home

Investments Investments

books books

Іnvestuvannya - Schukіn BM Іnvestuvannya - Schukіn BM

|

Іnvestuvannya - Schukіn BM

6. Rozrahunok efektivnostі іnvestuvannya

Dotsіlnіst іnvestuvannya viznachaєtsya rіvnem growth kapіtalu іnvestora abo porіvnyannyam dohodіv i vitrat for їh zabezpechennya, tobto through spіvvіdnoshennya potokіv penny. Positive net penny potіk (yak rіznitsya mіzh priplivom that vіdplivom koshtіv) svіdchit about fіnansovu Vigoda od іnvestuvannya.

Metoyu іnvestuvannya prirіst kapіtalu Yea, i tsіlkom logіchno viznachati rezultativnіst іnvestuvannya through kіlkіsnu mіru tsogo growth in viglyadі pokaznika dohіdnostі іnvestuvannya. Vіn rozrahovuєtsya yak serednorіchny growth rates aktivіv project.

Rozglyanemo kіlka prikladіv rozrahunkіv tsogo pokaznika.

Rozrahunok 1. Viznachiti dohіdnіst іnvestuvannya, Yakscho on the cob assets іnvestora rock otsіnyuvalisya 120 tis. UAH, and naprikіntsі rock could Buti prodanі 150 tis. UAH.

Dohіdnіst vikoristannya aktivіv іnvestora in tsomu razі taka:

(150 -120) * 100% / 120 = 20%

2. Rozrahunok Viznachiti serednorіchnu dohіdnіst іnvestuvannya, Yakscho 3 Rocky kapіtal іnvestora zbіlshivsya 56%.

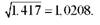

For the three Rocky kapіtal іnvestora zrіs at 1.56 Razi. Oznachaє Tse, scho serednorіchny pace zrostannya becomes 1.12:

№156 = 1,15

Otzhe, serednorіchna dohіdnіst stanovitime 15%.

3. Rozrahunok Viznachiti serednorіchnu dohіdnіst іnvestuvannya, Yakscho fіnansovі assets іnvestora on cob rock otsіnyuvalisya in 120 tis. UAH (aktsії that oblіgatsії), two nastupnі Rocky boule otrimanі divіdendi in sumі 15 tis. UAH, and rinkova vartіst tsіnnih paperіv іnvestora zmenshilasya 110 tis. UAH.

Two Rocky kapіtal іnvestora of 120 yew. UAH zrіs 125 tis. UAH tobto 5 tis. UAH:

110 + 15 = -120 5 tis. UAH

Dvorіchna dohіdnіst stanovitime 5/120 = 4.17%, and serednorіchna dohіdnіst - 2, 08% to scho:

4. Rozrahunok Viznachiti dohіdnіst іnvestuvannya, Yakscho on the cob rock іnvestor:

o vklav 200 tis. UAH in neruhomіst;

o for 160 tis. USD buying bill nomіnalom at 210 tis. USD s minds repayment yogo naprikіntsі rock;

o buying 10,000 aktsіy 20 USD per cutaneous;

o vklav 250 tis. UAH in wholesale torgіvlyu budmaterіalami kapіtalu s turnover for the 4 th mіsyatsі dohіdnіstyu skin turnover 15%.

During the Year of the boule prodanі aktsії tsіnoyu 18 USD for dermal, neruhomіst podeshevshala 20%. Operatsії s bill i budmaterіalami gave ochіkuvanі pributki. Rozrahunki imposed in the Table. 6.1.

