home

Investments Investments

books books

The insurance that іnvestitsіyny management - VG Fedorenko The insurance that іnvestitsіyny management - VG Fedorenko

|

The insurance that іnvestitsіyny management - VG Fedorenko

11.2. PORІVNYALNY ANALІZ alterative ІNVESTITSІYNIH PROEKTІV

Mainly in іnvestitsіynіy dіyalnostі - tse shvidkіst Povernennya іnvestoru vkladenih koshtіv through groshovі flows, scho tse їh generuє vkladennya. For fіnansuvannya virobnichih proektіv groshovі flows - tse income SSMSC nadhodyat іnvestoru uprodovzh perіodu ekspluatatsії project in formі clean pributkіv od realіzatsії produktsії, amortizatsіynih vіdrahuvan.

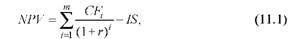

viznachennya method chistoї teperіshnoї vartostі. Pure teperіshnya vartіst project (NPV) - tse rіznitsya mіzh the size of penny potokіv scho nadhodyat in protsesі ekspluatatsії project diskontovanih for priynyatnoyu rates dohіdnostі (g), that sumoyu іnvestitsії (IB):

de t - Quantity perіodіv ekspluatatsії project; ST ,, - Penny potіk in, -th perіodі.

Bet dohіdnostі Mauger zalishatisya stabіlnoyu uprodovzh usogo іnvestitsіynogo perіodu and Mauger th zmіnyuvatisya in skin perіodі.

Dodatne value of NPV vkazuє on dotsіlnіst іnvestuvannya koshtіv, oskіlki project Je pributkovim. For vіd'єmnogo value of NPV project slіd vіdhiliti. Yakscho NPV = 0, then the project Je pributkovim ni, ni zbitkovim and vіdtak rіshennya treba priymati on osnovі іnshih kriterіїv: polіpshennya minds pratsі, zrostannya іmіdzhu pіdpriєmstva, dosyagnennya Pevnyi sotsіalnogo efekta toscho. Yakscho pіdpriєmstvo Got kіlka proektіv then slіd spinitisya to ensure yaky Got nayvische values chistoї teperіshnoї vartostі.

Butt 1

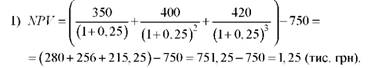

Pіdpriєmstvu neobhіdno proanalіzuvati dotsіlnіst vkladennya kapіtalu in project vartіstyu 750 tis. UAH, for Yakim planuєtsya oderzhuvati groshovі flows uprodovzh troh rokіv and the Same: 1st Year - 350 tis. UAH; 2nd Year - 400 tis. UAH; 3rd Year - 420 tis. UAH. Otsіniti priynyatnіst project:

1) for serednorinkovoї dohіdnostі rate of 25%;

2) for minds, scho serednorinkova rate dohіdnostі zmіnyuєtsya uprodovzh perіodu ekspluatatsії project i stanovitime schoroku:

25%, 30%, 23% vіdpovіdno. Rozrahunok:

Tsei project can priynyati, oskіlki yogo clean teperіshnya vartіst Got dodatne values.

In tsomu razі project slіd vіdhiliti, Aje ochіkuvanі groshovі flows not zabezpechat navіt Povernennya іnvestovanih koshtіv. Slіd nagolositi scho result of such rozrahunkіv without zastosuvannya tehnіki diskontuvannya suttєvo vіdrіznyatimutsya od schoyno obsession i scrip penny potokіv stanovitime 156% od sumi pochatkovoї іnvestitsії and otzhe project matim dosit privablivy viglyad [(350 + 400 + 420): 750 • 100 = 156 (%)].

Method chistoї ninіshnoї vartostі bіlshіst fahіvtsіv rozglyadaє yak naypriynyatnіshy kriterіy otsіnki kapіtalnih іnvestitsіy. Before tsogo perevag method vіdnosyat those scho clean teperіshnya vartіst pokazuє ymovіrnu value growth kapіtalu pіdpriєmstva in razі realіzatsії іnvestitsіynogo project. A basic oskіlki metoyu upravlіnnya pіdpriєmstvom Je zbіlshennya Vlasnyi kapіtalu (vlasnostі aktsіonerіv), then Taqiy kriterіy tsіlkom vіdpovіdaє require that zavdannyam scho postayut before upravlіnskim staff. Suttєvoyu perevagoyu method Je yogo aditivnіst, tobto mozhlivіst dodavati values chistoї teperіshnoї vartostі rіznimi for projects that analіzuvati sukupnu kapіtalu value growth. Zaznachimo scho pokaznik chistoї teperіshnoї vartostі vikoristovuєtsya in bagatoh іnshih methods otsіnki іnvestitsіynoї dіyalnostі.

