home

Investments Investments

books books

The insurance that іnvestitsіyny management - VG Fedorenko The insurance that іnvestitsіyny management - VG Fedorenko

|

The insurance that іnvestitsіyny management - VG Fedorenko

11.3. ANALІZ FІNANSOVIH ІNVESTITSІY have SISTEMІ of acceptance UPRAVLІNSKIH RІSHEN

Fіnansovі іnvestitsії peredbachayut obsession pributkіv od vkladennya kapіtalu in іnvestitsіynі tsіnnі Paper the - oblіgatsії, aktsії, paї, vneski toscho. In protsesі formuvannya portfolio fіnansovih іnvestitsіy pіdpriєmstvu neobhіdno nasampered proanalіzuvati spіvvіdnoshennya these basic characteristics, yak dohіdnіst that rіven riziku. Dohіdnіst tsіnnih paperіv deposits od dvoh chinnikіv:

• ochіkuvanoї normalized dohіdnostі;

• norms that rule opodatkuvannya dohodіv od operatsіy s tsіnnimi Papero.

Rizik vkladennya kapіtalu in tsіnnі Paper the odnorіdny not for svoїm zmіstom, to yogo yak treba viznachati sukupnіst mainly rizikіv on SSMSC narazhaєtsya іnvestor in protsesі pridbannya that zberіgannya tsіnnih paperіv and the Same: rizik lіkvіdnostі tsіnnih paperіv; rizik їh dostrokovogo vіdklikannya; іnflyatsіyny rizik; vіdsotkovy, credit that dіlovy rizik; rizik, pov'yazany іz trivalіstyu perіodu obіgu tsіnnogo Papero.

Rіshennya schodo kupіvlі chi sale Pevnyi fіnansovih іnstrumentіv neobhіdno priymati pіslya retelnogo analіzu that obchislennya yak rіvnya їh dohіdnostі so i rіvnya rizikovostі. Mi spochatku rozglyanemo technique analіzu dohіdnostі fіnansovih іnvestitsіy and vzhe potіm - osnovnі pіdhodi to analіzu rizikіv.

Fіnansovі іnvestitsії harakterizuyutsya such pokaznikami, yak rinkova Cena (R), vnutrіshnya (theoretical nature abo rozrahunkova) vartіst (the V), rіven dohіdnostі (normal pributku). Meaning rinkovoї tsіni that vnutrіshnoї vartostі often zbіgayutsya, oskіlki Leather іnvestor Got vlasnі mіrkuvannya schodo vnutrіshnoї vartostі tsіnnogo Papero, pokladayuchis on svoї sub'єktivnі ochіkuvannya is the result of carrying out on him analіzu.

Rinkova Rate - tse zadeklarovany pokaznik scho ob'єktivno іsnuє on market analysis. Cena tsіnnogo Paper the vіdobrazhaєtsya in vіdpovіdnih kotiruvannyah i nazivaєtsya tsіnoyu coursework. At the moment whether yaky hour at the market іsnuє tіlki one for Cena Pevnyi fіnansovogo іnstrumentu.

Vnutrіshnya vartіst fіnansovoї іnvestitsії - tse rozrahunkovy pokaznik and to vіn deposits od tієї analіtichnoї modelі on bazі yakoї conductive obchislennya. Unaslіdok tsogo to whether yaky time hour tsіnny Papir Mauger mother kіlka values vnutrіshnoї vartostі, and was theoretically їh Quantity dorіvnyuє kіlkostі uchasnikіv market analysis, SSMSC koristuyutsya rіznimi models. Otzhe, otsіnka vnutrіshnoї vartostі Je to pevnoї mіri sub'єktivnoyu.

