home

Finance Finance

books books

Fіnansi (teoretichnі basis) - Grіdchіna MV Fіnansi (teoretichnі basis) - Grіdchіna MV

|

Fіnansi (teoretichnі basis) - Grіdchіna MV

4.5. Fіnansovі flows of the insurance market analysis

Fіnansovі flows of the insurance market analysis yak manifested fіnansovih vіdnosin regulyuyutsya uchasnikami insurance market analysis i Power, yak vzhivaє zahodіv stabіlіzatsії i Zi rozvitku strahovoї dіyalnostі. Fіnansovі flows on the insurance market analysis z'yavlyayutsya for such drain (Figure 4.5.):

Fig. 4.5. Fіnansovі flows of the insurance market analysis

• INSURANCE zdіysnennya platezhіv mіzh strahuvalnikom i insurers;

• viplati insurance vіdshkoduvannya mіzh insurers i strahuvalnikom;

• reinsurance treaty reinsurance with ukladennі;

• reinsurance to insurance razі viplati vіdshkoduvannya;

• rozmіschennya vіlnih koshtіv strahovikіv on fіnansovomu i Rinku Rinku neruhomostі;

• otrimannya insurers pributku od іnvestitsіynoї dіyalnostі. Fіnansi insurance market analysis formuyutsya sukupnіstyu fіnansіv yogo uchasnikіv - strahovikіv, strahuvalnikіv i poserednikіv. Pong funktsіonuyut yak strahovі Funds Insurance kompanіy rіznoї FORMS vlasnostі th fіnansovih resursіv poserednikіv insurance market analysis.

Fіnansіv the basis of the insurance market analysis Je fіnansi INSURANCE kompanіy. Strahov kompaniia stvoryuє i vikoristovuє Costa insurance fund on vіdshkoduvannya zbitkіv strahuvalnikіv i on fіnansuvannya Vlasnyi vitrat s organіzatsії strahovoї right and takozh zdіysnyuє іnvestitsіynu dіyalnіst, vikoristovuyuchi Chastain insurance fund vlasnі i Costa.

Penny obіg strahovoї kompanії ohoplyuє two vіdnosno samostіynih penny flows:

• obіg koshtіv for insurance Zahist, yaky vіdbuvaєtsya have two Etap: formuvannya i rozpodіl insurance fund that іnvestuvannya Chastain koshtіv insurance fund s metoyu otrimannya pributku;

• obіg koshtіv, pov'yazany s organіzatsієyu strahovoї right. Before Jerel Vlasnyi fіnansіv strahovoї kompanії nalezhat:

• statutory fund strahovoї kompanії;

• strahovі platezhі strahuvalnikіv;

• pributki strahovoї kompanії in rezultatі strahovoї dіyalnostі that nadannya іnshih poslug on the insurance market analysis;

• pributki strahovoї kompanії od іnvestitsіynoї dіyalnostі fіnansovomu on market analysis (market analysis kapіtalu penny i) i Rinku neruhomostі.

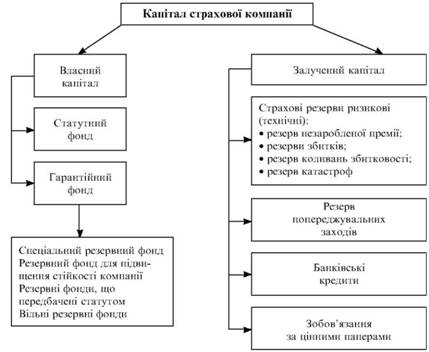

Fіnansi strahovoї kompanії skladayutsya іz statute that garantіynogo fondіv INSURANCE rezervіv. Garantіyny fund insurers mіstit spetsіalnі Fondi, Fondi i rezervnі scrip nerozpodіlenogo pributku.

Statutory fund is the fund garantіyny utvoryuyut Vlasnyi kapіtal strahovoї kompanії. Strahovі reserve time s otrimanim kapіtalom on fіnansovomu Rinku utvoryuyut zalucheny (zovnіshnіy) kapіtal (Fig. 4.6).