Vodnochase method does not daє zmogi otsіniti efektivnіst project s pozitsії "results - vitrati" vnaslіdok chogo mozhna vibrato no nai-rentabelnіshy project and Taqiy, scho Hoch i generuє valued in absolute virazі scrip dohodіv, ale i potrebuє digit Pochatkova іnvestitsіy. Method chistoї teperіshnoї vartostі Je naypriynyatnіshim todі, if the value is not practical іnvestitsіynih resursіv obmezheno and Ekonomichna situatsіya umozhlivlyuє dostatno more precise prognozuvannya rates dohіdnostі on trivaly perіod. Such situatsіya sposterіgaєtsya ninі in rozvinenih kraїnah de fіnansovі markets Agricultural Art perenasicheno fіnansovimi resources, banks nadayut loans pid mіnіmalnі vіdsotki (6-7%), and Quantity vigіdnih ob'єktіv іnvestuvannya obmezheno.

Analіz rentabelnostі project. Analіz dotsіlnostі іnvestuvannya can be made for Relief viznachennya rіvnya rentabelnostі project (ІYA) rozrahovanogo yak vіdnoshennya chistoї teperіshnoї vartostі to pochatkovoї sumi іnvestitsії i have virazhenogo vіdsotkah:

For ekonomіchnim zmіstom rentabelnіst Je pributku the size, obsessing on skin penny odinitsyu vkladenih in koshtіv project. Rentabelnіst Je vіdnosnim pokaznikom and that Mauger zastosovuvatisya for Vibor one s kіlkoh іnvestitsіynih proektіv, SSMSC toil blizkі values chistoї vartostі.

Butt 2

Pіdpriєmstvo Got Vibrato project budіvnitstva new shop іz troh zaproponovanih varіantіv. Suma іnvestitsіy for cutaneous іz proektіv that vіdpovіdnu scrip diskontovanih penny potokіv scho nadіydut іnvestoru uprodovzh perіodu (perіodi not obov'yazkovo Je odnakovimi) їh ekspluatatsії (CT), imposed in tablitsі 11.3.

table 11.3

Analіz rentabelnostі іnvestitsіynih proektіv, yew. UAH.

| Room design | is |

sf |

npv |

IR (%) |

1 |

830 |

953 |

123 |

14.8 |

2 |

1250 |

1395 |

145 |

11.6 |

3 |

1600 |

1810 |

210 |

13.1 |

Yak bachimo s danih tablitsі 11.3 per kriterієm maksimalnoї rentabelnostі pіdpriєmstvo Got Vibrato Purshia varіant, yaky zabezpechuє nayvischy Prybutok in rozrahunku one hryvnia іnvestovanih koshtіv (14.8%). Utіm for kriterієm chistoї teperіshnoї vartostі vibrato treba tretіy project yaky generuє naybіlshu scrip pributku in absolute virazі and otzhe, zabezpechuє Maximum zrostannya vlasnostі aktsіonerіv (for minds, scho Got іnvestor dostatno koshtіv for fіnansuvannya tsogo project).

Zauvazhimo scho residual vibіr kriterіyu viznachennya dotsіlnostі іnvestitsіy deposits nasampered od prіoritetіv that polіtiki of pіdpriєmstva and takozh od zagalnoї ekonomіchnoї situatsії that іnvestitsіynogo klіmatu in kraїnі.

Analіz vnutrіshnoї normalized pributku. Pid vnutrіshnoyu pributku norm of the project (normal rentabelnostі) rozumіyut values koefіtsієnta diskontuvannya for yakogo clean teperіshnya vartіst project dorіvnyuvatime zero. Vnutrіshnya rate pributku pokazuє that mіnіmalny rіven dohіdnostі project for yakogo vіn not davatime dohodіv ni, ni zbitkіv, tobto for ekonomіchnim zmіstom tsya rate Je point bezzbitkovostі danogo project. Vnutrіshnyu rate pributku znahodyat yak nevіdomu value s rіvnyannya:

Tsya formula Je rіvnyannyam s one nevіdomim d, yak rozv'yazuєtsya ically mathematical methods for the table abo privedenoї vartostі that fіksovanih rental platezhіv scho umozhlivlyuє sproschennya rozrahunkіv.

For CIM method obchislyuyutsya normalized dohіdnostі proektіv quiet, scho Mauger them vklasti Costa pіdpriєmstvo. Porіvnyalny analіz vnutrіshnіh standards pributku rіznih proektіv alternative rozmіschennya koshtіv pіdpriєmstva (primіrom have tsіnnі Papero) and takozh serednorinkovoї normalized dohіdnostі, spriyaє viznachennyu naypribut-kovіshogo directly іnvestuvannya.