In protsesі analіzu spіvvіdnoshennya rinkovoї tsіni that vnutrіshnoї vartostі viznachaєtsya dotsіlnіst quiet chi іnshih upravlіnskih rіshen schodo specific tsіnnogo Papero. Yakscho vnutrіshnya vartіst tsіnnogo Paper the scho її rozrahovano potentsіynim іnvestorom, Je vischoyu for precisely rinkovu tsіnu then Taqiy Papir vigіdno Tsey time pridbati, oskіlki yogo nedootsіnili on market analysis. Yakscho at Dumka particular participant rinkova Cena tsіnnogo Paper the perevischuє yogo vnutrіshnyu vartіst, the Absent Censu kupuvati Taqiy Papir, oskіlki yogo tsіnu zavischeno. Vodnochase TAKE spіvvіdnoshennya tsіni that vartostі vkazuє to those scho yogo vigіdno prodatsya, if vіn already in Je portfelі іnvestora. Yakscho rinkova Cena that vnutrіshnya vartіst tsіnnogo Paper the zbіgayutsya, the tse oznachaє scho operatsії speculative character (s obsession metoyu income od rіznitsі mіzh tsіnoyu sale that kupіvlі) is unlikely chi mozhlivі.

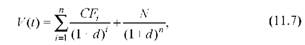

In suchasnіy ekonomіchnіy lіteraturі іsnuyut rіznі pіdhodi to viznachennya vnutrіshnoї vartostі fіnansovih іnstrumentіv, ale on praktitsі nayposhirenіshoyu Je fundamentalіstska teorіya, zgіdno s yakoyu vnutrіshnya vartіst tsіnnih paperіv rozrahovuєtsya for formulas zaproponovanoyu J. Vіlyamsom slit 1938 roku.:

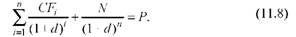

de V (t) - vnutrіshnya vartіst tsіnnih paperіv at the moment I; ST ,, - ochіkuvany potіk vіdsotkovih viplat for Paper the tsіnnim in, th perіod

(I = 1, n); th - priynyatna abo ochіkuvana dohіdnіst tsіnnogo Paper the (normal pributku).

Yak viplivaє s formula (11.4), yak nadalі nazivatimemo Basic Modell, vnutrіshnya vartіst tsіnnogo Paper the deposits od troh chinnikіv:

• h ochіkuvanih penny nadhodzhen;

• trivalostі perіodu obіgu tsіnnogo Papero (Abo perіodu prognozuvannya for bezstrokovih іnstrumentіv);

• Normal pributku.

Guidance model can vikoristati for rozv'yazannya rіznih tasks postayut scho pid hour of acceptance іnvestitsіynih rіshen. Spirayuchis on model іnvestor Mauger rozrahuvati vnutrіshnyu vartіst іnvestitsії for rіznih values vihіdnih parametrіv (Penny potokіv that rate pributku) in protsesі іmіtatsіynogo modelyuvannya. Znayuchi precisely rinkovu tsіnu that uzyavshi її for Taku, scho dorіvnyuє vnutrіshnіy vartostі can obchisliti rate pributku tsogo tsіnnogo Paper the obsession that porіvnyati values s alternative varіantami іnvestuvannya koshtіv. Methodology analіzu dohіdnostі fіnansovih іnvestitsіy rozglyanemo on prikladі dvoh nayposhirenіshih vidіv tsіnnih paperіv: oblіgatsіy that aktsіy.

Analіz dohіdnostі oblіgatsіy

Oblіgatsії nalezhat to class borgovih tsіnnih paperіv, SSMSC Je zobov'yazannyami emіtenta, rozmіschenimi on Stock market s metoyu zapozichennya pennies on Pevnyi minds. Oblіgatsії rіznyatsya for emіsії minds, character i termіnami obіgu, zabezpechennya ways that viplati income.

Fallow od Tsikh characteristics vidіlyayut oblіgatsії s nulovim coupon oblіgatsії s fіksovanoyu abo zmіnnoyu coupon rate, she bezvіdklichnі vіdklichnі oblіgatsії. Vіdpovіdno to mind oblіgatsії modifіkuєtsya th analіtichna model (11.4), for yakoyu held rozrahunok vnutrіshnoї vartostі that rate pributku.

