home

Investments Investments

Books Books

Інвестування - Щукін Б. М. Інвестування - Щукін Б. М.

|

Інвестування - Щукін Б. М.

Розрахунок рівня ризику

For розрахунку рівня ризику conducting серія розрахунків:

1. Before the basic pribudku pribudku for the project (napriklad, NPV), viznachayatsya varіantnі znachennya otraznika izvestivnosti іnvestuvannya pri mozhnivyh situatsіy u Maybutnomu. The number of such sites is understandable, and the projection

МРУ for dermal rozraunku NPV І, de і = 1, 2, п. Кількість варіантів mozhe bouti neobmezheno great. Komp'yutera tehnika das zmogu zdіysnyuvati rozraunki z bazhanyu kіlkistyu ta tochnіstyu.

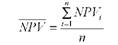

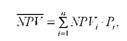

2. Viznachaatsya serednє znachennya obratnogo otpazanika effektivnostі іnvestuvannya z sіysh proizvedenih varіantnih rozraunkіv MRUI:

Abo

De Rі-імінірність майбутніх умов, що відображені і-м варіантом розрахунку;

П - кількість розрахованих варіантів показника ефективності проекту.

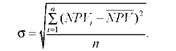

Середньоквадратичне відхилення варіантних показників від їх середнього значення

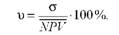

4. Роззаховується коефіцієнт варіації (v), який визначає ступінь відхилень варіантів від mean value of the display:

Can vvazhati, scho priinyatnim bude taka nevestuvannya, with yakomu koefіtsіnnt varіatsіії less than 10% less than it is. In other words, for the given project, you can vidhilennya vіd plannanovoї дохідності on 10% (і in більший, і в менший бік).

For koefitsynetom variatsii pozhna pobivnyukati proizvodstvii obsolyati mensh neiznacheni, toto mensh rizikovany, z bilshoyu nainii prognoziv proekt. Menshom koefіtsієнту варіації відповідає project in the least risky.

Використання наведенених formulas for розрахунку рівня ризику за проект проілюструємо на такому прикладі.

For tririchnym інвестиційним the project it is forecasted zagalny pridivleniya прибуток у розмірі 400 тис. UAH (pesuitistic forecast), 450 yew. UAH (nayvіrigіdnіsh prediction) і 540 thousand. UAH (optimistic forecast). Treba viznachit riven riziku (tobto neiznachensti) with predicted pributku for dani project.

Viznachimo riven riziku for the project through otsіnku neznachenchenstі prognoznyh varіantіv pributku. Розрахуємо середньоквадратичне відхилення прогнозів від середнього розміру прибутку і кефіцієнт його варіації.

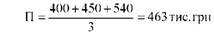

Serednaya the value of the additional income for the project for the trioma warants

Середньоквадратичне відхилення

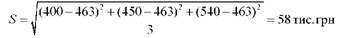

Коефіцієнт варіації

Otzhe, riven riziku in danomu raz mozhe buti representations yak znachennja koefіtsіnta varіatsii 12,5%. Priinyatnym rivnem risiku vvazhaetsya koefіtsіnnt varіatsії up to 10%. However, in general, the orien- tier, and the skin investor, moe bouti, have their own top of the page in vyglyadі koefіcієnt varіatsії - ochіkuvanoї neiznachenostі at інвестуванні.

Якщо в Інвестора є також інший проект з such by themselves showers дохідності, але з кефіцієнтом варіації 7%, then the first project can be відхилений як більш ризикований.

Riven varicoloured in the future, can be supplemented with various methods.

1. Analyz sensitivities to the result of investing on a quiet silent show, which form the final result of the project.

2. Розробка різних сценаріїв ходу реалізації проект й розрахунок відповідних показників ефективності інвестування.

3. Held bagaatok rozraunkiv effektivnosti іnvestuvannya on the basis of the mathematical model of the project.

Affectionate the project before the riches of factors, but vplyuyvat on dohіdnist project, viznachaetsya as follows:

O rorachovuyutsya basoviy varіant project shodo otkaznikіv dohіdnostі, abo pributku, abo terminu oploknosti, abo іnshogo otkaznik performance of the project;

O to make zmіni at the value yakogos ostentatnik, scho viznachaє rіvenь prodevіv for the project. Цемуть бути, наприклад, ціна реалізації продукції, forecast кількості продукції for sale, вартість одниці сировини, rate орендної плати, ватість обладнання, витрати на оплацу праці, вартість оборотних коштів тощо;

O znovu rozrahovuyutsya show of results to the project;

O viznachaatsya elastichnіst ostavlyaetsa proizvodstvennosti project shodo doslozdzhenogo factor;

O the factor of risk is ranked for the value of the factor of elastic elasticity of a factor;

O showers, yakі naybіlshoyom mirovu vplylyvat on the result of the project, pridelyayatsya osobliva uviga at rozrobotsі biznes-planu іnvestuvannya.