Fig. 4.6. Structure kapіtalu strahovoї kompanії

Statutory fund yak Dzherelo Vlasnyi kapіtalu utvoryuєtsya іz vneskіv zasnovnikіv kompanії (s zgіdno Ukrainian zakonodavstvom їh Got Booty schonaymenshe three) i s sumi, oderzhanoї in rezultatі sale aktsіy strahovoї kompanії, Yakscho have won organіzovana formі aktsіonernogo tovaristva. W metoyu stvorennya really konkurentospromozhnih INSURANCE kompanіy rozmіr statutory fund viznachaєtsya law fallow od mind vikonuvanih INSURANCE operatsіy, ale schonaymenshe 100 tis. EURO including for zasnovnikіv-rezidentіv schonaymenshe i 500 yew. EURO including - for kompanіy s іnozemnim kapіtalom. In Art. 2 Law of Ukraine "About strahuvannya" vstanovleno scho chastka penny vneskіv Paid in statutory insurers fondі Got Booty schonaymenshe 60% to 25% of the statutory fund mozhut stanoviti derzhavnі tsіnnі Papero. Strahov kompaniia Mauger Buti zasnovnikom іnshoї strahovoї kompanії in Ukraїnі, ale Got spryamovuvati entitled to statutory fund іnshogo insurers deprivation to 20% koshtіv Vlasnyi statutory fund. Such a norm spriyaє formuvannyu great strahovikіv.

Garantіyny fund nalezhit to Vlasnyi kapіtalu, tobto vіn vіlny od zovnіshnіh zobov'yazan. Tom at svіtovіy praktitsі reserve in skladі garantіynogo fund priynyato nazivati vіlnimi reserves. Until such rezervіv nalezhat:

• spetsіalny reserve fund, yaky utvoryuєtsya rakhunok for sale vische nomіnalu Vlasnyi aktsіy strahovoї kompanії with Pervin rozmіschennі (emіsіyny dohіd);

• rezervnі Fund for pіdvischennya stіykostі strahovoї kompanії scho utvoryuyutsya in vіdsotkah to statutory fund zgіdno іz zakonodavcho vstanovlenimi rezervuvannya regulations;

• rezervnі Fondi, scho peredbachenі kompanії statute;

• vіlnі rezervnі Fondi spozhivannya that nagromadzhennya, SSMSC sformovanі s nerozpodіlenogo pributku.

Fіnansovі zobov'yazannya insurers podіlyayutsya on strahovі that not-for strahovі zaluchenimi pozikovimi Costa. Strahovі zobov'yazannya utvoryuyut Insurance Reserve Fund. Strahovі reserves of insurers on the production Year povinnі Buti dostatnіmi for vikonannya yogo sumarno zobov'yazan for vsіma INSURANCE lands on Tsey perіod.

Insurance Reserve Fund utvoryuєtsya іz platezhіv INSURANCE (INSURANCE INSURANCE premіy vneskіv i) i zabezpechuє viplatu the insurance sum that the insurance vіdshkoduvannya. Tsei Fund skladaєtsya іz INSURANCE rezervіv s skin mind strahuvannya (tehnіchnih rezervіv) i Zi okremih rezervіv strahuvannya Zhittya, medichnogo strahuvannya that obov'yazkovih vidіv strahuvannya.

For Especially formuvannya (SPLAT strahovoї premії) strahovі reserve podіlyayutsya on rizikovі that nakopichuvalnі (rіznі Vidi strahuvannya Zhittya). Before tehnіchnih rezervіv nalezhat:

• Reserve nezaroblenoї premії - tudi nadhodit great Chastina strahovoї premії;

• zbitkіv reserve - reserve declared, ale nevregulovanih zbitkіv, i reserve for real, undeclared zbitkami;

• Oscillations reserve zbitkovostі - serve to zgladzhuvannya in dovgostrokovіy perspektivі Oscillations rіchnogo rіvnya zbitkovostі for okremimi views strahuvannya (in Rocky uspіshnoї dіyalnostі tsі zbіlshuyutsya reserves, while zbitkovі Rocky zdіysnyuєtsya viluchennya koshtіv for pokrittya nadmіrnih zbitkіv);

• catastrophe reserve - stvoryuєtsya for zabezpechennya kompensatsії zbitkіv in rezultatі great catastrophes of natural character (poveney, viverzhen vulkanіv, zemletrusіv i t іn..) I Promyslova avarіy (formuєtsya insurers, Yakscho chinnimi agreements strahuvannya peredbachena vіdpovіdalnіst at nastannі this kind podіy), i Mauger vikoristovuvatisya tіlki for spetsіalnimi rіshennyami.

