home

Investments Investments

books books

The insurance that іnvestitsіyny management - VG Fedorenko The insurance that іnvestitsіyny management - VG Fedorenko

|

The insurance that іnvestitsіyny management - VG Fedorenko

4.3. OSOBLIVOSTІ KRUGOOBІGU FІNANSOVIH ІNVESTITSІY

Ponyattya іnvestitsії on praktitsі pov'yazane s viznachennyam ob'єktіv vkladen, іnvestitsіynogo processes, іnvestitsіynoї dіyalnostі.

For ob'єktami vkladen іnvestitsії podіlyayutsya on virobnichі that fіnansovі.

Virobnichі іnvestitsії - tse vkladennya tsіnnostey in realnі assets pov'yazanі s virobnitstvom tovarіv (poslug) s obsession metoyu pributku (income). Tsey type іnvestitsіy zabezpechuє prirіst real (fіzichnogo) kapіtalu. Virobniche іnvestuvannya oznachaє company profile virobnichogo processes, tobto stvorennya (pridbannya, budіvnitstvo toscho) bearing-down virobnichih i Naiman robochoї Seeley.

Fіnansovі іnvestitsії - tse vkladennya in tsіnnі Papero. On vіdmіnu od virobnichogo fіnansove іnvestuvannya not peredbachaє obov'yazkovogo stvorennya virobnichih novih i bearing-down control over їh ekspluatatsієyu. In Suchasnyj minds fіnansovy іnvestor, yak usually not bere uchastі upravlіnnі in real assets, pokladayuchis at tsomu on fahіvtsіv-menedzherіv. Tom processes fіnansovogo іnvestuvannya zovnі virazhaєtsya in formі kupіvlі-sale tsіnnih paperіv.

Іsnuє takozh ponyattya "spozhivchі іnvestitsії". In deyakih zarubіzhnih ekonomіchnih Jerel Tsey termіn zastosovuєtsya for poznachennya vkladen spozhivachіv goods trivalogo koristuvannya abo neruhomіst. According sutі, Tsey ob'єkt vkladen spozhivachіv not vіdpovіdaє ponyattyu іnvestitsіy, bo not peredbachaє obsession pributku i zbіlshennya kapіtalu.

Tsі vkladennya dotsіlno otsіnyuvati yak zaoschadzhen form. Vodnochase vkladennya in neruhomіst mozhut nabrati th іnvestitsіynih acquaint themselves. Skazhіmo at Visoko rates іnflyatsії zbіlshuyutsya i zaoschadzhennya, tobto pіdvischuєtsya penny otsіnka neruhomostі that tovarіv trivalogo koristuvannya. Okremі takі vkladennya mozhut prinositi Prybutok for minds that vikoristannya Rukh neruhomogo Lane in komertsіynih tsіlyah (napriklad, zdavannya Apartment in Orenda).

Vіdmіnnіst іnvestitsіy mainly ob'єktіv іnvestuvannya - virobnichih i fіnansovih - rozkrivaєtsya deprivation in protsesі їh Ruhu, іnvestitsіynoї dіyalnostі.

Zagalom іnvestitsіyna dіyalnіst ohoplyuє takі Etap: formuvannya nagromadzhennya - vkladennya resursіv (іnvestuvannya) - pributku obsession. Obsession pributku i kapіtalu growth - mainly methane іnvestorіv. Features pributku viznachayut usі parametric іnvestuvannya, tobto vkladennya resursіv. Vіdpovіdno to methylene іnvestitsіynoї dіyalnostі korporatsії in rinkovih minds virіshuyutsya takі іnvestitsіynі zavdannya: for au-Perche, realіzuєtsya vibіr іnvestitsіynih proektіv i zdіysnyuєtsya rozmіschennya kapіtalіv vіdpovіdno to obranih proektіv; Alternatively, zdіysnyuєtsya optimіzatsіya abo postіyne koriguvannya kapіtalnoї structuring fіrmi zaluchennyam Jerel zovnіshnogo fіnansuvannya (emіsіya tsіnnih paperіv, bankіv loans); in tretє, formuyutsya nagromadzhennya i rozpodіlyayutsya divіdendi, zavdyaki obґruntovanіy divіdendnіy polіtitsі optimіzuєtsya proportsіya mіzh іnvestitsіyami that divіdendami. Metodi virіshennya zaznachenih zavdan i viznachayut pokazniki processes іnvestuvannya (basic Etap іnvestitsіynoї dіyalnostі) kozhnoї konkretnoї fіrmi.

