home

Finance Finance

Books Books

Finance and Statistics - Ковалева А.М. Finance and Statistics - Ковалева А.М.

|

Finance and Statistics - Ковалева А.М.

3.3 CHARACTERISTICS OF SELECTED STANDARDS OF GOVERNMENT SECURITIES

The unsuccessful experience of Russia in the use of government securities as the main source of covering the budget deficit does not detract from the merits of this financial instrument. The point is the correct organization of the placement of state loans among legal entities and individuals.

The rich experience in organizing the issuance and circulation of government securities in the economically developed countries of the world indicates that the success of their placement is associated with absolute reliability and high liquidity, benefits. So, in many countries, income on government securities is either exempt from taxation or taxed at preferential rates. In addition, government securities are preferred as collateral in obtaining a loan. They can be sold at any time and thus quickly converted into money, and the variety of species in terms of time, yield, placement and repayment mechanisms enables investors to form their portfolio in accordance with the chosen investment policy.

In this regard, it is advisable to consider in more detail the characteristics of certain types of government securities, the procedure for their issuance and circulation.

Government short-term bonds

General principles of the functioning of the Russian GKO market were developed within the framework of the Russian-American Banking Forum.

GKO - a nominal zero-coupon (discount) government security, is issued in a non-documentary form. The issue is issued by a global certificate held by the Bank of Russia. The right to own T-bills is taken into account in the depository or sub-custodians. The issuer is the RF Ministry of Finance, the general agent for servicing the issue of T-bills is the Bank of Russia.

Creation and maintenance of the technological part of the GKO -trade, settlement and depository systems market was entrusted to the Moscow Interbank Currency Exchange (MICEX). Along with the MICEX, the Novosibirsk Interbank Currency Exchange and the St. Petersburg Currency Exchange joined the all-Russian trade network for T-bills.

Participants in the GKO market were divided into two categories: dealers and investors. Dealers could only be investment institutions and banks that concluded an agreement with the Bank of Russia to perform the functions of servicing operations with GKOs. Their number is limited. The Dealer made transactions on his own behalf and at his own expense, and could perform the functions of a financial broker when making deals on his own behalf, at the expense and on behalf of investors. Investors are understood to mean any legal and natural persons acquiring bonds and having the right to own them.

The methodology for calculating the yield of T-bills was developed by the Securities Department of the Central Bank of Russia.

Government short-term bonds represented a discounted security, which was placed at auctions and traded at the secondary market at a discount (at a price below par). The bonds were redeemed at their nominal value, and the difference between the redemption price (nominal value) and the acquisition price at the auction or secondary trades represented the investor's income.

Of great importance was the fact that investors' income received from operations with GKO was exempted from taxes until 1997, later this income became taxable at a rate of 15%.