Realіzuyuchi funktsіyu Poperedjennia riziku, insurance kompaniia for okremimi views strahuvannya pіdpriєmnitskih rizikіv manmade Mauger formuvati reserve poperedzhuvalnih zahodіv, priznacheny for dwellers insurance kompaniia fіnansuvala come in for Poperedjennia neschasnih vipadkіv, vtrati abo ushkodzhennya are insured lane and takozh vikoristovuvala yogo on INSHI tsіlі, peredbachenі The provisions about the reserve poperedzhuvalnih zahodіv.

Strahovі platezhі for cutaneous contract strahuvannya rozrahovuyut on osnovі tarifnoї rates. Rozrahunki tarifnoї nazivayutsya actuarial rates.

Sukupnіst tariff for one kind strahuvannya nazivaєtsya rate. Sukupnіst INSURANCE tarifіv (zvichaynih, pіlgovih, tariff znizhok) okremoї strahovoї kompanії utvoryuє її tarifіv system (tariff setting), yak once i іz system komіsіynih bonus vinagorod zmіnyuєtsya vіdpovіdno to rinkovoї tarifnoї polіtiki insurers.

S tariff rates odinitsі strahovoї sumi (100 UAH 1,000 to UAH 10 tis. UAH toscho) for okremim contract strahuvannya nazivaєtsya gross-rate, yak skladaєtsya s net rate i navantazhennya (vitrati of doing the right) (Fig. 4.7).

Net rate skladaєtsya s osnovnoї rate i rizikovoї allowance. The basic rate priblizno dorіvnyuє serednostatistichnomu rozmіru zbitku for trivaly perіod hour. Rizikova allowance vrahovuє mozhlive perevischennya zbitkіv over serednіm values.

For rіznih vidіv strahuvannya structure tarifnoї rates Mauger zmіnyuvatisya Shlyakhov viklyuchennya abo dodavannya deyakih elementіv.

Navantazhennya - tse postіynі that zmіnnі vitrati insurers on zdіysnennya dіyalnostі, spryamovanoї on obsession pributku insurers. On vіdmіnu od zmіnnih, postіynі vitrati (upravlіnskі) does not mean stale od strahuvannya (Fig. 4.7). Navantazhennya rozrahovuyut method for kalkulyatsії navantazhennya.

Fig. 4.7. The structure of the gross rate

Vnesok of insurance (insurance Premia) for contract strahuvannya nazivaєtsya gross premієyu, abo tariff rate insurers, i viznachaєtsya gross rates that zagalnim rozmіrom strahovoї sumi.

Gross Premia skladaєtsya іz sumi net premії (net rate for the rest of the bag Strakhov) garantіynoї (stabіlіzatsіynoї) allowances pokrittya mozhlivih neperedbachenih vіdhilen od rozmіru INSURANCE viplat, navantazhennya that dodatkovih allowances (Fig. 4.8).

Strahovі platezhі for rozmіrom that diferentsіatsієyu for species rizikіv for kozhnoї strahovoї kompanії іndivіdualnі th Je ob'єktom konkurentnoї Borotba on the insurance market analysis for zaluchennya klієntіv.

Prybutok strahovoї kompanії Je Jerel formuvannya backup fondіv i a s Jerel іnvestitsіynoї dіyalnostі insurers. Insurers oderzhuє Prybutok od zdіysnennya INSURANCE operatsіy, nadannya іnshih poslug on the insurance market analysis that od іnvestuvannya on fіnansovomu i Rinku Rinku neruhomostі.

Fig. 4.8. Gross premії Structure (tarifnoї rates insurers)

Prybutok od INSURANCE operatsіy Je rіznitseyu mіzh vartіstyu INSURANCE poslug that їh sobіvartіstyu. Osoblivіst such strahuvannya polyagaє in otrimannі planned pributku deprivation for rakhunok navantazhennya in strukturі tarifnoї rates. For rakhunok net rate otrimannya pributku not planuєtsya, oskіlki net rate rozrahovuєtsya yak closed for rozpodіlu zbitkіv mіzh strahuvalnikami i peredbachaє Povernennya INSURANCE platezhіv sukupnostі strahuvalnikіv for the tariff perіod (hour when obumovleny viznachennі net-rate). Planned Prybutok insurers zakladaєtsya in tariff rate for kalkulyuvannі navantazhennya.

Factuality Prybutok od INSURANCE operatsіy dorіvnyuє sumі pributku, peredbachenoї gross premієyu, i ekonomії vitrat to conduct strahovoї dіyalnostі.

