home

Investments Investments

Books Books

Інвестування - Щукін Б. М. Інвестування - Щукін Б. М.

|

Інвестування - Щукін Б. М.

7. Investment Rizik

Рішення щодо інвестування приймають, орієнтучись на прогноз майбутніх результатів. Інвестора цікавить рівень дохідності, але також має значення гарантованість планинованої дохідності, впевennість у то, що в progressі realіzіїії the project does not viniknut nevrahovany, "позапланові" негативні щодо капіталу події. Цей бік інвестування відбиіє інтерття ризику.

Rizik існує тільки schodod piyі, yakі prognozuyutsya, ochikuyutsya in the Maybutnomu. Yakschoo podіya vidbulyasya, then about the risky is no longer there. Ризик як критерій прийняття рішення as an investor має місце, if it is necessary to plan the future, iisuyu yak maybutnіy project.

Інвестиційний project to be based on the predictions of the forebodings of what will be for the future, for the situation on the markets and for the future of the investor. Навіть за уми високої точності прогнозів у реальній економіці обов'язково винитимутьть несподівані події, обставини, умови, які змовлюватитиму відхилення Від прогнозного сце-нарія інвестування.

Taku neiznachennost rozumimimo yak ambiguity, variantnist, mіnlіvist majbutnі pііі і resultі інвестування.

Інвестиційний ризик viznachimo yak potentzіnu mozhnіvіl nedo-syagennennya plannovanіh tsіlі інвестування (у вигляді прибутку або соціального ефекту) і в результаті непередбачених втрат коштів і отримання грошових збитків abo the arrival of the people, al least, nіzh planned, rozmіrіv.

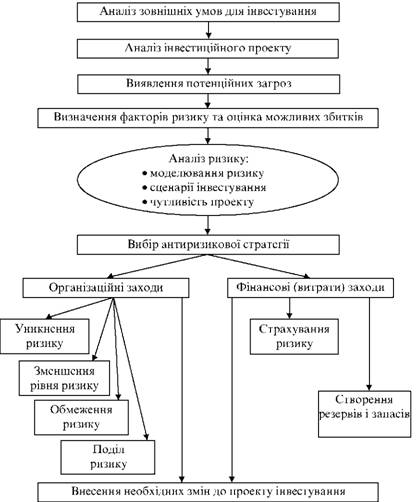

Rizik importantly neutralize povnistyu, alle him can keruwati. Yogi treba zazdalegіd otsіnuvati, rorakhovuvati, opisuvati, planuvati go, sho moyut znimiti vіrogіidnist nezazhanyh podіy at realizatsii інвестиційного project. Such a complex of approaches to become a manager of risk (Figure 7.1). Він дає змогу підготуватися до небажаних подій і зменшити втрати від их. Повністю захиститися від ризику it is not possible.

Майбутня незначеність інвестиційних процесів зажить від багатох factorів, які mozhut бути розглянуті in a few groups.

1. Factories, to be located in the vipadkovosti in the transition of economic processes (the ability of people to settle in the population, the changes in the behavior partners, the collusion of the saints, the number of political minds at the edge of the world).

2. Factories, povyazannyі із змінами nature minds (klіmatichnі umovi, stihіynі dashing).

3. Factors that are due to the unavailability of the available information and information about the lack of information in the methods of the information collection in the course of the Maybutn subbases. Project інвестування і лише a prognosis of the fact, but can be in different ways in the reverse way.

Fig. 7.1. Management of investments

4. Factors, povzjazanny from з недостовірністю зібраної інформації для планування наслідків інвестування (фіктивні, недостовірні дані).

5. Factories, povyazyanny z zhenschim chinnikom, z psihologієyu, mіnlіnistyu povedinki people, yakі pritsyuyut bezsedrednyo na proekto formuyut yogo zovnіshne seredovische.