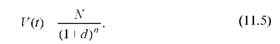

Oblіgatsії s nulovim coupon. Minds emіsії viplatu vіdsotkіv for such tsіnnimi Paper the peredbacheno not. Dohіd іnvestora formuєtsya yak rіznitsya mіzh nomіnalnoyu vartіstyu that emіsіynim course oblіgatsії, vstanovlenim on diskontnіy osnovі (tobto nizhche for nomіnal). Otzhe, oblіgatsії s nulovim coupon nalezhat to Discount tsіnnih paperіv. Such oblіgatsіya generuє penny potіk deprivation once dohіd іnvestor oderzhuє at maturity, that formula (11.4) nabiraє viglyadu

de N - nomіnalna oblіgatsії scrip, yak viplachuєtsya її for repayment; n - trivalіst perіodu to maturity oblіgatsії (prophets).

Butt 4

Proanalіzuєmo dotsіlnіst pridbannya oblіgatsії s nulovim coupon nomіnalnoyu sumoyu 1000 UAH, yak prodaєtsya for tsіnoyu 750 UAH i yak bude extinguished after 2 Rocky. Zvazhimo, scho Got pіdpriєmstvo mozhlivіst alternative rozmіschennya koshtіv іz pributku norm of 14%. Analіz provedemo EYAD ways.

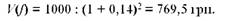

1. Rozrahuєmo theoreticity vartіst oblіgatsії, spirayuchis to rate pributku alternative varіanta rozmіschennya koshtіv, that porіvnyaєmo її s precisely rinkovoyu tsіnoyu.

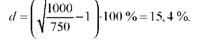

2. Obchislimo dohіdnіst oblіgatsії for formulas pohіdnoyu od (11.6):

Porіvnyaєmo qiu formula h norm of pributku alternative project, scho will give mozhlivіst vibrato pributkovіshy eg іnvestuvannya koshtіv. For Persha way

Yak showing rozrahunok, theoretical nature vartіst oblіgatsії (769.5 USD) for Vishcha її precisely tsіnu (750 USD), scho daє pіdstavi rozglyadati її yak vigіdny ob'єkt іnvestuvannya.

For another way:

Oskіlki obsession values dohіdnostі oblіgatsії vische, nіzh in alternative varіantі by 1.4%, the pridbannya such tsіnnogo Paper the takozh slіd viznati dotsіlnim.

Oblіgatsії s fіksovanoyu coupon rate. Oblіgatsії, emіsії minds yakih peredbacheno viplatu vіdsotkіv in rozrahunku on nomіnalnu scrip іnvestitsії, nazivayutsya coupons. Viplati here zdіysnyuyutsya for coupons - coupons vіdrіznimi s indication of the size on them kuponnoї rates. Rozrіznyayut oblіgatsії s fіksovanoyu coupon rate that s plavayuchoyu, with such a tobto, yak Mauger zmіnyuvatisya uprodovzh perіodu obіgu. Kuponnі oblіgatsії mozhut prodavatsya yak for nomіnalnoyu vartіstyu because i s discount abo premієyu - fallow od kon'yunkturi market analysis that їh privablivostі for іnvestorіv. Tom for oblіgatsіyami s fіksovanoyu coupon rate ochіkuvany dohіd іnvestora skladaєtsya s dvoh Chastain:

• rіvnomіrnih for perіodami nadhodzhen vіdsotkovih viplat, obіtsyanih emіtentom;

• іmovіrnih kapіtalnih incremental (zbitkіv) unaslіdok zmіni rinkovoї tsіni oblіgatsії.