For CIM method otsіnyuєtsya vazhlivіst vplivu okremih faktorіv (Cena realіzatsії, sobіvartіst, obsyag virobnitstva, vartіst obladnannya toscho) on zagalnu pributkovіst project i vіdpovіdno to rezultatіv vzhivayutsya come in schodo bіlsh ґruntovnogo opratsyuvannya іnvestitsіynih planіv scho spriyatime znizhennyu rizikovanostі, pov'yazanoї s viyavlenimi factors.

Analis prognoznyh scenarios rozvitku інвестування за проект perebacha розробку кількох варіантів ходу реалізації the project is hollowed out of the call of minds, the organisation of project management, the real money from the investor is not enough. Scenario - tse zasagalneny u vyglyadі basic tez, etapiv, podiy describe yakogis process, at danyom razi - project of innovation. The main respect for the scenarios is to log on to the development of the main line, without a fragment of detail.

Rozraunkki conducted, for example, for three scenarios: the base for rozraunok in the midst of nayvіrigіdnіshih umovah, optymistichniy varіant (with naykraschomu perebi подu podіy for all factors, yakі vplylyvat on dohіdnіst project), pesimisticheskiy varіant, in a naklidayutsya naygіrshі mozhilі situatsії in the kraine on a particular market.

Далі порівнемться viewers productivity in the future, creating negative scenarios, creating negative scenarios, looking at the sky, scenarios and innovations. Potim viznachayutsya subi ta umovi, yakі prizvodit to such neazhazhnyh scenarios, vyyavlyayutsya factorizy riziku, gotyutsya plan z neutralizatsii riziku z metoyu viklyuchenny nezazhanyh scenarios rozvitku processu iinvestuvannya.

The method of supplementing the risk on the basis of statistical Viprobovuvanne Polagaye in that, for the sake of obsoblyuvayalnoy technicians, the project will be rendered free of charge in the project, the project will take place in the showings and factors in the assigned dia-zones їх зміни. In the result, in the automatic mode, the average displays are the statistical characteristics of the vari- ation of the rozpodil for the purpose of analyzing the naiwazhivshih for the pre-project project and the projecting of the risks for the project for the different strains.

Tse method is realizing for the add-on of special computer programs for projects on rivin riziku.

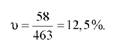

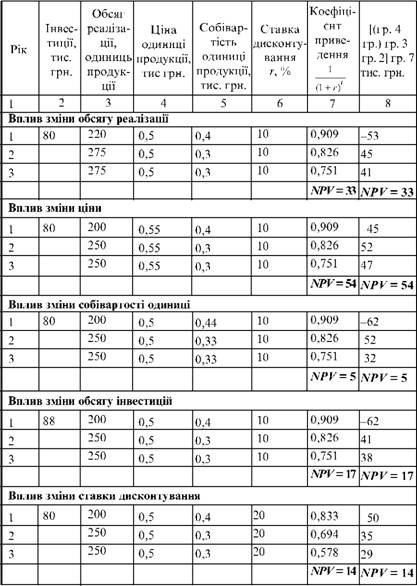

The application of rozraunkіv for analizu chuttivostі project before the factors are imposed inferior. The basic variant of a pure design is given in the table. 7. 1, cooks NPV with zmіnі okremih factory on the display NPV project - in Table. 7. 2. Rating vklivu okremih factorov (Practically tseotsynka elastichnisty zmіni otpazhnika efektivnostі project on zmіnu factor risiku) - in Table. 7. 3. Z Neїplivaye, Що найбільші зміни NPV at зміні factor of 1% відбуваються в разіміни ціни реалізації продукції. Tse factor is the most important thing for a project in the future. Obryuntuvannu prognosis of the factor of the spill pridiliti naybil'she respect, the same pomolok in prognozii matimut vidpodidno before conducted rozraunkku maximal vplyv on dohidnist project.

