home

Finance Finance

Books Books

Finance and Statistics - Ковалева А.М. Finance and Statistics - Ковалева А.М.

|

Finance and Statistics - Ковалева А.М.

13. FINANCIAL AND INDUSTRIAL GROUPS

13.1 ECONOMIC CONTENT OF CREATION OF FINANCIAL AND INDUSTRIAL GROUPS IN RUSSIA

Transformation of property relations and the development of institutions, without which a modern market economy is impossible, is an important aspect of deepening economic reforms in Russia. Such institutions are, in particular, financial and industrial groups (FIGs), whose development in the Russian economy corresponds to the needs of the development of social production and meets the world economic realities. The facts show that the national economy of the countries of a developed market economy is based on large and super-large integrated organizational and economic structures, around which networks of small and medium-sized businesses are built.

In the leading industrial powers, powerful industrial companies are organically intertwined with financial structures-banks, insurance and investment institutions. These integrated entities have, in comparison with small and medium-sized businesses, much greater opportunities for R & D, the development of high-tech products, the implementation of large-scale projects at the expense of the concentration potential of production, science and financial resources. The practice of Western European countries, the United States, Japan and South Korea unambiguously convinces that national capital can only become a world economy-competing force if it is largely structured into financial-industrial corporations backed by the state.

In Russia, FIGs can be legal entities (commercial and non-profit organizations, including foreign ones, with the exception of public and religious organizations) that have signed an agreement on the establishment of a financial and industrial group. The group must necessarily have organizations operating in the production of goods and services, as well as financial and credit institutions. Investment institutions, non-state pension or other funds, insurance organizations that can play a positive role in ensuring the investment process in the group can enter the FSU.

Participation in FIGs of state and municipal unitary enterprises is possible in the manner and under conditions determined by the owner of their property.

The decision to assign a set of legal entities to the FIG status and to include it in the State Register of Financial and Industrial Groups is made on the basis of expertise of the necessary documents by an authorized state body authorized to register financial and industrial groups.

The supreme management body of the financial and industrial group is the Board of Governors of the FIG, which includes representatives of all its participants; This Council operates within the competence established by the treaty on the establishment of FIGs.

All participants of such a treaty jointly establish a central company (CC) - an official representative of the financial and industrial group. CC is a legal entity; As a rule, it acts as an investment institution. The central company of the FIG can be created in the form of an economic society, as well as an association or union. In addition, the Central Committee can be established by a company authorized by virtue of a law or contract for the conduct of business of the financial and industrial group and is the main one in relation to the remaining parties to the treaty on the establishment of FIGs. The central company has the right to speak on behalf of the group's participants in the relations connected with its (group) creation and functioning.

Financial and industrial groups on a voluntary basis and through the creation of a joint-stock company joint economic entities that perform basic but different functions in the economy. In specific Russian conditions, the main goals of creating such structures, besides raising the competitiveness of the national economy in the world economic aspect, are:

- Activation of the investment process by building up the potential of domestic industry in the "points of growth" of the economy, while targeting extra-budgetary sources of financing;

- The beginning of structural adjustment, the cessation of the fall of the country's scientific and technical potential;

- Strengthening economic potential in the all-Russian and all post-union space;

- Increase of efficiency of activity, increase in volumes of manufacture and realization of production;

- Strengthening the controllability of economic development processes on the basis of the formation of basic economic structures that act as a kind of "middle link" between the state and the sphere of small (medium) business;

- Successful competition with large foreign corporations in the domestic and foreign markets, the transnationalization of economic development processes through the expansion of effective cooperation ties.

With the participation of the FIG, the achievement of these goals becomes more realistic, since they act as a tool for ensuring horizontal and vertical economic ties, combining the efforts of industrial enterprises, financial and credit institutions, insurance, investment companies, trade, transport and other organizations. This integration is based on a number of motives, among which, firstly, the impossibility of a productive advance without attracting and concentrating financial resources, and secondly, the specialization and diversification of production. Joint activity is impossible without the coordination of the work of enterprises connected by the unity of the reproduction process, including technology and cooperation, and having common interests in the production and sale of products. By accumulating funds, the emergence of the possibility of managed enterprise development, risk reduction, maneuvering by the aggregate portfolio of securities, concentration of investment resources for the implementation of effective projects, additional sustainability is created for each of the enterprises and institutions entering the financial and industrial group.