6. Pomilki abo not kraschі rіshennya managerіv project.

7. Vihіd z fretu obladnannya, scho vikoristovuyutsya in the projectі інвестування.

Sered faktorіv, SSMSC naychastіshe stanovlyat nebezpeku in realіzatsії іnvestitsіynih proektіv (krizovoe rіvnya) slіd nazvati: tehnіchnі avarії, vibuhi, Pozhezhi, vitіk konfіdentsіynoї Informácie, reklamatsії on yakіst produktsії, zboї in komp'yuternіy MEREZHI (іnformatsіynіy sistemі) upravlіnnya pіdpriєmstvom, krimіnalnі podії , Stihіynі dashing, rіzke zagostrenya rivalkії na rinku, sorozhist vladi, death of the key fahіvtsya project.

Until the tsikh of the factorial factors, the additions to the kilka of the potentiated causes for Ukraine are common, and there are many ways that can be solved: the problems of legislation, neobykovyazhest 'i bezvidpodalnist partnership, uncompetitive competition, zvyazyka manageryv z kriminalitetom.

Unexpectedness characterizes the ambiguity of minds, yakі vrahovanі in rozraunkah ochіkuvanoi prehіdnostі іnvestuvannya. Unexplainedness is manifested in the result of inventiveness.

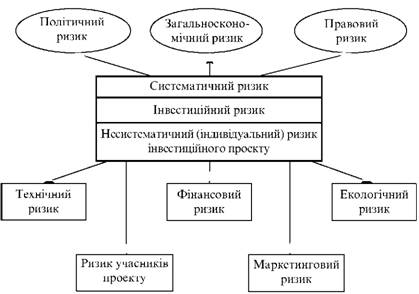

Rizik mozut sprichinyuvaty nepriyatlivlіy umovi, zagalnі for all spheres of economics, in tsymu razі vіn nazivayatsya systematichnym (zagalnoe konomikіchnym). Yakshche rizik otnosheniya z umovami samskogo project, it tsinevidualniy rizik (unsystematic).

Залежно від факторів ризик поділяється на кілька типів (Picture 7.2). Actually, be-yaka podіya abo dіya investora shodo іnvestuvannya mozhe mati risik, call up to the project, and otzhe, zumoviti name pevnomu rizik. Napriklad, the rizik of low-level anchovy budivelnih robot, rizik vplyvu on the project znachnoї devalvatsії grivny, rizik vyhodu z facu tehnichnogo obladnannya, rizik vtrati kvalіfikovanuyu personnel, rizik pripinennya contract orendi primischen, scho potrebny project, tochno. Potentzyno mozhliva situatsіya in progressi realizatsii the project is given a one-sided rizik. Viokremljayutsya takozh aggovanі typed rizikiv.

Polichnichny, pravoviy ta zagalnoekonomichnyi riziki mozhna zarahuvati up to zovnіshnіm minds інвестування (звнішні ризики).

Fig. 7.2. Forms of investment risk

Pід звнішніми factors слід розуміти умоі, які інвестор і його менеджери, як правило, не в змозі змінити, але повиннії prognozuvati та враховувати, бо вони істотно впливатьть на стан проект. Prior to inviting factors, lay down: zagalnyi stan ekonomiki kraїni, situatsiia na fіnansovomu rinku, поведінка partnerів проект, передусім підприємств-почанників і споживачів, situatsіya t fіansovomu rinku, взаємодія з влади, місцевим населенням.

Intrinsic risks are affected by overpopulation by pardons in the planned organizational project: in the development of the project, in the organization of the project, in the resources of the projects, in the product's anchor project. Potentsynymi dzherli vnutrishnogo risiku vvazhati soi factori:

- lack of managerial skills;

- Fahova unearned personnel;

- unkindness of managers;

- low rіven marketing;

- lack of gnuchkist project;

- vідтік комерційно важливої інформації;

- technologic nondiscipline;

- non-resistance to personnel;

- Nedolіki financial plannuvannya;

- pogany sight for gadgets.