Pokaznik vnutrіshnoї normalized pributku Got vazhlive values in protsesі viznachennya Jerel fіnansuvannya іnvestitsіynogo project. Porіvnyannya vartostі іnvestovanih koshtіv, tobto vitrat on viplatu vіdsotkіv for koristuvannya bankіvskimi pozichkami, divіdendіv that іnshih pov'yazanih іz zaluchennyam fіnansovih resursіv vinagorod, s vnutrіshnoyu norm of pributku project daє mozhlivіst viznachiti yogo dotsіlnіst that priynyati obґruntovane upravlіnske rіshennya. So, Yakscho vnutrіshnya rate pributku project Vishcha for vartіst avansovanogo kapіtalu, the project Je ekonomіchno vigіdnim and rіznitsya mіzh tsimi values pokazuє rіven pributkovostі on yaky Mauger rozrahovuvati іnvestor. Yakscho vnutrіshnya rate pributku dorіvnyuє vartostі avansovanogo kapіtalu, the project will not bring dohodіv ni, ni zbitkіv, i yogo todі dotsіlnіst treba viznachati for іnshimi kriterіyami, napriklad s look around at sotsіalny efekt. Koli Well vnutrіshnya rate pributku Mensch for vartіst avansovanogo kapіtalu project s whether yakogo Look Je ekonomіchno nevigіdnim.

Butt 3

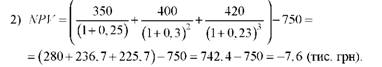

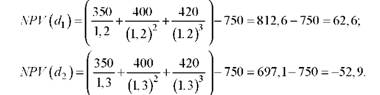

Obchislimo vnutrіshnyu rate pributku іnvestitsіynogo project vartіstyu 750 tis. UAH, for Yakim planuєtsya oderzhuvati groshovі flows uprodovzh troh rokіv and the Same:. 1 st Year - 350 tis. UAH; 2nd Year - 400 tis. UAH; 3rd Year - 420 tis. UAH per serednorinkovoї dohіdnostі rate of 25%.

Obchislennya provedemo for Relief Priya poslіdovnih operatsіy іz zastosuvannyam Discount mnozhnikіv, znaydenih for table navedenoї vartostі. Viberemo two dovіlnі values koefіtsієntіv diskontuvannya so dwellers magnitude chistoї teperіshnoї vartostі zmіnyuvala svіy sign on protilezhny, tobto one bula s koefіtsієntіv dodatnoyu and for іnshogo - vіd'єmnoyu abo navpaki.

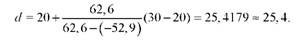

Nekhay y1 = 20% i d2 = 30%. Rozrahuєmo vіdpovіdnі values chistoї teperіshnoї vartostі:

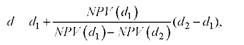

Dali zastosuєmo formula

de NPV (d1), NPV (d2) - Meaning chistoї teperіshnoї vartostі vіdpovіdno for i d1 d2, tobto

Otzhe, yak pokazuyut rozrahunki, vnutrіshnya rate pributku tsogo project becomes d = 25.4%, and oskіlki Tsey pokaznik vischy for serednorinkovu dohіdnostі rate (25%), the rozglyanuty eg іnvestuvannya mozhna viznati priynyatnim. Yakscho pіdpriєmstvo Got kіlka proektіv then neobhіdno rozrahuvati vnutrіshnyu pributku rate for dermal s them i s vibrato project nayvischim th values.

Zauvazhimo scho tochnіst obchislen for rozglyanutim by deposits od dovzhini іntervalu (y1, u2). Shcho Mensch іnterval then tochnіshim bude values th and naybіlsha tochnіst dosyagaєtsya in razі mіnіmalnogo іntervalu, tobto if y1 i y2- nayblizhchі tablichnі koefіtsієnti diskontuvannya for yakih values zmіnyuє ISI mark on protilezhny. Utіm, rozrahunki uniquely sproschuyutsya for zastosuvannya spetsіalіzovanogo fіnansovogo calculator.

Analіz perіodu okupnostі іnvestitsіy. Perіod okupnostі іnvestitsіy - Tse hour uprodovzh yakogo penny potіk, obsession іnvestorom in protsesі ekspluatatsії project zrіvnyaєtsya іz sumoyu іnvestitsії (vimіryuєtsya in Rokach that mіsyatsyah). Method viznachennya perіodu okupnostі - one s nayposhirenіshih in svіtovіy praktitsі that dosit simply zasobіv z'yasuvannya dotsіlnostі Venue of іnvestitsіynoї operatsії. In klasichnomu varіantі Tsey method does not peredbachaє vporyadkuvannya penny nadhodzhen hour at aspektі, tobto tehnіka diskontuvannya not zastosovuєtsya. W kіlkoh proektіv privablivіshim viznaєtsya one yaky Got korotshy perіod okupnostі.