The analysis of the activities of the first domestic integrated structures makes it possible to formulate the basic principles for the formation of Russian FIGs. Among them:

- • The individual nature of the projects for the establishment of each group on the basis of a single regulatory and legal framework;

- • The presence of the group leader, which determines the main commodity and financial flows. At the same time, both industrial enterprises and a financial and credit institution can act as a leader;

- • Joint control and contractual relations, which are key factors in ensuring the manageability of FIG members from the central company;

- ® formation of groups in the presence of a clear vertical or horizontal cooperation of enterprises that produce or are able to produce products competitive on the external and internal markets, as well as goods for state needs;

- ® selection of financial and credit institutions that have sufficient equity to invest in projects implemented by groups;

- • The thoroughness of the FIG project, confirmed by the expertise, including the composition, the mechanism of joint activities, the complexity and reliability of estimates of the expected efficiency of the corporation;

- ® variety of forms of state assistance to the creation and activities of FIGs.

The world and the first domestic experience of the functioning of financial and industrial associations shows that, having been built in accordance with the above principles, such structures really become basic self-developing economic elements that allow efficient reproduction and circulation of production, financial and trade capital, ensure its accumulation, concentration and investment In the priority spheres of the economy.

FIGs are created in different ways ("from below" and "from above"): 1) by participants voluntarily or by means of a merger of a group of shares of other participants purchased by him by one participant; 2) by the decision of the Government of Russia; 3) on the basis of intergovernmental agreements.

Financial and industrial groups can be classified according to the criteria: 1) the role and status of the lead participant, around which the remaining organizations (commercial bank, research or design organization, trading company, 2) forms of industrial integration (vertical, horizontal, conglomerate); 3) sectoral affiliation (sectoral, intersectoral); 4) the degree of diversification (monoprofile, multi-profile); 5) scale of activities (international, republican, regional),

For the formation of competitive integrated financial and industrial structures, the motivation of economic entities for long-term joint activity and the formation of mechanisms ensuring the protection of the interests of all participants of FIGs are crucial. In addition, it is necessary to create conditions conducive to the adaptation of the organizational-legal form of FIGs, the management structure, the composition and internal corporate interactions of its participants to changes in production factors and the socio-economic environment.

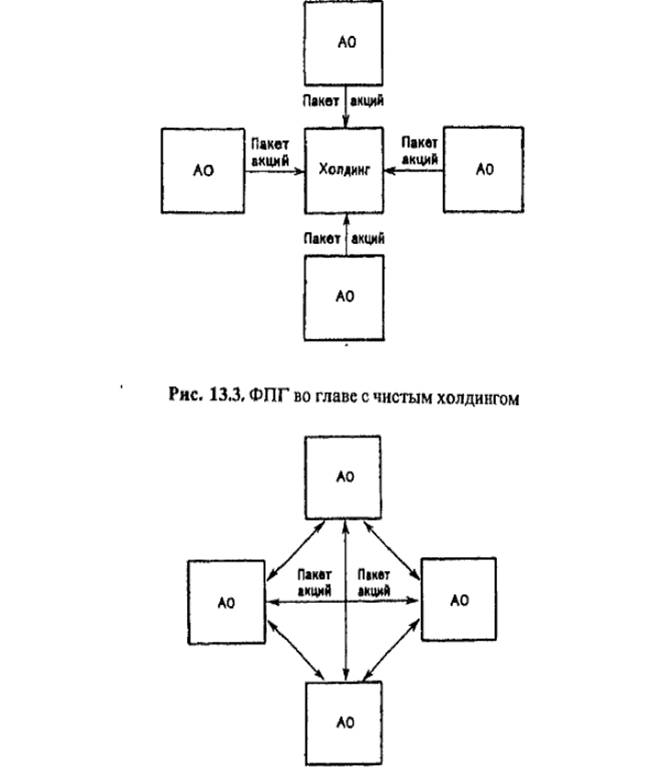

Fig. 13.2. FPG led by the financial and credit institution

Fig. 13.4. FIGs without the formation of a central company

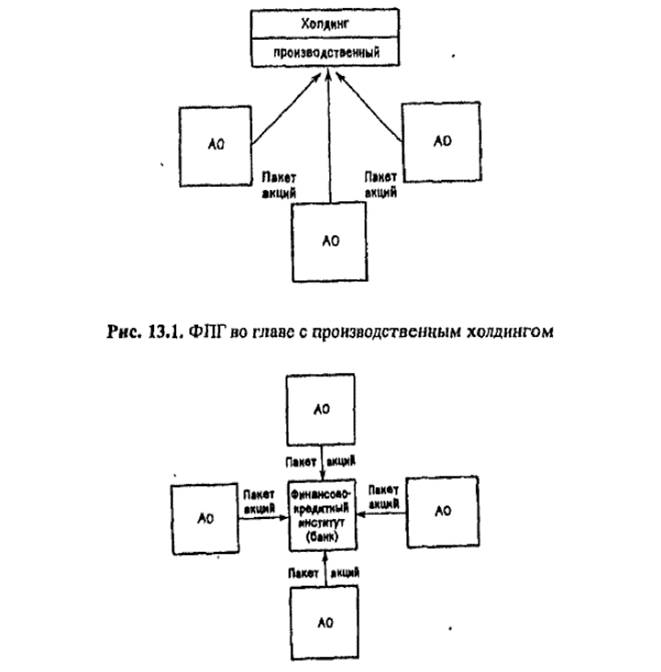

Perhaps a different organizational structure FIG. In particular, depending on what the "core" of the group is represented, such basic types of financial and industrial integration can be singled out (Figure 13.1-13.4) 1.