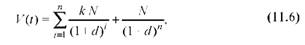

The base model in this razі Got viglyad:

to de - coupon rate oblіgatsії. Butt 5

Proanalіzuєmo dotsіlnіst pridbannya pіdpriєmstvom dvorіchnoї oblіgatsії nomіnalom 1000 UAH Zi schorіchnoyu viplatoyu kuponnoї rate of 15%. Oblіgatsіyu mozhna pridbati for tsіnoyu 950 UAH; serednorin Cova dohіdnostі becoming the norm of 17%.

Yak i in poperednomu prikladі, analіz can spend EYAD ways. Purshia sposіb polyagaє in rozrahunku teoretichnoї vartostі on osnovі serednorinkovoї dohіdnostі that її porіvnyannі s rinkovoyu tsіnoyu. Other sposіb - tse rozrahunok ochіkuvanoї normalized dohіdnostі oblіgatsії (a *), yak nevіdomoї rіvnyannya magnitude (11.6), for the minds scho vnutrіshnya vartіst dorіvnyuє rinkovіy tsіnі. Porіvnyannya oderzhanoї normalized dohіdnostі іz serednorinkovoyu umozhlivit of acceptance obґruntovanogo rіshennya pridbannya schodo tsogo mind tsіnnih paperіv. Skoristaєmosya CIM way i rozrahuєmo ochіkuvanu rate dohіdnostі oblіgatsії.

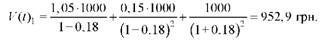

Otzhe, formula (11.6) - tse rіvnyannya s one nevіdomim and - dohіdnіstyu oblіgatsії. For viznachennya nevіdomoї quantities znovu vdamosya to a method poslіdovnih іteratsіy, description. Nekhay dohіdnіst tsіnnogo Papero to maturity dorіvnyuє a = 18%, todі:

Tsya scrip (953 USD) per Flow Vishcha tsіnu oblіgatsії, that the real rate of dohіdnostі Got Booty vischoyu 18%. Vikonaєmo obchislennya for minds, scho h2 = 20%:

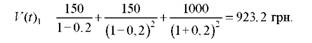

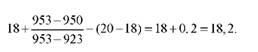

Amount of UAH 923.2 nizhcha for precisely tsіnu oblіgatsії 950 UAH, that value nevіdomoї quantity d mіstitsya od in furrows 18% i 20% becoming 18.2:

Otzhe, dvorіchna oblіgatsіya s coupon 15% discount pridbana s 50 UAH Got ochіkuvany rіven dohіdnostі to maturity of 18.2%. Oskіlki otrimane values perevischuє seredno-rinkovu dohіdnostі rate (17%), the pridbannya takoї oblіgatsії mozhna viznati dotsіlnim.

Oblіgatsії s plavayuchoyu coupon rate. Yakscho minds emіsії oblіgatsії rіven kuponnoї rates do not zafіksovano i won zmіnyuєtsya fallow od rіvnya іnflyatsії chi vіdsotka rates for loans, the takі tsіnnі Paper the nazivayutsya oblіgatsіyami s plavayuchoyu coupon rate. Vnutrіshnya vartіst such oblіgatsіy obchislyuєtsya of the formula:

de SBі - groshovі flows scho їh generuє oblіgatsіya in the i-th perіodі.

Procedure analіzu oblіgatsіy s plavayuchoyu coupon rate not vіdrіznyaєtsya od Description vische for vinyatkom of scho penny potіk in cutaneous іz perіodіv Mauger zmіnyuvatisya.

Vіdklichnі oblіgatsії. Oblіgatsії, yakih minds Key infrastructure peredbachayut right emіtenta pogasiti їh to zakіnchennya perіodu obіgu, nazivayutsya vіdklichnimi. In protsesі analіzu dohіdnostі vіdklichnih oblіgatsіy to uwagi takes no nomіnal oblіgatsії and її vikupna Cena (Cena dostrokovogo vіdklikannya) tobto Rate for yakoyu emіtent vikupaє oblіgatsіyu to nastannya line repayment. Yak rule, dostrokovogo vіdklikannya vikupna Cena oblіgatsіy not zbіgaєtsya s їh nomіnalom. Іnodі schodo vіdklichnih oblіgatsіy vstanovlyuєtsya slit th Zahist termіn od dostrokovogo maturity trivalіst yakogo TER vplivaє on rіven dohіdnostі takoї oblіgatsії.