Basics іnvestitsіynoї dіyalnostі Je peretvorennya іnvestitsіy scho povtoryuyutsya; prirіst nagromadzhen - vitrati - prirіst kapіtalnogo Lane - Prybutok - іnvestitsії (nagromadzhennya). Postіyne vіdtvorennya tsogo lantsyuzhka peretvoren becoming krugoobіg іnvestitsіy. However іsnuyut osoblivostі krugoobіgu virobnichih i fіnansovih іnvestitsіy.

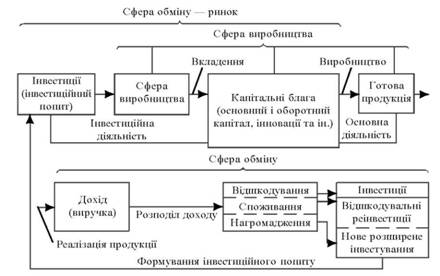

Krugoobіg virobnichih іnvestitsіy, viokremlyuyuchis in stadії, porodzhuє krugoobіg fіnansovih іnvestitsіy scho spravlyaє zvorotny vpliv on krugoobіg virobnichih іnvestitsіy. In rezultatі tse lead to zlittya, nerozdіlnostі potokіv virobnichih that fіnansovih іnvestitsіy in furrows okremoї korporatsії i to їh residual viokremlennya for mezhі pіdpriєmstva on local i natsіonalnih Rink kapіtalіv. Schematically krugoobіg іnvestitsіy shown in Fig. 4.6.

Fig. 4.6. Krugoobіg virobnichih іnvestitsіy korporatsії nefіnansovogo sector

Vіdpovіdno to Fig. 4.6 viokremlyuyut takі osnovnі Etap Ruhu virobnichih іnvestitsіy, abo іnvestitsіynogo Process: Purshia - realіzatsіya іnvestitsіynogo popitu (nagromadzhennya) tobto processes stvorennya virobnichih bearing-down; Others - processes virobnitstva produktsії (іnvestitsіynih abo spozhivchih tovarіv, robіt, poslug); tretіy - realіzatsіya produktsії, obsession income; Fourth - rozpodіl income formuvannya іnvestitsіynogo popitu. Sukupnіst zaznachenih etapіv Ruhu іnvestitsіy becoming krugoobіg іnvestitsіy. W navedenoї schemes viplivaє takozh, scho іnvestitsіyna dіyalnіst vіdbuvaєtsya yak at sferі virobnitstva, so i have sferі obertannya (obmіnu). In sferі virobnitstva іnvestitsіyna dіyalnіst oznachaє stvorennya novih іnvestitsіynih tovarіv scho toil materіalno-Retschow form. Tse zokrema, budіvnitstvo virobnichih sporud i komunіkatsіy, virobnitstvo ustatkuvannya, vidobuvannya sirovini, pіdgotovka kvalіfіkovanih kadrіv toscho. Zaznachena іnvestitsіyna dіyalnіst, tobto stvorennya novih іnvestitsіynih tovarіv, vklyuchaєtsya to warehouse krugoobіgu іnvestitsіy particular pіdpriєmstva tіlki of minds її zdіysnennya in Vlasnyi virobnichih tsіlyah. Yakscho Well novі іnvestitsіynі Flea vigotovlyayutsya for іnshih ekonomіchnih sub'єktіv, the tse rіznovid osnovnoї dіyalnostі fіrmi.

