home

Finance Finance

Books Books

Finance and Statistics - Ковалева А.М. Finance and Statistics - Ковалева А.М.

|

Finance and Statistics - Ковалева А.М.

4.2 CASH FUNDS OF ENTERPRISES

The most important aspect of the financial activities of enterprises is the formation and use of various monetary funds. Through them, economic activity is ensured with the necessary funds, as well as expanded reproduction, financing of scientific and technical progress, development and introduction of new technology, economic incentives, settlements with the budget, banks.

Monetary funds of enterprises can be divided into five groups:

The first group - funds of own funds -

- authorized capital,

- Extra capital,

- Reserve capital,

- Accumulation fund,

- Targeted financing and income,

- undestributed profits,

- Other;

Second group - funds of borrowed funds -

- Loans from banks,

- Commercial loans,

- Factoring,

- Leasing,

- Creditors,

- Other;

The third group - funds attracted funds -

- Consumption funds,

- Calculations on dividends,

- revenue of the future periods,

- Reserves of future expenses and payments;

The fourth group - funds, formed from several sources, -

- Non-current assets (sources - own and borrowed),

- Current assets (sources - own funds, credit, accounts payable, attracted),

- Investment fund (sources - profit, depreciation fund, borrowed funds),

- Monetary fund (sources - own and borrowed funds),

- Other;

The fifth group - operating cash funds -

- For payment of wages,

- For payment of dividends,

- For payments to the budget,

- Other,

The FIRST GROUP of the company's monetary funds is the funds of its own funds. They play a decisive role in the activities of the enterprise, since the requirements for their volume and organization are quite unambiguous.

At the organization the enterprise should have the authorized Fund, or the authorized capital, "at the expense of which the fixed assets and circulating assets are formed. The organization of the authorized capital, its effective use, management is one of the main and most important tasks of the financial service of the enterprise. The authorized capital is the main source of the company's own funds. The amount of the authorized capital of the joint-stock company reflects the amount of shares issued by it, and the state and municipal enterprise - the amount of the statutory fund. The authorized capital is changed by the enterprise, as a rule, based on the results of its work for the year after making changes to the constituent documents.

The authorized capital of the enterprise determines the minimum amount of its property that guarantees the interests of its creditors. The minimum size is determined in accordance with the statutory minimum wage in the country.

The authorized capital is the first cash fund, reflected in section III of the liabilities of the balance of the enterprise. In this regard, the balance of the enterprise is the following:

Active Passive

I. Non-current assets III. Capital and reserves

II. Current assets IV. long term duties

V. Short-term liabilities

Balance Balance

The asset is the property of the enterprise, the passive is the money resources at the expense of which the property is formed. The property is fixed assets and intangible assets (non-current assets) and current assets (current assets of the enterprise). Cash can be own (III section of the liability) and borrowed (IV and V sections).

After the authorized capital, the monetary fund of the enterprise's own funds is additional capital, which includes:

- The results of revaluation of fixed assets, i.e. Their revaluation;

- Share premium of the joint-stock company (income from the sale of shares over and above their nominal value less costs to sell them);

- Gratuitously received monetary and material values for production purposes;

- Allocations from the budget for financing of capital investments;

- Receipts for replenishment of working capital.

Additional capital accumulates funds received by the enterprise during the year through the channels listed. The main channel here is the revaluation of fixed assets. It is quite natural to increase the authorized capital by an additional one every year. However, as noted earlier, many enterprises do not.

Reserve capital is formed at the expense of deductions from profits in the amount determined by the charter.

The accumulation fund is formed in enterprises at the expense of net profit and is intended for the development of production.

Targeted financing and revenues are mainly budget funds coming to enterprises for a specific purpose: research, training, etc. They are stored on a separate budget account and are strictly targeted.

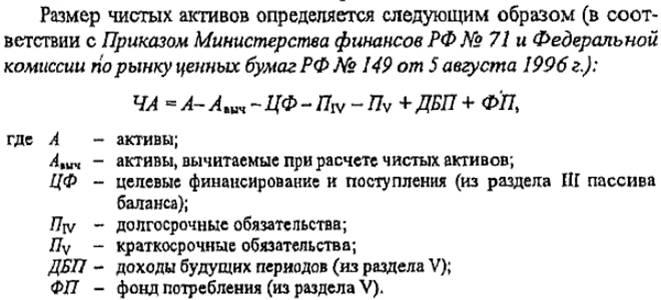

The concept of net assets is closely related to the company's own resources. In world practice they are also called share capital. The need to calculate net assets is due to the fact that some of the funds of enterprises are of a dual nature. On the one hand, they serve as their own means (for example, accrued dividends or consumption funds); On the other hand, they do not belong directly to the enterprise, but to its shareholders or employees. Net assets are real own funds at the moment.