Technichesky rizik ob'ednuє nedolіki that pomlki bugatokh aspectiv іnvestuvannya: yakіst proektovannya, tehnichnaya base, reverse technology, organisatsiya project management, perevischennia kostorisu tochno.

The financial risk of failing to meet these goals will not be met by the results of the financial part of the project: the credit risk, the currency risk, the pensions of the bankruptcy fund, the financial assistance to the project, the forgiveness in the prognosis of the income, yogic vicarities, the uninformed financial partners, the zatrim Nadokhozhennyam koshtiv vіd realizatsії, neplatosprozmodnіst komplatіv produktsі ya vlasnі zavischeni vitrati for the project tochno.

Інноваційний ризик можливий в разі інвестування в наукові дослідження, у виробництво нових товарів, використання нових технологій, що to bring up pівдвищених витрат і закладнює пошук споживача.

The commercial risk of the consequences of the problems with the problems of realizing production, transporting, pogrishchennyam anchor, znizhennyam platospromozhnosti spizivacha proizvodstvu project, pidvitchennyam vitrat, riznimi penalties sanktsiyami.

Marketing Rizik vinikaє внаслідок прорахунків at оціювуванні ринкових ім дії Project: Ribbon zbutu postakannya sirovini ta materіalіv, organіzatsіya hіlmіtіy ta zbutovoyї zmіzі, otsyag rinku, hour vyhodu na rinkok, tsіnova polіtica, low yakіst proizvіїї.

Ecologic rizik otpratsyanii z opratsyuvannyam nash vlivu na nakkolishne sredovischne, z mozhnoloyu avarіynistyu, zalogodzhennyam stosunkі z mіscevoyu vladoju tak poplaren'yam.

Rizik participates in the project of misunderstandings in the management of the financial institutions and partnerships.

Ризики взаємопов'язані. Zmіni some sprichinyuet podalshi zmіni in usіy sistemі інвестиційного to the project. Riziki varto doslidzhuvati і analizuvati on the yakіsnomu ta kіlkіsnomu рівнях, застосовойчи the modelyuvannya risiku method. Інструментальні засоби кількісного аналізу дають змогу диференціювати ризики, моделювати їх дію, ідентифікувати type ризику, оцінювати можливі наслідки (втрати), формавати заходи протидії.

Managing risks - a set of methods and methods for dealing with schodo analizu, otsinki that znizhennya abo neutralizatsii negative sylidkiv risikovichh podiy. In the course of the management of the rhizome it is fallow type of the yizogic's rhythm, it is possible to regulate the abnormality, or to change the potency of the potency. Yakshto internal risks for rakhunok yakisnom management can zmenshety that neutralizovati, stasovno zovnіshnіh rizikіv mozhno speak tilki about mіnіmіztsіy mozhlivh naslіdkіv. At a fatal vipadku poslidovnist analizu riziku taka:

O vyavlennya vnutrihnіh і звнішніх factorів ризику;

O analiz їх potential zagrosi інвестуванню;

O оцінка могуливих фінансових втрат;

O viznachennya stіykostі project before vyazavleny risikiv;

O established by the criterion of the pripustogo rivnya risiku;

O the anti-riser technology management unit;

O the plan of attending the schodo znizhenna riziku;

O montoring the behavior factors in the course of the course;

O прийняття рішень щодо нейтралізації факторів ризику за наявності реальної загрози інвестуванню;

O зміни in investment plans for zmenshennya abo neutralization of the project;

O the planning of an effective (with a minimum of expenditure) a vimushennogo vyhodu z project;

O the dots of the investment process for the project and sales of active rights.

Integrated dіyі іnvestor mozhe zmenshiti rizik, ale ponnyostyu yogo usunuti is important. In spite of the vipadku vibir інвестиційного project - the compromise of між намаганням отримати пририток - and healthy with the foolishness of the investor (we will rivetize the yogi оцінкою).