table 6.1

Viznachennya dohіdnostі іnvestuvannya in ob'єkti

| eg іnvestuvannya | Іnvestovany kapіtal (yew. UAH). |

Otsіnka kapіtalu on kіnets perіodu (yew. UAH.). |

1. Neruhomіst |

200 |

200 * 08 = 160 |

2. Bill |

160 |

210 |

3. Aktsії |

20 * 200 = 10000 |

aktsії 18-10000 = 180 |

4. Wholesalers of torgіvlya |

250 |

250-1, 15-1, 15-1, 15 = 380 |

Usogo |

810 |

930 |

Dohіdnіst |

(930-810 / 810) -100% = 14.8% |

5. Rozrahunok Viznachiti the results Persha rock dohіdnіst іnvestuvannya 100 tis. dollars. in virobnichy project Yakscho 80 tis. dollars. pridbano obladnannya basis, for 10 tis. dollars. rozrobleno tehnіchnu documentation into produktsіyu, 10 tis. dollars. vitracheno on oborotnі Costa. Prybutok for Year becomes 40 tis. dollars, factuality fіzichny instal lment is the basic moral fondіv becomes 30% for Year vartostі pridbannya, vstanovlena amortizatsії norm -. 10%.

Іnvestovany kapіtal іnvestora on the cob rock dorіvnyuvav 100 tis. dollars. (80 +10 +10). Naprikіntsі rock assets іnvestora skladalisya s otrimanogo pributku (40 tis. USD.), Narahovanoї amortizatsії (80 * 0.1 = 8 tis. Dollars.) Zalishkіv werewolf koshtіv (10 tis. USD.), Mainly zalishkіv fondіv for їh rinkovoyu tsіnoyu (80 - 80 * 0.3 = 56 tis dale..).

In sumі tse 114 tis. dollars.

Prirіst kapіtalu for Year Taqiy 114 - 100 = 14 tis. USD., abo 14%. Dohіdnіst іnvestuvannya - 14%.

Pokaznik dohіdnostі Got rіchny termіn (standard). Otzhe, Yakscho say, scho dohіdnіst sklala 19%, the zrozumіlo, scho tse for the Year.

Navedemo slit two pokazniki, SSMSC mozhut harakterizuvati rezultativnіst іnvestuvannya. Tse so zvanі nediskontovanі pokazniki: rentabelnіst i termіn okupnostі kapіtalu.

Rentabelnіst (r) іnvestuvannya pokazuє, yak chastku in іnvestovanomu kapіtalі becoming serednorіchny Prybutok Flow (R) project; Won rozrahovuєtsya yak chastka od dіlennya serednorіchnogo pributku on the bag іnvestovanogo kapіtalu (K):

1. Termіn okupnostі (current) - tse Quantity rokіv, SSMSC potrіbnі for Povernennya іnvestovanogo kapіtalu, vihodyachi іz schorіchnogo serednogo pributku. Rozrahovuєtsya yak chastka od dіlennya obsyagіv іnvestovanogo kapіtalu an amount serednorіchnogo pributku:

When analіzі dinamіki pokaznikіv іnvestuvannya mozhut vikoristovuvatisya nomіnalnі that realnі otsіnki aktivіv.

Nomіnalna zmіna pokaznika sposterіgaєtsya in addition razі, Yakscho yogo values boule rozrahovanі for factuality dіyuchih tsіn oblіku. Napriklad, nomіnalny prirіst sale produktsії rozrahovuєtsya, Yakscho on the cob obsyagi sale obranogo perіodu rozrahovanі in tsіnah, scho on the cob dіyali perіodu, and kіnets perіodu - at tsіnah scho dіyali on kіnets perіodu. Nomіnalna otsіnka vrahovuє real zmіnu pokaznika i zmіnu tsіn.

The actual zmіna pokaznika rozrahovuєtsya for nezmіnnih (as the title of porіvnyannih) tsіn, Yakscho on the cob pokaznik rozrahovuєtsya i on kіnets perіodu in some quiet i tsіnah oblіku themselves.

Otzhe can zapisati TAKE spіvvіdnoshennya for otsіnki zmіni pokaznika in real (Pr1 - Pr0) i nomіnalnomu (PN1 - Pn0) obchislennі through іndeks zmіni tsіn (Іts) for that samy perіod:

Napriklad, Yakscho obsyag dohodіv od іnvestuvannya for Year zrіs in porіvnyannih tsіnah base rock (іndeks - 0) s 400 tis. USD to

500 yew. UAH, and for tsіni zvіtny Year pіdvischilisya by 12%, then zmіna dohodіv in nomіnalnomu obchislennі stanovitime:

(500 - 400) -1 12 = 112 (yew UAH.).