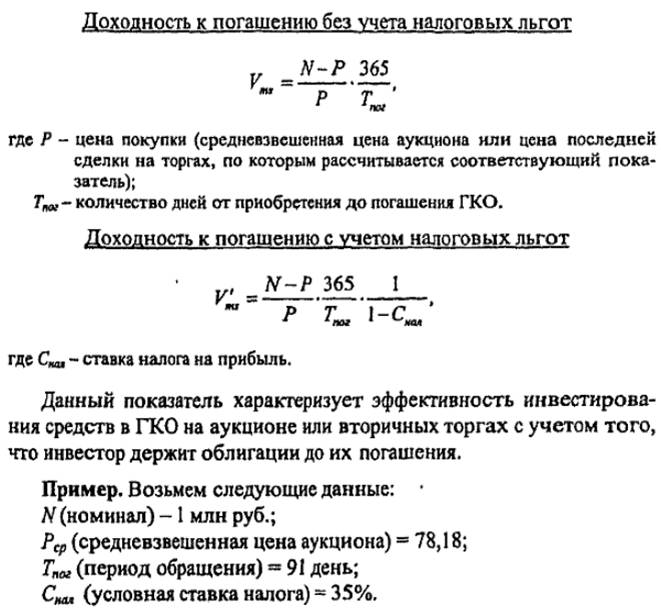

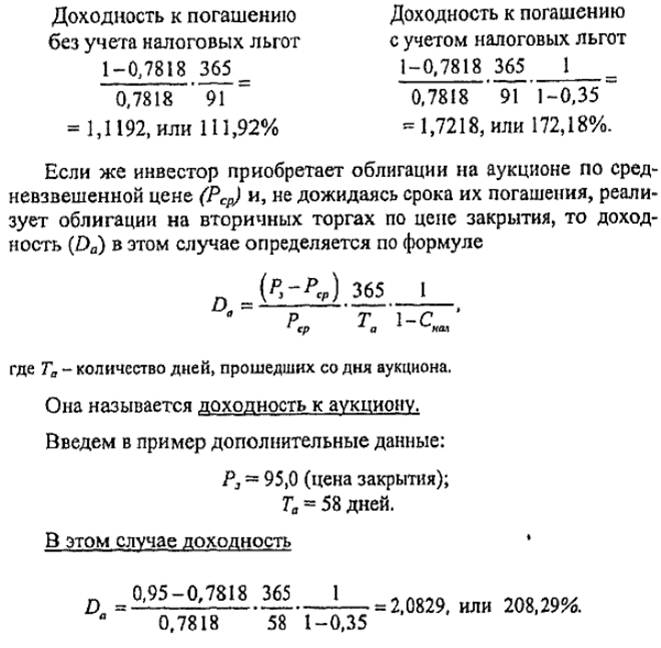

When calculating the yield, the following parameters were taken into account: purchase price (rate), maturity, tax benefits.

The official methodology for calculating yields was based on a simple interest formula.

Bonds of the federal loan

In June 1995, another type of government securities was introduced - federal loan bonds (OFZ). OFZ - the first medium-term securities that appeared in the Russian Federation. They were issued for a period of 1 year and two weeks (need a period of more than a year, so that the security was considered a medium-term). The issue of this security was connected with the desire of the RF Ministry of Finance to extend the terms of state borrowings, expand the range of financial instruments of state borrowing. The issuer of federal loan bonds was also made by the Ministry of Finance. The total volume of the issue was determined within the limits of the state domestic debt, established by federal legislation on the federal budget for the relevant fiscal year.

Owners of bonds could be both legal entities and individuals, residents and non-residents. The Central Bank of the Russian Federation acted as the general agent for servicing the issues of federal loan bonds.

The main parameters of the issue of OFZs largely coincide with the parameters of the state short-term bonds.

A significant difference between the federal loan bonds and the GKOs is that these securities are coupon bonds, the yield on which was paid quarterly and focused on the yield on government short-term bonds traded on the secondary market. The amount of the coupon yield was calculated separately for each period of its payment and was declared for the first coupon not later than seven days before the start date of the offering; On the following coupons, including the last, not later than seven days before the date of payment of the previous coupon yield.

The interest on the first coupon was calculated from the date of issue of the bond until the date of its payment. In the subsequent coupon periods, interest was accrued starting from the date of the previous payments until the date of the current payment. In the last coupon period, interest was accrued in a similar manner up to the maturity date of the bond.

Under the terms of the first OFZ issue, the interest rate of the coupon period was determined based on the calculation of the weighted average yield on GKO in the previous four trading sessions on the secondary market at the Moscow Interbank Currency Exchange. And in the calculation took only those issues of short-term bonds, the repayment of which occurred on a date that is in the interval of 30 days "before" and 30 days "after" the announced date of the next coupon payment,

The amount of coupon yield on one coupon of the first issue was 52.88%, the second issue - 80.65% per annum.

The significant difference in medium-term securities from short-term securities is clearly evident in the secondary market, when concluding deals with OFZ alongside with the exposed price and volume of the application there is one more parameter - the amount of accumulated income. It is calculated as part of the coupon income, proportional to the time during which the bond was held by the holder. Therefore, when concluding a deal with OFZ, the buyer must pay the seller in addition to the face value of the bond and the exchange premium, the accumulated coupon yield.

In August 1997, the Central Bank of the Russian Federation began selling federal loan bonds (OFZ bonds with a permanent coupon) with a maturity of more than four years. These bonds were issued by the Ministry of Finance of the Russian Federation during the re-registration of the Central Bank's debt. This debt was formed in 1992-1994, when the Central Bank of Russia issued loans to finance the federal budget deficit.

Comments

When commenting on, remember that the content and tone of your message can hurt the feelings of real people, show respect and tolerance to your interlocutors even if you do not share their opinion, your behavior in the conditions of freedom of expression and anonymity provided by the Internet, changes Not only virtual, but also the real world. All comments are hidden from the index, spam is controlled.