To give for its own values the factor of the products of production, the real estate and investment rates, the discount rates. Instructions of the butt of the wastewater, or of the scarf of the wind, the practical winters: they are the most important factors in the existence of pribootko-

Table 7.1

The basic variant of the rozraunka is given to the draft project

Table 7.2

Розрахуннок варіантних значен NРV при зміні факторів

Table 7.3

Otsіka znachenya factor for the adjusted project

The factor that I injected into the NRV was |

Factor factor, % |

The base of the value of NFV |

Nove znachennya TRU |

Зміна НРV (гр 5-гр. 4) / гр.4,% |

Зміна НРV на 1% зміни Factor, gr. 6 / gr. 3,% |

Factor Rating |

|

1 |

Oblag realizatsii |

10 |

25 |

33 |

32 |

3.2 |

ІІІ |

2 |

Price Real-life Odnitsy Products |

10 |

25 |

54 |

116 |

11.6 |

І |

3 |

Собівартість виробництва одниці продукції |

10 |

25 |

5 |

80 |

8 |

ІІ |

4 |

Obnag investment |

10 |

25 |

17th |

32 |

3.2 |

ІІІ |

5 |

Discount rate |

200 |

25 |

14 |

44 |

0.2 |

IV |

Вість інвестиційного проекту, є очікуванна ціна реалізації продукції та собівартість одниці продукції. Pamphlets in їх predictions матимуть найбільші негативні наслідки для проекту.

The ratings can be factorized into the risk of investing a mantle of rozrachovuvatysya for a skinnyinvestitsynogo project.

In the case of financial innovations in tinnyi papiri, rivin riziku viznachaetsya takozh for vysglyanutoyu vische methody otsinki varyantnosti result іnvestuvannya, ale yak varіanti dohіdnostі take the value of the display of the effectiveness of the reverse tool in the past for a period of several days.

Napriklad, treba viznachiti riven riziku інвестування 100 тис. UAH у прості акції виробничого підприємства в акціонерній формі. An investor can decide on a regular basis on a line-by-line income for a visually divisive. For ostannny 5 rockiv on the skin of the zikh anktsi viplachuvalisya soi dividendi: 5, 3, 4, 1, 2 uah.

Rosrakhunok vikonaetmo vikladenoyu vische methody through koefіtsієnt varіatsії:

1. Середній рівень дивідендів за минулий період:

(5 + 3 + 4 + 1 + 2) / 5 = 3 UAH per share.

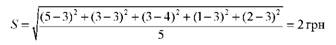

2. Середньоквадратичне відхилення дивідендних виплат від середніх виплат за останні п'ять років

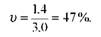

3. Коефіцієнт варіації

Отриманий кефіцієнт варіації 47%, madly, nato great, sho sіchdchit about znachnu varіantnіst magnitudes дивідендів у mіlmu thu taku samu neiznachenіst otrymannya ochіkuvanoi perechnoї odіchіnostі vіd zіого фінансового інструмента в майбутньому.

In practice, financial innovation in the case of financial methods, the model of financial innovation (CAPM), the unsystematical rizik of the instrument, the investment, is to be recognized for the sake of the so-called beta-agreement of a common paperman.

Model оцінювання фінансових активів becoming a rizik інвестування в цінний папір у вигляді двох складових:

O a systematic risk of misconduct due to factors that can be spent one-hour on the entire market of zonal paperms, and can be identified through the medium of the middle income period (the portfolio portfolio, which is stored in the households, and on the market);

O unsystematic rizik pritamanny lisha danoomu tsinnomu papperu і zalozhit v yod yogo osoblivostej. Tse rizik mozhe bouti neutralizovano included before the investment portfolio tsіnnih papperіv z riznim rivnem riznosprjamovanogo unsystematic riziku.

The systemic risk of the pre-ordinance of the papermarker for the methodology of the CAPM model is to be calculated through the value of the so-called beta-collection of the standard paperman, which shows the extent of the pre-ordinance of the paperman in the pre-inception of the virgin market (the portfolio of household goods, or on the market). Rozglyanemo the technique of rozraunku Beta-koefitsynt tsinnogo papera.

1. For the actual giving of the last few minutes, the number should be calculated as the actual value of the market (R) yk of the average value of the value for the whole period of the year. The value of the price is equal to zero (for the percentage rate of the statistically unimportant pawns (b) for the same period. = D - L) viznachatime rіven serednorinkovoї premiії for rizik, tobto додаткової дохідності щодо безризикової дохідності.