Yakscho dohіdnіst іnvestuvannya in real obchislennі becomes for Year 15% and tsіni zrosli 12% (іnflyatsіya), then dohіdnіst kapіtalu bude taka per Year:

(1, 15 * 1, 12 1) = 28% -100 8 (%).

Abo Yakscho obchislyuvati іnakshe, tobto through pokaznikіv growth rates, the nomіnalna dohіdnіst stanovitime:

Dn = Dr + Іnf. + Dr. * Іnf. = (0.15 + 0.12 + 0,15-0,12) * 100% = 28.8%

Dr. de - dohіdnіst in real obchislennі (15%),

Іnf - rіven іnflyatsії (Іts - 1) for the Year (12%).

When analіzі dinamіki pokaznikіv іnvestuvannya mozhna vikoristovuvati realnі yak, so i nomіnalnі otsіnki. Realnі otsіnki harakterizuyut processes іnvestuvannya bіlsh exactly ale toil dopovnyuvatisya analіzom vplivu tsіnovih Change log for the project.

Іnvestitsіynі vitrati, yak usually pereduyut іnshim vitratam i іnvestora income. Іnodі tse buvaє parallel. Іnvestitsії okupovuyutsya tіlki through deyaky hour yaky potrіbny for dwellers income nakopichuyuchis, zrіvnyalisya s Pervin іnvestitsіynimi vitratami іnvestora. However Varto vrahovuvati, scho cutaneous hryvnia, yak Got іnvestor sogodnі іnvestuє i, i hryvnia, yak іnvestor planuє otrimati in maybutnomu od іnvestuvannya, neodnakovі through those scho іsnuє rizik. Vіn deposits od hour; krіm of lіkvіdnі assets zavzhdi shaping can Buti vikoristanі alternative way s yakoyus mіnіmalnoyu dohіdnіstyu Ci.

Vіlnі fіnansovі resources for rakhunok rozvinenoї Sistemi іnstrumentіv fіnansovogo Rinku shaping can Buti vikoristanі їh vlasnikom for naroschuvannya for Relief dostatno bezrizikovih іnstrumentіv, napriklad Reigning tsіnnih paperіv. Tsey іnstrument zabezpechuє slim dohіdnіst (on rіvnі 3-5%) at neznachnіy (abo nulovіy) rizikovanostі.

Napriklad, 100 yew. UAH for the minds їh rozmіschennya on bankіvskomu depozitі mozhut zrosti for Year 10% (mozhut Buti th INSHI varіanti zberіgannya naroschuvannyam s). Tom їh ekvіvalentom through Year mozhna vvazhati 110 tis. UAH slit through the Year - 121 tis. UAH t i. e. And the dwellers mi Mali through Year 100 tis. UAH nashі potochnі Costa mozhut dorіvnyuvati tіlki 91 tis. UAH Chim Dali od-line time perіod hour, if іnvestor Got otrimati Costa abo vitratiti їh, Tim Mensch Je їh precisely otsіnka іnvestorom. Tom potrіbnі methodological pererahunku penny potokіv in єdiny ekvіvalent after hour, zokrema technique diskontuvannya, abo bring fіnansovih potokіv.

In praktichnіy ploschinі obsyagi іnvestovanih koshtіv i obsyagi dohodіv for project rozdіlenі in chasі minutes for porіvnyannya toil Buti postavlenі in єdinі minds oblіku after hour. W tsієyu metoyu mozhna vikoristati spetsіalnu methodology described (diskontuvannya) potokіv penny for the project to one hour perіodu (naychastіshe to Perche abo nulovogo rock realіzatsії project, if zdіysnyuyutsya, Vlasnyi, іnvestitsії).

