home

Finance Finance

Books Books

Finance and Statistics - Ковалева А.М. Finance and Statistics - Ковалева А.М.

|

Finance and Statistics - Ковалева А.М.

11. FINANCIAL ANALYSIS AND FINANCIAL STRATEGY OF THE ENTERPRISE

11.1 FINANCIAL ANALYSIS AT THE ENTERPRISE

In modern conditions, the normal functioning of the enterprise regardless of the form of ownership requires a careful, system-integrated approach to financial analysis, and for the competent management of the company's finances, the development and implementation of a financial strategy.

The analysis of the financial situation (later - financial analysis) comparatively recently, only in the middle of the 20th century, separated itself into an independent branch of knowledge, earlier it was produced in the framework of economic analysis.

Brief historical background: the founder of a systematic economic analysis is Frenchman J. Savary (XVII century.), Who introduced the concepts of synthetic and analytical accounting. Around the same time in Italy, A. di Pietro promoted a methodology for comparing successive budgetary allocations with actual costs, and B. Venturi constructed and analyzed dynamic series of indicators of the economic activity of the enterprise for 10 years. The ideas of J. Savary were deepened in the XIX century. Italian accountant D. Cherboni, who created the doctrine of the synthetic addition and analytical decomposition of accounting accounts. In the late XIX - early XX centuries, a new trend in accounting - balance studies, providing for economic analysis of the balance sheet. At this time, the development of the theory of economic analysis of the balance involved I. Sher, P. Gerstner and F. Leiter. In particular, P. Gerstner introduced the concept of the analytical characteristics of the balance sheet: with regard to short- and long-term obligations, setting the upper limit of borrowed funds in the amount of 50% of the advanced capital, the relationship between the financial condition and liquidity. In Russia, the development of the science of analyzing the balance falls on the first half of the 20th century, when the Russian accountant AK, Roshakhovsky first assessed the role and significance of economic analysis and its relationship with accounting. In the 20 - 30s of the XX century. A.P. Rudanovsky, N.A. Blatov, I.R. Nikolaev finally formulated the theory of balance studies. At the same time, actively developed the science of commercial computing, which was part of the financial analysis of the enterprise.

In the conditions of planned business management, commercial calculations were not required, the analysis was essentially reduced to the control function of finance: the analysis of deviations of the actual values of the indicator from the planned ones dominated. Such an analysis is a thing of the past.

As a result, by the mid-20th century. Financial analysis in Russia was transformed into an analysis of economic activity, the theory of which was engaged by SK. Tatur, M.F. Dyachkov, M.I. Bakanov, A.D. Sheremet, I.I. Karakoz, N.V. Dembinsky.

At present, many Russian economists pay attention to the theory and practice of financial analysis, among which one wants to single out A.D. Sheremeta, V.V. Kovaleva, M.N. To Kreinin.

Summarizing the different points of view of domestic and foreign economists, we can assume that the financial analysis consists of three interrelated parts:

- The actual analysis (from the Greek "analysis") - the logical methods of determining the concept of enterprise finance, when this concept is decomposed by feature into component parts in order to make its knowledge clear in its entirety;

- Synthesis (from the Greek - "synthesis") - the connection of previously decomposed elements of the studied object into a single whole;

- Development of measures to improve the financial condition of the enterprise.

The subject of financial analysis is financial resources and their flows.

[Brockhaus FA, Efron IL Encyclopaedic dictionary / Ed. I.A. Andrievsky. - St. Petersburg, 1890. - T.2. - P.693. 2Tamzhe.-T.59.-P.52.

The main purpose of the financial analysis is to assess the financial state and identify opportunities to improve the efficiency of the enterprise.

The main task is the effective management of the company's financial resources.

Information base - annual, semi-annual or quarterly financial statements of the enterprise - the balance of the enterprise - form 1, the profit and loss account - form 2.

The subjects of the financial analysis are divided into external and internal. External financial analysis is carried out by outside organizations, usually auditing firms. On the one hand, external analysis is less detailed and more formalized, on the other - more objective and conducted by more qualified specialists. The information base of internal financial analysis is much broader, which allows you to take into account all the internal information that is not available to external analysts, but on the other hand, internal analysis is more subjective.

Currently, internal financial analysis is carried out by employees of the enterprise, often not prepared for this work.

Given the importance of financial analysis for the life of the enterprise, it is necessary in the near future to make a transition to this work by specially trained managers - financiers, to completely abandon the practice of using unskilled workers.

