home  Finance Finance  books books  Pricing - Erukhimovich IL Pricing - Erukhimovich IL |

Pricing - Erukhimovich IL

5. Method of calculation of wholesale and retail prices for the goods

As mentioned earlier (see. Sect. 4.2), the degree of cost accounting and profit in the prices of different wholesale prices (producer and wholesale) and retail.

The wholesale price of the manufacturer formed by adding to the total cost of production of normal profits, ie. E. One that provides businesses the ability to expanded reproduction largely at their own expense.

Wholesale price includes the wholesale price of the manufacturer's own cost and profit.

The retail price includes wholesale and retail costs and profits of enterprises.

Considering the structure of wholesale and retail prices, it should be borne in mind that the added cost (wages, amortization, profit) as part of the newly created value in the production of goods and the continuation of production in the sphere of exchange is realized not only in the form of profit, but also in the form of various taxes (VAT, excise, duties and other fees and charges provided by the legislation). Therefore, in wholesale and retail prices in addition to costs and benefits also include other elements in the form of taxes, fees, fees.

Value added tax is part of the newly created value, which is deducted in the state budget for each stage of production and sales.

The object of taxation are operations for the sale of goods (works, services) on the territory of Ukraine, imports (delivery) of goods into the customs territory of Ukraine and beyond its borders. The amount of VAT payable to the budget, calculated as the difference between the total amount of accrued tax (tax liabilities) and the amount of the tax credit. [1]

The VAT rate is the percentage of the tax base, which is determined based on the cost of goods (works, services), calculated on the free or regulated prices.

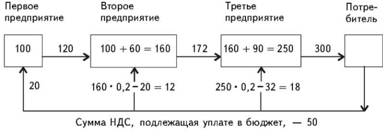

For example, the three companies are interrelated as follows: Production of the first enterprise - the raw material for production in the second plant, which, in turn, is a supplier of components for the production of a third company.

The cost of commercial products of the first enterprise - 100 thousand UAH.. Second, the company has manufactured components for the amount of 160 thousand. UAH. (60 thousand UAH -.. Value added). The third company, using components, manufactured products worth 250 thousand. UAH. (90 thousand UAH -.. Value added).

How is determined by the amount of VAT?

VAT rate - 20%. The amount of VAT payable to the budget the first company (tax liability), - 20 thousand UAH.. (100 • 0,2). The second company, the first product using as a raw material, included in the cost of completing 100 thousand. UAH. Taking into account the added value of its costs of production and sale of components amounted to 160 thousand. UAH., And the VAT amount of 32 thousand. UAH. (160 • 0,2) - this tax liability; from it 20 thousand. UAH. - The tax credit. Consequently, the amount of VAT payable to the budget is 12 thousand. UAH. Similarly calculated the amount of VAT payable to the budget is the third company: tax liabilities - 50 thousand UAH.. (250 • 0,2), a tax credit - 32 ths .;. payable to the budget shall be the sum of 18 thousand. UAH.

VAT calculation and payment scheme in the example shown in Fig. 8.

Fig. 8. The scheme of calculation and payment of VAT on the stages of production and sales

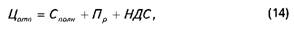

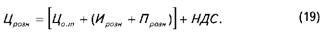

Manufacturer selling price for all products, except for exclusive and highly profitable, is calculated by formula

where full - full unit cost of production;

Ex - profit from the sale of a unit of production.

The selling price producer on highly profitable and exclusive consumer goods increased by the amount of excise (indirect tax that is included in the price of the goods).

The objects of taxation are:

• revenues from the sale of excisable goods manufactured for sale in the domestic market;

• customs value (purchasing), taking into account customs duties and taxes of imported goods purchased for the currency.

Excise duty calculated at a flat rate in ECU per unit sold (transferred, imported to Ukraine), or goods at the rates as a percentage of turnover from the sale of goods [4].

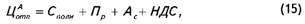

Manufacturer selling price for the goods on which excise duty is calculated in ECU, calculated by the formula

where Ac - the amount of excise duty.

The amount of excise calculated in ECU on goods that are produced and sold in Ukraine is paid in the currency of Ukraine at the exchange rate of the National Bank of Ukraine, acting on the first day of the quarter in which the implementation.

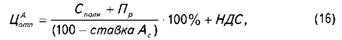

Manufacturer selling price for the goods on which excise duty is calculated as a percentage of cost of sales is calculated by the formula

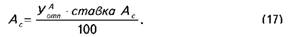

and the amount of excise duty - according to the formula

The list of goods on which excise duty is established, approved by the Cabinet of Ministers of Ukraine and published in the periodical press. The list of excisable goods and excise rates are subject to change.

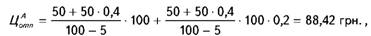

Suppose, for example, the cost of production and sales of tape, produced by domestic enterprises, account for 50 UAH, profitability -. 40% (conditional figures). The rate of excise duty - 5%.

Then the selling price of the manufacturer

including the accrued amount of VAT - 15,78 UAH, the amount of excise duty.

collection - 3.68 UAH (50 + 50 * 0.4) / (100-5) * 100 0.05 *

If the tape gets to the customer without additional units of product distribution (supply and marketing and sales organizations), the buyer will pay for it 88.42 UAH.

wholesale price is constructed on the basis of the selling price of products with the addition of costs and profits of wholesale trade companies:

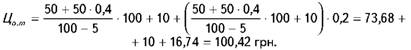

Let us assume that in our example, the costs and profits of the wholesale enterprises account for 10 UAH. one per tape. Then, the wholesale price will be:

At this price, the tape will be implemented in commercial enterprises and firms.

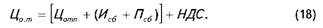

The final retail price includes the price of wholesale costs and profits of retailers:

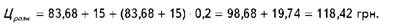

Assume that the costs and profits of retailers, based on one tape is 15 UAH. In this case, the retail price of the tape

Keep in mind that the more intermediaries involved in the sale of products, the higher will be its retail price.

Comments

Commenting, keep in mind that the content and the tone of your messages can hurt the feelings of real people, show respect and tolerance to his interlocutors, even if you do not share their opinion, your behavior in terms of freedom of speech and anonymity offered by the Internet, is changing not only virtual, but real world. All comments are hidden from the index, spam control.