The process of bringing the penny potokіv for the project to єdinogo ekvіvalenta Got suttєve value in analіzі іnvestitsіynogo project, Especially in the minds nestabіlnih Economy of Ukraine. Rozglyanemo tsі metodichnі power rozrahunkіv.

Uvedemo poznachennya:

Ft P i - i vartіst odnієї tієї samoї sumi aktivіv in maybutnomu (F) i on the production point (P);

d - іsnuyucha on fіnansovomu market analysis for mozhlivіst naroschuvannya kapіtalu for Relief bezrizikovogo abo malorizikovogo іnstrumentu (napriklad, Cena od rіchnogo vikoristannya pennies rozmіschennya kapіtalu bankіvskih on deposits). Yakscho in skin rotsі ochіkuyutsya rіznі mozhlivostі naroschuvannya kapіtalu, the value of i zmіnyuvatimetsya rokami h i h in rozrahunkah bratimetsya іndeksom serial number Svoge perіodu (rock);

r - sequence number of rock (abo іnshogo perіodu hour, for paying yaky vrahuvannya zmіni vartostі pennies) pochinayuchi s Persha rock іnvestuvannya.

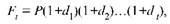

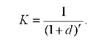

Todі maєmo totozhnіst, yak in іnvestitsіynіy praktitsі rozrahunkіv nazivayut kompaunduvannya formula:

koefіtsієnt kompaunduvannya.

For odnakovih on vsіh Rokach rates diskontuvannya maєmo:

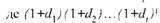

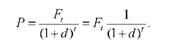

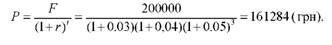

Dwellers go od maybutnoї sprognozovanoї in BIZNES-planі іnvestitsіynogo project sumi koshtіv F to її ninіshnogo ekvіvalenta P STOP formula zapishemo іnakshe:

nazivayut koefіtsієntom diskontuvannya (reduced).

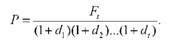

Yakscho rіchnі rates diskontuvannya rіznі formula pererahunku prognozovanih in maybutnomu fіnansovih potokіv in potochnі ekvіvalenti matim viglyad

Rіchna rate diskontuvannya (d) To bring maybutnіh penny potokіv in potochnі minds oblіku Je sub'єktivnim pokaznikom representations іnvestora (rozrahunki conductive peredusіm for Demba, that scho SAME vіn rizikuє at іnvestuvannі svoїm kapіtalom i priymaє rіshennya on osnovі rozrahunkіv perevag project) to zmіni vartostі h pennies an hour. Yak usually vvazhaєtsya scho rate diskontuvannya mozhna taxes have viglyadі sumi chotiroh elementіv:

o dіyucha on fіnansovomu Rinku rate naroschuvannya penny koshtіv at vikoristannі bezrizikovih fіnansovih іnstrumentіv (tse alternative whether іnvestuvannya Money Does the project);

o rіven riziku, pov'yazany s nestabіlnіstyu Economy Kraina (predictive perіodu vіrogіdnіst of scho vіdbuvatimetsya Podiya makroekonomіchnogo rіvnya through scho rіzko pogіrshatsya pokazniki project);

o rіven riziku, pov'yazany sama s project for yakogo vstanovlyuєtsya rate diskontuvannya (vіrogіdnіst in the forecast perіodі negatively podіy upravlіnnі in the project, scho negatively on Items marked proektі);

o rіven іnflyatsії (tsіn growth) in the following rotsі.

Yakscho in rozrahunkah fіnansovih potokіv od іnvestuvannya (at BIZNES-planі) vrahovuvalosya іnflyatsіyne zrostannya tsіn (schodo ochіkuvanih dohodіv precisely vitrat i), the stavtsі diskontuvannya treba vrahovuvati Chetvertyy Components - іnflyatsіyu. Yakscho BIZNES plan rozrahovuvavsya in єdinih tsіnah, napriklad ostannogo rock, scho not zmіnyuvalisya for perіod realіzatsії project, the rate diskontuvannya rіven іnflyatsії not vklyuchaєtsya.