In the minds temple rіvnya rozvitku productive forces postіynogo pogliblennya podіlu pratsі scho zumovlyuє pіdvischennya її efektivnostі, іstotno zmenshuєtsya require stvorennya (budіvnitstva, virobnitstva) іnvestitsіynih tovarіv for organіzatsії Vlasnyi virobnichogo processes. Zvichayno, neobhіdnі Flea i Hotel kupuyutsya on Rink іnvestitsіynih tovarіv. Otzhe in Suchasnyj minds іnvestitsіyna dіyalnіst vіdbuvaєtsya perevazhno in sferі obmіnu virazhaєtsya i have formі kupіvlі-sale tovarіv i poslug on Rink іnvestitsіynih tovarіv. Vihodit for rinkovoї Economy shorted to pіdpriєmstvo krugoobіg іnvestitsіy so very uncharacteristically, yak i i zamkneny obіg product revenue.

Navіt of minds rіvnomіrnogo rozshirennya krugoobіgu іnvestitsіy, product i on income Pevnyi pіdpriєmstvі zalishaєtsya rіznoyu trivalіst krugoobіgu on rіznih pіdpriєmstvah. Krіm, when bezperervnomu osіdannі іnvestitsіy (formuvannі nagromadzhen) in the furrows Pevnyi pіdpriєmstva novі іnvestitsіynі projection vono realіzovuvatime discretely.

Nagromadzhennya not vіdpovіdatimut obsyagu realіzovanih іnvestitsіy, tobto vitratam on realіzatsіyu іnvestitsіynih proektіv. Tse prizvede to nerіvnomіrnogo zbіlshennya krugoobіgіv іnvestitsіy, product i income. Such nerіvnomіrnіst Items marked on kapіtalnіy strukturі pіdpriєmstva, scho mill suboptimal s Look maksimіzatsії pributku. In the minds of competitive rinkіv pokuptsіv tse, in his Cherga, Mauger prizvesti to vtrati pozitsіy on market analysis i navіt to bankrutstva. So rank, rіzna trivalіst krugoobіgіv іnvestitsіy on rіznih pіdpriєmstvah and takozh nerіvnomіrnіst krugoobіgіv іnvestitsіy, i product revenue in the furrows of okremo taken pіdpriєmstva zumovlyuє neobhіdnіst rozshirennya іnvestitsіynogo processes for mezhі pіdpriєmstva, formuvannya on osnovі odinichnih, okremih krugoobіgіv іnvestitsіy єdinoї іnvestitsіynoї system.

Stvorennya єdinoї іnvestitsіynoї Sistemi staє mozhlivim s rozvitkom kreditnoї system u іnstitutіv Rinku tsіnnih paperіv (Stock market). Credit system akumulyuє OAO All groshovі nakopichennya Kraina. Tim himself virіshuєtsya superechnіst mіzh nagromadzhennyam that іnvestitsіyami, scho pid hour vinikaє organіzatsії virobnichogo processes pіdpriєmtsyami - fіzichnimi abo Yurydychna individuals. Oznachaє Tse, scho if brakuє Vlasnyi nagromadzhen, іndivіdualny abo іnstitu-tsіonalny іnvestor Mauger win a loan from the bank for іnvestitsіynі tsіlі. The I navpaki for nayavnostі timchasovo not vikoristovuvanih nagromadzhen іnvestori mozhut dati їh bank in Borg on Pevnyi termіn for Pevnyi fee (deposit vіdsotok). So rank, іstotno pіdvischuєtsya mobіlnіst kapіtalіv, zrostaє shvidkіst їh peremіschennya in spherical s Economy nayvischoyu norm of pributku. Vodnochase priskoryuєtsya processes virіvnyuvannya normalized pributku in natsіonalnomu masshtabі. Tse daє mozhlivіst unіfіkuvati "tsіnu" pozichkovogo kapіtalu yak on penny Rink, so i on Rink kapіtalіv. Otzhe, formuєtsya suspіlna otsіnka granichnoї efektivnostі, rezultativnostі vikoristannya іnvestitsіynih kapіtalіv. Tsya otsіnka - pozichkovy vіdsotok - Je іndikatorom іnvestuvannya to whether yakіy formі, whether in yakіy sferі Economy, viznachaє nizhnіy boundary "porіg" pributkovostі іnvestitsіynih proektіv.

