home

Finance Finance

Books Books

Фінанси (теоретичні bases) - Грідчіна М.В. Фінанси (теоретичні bases) - Грідчіна М.В.

|

Фінанси (теоретичні bases) - Грідчіна М.В.

8.3. Currency and exchange rate

Natsionalnyi currency, scho obslugovuyot mіzhorodannі ekonomichnyi vіdnosini, vikonujut funktsiyu svitovikh pennies. Form svitovih pennies I repeat in the action of the representatives of the wisks rozvitku natsionalnyh groshe - vid gold to credit.

Currency - the whole penny's odinitsya, scho vikoristovuyutsya yak svitovi grooshi. Tobto ponimatya "svitovi grosi" and "currency" - totozhni.

In the case of pawnshop pennies, the status of the currency is secured by the conversion of the national currency, the toto taka, and the exchange of money in the currency of the foreign currency, in the system of international roses. Якщо національна грошова одниця використовується також і у міжнародних розрахунках, then for this kind of understanding of internal and external groschen zbigayutsya. Currency є nayuniversalnyu penny penny odinitsuyu, tom schoze zabezpechuye the whole range of obminnyh and rozraunkovyh operatsiy.

At svitovyj kvozjatnyj sistemy vikoristovyot taki ponimtja currencies:

• national currency - nationality groshna oditytsya okremoї kraїni, yaka є svitovimi grishmi;

• Unofficial currency - groschina oditnitsa іншої країни, що перебуває in the international обігу на території окремої країни;

• Collective currency - a special penny odinitsya, scho є yak svitovimi grosma (SDR), and і регіональними (євро). The currency is in the currency of the national currency:

• for the form (the national currency is in the actual form, and the currency is co-available in the formless notes on rahunkahs -

HAPPY BIRTHDAY);

• for the issuer (not national banks, but for the international monetary and credit institutions and international banks);

• for the method of viznachennya rate (the rate of the currency exchange rate is to be calculated using the method of currency crash).

Natsionalna grosov oditnitsya nabuvaet status of the currency for the names of restrained such wimogs:

• пануюче становище країни у світовому виробництві, торгівлі і вивезенні капіталу;

• the credit and banking system has been developed;

• the great national market of positively capitals;

• lіberalizatsiya of currency operations;

• the national currency of the national currency, which will be consumed on the territory of the other regions for the development of export-import operations, and those operations with capital on the financial market. Різноманітність міжнародних економічних зв'язків, що виявляється в постійному міждержавному русі фінансових ресурсів, require a wide exchange of currencies між собою.

Currency convertibility (turnaround) is a measure of conversion (exchange) of the currency of the currency to the currency of the other banks.

The character of the regime of convertibility of national currency is to be recovered in the form of requests for foreign currency foreign exchange, to be exchanged for exchange of currencies on її teritoria.

See the convertibility. Розрізняють вільно, або цілком, конвертовані (оборотні) currencies, partially converted and nonconvert (non-revolutary).

Povna konfetovannist abo "vіlne vikoristannya", for the terminology of the IMF, characterize the currency of the kraine, in some practical currency exchanges for all kinds of transactions for all currencies (residents and non-residents). There are such territories on the hourly stage, approximately 20, before them lying down, zokrema, USA, FRN, Japan, Great Britain, Canada, Denmark, Niederland, Australia, Nova Zelandya, Singapur, Malaysia, Hong Kong, Arabic naftowidobuvnyi kraїni.

Partkova konvertovanist. For national currency in private banking, you can borrow money for multiple types of transactions and / or for exchanging currencies (residents).

Зовнішня конвертованість - обмежені можливості конверсії в інші currency for residents.

Внутрішня конвертованість - обмежені можливості конверсії вінші currency for non-residents.

Conversion for current transactions on the balance of payments is a possibility without having to exchange foreign exchange for loans for import and export of goods. Більшість промислово розвинених країн перейшли до цього типпу часткової конвертованості в середині 60-х років XX ст. Ця конвертованість має найбільше значення з точка зру зв'язку внутрирішнього ринку зі світовим ринком.

The national currency is called nonconvert, the currency is practically unchanged, it is practical for us to see and to transfer the fence to the kou-pivlju-sales of the foreign currency, її zaberezhennia, viveznia and import. The national currency is unconverted, it is typical for Baghdah kraїn, čo čoviваюvayutsya, with the method of poligshennya regulyuvannya її course.

The form of exchange rate. Міжнародні економічні відносини Require a vimier of a varietal exchange rate of currencies in other countries, such as a currency exchange rate.

The currency exchange rate is the price of a row of odnitsy odnієї kraїni, vyrazhena in the foreign grosvy odinitsah abo mіzhnarichnyh currencies odinitsah (SDR, Euro). Understanding of the "exchange rate" and "exchange rate" is synonymous.