Methods and methods used in financial analysis can be classified:

• formalization and non-formalized methods according to the degree of formalization. Formalized methods are the main ones in conducting a financial analysis of an enterprise, they are objective in nature, they are based on strict analytical dependencies. Unformalized methods (method of peer review, comparison method) are based on a logical description of analytical techniques, they are subjective, since the result is greatly influenced by the intuition, experience and knowledge of the analyst;

* For the toolkit used - economic methods (balance sheet - construction of a comparative analytical net balance, simple and compound interest, discounting); Statistical methods (methods of chain substitutions, arithmetic differences, isolation of the influence of factors, mean and

Relative values, groupings, index); Mathematical-statistical methods (correlation analysis, regression analysis, factor analysis); Methods of optimal programming (system analysis, linear and nonlinear programming);

In the used models - descriptive, predicative and normative types of models. Descriptive models are the main ones in assessing the financial condition of an enterprise; these are descriptive models based on accounting data. Descriptive models begin with the construction of balances and financial statements in various profiles, including vertical, horizontal and trend analysis, subsequent analysis of various financial ratios, and conclude with the compilation Analytical note to the reporting. Vertical analysis is the presentation of balance sheet items in the form of relative values (specific weights) that characterize the structure of the summarizing summary indicators. Horizontal analysis is the determination of the dynamics (changes) in balance sheet items, the identification of trends in the changes of individual balance sheet items or their groups, Trending analysis-studying the dynamics of relative indicators for a certain period. Predictive models are financial forecast forecasting models, dynamic analysis models (rigidly deterministic factor models and regression models). Normative models are models that allow comparing the actual results of activity with the legislatively established, average for the industry or internal standards of the enterprise (used mainly for internal financial analysis). The model assumes setting of standards for each indicator and analysis of deviations of actual data from specifications.

Components of the financial analysis of the enterprise: general analysis of financial condition, analysis of financial stability, analysis of liquidity balance, analysis of financial ratios, analysis of coefficients of financial results. The analysis of the financial condition of the enterprise is shown in Fig. 11.1.

The result of the general analysis is a preliminary assessment of the financial condition of the enterprise, including the results of the analysis:

• the dynamics of the currency of the balance sheet (the sum of the values of the asset's indicators and the balance's liabilities). It is normal to increase the balance currency. Reduction, as a rule, signals a decrease in the volume of production and can serve as one of the reasons for the insolvency of the enterprise;

Assets structure Determination of the shares of immobilized (non-current) and mobile (circulating) assets, the establishment of the value of material current assets (unjustified overstating of which leads to overstocking, and the disadvantage - to the impossibility of a normal operation of production), determination of the value of receivables with a maturity of less than a year or more , The amount of free cash in the company's cash (cash) and non-cash (settlement, currency accounts) forms and short-term financial investments;

In the structure of liabilities. Analysis of the structure of liabilities is carried out in conjunction with the analysis of sources of formation of working capital. At the same time, long-term borrowed funds, due to their primary use for the formation of fixed assets, and other sources of formation of working capital (deferred income, reserves of future expenses and payments) can also be accounted for as part of own sources of funds. When analyzing the structure of liabilities, the ratio between the borrowed and own sources of the enterprise's funds is determined (a significant proportion of borrowed sources - more than 50% - indicates a risky activity of the enterprise, which can lead to insolvency), the dynamics and structure of the enterprise's accounts payable, its share in liabilities;

In the structure of stocks and costs of the enterprise. The analysis of reserves and costs is due to the importance of the "Stocks" section of the balance sheet for determining the financial stability of the enterprise. The analysis reveals the most "significant" articles having the largest specific gravity;

9 structure of financial performance of the enterprise.

The analysis provides an assessment of the dynamics of revenue and profit indicators (the identification and measurement of the effect of various factors on them).

For the general analysis, the following are calculated:

• the specific weights of the absolute values of the balance sheet indicators that characterize the structure of the asset, liability and the enterprise's reserves;

In the changes in absolute values (difference in absolute values at the end and at the beginning of the period), characterizing the growth or decrease of a balance sheet item;

• changes in specific weights (difference in specific values at the end and at the beginning of the period), showing the dynamics of the structure of the asset and liabilities of the balance sheet, the enterprise's reserves;

• the growth rate of the balance sheet indicators for the period under review;

• specific weight of changes in the balance sheet in the change in the balance currency for the analyzed period.

