvalenta varstі.

Щоб відповісти на питання, як створюються гроші, потрібно проанлізувати грошовий ринок, at that numeral propose of a penny.

Comments

When commenting on, remember that the content and tone of your message can hurt the feelings of real people, show respect and tolerance to your interlocutors even if you do not share their opinion, your behavior in the conditions of freedom of expression and anonymity provided by the Internet, changes Not only virtual, but also the real world. All comments are hidden from the index, spam is controlled.