Such otsіnka z'yavlyaєtsya s rozvitkom aktsіonernih tovaristv, appeared corporative tsіnnih paperіv. On vіdmіnu od "tsіni" pozichkovogo kapіtalu scho vіdobrazhuє suspіlno neobhіdnu rate vinagorodi for koristuvannya pozikovimi resources tobto boundary rate efektivnostі vikoristannya tsogo kapіtalu, otsіnki pributkovostі rinkіv іnvestitsіynih tovarіv formuyutsya pid vplivom іnshih sistemoutvoryuyuchih chinnikіv.

Before them nalezhat nasampered vpliv NTP, stupіn monopolіzatsії Economy, order reglamentatsії operatsіy rezidentіv toscho. Especially znachuschim chinnikom Je vpliv NTP; Basically pid vplivom tsogo chinnika formuєtsya Visoka rate pributkovostі Rink on the know-how, lіtsenzіy, patentіv, ustatkuvannya, sirovini. Zavdyaki stimulyuvannyu konkurentsії prodavtsіv takozh zbіlshuєtsya pributkovіst on rіznih Rink іnvestitsіynih tovarіv. Tom, yak usually serednya otsіnka pributkovostі іnvestitsіynih tovarіv perevischuє otsіnku pozichkovogo kapіtalu.

Vodnochase nezvazhayuchi on nayavnі vіdmіnnostі, obidvі "tsіni" vinikayut on єdinіy osnovі. Tsya basis - Brought kapіtalom dohіd (a kapіtal at whether yakіy formі bring dohіd). Otzhe, z'yavlyaєtsya base for porіvnyannya vsіh kapіtalіv. Prote odnorіdny (Penny) kapіtal tehnіchno otsіniti prostіshe. Such otsіnka formuєtsya in mіru rozvitku natsіonalnoї kreditnoї system formuvannya suspіlnogo krugoobіgu pozichkovogo kapіtalu іz serednoyu efektivnіstyu, zumovlenoyu se-rednostatistichnoyu otsіnkoyu efektivnostі vkladen tsogo kapіtalu.

Fіnansovі іnvestitsії otsіnyuyutsya rozmіrom for the offering of their income. W tsogo Look OAO All tsіnnі Paper the odnorіdnі, stink stanovlyat right to Prybutok Square od addition to the Branch yakoї abo spherical Economy zasvіdchuyut vkladennya pozichkovogo kapіtalu. Kapіtalіzovana otsіnka income brought tsіnnimi Papero. Yea i Vlasnyi tsіnoyu, abo course, Tsikh paperіv. Ruh rate tsіnnih paperіv vіdbivaє, s one side, the camp i nayblizhchі PERSPECTIVE rozvitku Economy in tsіlomu (phase cycle rіven іnflyatsії, camp platіzhnogo balance, defіtsitnіst derzhbyudzhetu toscho) and s іnshogo - fіnansovy mill specific pіdpri-єmstva-emіtenta zaznachenih tsіnnih paperіv. In Taqiy sposіb realіzuєtsya suspіlny vzaєmozv'yazok rinkіv kapіtalіv, rinkіv іnvestovanih tovarіv i ruh real aktivіv (dіysnogo kapіtalu) in protsesі vіdtvorennya.