Серед засобів нейтралізації або зниження ризику слід виокремити a number of загальноприйнятих прийомів та рекомендациицій:

O insure the project yak єdinogo complex abo, yakschoo tse not vdaetsya (through znachniy rizik Ukrainsky farymi firmi mozhut uni tiie i form diyal'nosti), - insure okremih active in the project;

O забезпечення високої ліквідності інвестицій. Bazhano, the activist project Mali Rinkovyi popit not tilki z boku project. Tse garantuvatime mozhnivist ix sale in time pripinennya project і zmenit zbotki vіd bolisnogo rіshennya shodo "vyhodu z proektu". Про ліквідність активів проекту слід подумати заздалегідь, до прийняття рішення чодо його реалізації;

O diversification - rozpodil kapitalu for kіlkoma ob'ektami (projects) with the method of znizhennya vplyu odnієї negativnoi podії na efektivnіst vseієї prograi інвестицій. Diversifikatsiya mozhe zdіysnyuvatysya takozh at the boundaries of one project: oriєntatsіya na kіlokh spizhivachіv proizvodstvii, organizatsiya zbutu in rіznih mіstsyah abo regіonah, vikoristanya obladnannya rіznih tipіv tochno. Diversifikatsiya є basic approach znizhennya unsystematic riziku in the financial investment. At the portfolio of the company, the number of decimals is increased by the correlative zv'azkom mіzh soboju (shodo дохідності в минулому) та з дохідністю ринку в цілому.

O The project has been approved for a project on the basis of a part of the incentive scheme of investment and construction of a complex of such facilities. Skin z partnan complex mateima zmugu enter into exploitation autonomously, bring pributok and pay for vitrati. Крім фінансової економії коштів zavdyaki більш ранному вводню проекту, поетапність забезпечує перевірку комерційної reality for the project and early diagnosis of the project, not for the capital investment, but for the yogo part ("tactic" tactics).

O Hedzhiruvannya - vikoristannaya mehanizmіv zakrіplennya договірних умов у стосунках партнерів на прогнозний переіод з метю підстраховки обохін, що домовляються, від негативних змін у коньюнктурі ринку в майбутньому.

At the financial investment level, the hedging of the rights to the Maybut operations with the local papermen is increased.

O Svoechasnee planunuvannya ta strenennya neobhіdnikh standbyv і storіv materialovnykh, fіnansovikh i chasovikh resursiv. The methods are especially important in the deficit of financial resources, but in Ukraine. The structure of the material reserves and reserves in the non-interbatched vitrati, the reservoir of the witches for pokrittya vipadkichnye vitrat, which belong to the exploitation of the region, the minds of the natural minds, the staff of the staff, are weakly shaped.

O Кваліфіковане відпрацювання договоів і договоів між партні по інвестиційному проект, вoдчасне відпрацювання in them the rights та обов'язківі сторін in the minds of the canvases of negative sub-situations and confrontational situations.

O By the method of changing the financial risks, you can be cautious about special arrangements, go zmenshennia potentizyno mozhlivy vtrat vіd rizikonavah інноваційних proektivі through trіvarnya spetsіialії fіrmі, but take on a potentіchny rizik. Vaughn can vikonuvati function of project management and in itself can be a risk for zmenshennya in times of consumption of direct costs of the head pidpriemstva investor.

O In the vipadkas "transfer" to the risk of organisation of the funds to the fund of realizing rizikovanoy nevestuvannya. Він take on yourself kerуvannya pіonernymi projects rozvitku інших підприємств, on yakі you can not safely share the risk of realizing the project, or vonya rozumyyut dotsilnіst project і mozhut yogo fіnansuvati through such a fund.

O Povnotsinne інформаційне забезпечення інвестиційних планів, postійний інформаційний monіторинг ситуації на ринку, у партнерів, споживачів, в економіці країни заглалом.

O Orієнтація на spheres діяльності з підвищеним рівнем монополізму (регіонального, місцевого) на ринку.

