home

Banking Banking

Books Books

Money and credit - Ivanov V.М. Money and credit - Ivanov V.М.

|

Money and credit - Ivanov V.М.

4.2. Non-cash settlements

The choice of a specific form of non-cash payment is the right of economic entities (Table 1). In this connection, the form and procedure of settlements are integral elements of any business agreement. As already noted, there are the following documents for processing non-cash payments.

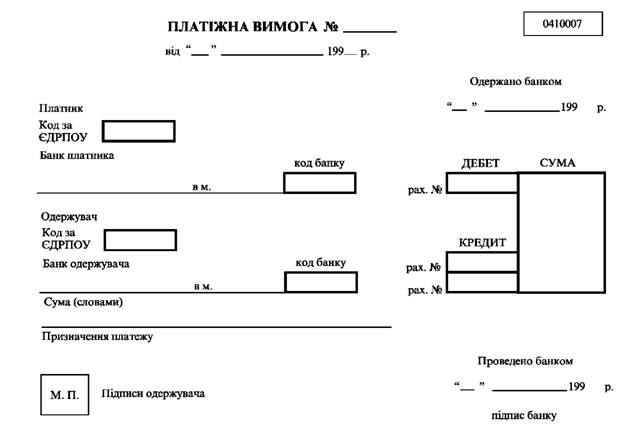

Payment claim (Annex 6) - a document whereby the recipient of the money provides the bank with a claim to the payer about the payment of a certain amount of money. Used only for netting requirements.

Pre-payment or planned payments are made using payment orders.

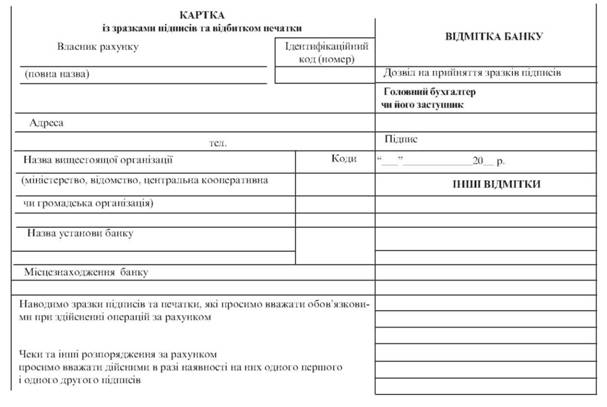

Annex 1

Apply for a loan in the Naimenuvannya bank install the bank

Naimenuvannya pідприємства

(Exact and exact)

Ідентифікаціний код за ЄДРПОУ Ідентифікаціний номер ДРФО

Ask for an answer

(On-line, budget-financed), rakhunok on pіdstavі Інструкції natsionalnogo banku Ukraini about vіdkritta banks rahunkіv u natsionalnі ta іnozemnіy currencies, sho moe for us obovvjazkovu force, із змістом цієї Інструкції знайомлені. In the earlier establishments, the Bank of Rakhunki is not a mere, maemo (in the order of number of banks in such bank establishments)

Керівник (посада) (Підпис, прізвище, ініціали)

Golovniy bookkeeper (Pidispis, prizvische, іnіціали)

"_"___R.

M.P.

Bank receipts

Documentation for registration

_ Рахунок відкриття рахунку та здійснення

(Point-by-point, budget-financed and rahunki) transactions for rahunkom perevyriv:

I authorize Kernivnik (pidispis)

Date відкриття рахунку "_" __ р-

| № ball. Rahunku | No. of individuals. Rahunku |

Head

Accountant (підпис)

(Naimenuvannya nednnika rahunka)

Rabochok No.

| Posada | Прізвище, ім'я та по батькові |

Зразок підпису |

The first sign |

||

The first sign |

||

Another peep |

||

Another peep |

A signet finger

Vse obovyazyki on vedennu oblіk ta zvіtnosti pokladeni on the head accountant.

Місце для печатки вистеоящої оргаізації, що завідчила повноваження та підписи.

Rows of an increase and a list of service posts, yakі timchasovo korostytsya the right of the first chi of another pіdpіїв, звідчуємо:

Керівник _

Head accountant _

Povnovavzhennya pidpisi kerivnika ta head accountant, yakі dіyut vіdpііdіdo to satutu (Poslozhnya),

Засвідчую_

(Да)

| Видані грошові чеки | |||||

date |

З № |

Up to No. |

date |

З № |

Up to No. |

The text of the provision No 0157500-972 (Part 3)