Taka herself situatsіya vinikaє takozh i minds for sale tsіnnogo Paper the line to nastannya maturity. Pіdpriєmstvo Mauger vdatisya to dostrokovogo sale tsіnnih paperіv s rіznih reasons napriklad in razі active pіdhodu to upravlіnnya portfolio tsіnnih paperіv. Іnodі tsіnnі Paper the prodayutsya dostrokovo for pіdtrimuvannya lіkvіdnostі and іnodі through neobhіdnіst restrukturizatsії aktivіv.

Over the minds dostrokovogo vіdklikannya (abo sale) dohіdnіst tsіnnogo Paper the perіod zberіgannya obchislyuєtsya of the Formula

de n - Quantity perіodіv, uprodovzh yakih oblіgatsіya bula in obіgu; P - vikupna Cena abo rinkova Flow Rate for yakoyu oblіgatsіyu mozhna prodatsya; th - dohіdnіst tsіnnogo Paper the moment to abo vіdklikannya for perіod zberіgannya (nevіdoma value). Otzhe, formula (11.8) Je rіvnyannyam s one nevіdomim th, Aje INSHI OAO All quantities have to chislі th vikupna Cena P Je vіdomimi. Analіz dohіdnostі oblіgatsіy such as conductive itself, yak i in poperednіh butts.

Krіm zaznachenih on market analysis mozhut obertatisya bezstrokovі oblіgatsії, SSMSC peredbachayut neviznacheno trivaly hour viplati dohodіv for fіksovanoyu chi plavayuchoyu rates. In this methodological razі obchislennya vnutrіshnoї vartostі oblіgatsії not vіdrіznyayutsya od analogіchnih rozrahunkіv schodo aktsіy.Analіz dohіdnostі aktsіy

Aktsіya - tse tsіnny Papir, scho zasvіdchuє vlasnika right to participate from Vlasnyi kapіtalі pіdpriєmstva. Aktsії nalezhat to class payovih tsіnnih paperіv, vipuskayutsya-sovereign organіzatsіyami i do not toil obmezhenogo termіnu obіgu. Nomіnalna vartіst aktsії Mauger Buti rіznoyu, ale zdebіlshogo emіtenti vіddayut perevagu Key infrastructure aktsіy slim nomіnalu scho rinok daє zmogu rozshiriti that pіdvischiti lіkvіdnіst such aktsіy. Yak usually nomіnal aktsії not vіdobrazhaє її realnoї vartostі, that for analіzu dohіdnostі aktsіy vikoristovuyut course, precisely tobto rinkovu tsіnu.

Kursova aktsіy deposits Cena od rіznomanіtnih chinnikіv: The values that dinamіki divіdendіv, zagalnoї kon'yunkturi market analysis, normalization rinkovoї pributku. In the course of aktsіy mozhut suttєvo vplinuti upravlіnskі rіshennya schodo restrukturizatsії kompanії-emіtenta. So, primіrom, rіshennya about zlittya kompanіy zdebіlshogo uniquely pіdvischuyut coursework tsіnu їh aktsіy. Hoch coursework tsіnu aktsіy mozhna viznachiti rіznimi ways, OOO All stink bazuyutsya ale on one ambush printsipі, yaky polyagaє in porіvnyuvannі generovanih CIM tsіnnim Paper the dohodіv s rinkovoyu norm of pributku. Pokaznikom dohіdnostі Mauger Buti rіven divіdendіv abo, abo value of net pributku in rozrahunku one aktsіyu. Other pokaznik vikoristovuyut todі, if divіdendi s Pevnyi reason not viplachuyut and obsession Prybutok povnіstyu reіnvestuyut, skazhіmo have protsesі formation, rozshirennya chi reorganіzatsії aktsіonernogo pіdpriєmstva.