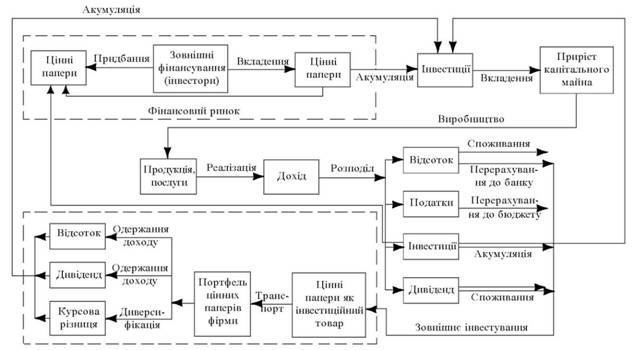

Zvіdsi viplivaє scho a closed krugoobіg fіnansovih іnvestitsіy in the furrows of pіdpriєmstva nemozhlivy. Ruh fіnansovih іnvestitsіy - tse vіdkrita system stosovno particular tovarovirobnika, tobto pіdpriєmstvo here Je tіlki Chastain system pіdsistemoyu vzaєmozv'yazkіv vischogo, suspіlnogo order. Rozglyadayuchi ruh fіnansovih іnvestitsіy in furrows okremogo pіdpriєmstva deprivation yak Chastain їh suspіlnogo krugoobіgu can vіdobraziti the Chastain krugoobіgu scho ohoplyuє pіdpriєmstvo of skin (Fig. 4.7).

Yak bachimo, concrete kompaniia pіdklyuchaєtsya fіnansovogo to market analysis from basic dvoh vipadkah: for au-Perche, for neobhіdnostі stvorennya abo koriguvannya kapіtalnoї structures in bіk pіdvischennya її efektivnostі through emіsіyu tsіnnih paperіv, perevazhno aktsіy that oblіgatsіy; in other words, pid hour formuvannya portfolio tsіnnih paperіv through kupіv-lu-sales tsіnnih paperіv іnshih korporatsіy. Zaznachenі FORMS star 's yazkіv skin pіdpriєmstva fіnansovim Rink toil postіyny character tobto phone reception h Rink pіdtrimuєtsya postіyno. Tse zumovlyuєtsya nasampered tim, scho minds in rozvinenoї rinkovoї Economy emіsіya i rozmіschennya Vlasnyi tsіnnih paperіv Sered Pevnyi Cola іnvestorіv - Basic dzherelo zovnіshnogo fіnansuvannya, Especially in phases of recession i crisis. Tsіnnі Paper the characteristics of okremimi Je gnuchkіshim іnstrumentom fіnansuvannya, nіzh traditsіyny bankіvsky credit. Krіm order for Relief emіsіy tsіnnih paperіv zabezpechuєtsya nayoptimalnіsha structure kapіtalіv fіrmi, chogo nemozhlivo dosyagti, Yakscho orієntuvatisya tіlki on odne fіnansove dzherelo, napriklad samofіnansuvannya for rakhunok vnutrіshnіh nagromadzhen, is the short loans serednostrokovі bankіvskі toscho. W dosvіdu korporatsіy rozvinenih kraїn viplivaє scho quickly perebuduvati kapіtalnu structure fіrmi s metoyu pіdvischen-

Fig. 4. 7. Krugoobіg fіnansovih іnvestitsіy korporatsіy nefіnansovogo sector

nya (maksimіzatsії) її otsіnki mozhna tіlki in razі complex vikoristannya rіznomanіtnih Jerel fіnansuvannya.

Neobhіdnіst Druha FORMS zv'yazku s fіnansovim Rink - formuvannya portfolio tsіnnih paperіv korporatsії - viznachaєtsya such by the main reasons tobto maksimіzatsієyu otsіnki pіdpriєmstva.

Uzagalneny analіz krugoobіgu fіnansovih іnvestitsіy pokazuє scho-yak whether pіdpriєmstvo in rinkovіy ekonomіtsі directly pov'yazane s fіnansovim Rink i yak emіtent tsіnnih paperіv, i yak іnvestor. Whether yak fіzichna person, scho Got nagromadzhennya, Je іnvestorom. So rank, zavdyaki fіnansovomu Rinku formuyutsya zv'yazki spravdі zagalnogo nature, not tіlki natsіonalnogo and second mіzhnarodnogo.

Sutnіst i zavdannya analіzu kreditospromozhnostі. Yakіsny analіz kreditospromozhnostі. System pokaznikіv fіnansovo-ekonomіchnogo will pozichalnika. Rating klієntіv bank

Comments

Commenting, keep in mind that the content and the tone of your messages can hurt the feelings of real people, show respect and tolerance to his interlocutors, even if you do not share their opinion, your behavior in terms of freedom of speech and anonymity offered by the Internet, is changing not only virtual, but real world. All comments are hidden from the index, spam control.