2. To grow as a self-image for a rizik (R) for the self-perpetuating in the past, ali vihodachi z vektochnoї dohіdnosti (L) tsennogo papera, yakii doslidzhuyutsya. Therefore, the value of Pd = D - L.

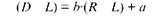

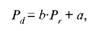

3. Viznachaatsya regressionny zv'yazok mіzh premіієyu for rizik for iznim tsіnnym paperom (D) i serednjorinkovoyu premiieju for rizik (R). Рівняння регресійного зв'язку матиме is such a vigil:

Abo

De a - the elder member of the regressive rivnyannya (yogo kіlkіsny rіven not mоy еconomіchnії інтерпретції);

B - Beta-kofіtsііnt rozgljanutogo tsіnogo papera, yak kіlkіsno viznacha zalizhnіst mіzh premiєєyu for rizik danogo tsіnogo papera і premіієyu for rizik zagalom on rinku tsіnnih papperіv. Beta-koefіtsієnt mozhe mati znachennya від 0 і більше.

Yakshchoo rizik tsinnogo papera bude below vid sreddnyorinkovogo, then the beta-koefitsyne budes menshii oditytsi.

Yakshchoo rizik tsinnogo papper perevischuvatime serednyorinkovy, then beta-koefitsyne bude bіlshy odinnitsi.

Yakshchoo rizik tsinnogo papar dorivnyuatime middling, then the beta-koefitsyne dorivnyuatime oditytsi.

Beta-koefіtsієnt - an important characteristic рівня ризику цінного папера. Rozraunki Beta-koefіtsієntіv on rozvineny fundovyh rinkah conducted analitikov systematically, і for the skin tiny papa статисти statistic series of beta-kyofіtsіynta, yaky vrachovuєtu at predzviznannі predihіdnostі of that chi іnshogo tsіnogo papera y урахуванням його ризикованості.

Controlling food

1. Understand the investment risk.

2. Systematic risk.

3. The financial risk.

4. Manage the risky.

5. Rizik participating in the project.

6. Applied marketing risk.

7. Sexy rizik.

8. Project risk.

9. Загальноекономічний ризик. 9. Загальноекономічний ризик.

10. Unsystematic risk.

11. Kilkisne viznachennya risiku through neiznachenіst ochіkuvanih results. Yak zerozumi?

12. Чотири етапи кількісного розрахунку рівня ризику. 12. Чотири етапи кількісного розрахунку рівня ризику.

13. Affect the project.

14. The factor of investment project, I mean the yogo effectiveness.

15. Three times the risk for the amount of waste.

16. Likvidnist project.

17. Legal risk of the project.

18. Rules, how to give zmogu zmenshit rizik.

19. Diversifikatsiya at інвестуванні. Її meta.

20. What is the meaning of income?

21. Find the factors for the project. Yak-ikh with a vengeance?

22. The virbitious rhizik project.

23. Elastichnist pributku for the project vіd tsіni realizatsії produktії to become 0,4, and від to the ointment of investments - 0,7. What do you mean? What is the most important factor for the project?

24. The co-ordination of the project for the project is 12%. Tse is good for chi? To Chom?

25. Planned earning.

26. Modelyuvannya risiku.

27. Yak rozumiti viz "імовірність окупності the project to become 70%"?

28. Serednokvadratichne vidhilennya for 10 variants ochikuvanoi pributkovosty project to become 67 yew. UAH Tse is good for chi? To Chom?

29. In one project, the midweekwatches in the NPV become 100 yew. UAH, in the other project - 203 thousand. UAH Which project is stealing? To Chom?

30. In one project, the forecasting of the prognosis of the surplus is 14%, in the -18%. Which project is stealing? To Chom?

31. What is the meaning of realiza- tion? Witness how to recommend to the investor?

32. Doslіzhenzhenya risiku.

33. Strahuvannya yak sposіb manages the risk. For some fear? Що буде страховою подією?

34. Monopolism of the investment project. Tse pogano chi well?

35. Information of the investor is a good thing, I see a rizik. Is it possible to invest in the investor? Yaka інформація потрібна йому для зниження ризику?

36. How can I get all the activists behind the project?

37. Do you want to get involved in the development of an investment plan, a prizvyachenomu risizu?

Literature [4, 5, 13, 15].

Comments

When commenting on, remember that the content and tone of your message can hurt the feelings of real people, show respect and tolerance to your interlocutors even if you do not share their opinion, your behavior in the conditions of freedom of expression and anonymity provided by the Internet, changes Not only virtual, but also the real world. All comments are hidden from the index, spam is controlled.