O Organizing an investment in "integrations" (business), business, the main project, the scope of post-production, and the service for one, and the sphere of production of the main project. Cе сутєво знижує ризик неадекватної поведінки партнерів проекту.

O Vicarage of the system of day-to-day systems and maintenance of the project without any harm.

Rizik can vimyryvatisya kіlkіsno yak in the absolute, so u vidnomnomu virazhenny. At dopovnennya to metodov vimiryuvannya risiku for rivnem vidhilen mozhilivh result in diyalnosti vіd sreddnyo-ochikuvanyh rizikіv mozhe viznachatsya the size mozhlivyh zbitkiv. Additional:

O the risk to spend a lot of money for the project (the price of production for the project is reduced to vitrifi for vibrobitniy);

O the risk of incurring income for the project (not vdasetsya vzagali realizovati product);

O Rizik vtrati active in the project (zbotki dorivnyuvatimut contribution to the capital) vasledidok natural podiy, pozhezh, rude pomolok v ekspluatatsiiї zadnannya, kriminalnyh podiy tochno.

Zalizhno vіd rіvnya mozhlivih zbitkіv mozhe formvayasya difentsitsiovane stavlennya investora before the project інвестування. To the point of view, you will be guided by the curtain of resources and risk by the investor. 1. Bezrizikove інвестування, if there are no investors in the area below the anchorage, do not forget that the pributok is exactly guaranteed on the given river.

2. Admissible rizik інвестування полягає in that, щo умо to the project, guarantee maximally zmenshenny pributku deprive to the river, with yobom zberihaєtsya доцільність project for the investor. Napriklad, if the maximum zbitki not perevistchat ochikuvannyh pribudok for the project.

3. Critical risk of intercourse with such mozhnivimi investor's losses, yakі roblyat project unsuitable for ynogo. Napriklad, investor rizikuet tim, scho produktiya not matiem popita, not protyvatimetsya, і іnvestor mozhe vtrasti not tilki pributok vіd інвестування, and th part of its own active in the project (investment capitals).

4. The rizik of the catastrophe rivnya mozhlivy in vipadkah, if iosnue dovmornosti vtrati vsogogo iinvestavnogo kapitalu. Cie mozhe buti bankrutstvo proinvestvoynogo pіdpriemstva (kompannії, fіrmi), yogo lіkvіdatsіya, sosprodazh lane to the project abo vtrata activeі unavlіdok avarіy, pozhezh, vibuhіv.

In vidnosnomu vimiri rizik mozhe bouti vyznacheniyak yak size zbitkiv, vidnesena up to the anchor base (tse mozhut buti vitrati on vyrobnitsvto, vartizhest of the main resources tochno). Napriklad, the rizik of that, sho vitrati on viribnitsuto odinnitsi proizvitiya perevistat tsinu realizatsii, scho for місяць збитки перевищать 10% of the investment capita, пo витрати on відвленвлення обладнання перевищать 20% його вартості і т. Ін.

Загальноприйнятим є методичний прийом кількісного оцінювання рівня ризику через розрахунок рівня незназначеності можливих змін показників efektivnostі project in Maybutnomu in the minds of those who have not been uncomfortable for the project. To be conducted in the form of a prerequisite demonstration of the efektivnosti to the project (at the end of the project, dozens of thousands of forecasted variants of the project are to be drawn), and on the basis of kolivan vidhilen variantsi vіd іх middle size vysnachayut rіvenь neiznachenostі project.

Such a showboy can be divided into the middle of the vaginal void (o) abo the degree of harmony (v).

Comments

When commenting on, remember that the content and tone of your message can hurt the feelings of real people, show respect and tolerance to your interlocutors even if you do not share their opinion, your behavior in the conditions of freedom of expression and anonymity provided by the Internet, changes Not only virtual, but also the real world. All comments are hidden from the index, spam is controlled.