Annex 3

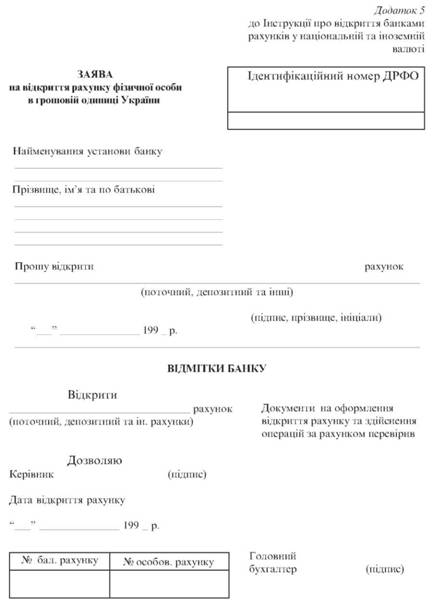

Dodatok

Before the resolution of the National Bank of Ukraine No. 64 dated March 17, 1997 p.

Submitted by admin (місто, район)

Dovydka

About vidkritya (zakrtya, zmіnu) rahunku

Повідомляємо, що "_" _ 199_ року_

(Name the bank)

Відкрито (закрито, змінено номер) _

(Calling the governor a rahunku)

Rakhunok №_

(Rozraunkovy, pochchny, budgetary, depository and savings in the national and foreign currencies)

Керівник establish the bank (підпис)

Head Accountant (pidpis) M.P.

Annex 4

Poktorny razhunok in the foreign currency of the phizic individual - inozemtsya (resident chi of non-resident), individuals without gromadyannosti that gromadyanina of Ukraine - non-resident.

Vikriti pochnchny rakhunok

No. _ _

In _ (name the install an additional bank)

(Currency exchange)

(Pisdiski servisovih osib bank) "_" _ 199 _ p.

Zaya

Від_,

(Prіzvische, ім'я, по батькові)

Passport, seriya _______ № _______________, gromadyanny _______________________

(Other document, person who is ill)

Ідентифікаційний номер ДРФО (для іноземців-резидентів) _______________________.

That osib without gromadyanya - redizentiv)

I ask you to criticize the current rake at _________________________________________

(Currency exchange)

On my own.

Letters rasporadzhennya budut pidpisuvatysya me abo ovnovnivazhenyu me special for dovirenistyu.

At different times, individuals are entitled to the right to rozporyadzhatsya rahunkom zobov'yazuyus negoyno pobidomiti prose in letter form.

The rules of the Bank of the Worship of the final stages of the change, and I vvazhayu їх for myself obovyazykovymi. All the listworm shodo chyogo rahunku ask nadsilati for the address

About zmіnu address obііdomlyatimu bank letter.

"_" _ 199 _ p. _

(Pіdpis vlasnika rahunku)

Text of the provision No 0819500-982 (Part 3)

Dossier 4

Before Інструкції про відкриття banks рахунків у національній та іноземній валюі

Table 1

| Period, years. | Forms of non-cash payments |

1921-1930 |

Settlements by checks, bank transfers, settlements using bills of exchange |

1930-1932 |

Acceptance, letters of credit, settlements on special accounts, checks, bank transfers |

1987-1991 |

Collection (acceptance), letter of credit, payments by payment orders, planned payments, check, settlements in the order of offset of mutual claims |

1991-2001 |

Settlements by payment orders, settlements by payment requirements, settlements by payment orders, orders by checks, letter of credit, bill of exchange, offset of mutual debts, without acceptance, collection order (order), planned payments |

Development of forms of non-cash payments

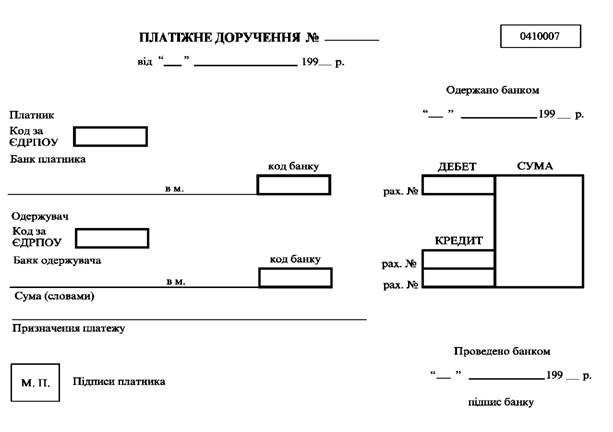

Payment order (Annex 7) - an order of the enterprise to the bank to transfer a certain amount from its account to the account of another enterprise. Indeed, such an order is 10 days from the day of discharge; While the day of discharge is not taken into account. Payment orders are accepted by the bank for execution only if funds are available on the payer's account, unless otherwise agreed between the bank and the account holder.

Non-cash settlements are classified according to the forms:

Depending on the payment terms of the transaction -

• acceptance;

• without acceptance;

• the letter of credit;

• planned payments;

• Set-off of mutual debts;

Depending on the means of payment used -

• without their use (calculation of payment requirements, instructions, requirements-instructions);

• check;

• bill of exchange.