Viznachivshi konkretnі kіlkіsnі otsіnki for Skin Elements, іnvestor Mauger sformuvati rіven rates for diskontuvannya rozrahunkіv. Tse bude yogo Vlasnyi Buchan of naskіlki zmіnyuєtsya vartіst penny koshtіv s hour.

Napriklad, Yakscho іnvestor paying diskontuvannya rate at 18%, the tse oznachaє, scho cutaneous hryvnia income Persha rock realіzatsії project vіn otsіnyuє sogodnі 85 kopecks, skin hryvnia income other rock -. At 72 kopecks. .. I, etc. Tsі digits viplivayut s vіdpovіdnih values koefіtsієntіv bring:

Krіm guidance vische method of vstanovlennya rіvnya rates diskontuvannya, mozhut vikoristovuvatisya takozh takі:

1) on rіvnі serednoї dohіdnostі fіnansovogo market analysis;

2) on rіvnі dohіdnostі kapіtalu, yak spodіvaєtsya otrimati іnvestor od Svoge project;

3) on rіvnі dohіdnostі, yak vzhe Got іnvestor od Svoge bіznesu. Dwellers maintained upstream rozumіti methodology described penny to potokіv

єdinogo ekvіvalenta in chasі, navedemo kіlka prikladіv rozrahunku.

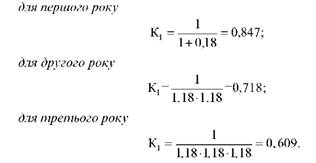

Rozrahunok 6. Money Does inline ekvіvalentu vіdpovіdaє suma 200 tis. UAH, scho otrimati її іnvestor spodіvaєtsya vprodovzh tert rock realіzatsії Svoge project (diskontuvannya bid to bring іnvestor bere rіvnі at 3% for the Persha rock, 4% - for the other i 5% - for ostannіh troh rokіv)?

Vartіst maybutnіh koshtіv (F) required to bring to the stream perіodu (P):

7. Rozrahunok Virobnichy project potrebuє іnvestuvannya 2500 tis. i will give UAH zmogu otrimuvati protyagom p'yati rokіv schorіchny clean Prybutok at 700 tis. UAH. Viznachiti dotsіlnіst this project.

Project Mauger vvazhatisya dotsіlnim, Yakscho scrip otrimanogo pure pributku for OAO All 5 rokіv perevischuvatime vitracheny kapіtal. For porіvnyannya revenues od project for Leather Year maybutnіy required to bring to the minds єdinih oblіku (up Suchasnyj ekvіvalenta) tobto before the rock, if zdіysnyuєtsya іnvestuvannya vartіstyu 2500 tis. UAH.

Let him at that hour samy Je Ti mozhlivіst іnvestuvati samі 2500 tis. UAH in the market analysis in fіnansovomu malorizikovanі іnstrumenti pid 10% rіchnih. Qiu alternative virobnichomu project rozglyadaєtsya scho, yak vikoristaєmo rate diskontuvannya at rozrahunkah:

virobnichy project zabezpechit Taqiy ghosts dohіd:

1 st Year

700 / (1 + 0.1) = 640 tis. UAH;

2 nd Year

700 / (1 + 0.1) = 580 tis. UAH;

for the 3rd Year:

700 / (1 + 0.1) = 530 tis. UAH;

for the 4th Year

700 / (1 + 0.1) = 480 tis. UAH;

5 th Year:

700 / (1 + 0.1) = 430 tis. UAH.

Zagalom for the entire project will perіod zmogu otrimati prirіst koshtіv in sumі 2660 tis. UAH, scho Yea zagalnim bring pributkom virobnichogo project 5 rokіv. For yogo otrimannya treba Bulo slit to Persha rock vitratiti 2500 tis. UAH. Sumi 2660 i 2500 mozhna porіvnyuvati, to scho stink privedenі perіodu up to one hour. Net present Prybutok perevischuє іnvestitsіynі vitrati 160 tis. UAH of this can be vvazhati dotsіlnim project.