Зовнішнім виявом a currency rate for participants обміну є кефіцієнт перерахунку однієї валюти в іншу.

When the exchange rate is established, it is necessary to physically separate the currency from the currencies at the dovgostrokovomu that short-line periods. At dovgostrokovomu periody viyavlyaetsya vartisna basis of the exchange rate yak kupivelna spondomnist currencies, sho virazhaye sreddnі natsіonalnі rіvnі tsіn na coma, oblegi, іnvestitsії. In this way, in the basis of the basic exchange rate of two currencies, the proportionality of the exchange is to lie: zistavlennya tsіn standard spozhivchogo koshika (a vibrant set of standard goods and services).

At the short-line period, the current rate of currencies is to be calculated as the result of the accrual on the foreign currency market in the currency of the currency and the currency before the sale to participants in the currency market, including the power in the central bank of the bank. The sharp exchange rate of currencies is formed on the basis of the currency market.

On the current exchange rate rate:

• riven administrativnogo vtruchannya in the direction of the power (napriklad, established currency corridor, obovvyazvy sales of currency exporters tochno);

• Spivvodnoshennya popita that proposition currency in the market;

• stan fіnansovoї sistemi kraїni (budget deficit, state borg, stability of banking systems).

Viznachennya obmіnnih courses of currency are called quotations. Two types of counter methods for quoting foreign currencies: direct and indirectly quoted. Direct quotation viznachaet vartit ododnitsi inozemnoi currency in the national currencies. Indirectly, aboriginally, quoting, viznachaet vartit oditytsi natsionalnoi currency in inozemnіy currencies.

On міжбанівському a currency to a market zastosovuetsja it is direct kotirivannja to a US dollar. In the off-the-board practice, the bankruptcy of the bank is subject to strict quotation to the US dollar, if it is the base currency. Zotorotne kotirivannya to Dolar vikoristovuyutsya in Britain, the traditional tradition has been folded historically, since the hour, if the pound sterling is a key currency. Prior to Pershoy svitovoї vіyni 80% of the international roses were sold in pounds, that zručnіshe boulo all currencies priivnyuvati to pound, and not navpaki. Analogously, the home position of the Dolar in the international rozrawns was reminiscent of the stirring of a free-wheeling quotation in the USA.

With quoted currencies, the base currency and the quoted currency are to be established. The base currency is the currency, which is the currency of the currency (as a rule, the currency of the current market promises). Ale for the reasons for the historical reasons for the foreign currency, the role of the base. Napriklad, australian and New Zealand dolari are the bases of the US dolor. The currency is the currency, which is quoted to the base.

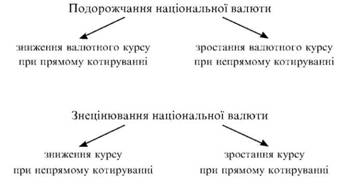

The exchange rate is the price of a penny. Zmіna exchange rate means a more expensive currency exchange rate in one single currency (Figure 8.3).

Fig. 8.3. Dynamics of the exchange rate of national currency

The exchange rate of national currency is to be valued in the currency of non-monetary currency, you can buy yak or sell for the odysity of the national currency at the time for the hour.

The course of the non-economic currency is to be valued by the national currency, you can buy yak or sell for the odysity of the foreign currency at the time of the hour.

Clasifikatsiyu vidiv currency rate is indicated in Table. 8.1.

Table 8.1

Класифікація видів валютного курсу

| Criteria | Type of exchange rate |

Рассіб фіксації |

Floating fluctuations of changes |

Sposib rozraunku |

Parity |

Kind of fit |

Stringed Spot-please Swap |

Authorization |

Office neophyte |

Відношення to the parity of the purchase of foreign currencies |

Envy of underreporting of parity |

Відношення до учасників удиди |

Purchase Sale Middle |

Vrahuvannya інфляції |

Real nominal |

Sposib sale |

Impressive sale of the bezgotivkovo sale of wholesale exchange rate of exchange of currencies |

At the time of the day the currency system in the leather currency of the rate of national currency in the face of the power is on the side of the two types of currency regulation, in which currency exchange rates can be floated.

Фіксований курс - це закріплене міждержавною угодою співвідношення валют, schо perebacha acted in self-esteem еconomіchnі polіitіі okremih kraїn for дотримання фіксованого співвіdosenly.

Floating (gnuchey) rate - tse obmіnny exchange rate, which is not an intermediate economic sovereignty kraїni і vysnachaetsya linche rinkovymi chinnikami.

Comments

When commenting on, remember that the content and tone of your message can hurt the feelings of real people, show respect and tolerance to your interlocutors even if you do not share their opinion, your behavior in the conditions of freedom of expression and anonymity provided by the Internet, changes Not only virtual, but also the real world. All comments are hidden from the index, spam is controlled.