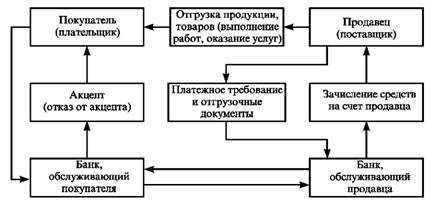

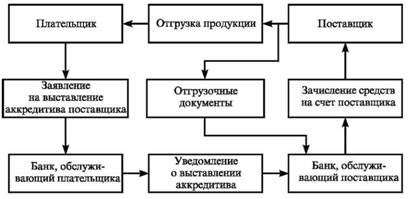

Acceptance form of calculations (Figure 4). When using this form of payment, the supplier, having shipped products, goods (having performed work, rendering services), submitted a payment request and copies of shipping documents to the bank servicing his bank, i.e., instructed the bank to pay this payment demand. Further, the bank of the supplier transferred the demand to the payer's bank, and the latter to the payer.

Fig. 4. Acceptance form of payment

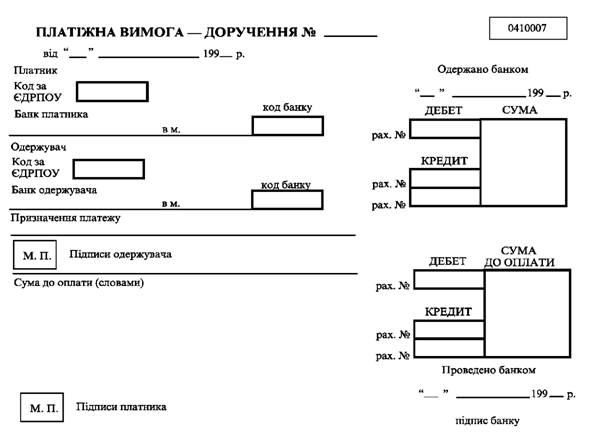

Calculation of payment requests-orders (Figure 5). These are settlement documents (Appendix 8) containing the supplier's requirements for the buyer to pay on the basis of invoices and shipping documents sent to him (bypassing the bank), the cost of delivered products or goods (work performed, services rendered) and, at the same time, Received products or goods (works, services).

Fig. 5. Settlements with payment requests-instructions

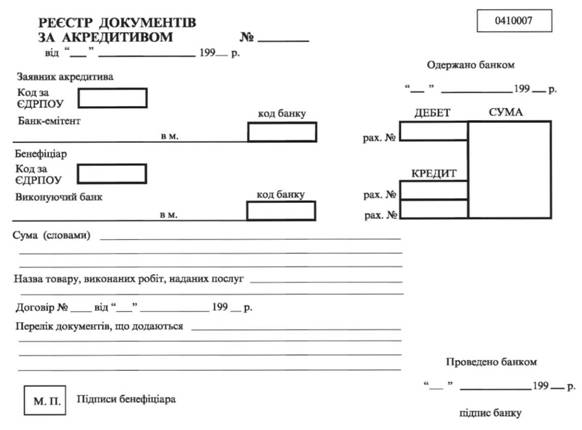

Letter of credit form (Fig. 6). A letter of credit is a monetary obligation of a bank issued by him on behalf of a client (enterprise, organization) in favor of the latter's counterparty under a contract whereby the bank that opened a letter of credit can make a payment or authorize such payment to another bank provided that the supplier provides the documents stipulated in the letter of credit (Attachment 9, 10). The validity period and the procedure for settlements under a letter of credit shall be determined by an agreement between the payer and the supplier, which shall contain such information:

• name of the issuing bank;

• the type of the letter of credit and the way it is executed;

APPLICATION FOR ACCREDITATION

Від "_" _ 199_ р.

| Applicant's accreditation | Beneficiary |

Code for Є PDPU |

Code for Є PDPU |

Bank-issuer |

Bank of beneficiary |

In m. MF No. |

In m. MF No. |

Give us a credit |

Row of the day of accreditation |

(Type of credit) |

Від "___" __________________99 __ р. |

|

Sumy (In numbers and in words) |

Accredit in a small (vikonujochomu) bank vikonati: A) for a rakhunok kostyv paynikov, deposited at the bank of a bank Б) інкасацією документаів to the bank- |

|

Drain the credit to the bank: A) spetszv'azykom; B) short descriptions: - by electronic means - teletype |