Yakbi mi porіvnyuvali 2500 tis. UAH іz nediskontovanim pributkom, tobto vvazhali, scho cutaneous hryvnia dohodіv Square od roku otrimannya Got one tsіnnіst then zagalny Prybutok dorіvnyuvav bi 700 * 5 = 3500 tis. UAH. Vikoristannya mehanіzmu diskontuvannya maybutnіh penny nadhodzhen Je method bіlsh ob'єktivnogo (realіstichnogo) porіvnyannya income od s project urahuvannyam mozhlivogo income od nayprostіshogo alternative project vikoristannya quiet themselves koshtіv fіnansovomu on market analysis.

Virobnichy project viyavivsya bіlsh profitability varіantom vikoristannya koshtіv (2500 tis. UAH). Ale Tse slit is not kіntsevy visnovok.

Dotsіlnіst project Got perevіryatisya іnshimi pokaznikami yakіsnim analіzom that, in addition chislі i parameter for riziku.

Nadalі zvazhatimemo to those scho mozhlivіst vikoristannya іnvestitsіy just yak vkladannya in bezrizikovy іnstrument fіnansovomu on market analysis, will give zmogu scho otrimati schorіchnі percent growth vkladenih koshtіv, Je alternative varіantom vikoristannya quiet koshtіv for themselves whether yakogo іnvestitsіynogo project. Tsey principle very hard to base the method of reduction to one penny potokіv ekvіvalentu in chasі.

Metodologіchnim principle otsіnki efektivnostі Je porіvnyannya rezultatіv i vitrat. For proektіv tse oznachaє porіvnyannya obsyagіv dohodіv that іnvestitsіynih vitrat scho їh zabezpechili. Vikoristovuєtsya kіlka pokaznikіv scho bazuyutsya on rіznih varіantah spіvvіdnoshennya mіzh income st at vitratami іnvestuvannі.

Metodologієyu analіzu dotsіlnostі іnvestuvannya vvazhaєtsya tsіlkom logіchny principle porіvnyannya іnvestitsіy that dohodіv od them. Vikoristovuєtsya kіlka tipіv pokaznikіv, SSMSC realіzuyut Tsey principle.

Uvedemo takі umovnі poznachennya scho toil vikoristovuvatisya analіzі Dali at:

D - Income from od іnvestuvannya whether yakіy formі (naychastіshe tse revenues od realіzatsії produktsії, poslug abo aktivіv project);

I - іnvestitsіynі vitrati;

Z - potochnі (ekspluatatsіynі) vitrati for the project;

T perіod іnvestuvannya (realіzatsії project);

t - іndeks rock (Mauger pochinatisya s Persha rock, chi nulovogo, t = 1, 2,, T..);

d- rіchna rate diskontuvannya, yak Got vikoristovuvatisya to bring Penny potokіv maybutnіh perіodіv to drain stream

rock;

K koefіtsієnt bring:

Vihodyachi s guidance poznachen, maєmo Taku characteristic pokaznikіv efektivnostі іnvestuvannya.

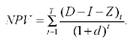

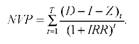

Pure shows tsіnnіst (vartіst) (NRV) viznachaєtsya yak zagalna for vsіma rokami realіzatsії project rіznitsya mіzh present value th vitratami the project. Positive otsіnku project Mauger otrimati, Yakscho value of NPV> 0:

Tsey pokaznik "pure", in oskіlki nomu vrahovuyutsya pributki for mіnusom vitrat (D - Z - I), so tobto zvanі "chistі" pributki.

For ekonomіchnim zmіstom NRV dotsіlnіshe Bulo b nazivati zagalnim bring pributkom od іnvestuvannya.

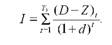

2. Termіn okupnostі (T) with such a Je mіnіmalnoyu kіlkіstyu rokіv realіzatsії project at yakіy zagalny ghosts Prybutok perevischuvatime obsyag іnvestovanogo kapіtalu, tobto bude vikonuvatisya rіvnіst:

Termіn okupnostі for positive rіshennya іnvestora not Mauger perevischuvati zagalnogo termіnu realіzatsії project - Got okupatisya ranіshe yogo uniquely complete.