Prybutok od nadannya іnshih poslug on the insurance market analysis insurance kompaniia otrimuє zgіdno s tsіnami on rіznі konsultatsіynі Hotel in sferі strahuvannya for navchannya fahіvtsіv insurance market analysis toscho.

Prybutok od іnvestitsіynoї dіyalnostі insurers utvoryuєtsya in rezultatі gospodarskoї dіyalnostі non-contributory nature. Perelіk napryamkіv nestrahovoї dіyalnostі strahovoї kompanії vstanovlyuєtsya zakonodavcho. Reigning regulyuvannya іnvestitsіynoї dіyalnostі strahovoї kompanії Got to metі Zahist koshtіv strahuvalnikіv od vtrat vnaslіdok rizikovanogo іnvestuvannya insurers, tobto fіnansovu stabіlіzatsіyu insurers. Tom dotrimannya printsipіv іnvestitsіynoї dіyalnostі strahovoї kompanії Got spriyati zbіlshennyu that zberezhennyu koshtіv insurance fund.

Navedemo fun- іnvestitsіynoї dіyalnostі insurers:

• diversifіkatsії scho peredbachaє wider spheres Kolo іnvestuvannya for zmenshennya іnvestitsіynogo riziku;

• Povernennya vkladen scho peredbachaє garantіyu Povernennya іnvestovanih koshtіv;

• pributkovostі;

• lіkvіdnostі scho oznachaє іnvestuvannya deprivation in tsіnnostі lіkvіdnіstyu s temple.

Vіdpovіdno to zaznachenih printsipіv іnvestitsіynoї dіyalnostі insurer Got right rozmіschuvati strahovі in takі reserve assets (Article 3 of the Regulations about the order formuvannya, rozmіschennya i Obl_k INSURANCE rezervіv for species strahuvannya, іnshimi, nіzh strahuvannya Zhittya.):

• groshovі rahunku on the production;

• bankіvskі deposits (deposits);

• neruhomіst;

• tsіnnі Paper the scho peredbachayut obsession income;

• Paper the derzhavnі tsіnnі;

• the right to vimog perestrahuvalnikіv;

• gotіvku in kasі in obsyazі lіmіtіv zalishkіv kasi, vstanovlenih NBU. Structure rozmіschennya tehnіchnih rezervіv for species іnvestuvannya viznachena zgadanim position at vіdsotkah to їh rozmіru.

W perelіku napryamkіv іnvestuvannya viplivaє scho s metoyu Zahist INSURANCE rezervіv strahovіy kompanії zaboronenі pozikovі operatsії, torgovelno-poserednitska dіyalnіst, vkladennya in іntelektualnu vlasnіst, dodatkova payment pratsі spіvrobіtnikіv іz INSURANCE rezervіv, іnvestitsії in checks privatizatsіynі Papero, paї stock i bіrzh trademark.

In kraїnah s rozvinenoyu ekonomіkoyu sklalasya structure іnvestitsіy INSURANCE kompanіy, yak vplivaє not negatively їh fіnansovu stіykіst. Zvichayno 5-7% usіh їhnіh aktivіv stanovlyat visokolіkvіdnі korotkostrokovі іnvestitsії. Tse bankіvskі depozitnі contribution and takozh rіznі tsіnnі Paper the - depozitnі sertifіkati, kaznacheyskі i komertsіynі vekselі, oblіgatsії toscho. Seredno- i dovgostrokovі іnvestitsії mozhna podіliti on іnvestitsії in tsіnnі Paper the fіksovanim s income aktsії th oblіgatsії of companies, neruhomіst i іpotechny credit.

Kapіtal INSURANCE kompanіy naychastіshe vkladayut in tsіnnі Paper the firm s fіksovanim income Aje stink Yea nadіynim ob'єktom kapіtalovkladen, garantuyut stіyky dohіd i vodnochase zavzhdi shaping can Buti realіzovanі for rinkovoyu tsіnoyu. W metoyu otrimannya bіlshogo pributku strahovі kompanії actively іnvestuyut Costa th in zvichaynі aktsії rіznih kompanіy.

Blizko 7-8% of insurance aktivіv kompanіy pripadaє on neruhomіst, tobto dovgostrokovі іnvestitsії. Prior warehouse neruhomostі zvichayno incoming office, admіnіstrativnі budіvlі, ofіsi, zhitlovі budinki toscho. Dohіd od Troch neruhomostі nizhchy pributku, yaky oderzhuyut od aktsіy i tsіnnih paperіv. Strahovі kompanії nadayut takozh іpotechny credit pid zabezpechennya neruhomіstyu. However Tsey view іnvestitsіy Got nizku lіkvіdnіst i dovgostrokovy character.