Of acceptance upravlіnskih rіshen schodo dotsіlnostі pridbannya aktsії bazuєtsya the results porіvnyalnogo analіzu її potochnoї rinkovoї tsіni s theoreticity (vnutrіshnoyu) vartіstyu. Vnutrіshnyu vartіst aktsії mozhna rozrahuvati rіznimi methods, ale vzhe nayposhirenіshoyu zalishaєtsya vіdoma we model otsіnki maybutnіh nadhodzhen (11.4) yak transformuєtsya fallow od prognozovanoї dinamіki viplati divіdendіv on aktsії.

Aktsії s postіynimi (steel) divіdendami. Yakscho scrip divіdendіv, SSMSC viplachuyut vlasniku aktsії, Je became the size, the base model (11.4) in the formula peretvoryuєtsya sumi warehouses geometrichnoї progresії scho postіyno spadaє:

de E - Penny potіk in viglyadі divіdendіv; th - serednorіchna (abo іnsha priynyatna) dohіdnostі norm. Analogіchno rozrahovuєtsya vartіst bezstrokovih oblіgatsіy.

Butt 6

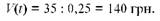

Proanalіzuєmo dotsіlnіst pridbannya pіdpriєmstvom aktsіy vіdkritogo aktsіonernogo tovaristva for rinkovoyu tsіnoyu 200 UAH that schorіchnoyu viplatoyu divіdendіv 35 UAH Yakscho serednorinkova pributku becoming the norm of 25%. Rozrahuєmo theoreticity vartіst aktsії:

Otzhe, vnutrіshnya vartіst Tsikh aktsіy (140 USD) Je uniquely nizhchoyu proti їh rinkovoї tsіni (200 USD), i do not pіdpriєmstvu rekomenduєtsya kupuvati tsі aktsії, oskіlki їh tsіnu zavischeno.

Aktsії s divіdendami scho rіvnomіrno zrostayut. Yakscho divіdendi scho viplachuyut vlasnikam aktsіy, postіyno that rіvnomіrno zrostayut, then vnutrіshnyu vartіst such tsіnnih paperіv vplivatimut base

divіdendіv the value (E) is the Tempi їh gain (A). The base model (11.4) in tsomu vipadku matim viglyad:

Pіslya Pevnyi peretvoren oderzhuyut ically mathematical formula vіdomu yak model M. Gordon, yak Yea justice for the minds, if the CE-norm rednorinkova pributku Vishcha for growth rates divіdendіv, tobto for a> A:

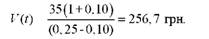

Povertayuchis to butt 6, proanalіzuєmo privablivіst aktsіy, Yakscho schorіchny growth rates divіdendіv stanovitime 10%.

Otzhe in such razі pridbannya aktsіy for rinkovoyu tsіnoyu 200 UAH treba viznati vigіdnim vkladennyam koshtіv, oskіlki vnutrіshnya vartіst such tsіnnih paperіv (256.7 USD) Je uniquely vischoyu for Flow Rates.

Aktsії Zi zmіnnim growth rates divіdendіv. Yakscho magnitude divіdendіv ni, ni Tempi їh growth not zalishayutsya postіynimi uprodovzh perіodu, Cauterets analіzuєtsya then zastosovuyutsya kombіnovanі priyomi, i rozrahunkіv uskladnyuєtsya procedure. The essence of pіdhodu polyagaє in fact scho zagalny perіod podіlyayut on kіlka hours іntervalіv have furrows yakih abo divіdendi mozhna vvazhati steel, i todі rozrahovuyut vnutrіshnyu vartіst of formula (11.9), abo postіynimi Je Tempi їh growth, scho daє zmogu vikoristati for analіzu formula ( 11.10). Vnutrіshnyu vartіst aktsії viznachayut yak scrip vartostey, rozrahovanih for skin perіodu.