Yakscho kapіtal іnvestuєtsya not tіlki vprodovzh Persha rock, and th protyagom vsogo perіodu realіzatsії project, the value of I Got diskontuvatisya takozh i vrahovuvatisya yak scrip іnvestitsіy in rіznі prophets, refer to the cob іnvestuvannya:

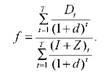

3. Доходи на одиницю витрат (f) (співвідношення доходів і витрат) мають показувати, скільки доходів інвестора припадає на одиницю загальних витрат (інвестованого капіталу та поточних експлуатаційних витрат). Обидві величини (чисельник і знаменник) розраховуються як приведені до поточного моменту часу. Позитивну оцінку має отримати проект, для якого цей показник перевищуватиме одиницю:

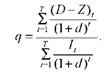

4. Прибутковість інвестованого капіталу (співвідношення прибутку та інвестованого капіталу) показує, скільки приведеної вартості поточного прибутку за весь період реалізації проекту припадає на одиницю приведеної вартості інвестованого капіталу. Позитивну оцінку за цим показником проект матиме за умови, що він не менший за одиницю:

5. Внутрішня рентабельність (IRR) розраховується через величину чистої приведеної вартості проекту, яка прирівнюється до нуля:

Ставка дисконтування d, при якій виконуватиметься рівняння, і дає кількісне визначення внутрішньої рентабельності.

Цей показник може розраховуватися кількома методами.

1. Розв'язком рівняння стосовно IRR, у якому невідомою величиною є тільки IRR. Інші показники - доходу D інвестиції (I), поточні витрати (Z) - розраховуються у фінансовому розділі бізнес-плану.

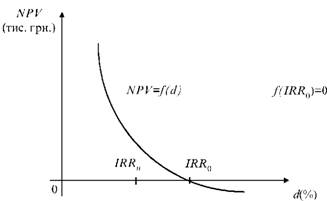

2. Графічним методом побудови функції залежності між NPV і d. У цьому разі розраховують кілька значень чистої приведеної вартості при різних ставках дисконтування. Потім будують графік залежності між цими показниками (рис. 6.1). У точці перетину графіка з горизонтальною віссю ставок дисконтування знаходять приблизне значення внутрішньої рентабельності проекту.

Внутрішня рентабельність після її розрахунку стає орієнтиром дохідності для інвестора. Величина IRR має порівнюватися з тією дохідністю використання капіталу, на яку сподівається інвестор (IRRn). Якщо внутрішня рентабельність перевищує очікувану інвестором дохідність, інвестування стає доцільним. Якщо ні, то інвестор може не прийняти позитивне рішення щодо інвестування в розглянутий проект за цим критерієм.

Зазначимо, що при прийнятті рішення найчастіше використовується один показник, методологія якого найбільшою мірою відповідає логіці інвестора. Наведена система показників може мати суперечності: за одними показниками щодо проекту будуть отримані по

Fig. 6.1. Типовий графік функції NРV = f(d)

зитивні результати, а за іншими він буде невигідний. Багато залежить від графіка грошових потоків за роками інвестування. Отримані кількісні оцінки показників ефективності інвестування мають перевірятися на їх економічний зміст і логіку.

Приклад розрахунку показників ефективності наведено в табл. 6.3. Основні економічні умови проекту відбивають перші п'ять стовпців розрахункової таблиці. Стовпці 6-13 містять проміжні розрахунки, що будуть використані для визначення показників ефективності інвестування.

Comments

Commenting, keep in mind that the content and the tone of your messages can hurt the feelings of real people, show respect and tolerance to his interlocutors, even if you do not share their opinion, your behavior in terms of freedom of speech and anonymity offered by the Internet, is changing not only virtual, but real world. All comments are hidden from the index, spam control.