home

Finance Finance

Books Books

Finance and Statistics - Ковалева А.М. Finance and Statistics - Ковалева А.М.

|

Finance and Statistics - Ковалева А.М.

7.5 Efficiency of the use of current assets

In the system of measures aimed at increasing the efficiency of the enterprise and strengthening its financial status, an important place is occupied by the issues of rational use of current assets. The problem of improving the use of current assets became even more urgent in the conditions of the formation of market

"According to the collection of the State Statistics Committee of the Russian Federation" Social and Economic Situation of Russia ". - 1999.-№12. -C.149.

Relations. The interests of enterprises require full responsibility for the results of their production and financial activities. Since the financial position of enterprises is directly dependent on the state of circulating assets and involves the commensurability of costs with the results of economic activity and the recovery of costs by own means, enterprises are interested in the rational organization of working capital - organizing their movement with the minimum possible amount to obtain the greatest economic effect.

The efficiency of using current assets is characterized by a system of economic indicators, primarily turnover of circulating assets.

Turnover of circulating assets means the duration of one complete circulation of funds from the moment of turning working capital in cash into production stocks and until the output of finished goods and its sale. Circuit of funds is completed by transfer of proceeds to the account of the enterprise.

The turnover of circulating assets is not the same at enterprises of one or different branches of the economy, which depends on the organization of production and marketing of products, deployment of working capital and other factors. So, in heavy engineering with a long production cycle, the turnover time is the highest; Faster turnaround of working capital in the food and extractive industries.

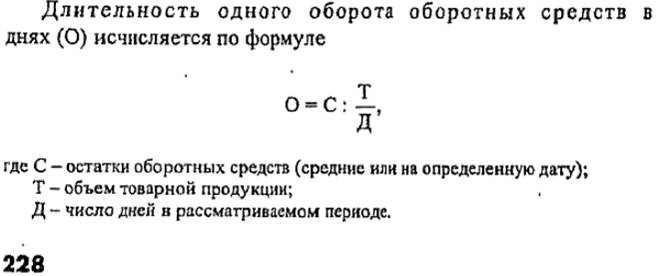

The turnover of circulating assets is characterized by a number of interrelated indicators: the duration of one turnover in days, the number of turnover for a certain period-year, half-year, quarter (turnover ratio), the amount of circulating assets employed per enterprise per unit of output (load factor).

At the same time with the growth of production, and the rate of growth in output exceeds the growth rate of working capital balances.

The efficiency of the use of current assets depends on many factors that can be divided into external factors that exert influence regardless of the interests of the enterprise, and internal, to which the enterprise can and should actively influence. External factors include such as the general economic situation, tax legislation, loan conditions and interest rates on them, the possibility of targeted financing, participation in programs financed from the budget. These and other factors determine the framework in which an enterprise can manipulate the internal factors of the rational movement of current assets.

At the present stage of economic development, the main external factors affecting the state and use of current assets include the crisis of non-payments, a high level of taxes, high rates of bank credit.

The crisis in the sale of manufactured products and non-payments lead to a slowdown in the turnover of current assets. Therefore, it is necessary to produce those products that can be sold rather quickly and profitably, stopping or significantly reducing the output of products that do not enjoy current demand. In this case, in addition to accelerating turnover, the growth of accounts receivable in the assets of the enterprise is prevented.

At the current rate of inflation, it is advisable to direct the profit received by the enterprise primarily to replenish working capital. The rate of inflationary depreciation of working capital leads to an underestimation of production costs and their flow into profits, where the working capital is dispersed for taxes and non-production expenses.

Significant reserves to improve the efficiency of the use of current assets are hidden directly in the enterprise. In the sphere of production, this applies primarily to production reserves. Being one of the components of current assets, they play an important role in ensuring the continuity of the production process. At the same time, industrial stocks represent that part of the means of production, which temporarily does not participate in the production process.

The rational organization of production stocks is an important condition for increasing the efficiency of the use of working capital. The main ways to reduce production reserves are reduced to their rational use, liquidation of excess material stocks, improvement of rationing, improvement of supply management, including by establishing clear contractual delivery conditions and ensuring their fulfillment, optimal selection of suppliers, and well-established transport operations. An important role belongs to improving the organization of storage facilities.

Reduction of the residence time of working capital in the work in process is achieved by improving the organization of production, improving the technology and technology used, improving the use of fixed assets, especially their active part, saving on all items of working capital.

Staying of circulating assets in the sphere of circulation does not contribute to the creation of a new product. Excessive distraction of them in the sphere of circulation is a negative phenomenon. The most important prerequisites for reducing the investment of current assets in this sphere are the rational organization of the sale of finished products, the use of progressive forms of settlements, the timely processing of documentation and the acceleration of its movement, compliance with contractual and payment discipline.

Acceleration of turnover of current assets allows to release significant sums and, thus, to increase the volume of production without additional financial resources, and the released means to use in accordance with the needs of the enterprise.

Control questions

1. Give a definition of working capital.

2. Expand the process of circulation of circulating assets in phases.

3. What are the functions of the current assets of enterprises?

4. Expand the principles of organization of current assets of enterprises.

5. Give a classification of working capital.

6. Show the composition and placement of working capital.

7. What is the composition and purpose of working capital?

8. What are the composition and purpose of the circulation funds?

9. Determine the role of the normalization of working capital.

10. Give the basic principles of rationing of current assets in enterprises.

11. What is the "norm" and "norm" of current assets and how are they determined?

12. Uncover the content and scope of the basic methods of rationing of working capital.

13. What is the methodology for calculating the norm and the standard of working capital in production reserves?

14. What is the role of working capital in unfinished production and how is their rationing carried out?

15. What are the principles of rationing current assets in finished products?

16. How is the aggregate working capital ratio determined?

17. Expand the meaning, the procedure for determining the increase in the standard of working capital and its reflection in the financial plan of the enterprise.

18. Identify the types and role of non-standard working capital.

19. Formulate the value of the process of formation of working capital.

20. What is the role of own working capital in the sources of their formation?

21. In what cases does the lack of own working capital arise, how is it calculated and what are the sources of its replenishment?

22. Show the role and composition of borrowed funds.

23. Disclose the meaning and content of the enterprise's accounts payable.

24. What are the methods of calculating the turnover of circulating assets and determine the value of the acceleration of their turnover.

25. What are the ways to improve the use of working capital?

Comments

Commenting on, remember that the content and tone of your message can hurt the feelings of real people, show respect and tolerance to your interlocutors even if you do not share their opinion, your behavior in the conditions of freedom of expression and anonymity provided by the Internet, changes Not only virtual, but also the real world. All comments are hidden from the index, spam is controlled.