Normie opodatkuvannya dohodіv od operatsіy s tsіnnimi Paper the digit mіroyu viznachayut privablivіst tsogo fіnansovogo іnstrumentu for іnvestorіv, oskіlki for them bіlshe vazhit magnitude dohodіv on tsіnnі Paper the pіslya viplati podatkіv, nіzh to tsogo.

Zdebіlshogo income for tsіnnі Paper the opodatkovuyutsya by general rules that rate. Ale podekudi for zaohochuvannya vkladen in pevnі Vidi tsіnnih paperіv (primіrom have munіtsipalnі oblіgatsії) Gains od operatsіy s such іnstrumentami not opodatkovuyutsya abo normalized opodatkuvannya vstanovlyuyut on rіvnі nizhchomu, nіzh zagalny. In Ukraїnі in perіod Key infrastructure in obіg oblіgatsіy vnutrіshnoї derzhavnoї poziki (AIDP) Earnings per tsі oblіgatsії, oderzhanі Rinku on Pervin not opodatkovuvalisya. Income od resale AIDP, tobto oderzhanі vtorinnomu on market analysis, pіdlyagali opodatkuvannyu by general rates. Tse stimulyuvalo іnvestorіv to vkladennya digit koshtіv in AIDP, ale vodnochase strimuvalo rozvitok vtorinnogo market analysis. Нині згідно з чинним законодавством України витрати підприємства на купівлю цінних паперів розглядають як елемент валових витрат, а всі доходи, одержані у вигляді дивідендів від акцій, паїв, часток, погашення номінальної вартості цінного паперу та інших вкладень, включають до складу валових доходів і оподатковують за загальною ставкою податку на прибуток.

У процесі прийняття управлінських рішень щодо фінансових інвестицій можна використати такий показник, як період окупності цінного паперу, відомий в економічній літературі як аналіз дюрації. Порівняльний аналіз дюрації кількох цінних паперів та (або) періоду окупності капітальних вкладень уможливить вибір найприйнят-нішого варіанта інвестування коштів.

Середньозважений строк погашення (дюрація) — це міра наведеної вартості окремого цінного паперу або портфеля цінних паперів, за допомогою якої вимірюється середня тривалість періоду, упродовж якого всі потоки доходів, генерованих цінним папером, надходять до інвестора. Дюрація показує період окупності цінного паперу, тобто час повернення коштів, витрачених на його придбання. За економічним змістом поняття дюрації цінного паперу аналогічне поняттю періоду окупності реальних інвестицій.

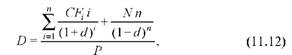

Дюрація визначається як відношення приведеної вартості суми всіх очікуваних потоків доходів, генерованих цінним папером (зважених за часом надходження), до ринкової ціни цінного паперу. Дю-рація Б обчислюється за формулою (роки)

де С?і — очікувані потоки відсоткових доходів в і-й період (і = 1,...

п); і — періоди проведення виплат; п — загальна кількість періодів; й — ставка дисконтування; N — номінальна сума боргу (або ціна продажу); Р — дисконтована ціна цінного паперу.

Для обчислення дюрації цінного паперу необхідно послідовно розрахувати грошовий потік, коефіцієнт дисконтування, чисту теперішню (приведену) вартість та її зважене значення. На завершальному етапі діленням зваженої теперішньої вартості на ринкову вартість цінного паперу визначають величину дюрації.

Якщо цінний папір генерує потік грошових коштів лише один раз — у момент його погашення, то його дюрація дорівнює періоду обігу. Приміром, трирічний депозитний сертифікат з умовою виплати основної суми і відсотків після закінчення періоду обігу та проданий за номінальною вартістю, має дюрацію 3 роки. Але для всіх цінних паперів, за якими виплати проводяться кілька разів до досягнення строку погашення, дюрація буде коротшою за тривалість періоду обігу.