When conducting a general analysis of the financial condition of an enterprise under inflation conditions and frequent revaluations of fixed assets, it is best to pay attention to the relative values of the indicators.

Analysis of financial stability is carried out to identify the solvency of the enterprise - the ability of the enterprise to settle on payments to ensure the process of continuous production, i.e. Pay for basic and current production assets. Proceeding from the fact that long-term loans and borrowed funds are mainly used for the purchase of fixed assets and for capital investments, in order to fulfill the solvency conditions of an enterprise, it is necessary to limit reserves and costs to the amount of own working capital, with short-term borrowed funds, if necessary. Financial stability is determined by the indicator of the provision of reserves and costs by own and borrowed sources. In accordance with this, the following types of Financial Stability are distinguished:

- Absolute stability of financial condition (it is extremely rare) - own circulating assets provide stocks and costs;

- Normally stable financial condition - stocks and costs are provided by own circulating assets and long-term borrowed sources;

- Unsustainable financial condition - reserves and costs are provided by own working capital, long-term borrowed sources and short-term loans and borrowings, i.e. Due to all the main sources of stock formation and costs;

- Crisis financial condition - stocks and costs are not provided by the sources of their formation; The enterprise is on the verge of bankruptcy.

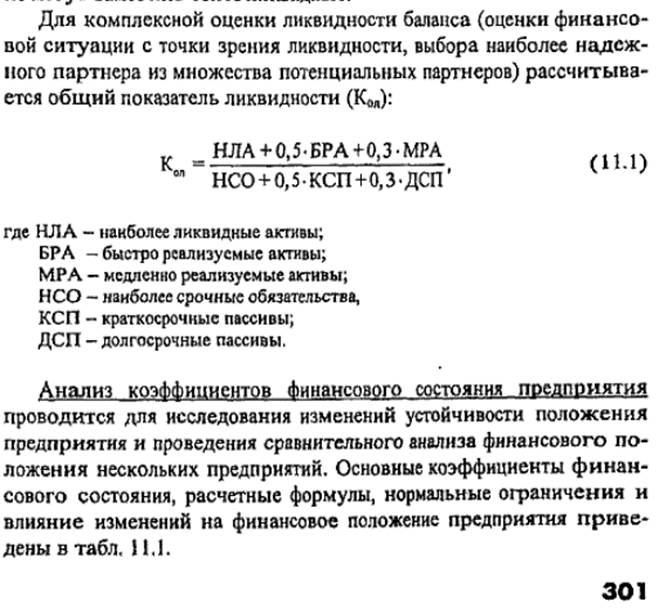

An analysis of the liquidity of the balance sheet is made to assess the creditworthiness of the enterprise (the ability to settle for its obligations). Liquidity is determined by covering the liabilities of the enterprise with its assets, the period of conversion into money corresponds to the maturity of liabilities. The most liquid assets (cash and short-term financial investments of an enterprise) should be greater or equal to the most urgent obligations (payables and other short-term liabilities); Quickly sold assets (accounts receivable with a maturity of less than a year and other current assets)

Should be greater or equal to short-term liabilities (short-term borrowed funds); Slowly sold assets (accounts receivable with a maturity of more than one year, inventories with the exception of future expenses, VAT on purchased assets and long-term financial investments) should be greater than or equal to long-term liabilities (the result of section IV of the balance sheet); Hard assets (non-current assets, less long-term financial investments) should be less than or equal to constant liabilities (capital and reserves, deferred revenues, reserves of future expenses. And payments adjusted for future expenses).

If these conditions are met, the balance is considered to be absolutely liquid. In the event that one or more conditions are not met, the liquidity of the balance differs more or less from the absolute. In this case, the lack of funds for one group of assets is compensated by their excess in another group in value terms. In a real payment situation, less liquid assets can not replace more liquid assets.

The task of analyzing the coefficients of financial performance of an enterprise is to identify trends in changes in business activity, determined through turnover, and profitability of the enterprise. Coefficients of financial performance are shown in Table. 11.2.

Comments

When commenting on, remember that the content and tone of your message can hurt the feelings of real people, show respect and tolerance to your interlocutors even if you do not share their opinion, your behavior in the conditions of freedom of expression and anonymity provided by the Internet, changes Not only virtual, but also the real world. All comments are hidden from the index, spam is controlled.