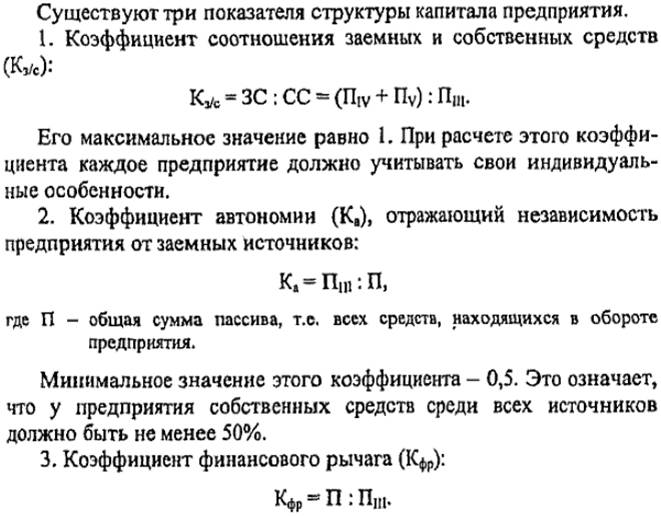

This coefficient has no minimum or maximum values, since its role is to show the effect on the profitability of equity capital structure as one of the main factors.

Thus, in order to increase efficiency, profitability, return of own funds, an enterprise must use borrowed funds not only when its own funds are not enough, but also when there are enough of them, that is, As a financial leverage.

The THIRD GROUP of the company's monetary funds is the funds of attracted funds. Such funds are of a dual nature: on the one hand, these funds are in the turnover of the enterprise, on the other - they belong to its employees (dividends and consumption fund). Confirm their duality the following facts: first, in the balance sheet of the enterprise they are in the section V of the passive, i.e. Among short-term liabilities; Secondly, in some calculations they are excluded from the obligations of the enterprise.

The consumption fund is a monetary fund formed at the expense of net profit and used to meet the material and social needs of the employees of the enterprise. When forming a consumption fund, an enterprise must take into account one very important regularity: the growth rates of the balance sheet profit should be higher than the growth rates of the consumption fund, including wages

The FOURTH GROUP of the company's monetary funds (formed from several sources) are fundamental funds, including a number of previously considered funds. Non-current and current assets are two parts of the entire property of the enterprise. Monetary funds for their formation have, apparently, different sources, which are discussed in more detail in the relevant chapters. The investment fund is formed primarily through an amortization fund and profits. At the same time, such a specific monetary fund, as depreciation, is intended for simple reproduction of fixed assets, and profits must provide extended reproduction.

The investment fund is intended for the development of production. It concentrates:

- A depreciation fund intended for simple reproduction of fixed assets;

- The accumulation fund formed at the expense of deductions from profit and intended for development of manufacture;

- Borrowed and attracted sources.

The role of this fund is obvious, the Enterprise should be able and obliged to ensure, at the expense of its own profit and other sources, a growth in working capital and financing of capital investments. This should always be taken into account by the enterprise when distributing net profit and deciding how much of it should be used to pay dividends and to develop production.

The investment fund is a source of increasing the authorized capital of the enterprise, since investments in the development of production increase the property of the enterprise.

The currency fund is formed at the enterprises receiving currency earnings from export operations and buying currency for import operations. This fund has no independent purpose. It is allocated in so far as the operations with the currency have their own characteristics. For this purpose, enterprises in commercial banks that have a license of the Central Bank of the Russian Federation to conduct currency transactions open currency accounts,

The operational monetary funds of the enterprise, forming the FIFTH GROUP of monetary funds, are created periodically.

Twice or once a month, an enterprise is formed at the enterprise to pay wages. Its basis is the wage fund. In order to ensure the timely payment of wages by businesses, a number of tasks are carried out to collect the necessary funds in the account, and, in their absence, enterprises apply to the bank for a loan for the payment of wages. It is of no less importance to determine the optimal terms for payment Wages and the number of days required for this.

Periodically, the company organizes a fund for payments to the budget of various taxes. Untimely payments to the budget of the enterprise entail penalties.

In addition to those listed at the enterprise, a number of other funds of money are being created: to repay loans from banks, to develop new equipment, research works, and deductions from a higher organization.

Comments

When commenting on, remember that the content and tone of your message can hurt the feelings of real people, show respect and tolerance to your interlocutors even if you do not share their opinion, your behavior in the conditions of freedom of expression and anonymity provided by the Internet, changes Not only virtual, but also the real world. All comments are hidden from the index, spam is controlled.