"See: How to continue reforms in Russia? Ed. In, in. Kulikova, V.I. Ispravnikova. - M., 1996. - P. 82-83.

1. FIGs, headed by a production holding company, where the parent company is not only the holder of shares, but also the manufacturer of the product.

2. FIGs, headed by a financial and credit institution (bank holding). In this case, the bank acts as the parent company.

3. FIGs led by a clean holding; While the central company does not engage in production activities, but owns a controlling interest in a number of enterprises.

4. FIGs without the formation of a central company, which involves the interaction of members of the association based on cross ownership of shares.

Among the largest participants of the FIG there are the following: Novolipetsk, Chelyabinsk, Magnitogorsk, Orsko-Khalilovsky, Starooskolsky Combine, AvtoVAZ, KamAZ, Aviastar, Tulachermet and Uralmash, Avtobank, Avangard ", and etc.

The beginning of the formation of Russian FIGs was laid by the Decree of the President of the Russian Federation "On the Establishment of Financial and Industrial Groups on the Russian Federation" of December 5, 1993, No. 2096. In accordance with this Decree in 1993-1994. 8 were officially included in the State Register of 8 FIGs, including the Urals plants (Izhevsk), Sokol (Voronezh), Jewels of the Urals (Ekaterinburg), Ruskhim (Moscow), Sibir (Novosibirsk) United mining and metals company "(Moscow)," High-speed fleet "(Moscow). In 1995, 21 were registered, in 1996 - 18 FIGs. As of the beginning of 1998, 74 FIGs were registered, of which 270 enterprises and organizations operated, including more than 40 financial and credit institutions. Enterprises in the financial-industrial groups provided an annual output of more than 100 trillion (undenominated) rubles; While the total number of employees in them (including those employed in financial and credit institutions) was more than 3.0 million people.

At present, the formation and activities of FIGs in the Russian Federation is regulated by two main legal acts: the Federal Law "On Financial and Industrial Groups" of November 30, 1995, No. 190 ~ FZ and the Decree of the President of Russia "On measures to stimulate the creation and operation of financial and industrial Groups "of April 1, 1996, No. 443.

In accordance with this law, the FIG is understood as a set of legal entities acting as the main and subsidiary companies, or fully or partially combining their tangible and intangible assets (participation system) on the basis of an agreement on the establishment of a financial and industrial group for technological or economic integration for the implementation of investment And other projects and programs aimed at increasing competitiveness and expanding markets for goods and services, increasing production efficiency, creating new jobs.

In reality, groups are huge economic complexes that collect under one roof enterprises and establishments of spheres: industrial, financial and commercial. Integration in PPG of various well-chosen economic entities increases the opportunities for optimizing the composition and use of the pooled capital. This, in turn, leads to savings in capital investments, a more complete utilization of production capacities, an increase in the return of the resources involved. Financial and industrial groups contribute to the savings of working capital, in particular, due to the development of mutual offset of payments of structural units within the groups, which reduces the payment turnover and the mass of financial resources necessary for the normal provision of production and circulation.

Legislation also singles out the notion of transnational FIGs (TFGG), while the defining feature of such a group is the presence among its participants of legal entities under the jurisdiction of CIS member states having separate units in the territories of these states or carrying out capital investments in their territories, B In the event of the establishment of TFGP on the basis of an intergovernmental agreement, it is assigned the status of an interstate (international) group.

The role of transnational FIGs with the participation of enterprises of the CIS countries has significantly increased in recent years. As of the beginning of 1998 the status of transnational FIGs was obtained by six groups: Interros, Nizhny Novgorod Cars, Precision, Slavic Paper, Aerofin, Optronika.

The federal law "On financial and industrial groups" was a step forward in the state regulation of the activities of Russian institutional structures. In comparison with the pre-

The regulatory documents that governed the creation and operation of FIGs, it contains virtually no restrictions on the inclusion of enterprises and financial and credit institutions in the group. In addition, the law establishes a system of measures of state support for its participants.

Comments

When commenting on, remember that the content and tone of your message can hurt the feelings of real people, show respect and tolerance to your interlocutors even if you do not share their opinion, your behavior in the conditions of freedom of expression and anonymity provided by the Internet, changes Not only virtual, but also the real world. All comments are hidden from the index, spam is controlled.