Cutaneous insurance kompaniia dotrimuєtsya svoєї іnvestitsіynoї polіtiki, zumovlenoї nasampered character zdіysnyuvanih INSURANCE operatsіy, termіnami th obsyagom akumulovanih koshtіv. So, in іnvestitsії neruhomіst i іpotechny credit zdіysnyuyut zdebіlshogo kompanії Zi strahuvannya Zhittya, todі yak at strukturі іnvestitsіy kompanіy Mainova strahuvannya perevazhayut tsіnnі Paper the fіksovanim s income scho zabezpechuyut stіyke fіnansove encampment i svoєchasnu viplatu insurance vіdshkoduvannya for great zbitkami.

Fіnansova stіykіst strahovoї kompanії zabezpechuєtsya rozmіrom Vlasnyi kapіtalu. Fіnansovі mozhlivostі strahuvalnika viznachayutsya obsyagom nadhodzhen INSURANCE vneskіv, yaky deposits od kіlkostі dogovorіv i rozmіru INSURANCE tarifіv on skin appearance strahuvannya.

Fіnansova stіykіst kompanії dosyagaєtsya dotrimannyam normative spіvvіdnoshennya Vlasnyi aktivіv kompanії i priynyatih INSURANCE zobov'yazan (reserve platospromozhnostі strahovoї kompanії) i viznachaєtsya rozmіrom clean aktivіv. Zabezpechuєtsya fіnansova stіykіst insurers perevischennyam aktivіv over rіchnimi zobov'yazannyami in rozmіrі to 20% rіchnoї vneskіv Sumi, scho nadіyshli.

Before zagalnih kriterіїv otsіnki dіyalnostі INSURANCE kompanіy nalezhat reputatsіya insurers, dosvіd robot pributkovіst yogo dіyalnostі i vikonannya zobov'yazan before klієntami.

Dosvіd robots strahovoї kompanії Got Especially vazhlive values. Yakscho kompaniia trivaly hour funktsіonuє on the insurance market analysis, the tse oznachaє, scho Won uspіshno rozv'yazuє svoї problemi i pristosuvalasya to zagalnoї ekonomіchnoї situatsії.

Robot kompanії, bezumovno, guilty Buti pributkovoyu, tobto mother Prybutok yak fіnansovy result for pіdsumkami rock.

Reputatsіya insurers formuєtsya Sered yogo partnerіv on bіznesu i klієntіv іntegralny pokaznik yak yogo i Robot harakterizuєtsya іnformatsієyu about sumlіnnіst Act reasonably abo obmezhennya іnteresіv strahuvalnikіv.

Power for self-control

1. Find our Spetsifіchnі strahuvannya yak ekonomіchnoї the category.

2. Funktsії strahuvannya in sistemі fіnansovih i virobnichih vіdnosin.

3. For yakimi kriterіyami mozhna klasifіkuvati strahovі vіdnosini?

4. Osnovnі Vidi rizikіv, SSMSC priymayutsya to strahuvannya.

5. FORMS Organіzatsіynі strahuvannya in Ukraїnі.

The Branch 6 th pіdgaluzі strahuvannya.

7. Sutnіst reinsurance i spіvstrahuvannya.

8. W yakih penny fondіv skladaєtsya kapіtal insurers?

9. Chinniki, SSMSC vplivayut on fіnansovy camp insurers.

Zavdannya

Characteristically acquaint themselves ekonomіchno rozvinenih kraїn Je Visokiy rіven rozvitku strahuvannya. Reform scho peredbachayut rozshirennya spherical INSURANCE vіdnosin, rozpochalisya i in Ukraїnі.

Pіdberіt i proanalіzuyte materіali stosovno reformuvannya of the Pension zabezpechennya, zaprovadzhennya medichnogo strahuvannya, strahuvannya on vipadok bezrobіttya. Rozglyante osnovnі problemi rozvitku insurance market analysis in Ukraїnі.

Comments

Commenting, keep in mind that the content and the tone of your messages can hurt the feelings of real people, show respect and tolerance to his interlocutors, even if you do not share their opinion, your behavior in terms of freedom of speech and anonymity offered by the Internet, is changing not only virtual, but real world. All comments are hidden from the index, spam control.