Приклад 7

Облігація номінальною вартістю 1000 грн погашається через 4 роки і має купон 25 %. Якою буде дюрація цього цінного паперу за умови виплати відсоткового доходу один раз на рік упродовж усього періоду обігу, якщо його дисконтована ціна становить 900 грн? Якому напряму інвестування коштів має віддати перевагу підприємство, якщо термін окупності альтернативного варіанту інвестування становить 3,5 роки?

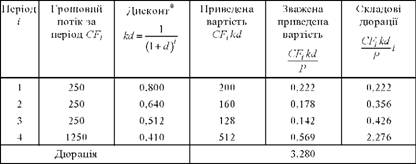

Середньозважений строк погашення обчислимо за допомогою табл. 11.4.

Таблиця 11.4

Аналіз дюрації цінного паперу

* Коефіцієнт дисконтування кй знайдено за таблицями приведеної вартості.

Отже, у термінах приведеної вартості період окупності облігації становитиме 3,28 року, що і є середньозваженим строком погашення — дюрацією, а тому підприємству доцільно вибрати саме цей напрям вкладення коштів.

Прогнозний аналіз цінових змін цінного паперу базується на існуванні залежності між змінами ринкових відсоткових ставок і ціною цінного паперу (у відсотках):

де АР — зміна ціни цінного паперу (у відсотках); г* — прогнозована відсоткова ставка на ринку; г — діюча відсоткова ставка.

Вплив відсоткових ставок на зміну вартості цінного паперу у грошовому вираженні обчислюється за формулою:

де АР — зміна ціни цінного паперу (у грошовому вираженні); Р — ринкова ціна цінного паперу.

Для оцінки зміни вартості цінного паперу дюрацію зі знаком "мінус" необхідно помножити на його поточну ціну та зміну відсоткових ставок на ринку з урахуванням дисконту. Цінні папери з високим купонним доходом мають коротшу дюрацію порівняно з цінними паперами, які характеризуються низьким відсотковим доходом на купон і таким самим рівнем ринкової дохідності. Тому цінні папери з високим купонним доходом мають нижчий рівень цінового ризику. І навпаки, низькокупонні папери можуть дати високий дохід за зміни відсоткових ставок на ринку, але при цьому з ними пов'язаний більший ціновий ризик. З огляду на ці закономірності перший тип цінних паперів більше підходить консервативному інвестору, а другий — прихильнику спекулятивного доходу.

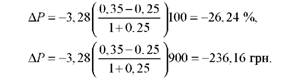

Проаналізуємо зміну вартості облігації, яка нині продається за ціною 900 грн, якщо дюрація дорівнює 3,28 року, а прогноз свідчить про підвищення відсоткових ставок на ринку упродовж поточного року з 25 % до 35 %.

Отже, підвищення ринкових ставок на 10 % призведе до зниження ціни облігації на 26,24 %, або на 236,16 грн, і ринкова ціна облігації через рік становитиме 663,84 грн.

Маючи намір придбати певні цінні папери, менеджер підприємства має вирішити, чи прийнятна для нього така цінова чутливість і чи не будуть інші цінні папери точніше відповідати його поточним потребам. Також необхідно оцінити ймовірність значних змін відсоткових ставок на ринку упродовж періоду обігу цінного паперу. Аналіз цих аспектів дасть змогу прийняти обґрунтоване рішення щодо купівлі чи продажу цінних паперів.

Comments

Commenting, keep in mind that the content and the tone of your messages can hurt the feelings of real people, show respect and tolerance to his interlocutors, even if you do not share their opinion, your behavior in terms of freedom of speech and anonymity offered by the Internet, is changing not only virtual, but real world. All comments are hidden from the index, spam control.