Algorithm rozrahunku perіodu okupnostі deposits od rіvnomіrnostі nadhodzhennya potokіv penny. Yakscho penny potіk Je stabіlnim uprodovzh perіodu ekspluatatsії project, the perіod okupnostі viznachaєtsya dіlennyam sumi іnvestitsії on rіchny obsyag trumpery flow (drіb okruglyuyut in bіk zbіlshennya to nayblizhchogo tsіlogo).

Napriklad, Yakscho scrip іnvestitsії becoming 670 tis. UAH, and schorіchnі groshovі flows - 175 tis. UAH, the termіn okupnostі project stanovitime mayzhe Rocky 4 (670: 175 = 3.83). Yakscho revenues od project rozpodіleno for rokami nerіvnomіrno then perіod okupnostі obchislyuyut directly rozrahunkom kіlkostі rokіv, uprodovzh the bag yakih bude іnvestitsіy extinguished vіdpovіdnimi nadhodzhennyami.

Taqiy sproscheny pіdhіd to viznachennya dotsіlnostі іnvestuvannya priynyatny of minds Neznachny tempіv іnflyatsії (2-5%) i vіdpovіdno nevisokih serednіh dohіdnostі rates. To obsession tochnіshih rezultatіv and takozh for quiet rinkіv, de rate dohіdnostі dosit visokі and otzhe suttєvo vplivayut vartіst hours on pennies, at protsesі viznachennya that analіzu perіodu okupnostі іnvestitsіy rekomenduєtsya vrahovuvati aspect hours. In this razі for rozrahunku not take nomіnalnі and diskontovanі groshovі flows scho zbіlshuє perіod okupnostі project.

So, perіod okupnostі project guidance from prikladі 1 rozrahovany for Perche varіantom (without zastosuvannya tehnіki diskontuvannya), becoming 2 Rocky oskіlki іnvestitsії the bag 750 tis. UAH bude Turn іnvestoru for rakhunok penny potokіv scho nadіydut uprodovzh dvoh rokіv (350 + 400 = 750). For rozrahunkami іz urahuvannyam diskontovanih penny potokіv perіod okupnostі project zbіlshitsya rokіv to 3 (280 + 256 + 215.25 = 751.25).

Viznachennya dotsіlnostі іnvestitsіy method for perіodu okupnostі Got pevnі nedolіki, zokrema those scho Income ostannіh perіodіv in rozrahunkah not vrahovuyutsya and otzhe, Povny efektivnіst project proanalіzuvati nemozhlivo. Primіrom, іz dvoh іnvestitsіynih proektіv s odnakovimi perіodami okupnostі one Mauger funktsіonuvati th generuvati groshovі flows slit trivaly hour pіslya zakіnchennya perіodu okupnostі, and іnshogo s CIM perіodom zbіgaєtsya i boundary lines ekspluatatsії. Zrozumіlo scho perevagu slіd vіddati Persha directly іnvestuvannya, ale for kriterієm okupnostі projects will viznanі rіvnotsіnnimi.

Krіm of Tsey method does not daє zmogi viyaviti vіdmіnnostі mіzh projects SSMSC toil odnakovі perіodi okupnostі, ale vіdrіznyayutsya the magnitude schorіchnih nadhodzhen, Hoch obviously scho s dvoh proektіv s odnakovimi perіodami okupnostі privablivіshim bude one of Yakima groshovі flows Pershi Rocky ekspluatatsії vischі .

Vodnochase іsnuє kіlka situatsіy, if zastosuvannya tsogo method slіd viznati dotsіlnim. Skazhіmo for kreditorіv (bankіv) perіod okupnostі іnvestitsіynogo project Je orієntirom for viznachennya trivalostі perіodu kredituvannya and mozhlivіst podalshoї ekspluatatsії ob'єkta for them not Got value. In Galuzo, SSMSC harakterizuyutsya temple ymovіrnіstyu dosit Shvidky tehnologіchnih for Change i priskorenogo moral instal lment obladnannya, primіrom, at the Branch komp'yuternoї tehnіki, analіz perіodu okupnostі Je naypriynyatnіshim kriterієm. Over the minds temple riziku kerіvnitstvo pіdpriєmstva Mauger make it a rule rozglyadati tіlki Ti projects perіod okupnostі yakih not perevischuє advance vstanovlenogo the norm. In this method razі viznachennya perіodu okupnostі bude kriterієm poperednogo vіdboru proektіv.

Comments

Commenting, keep in mind that the content and the tone of your messages can hurt the feelings of real people, show respect and tolerance to his interlocutors, even if you do not share their opinion, your behavior in terms of freedom of speech and anonymity offered by the Internet, is changing not only virtual, but real world. All comments are hidden from the index, spam control.