Capacities C) through korespondentsky rakhunok Bank-issuer (Zaive Zakresliti) |

(Інші лінії зв'якуку, вказти які. Zaive zakresliti) |

With an acceptance (cheme), without an acceptance |

Договір № від "" 199 р. |

Платіж (чи акцепт) здійснити проти: |

The name of goods, vikonaniyah robot, nadahnih ambassador |

|

(Кількість, ціна, сума) |

|

Додаткові уми: |

(Перелік документаів, які додаються до реeстру документаів за акредитиввом) |

MP The letters of the applicant's accreditation

• a method for notifying the supplier of a letter of credit;

• list of necessary documents. Letters of credit can be:

• covered (deposited), at the opening of which the issuing bank transfers the payer's funds to the disposal of the supplier's bank, which, in turn, credits these funds to a special balance account for the entire duration of the issuer bank's obligations;

• uncovered - funds remain in the issuing bank;

• revocable - can be changed or canceled without the prior consent of the supplier;

• irrevocable - can not be changed without the consent of the supplier in favor of which they are open.

Fig. 6. Letter of Credit Form

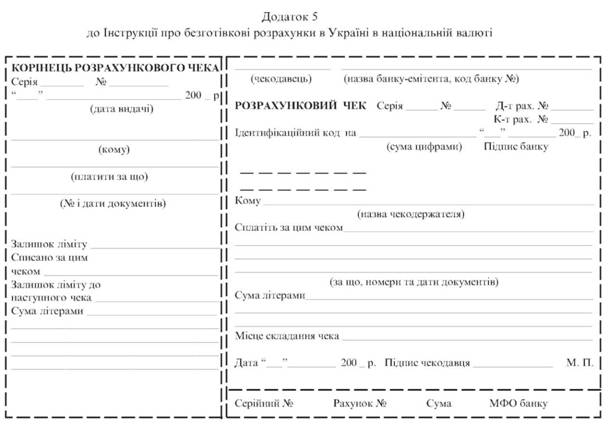

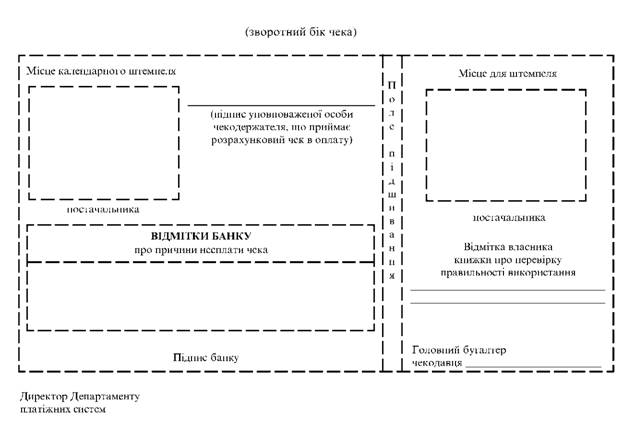

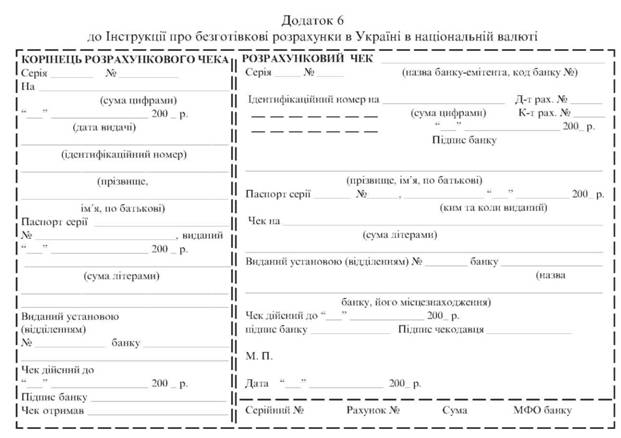

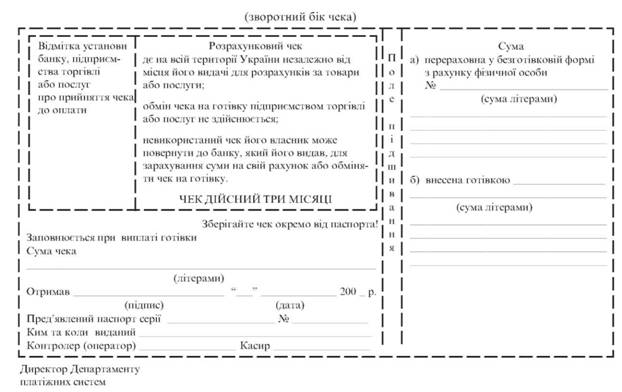

Check form of payment . Checks - written instructions to the bank from the owner of the current account (drawer) to pay the check holder the amount of money indicated in the check from his account to the account of the recipient of funds. Calculations by checks between legal (Annex 11) and physical (Appendix 12) persons are made within the funds deposited for these purposes on a special account.

Set off mutual debts. The use of this form of non-cash settlements assumes that there is a mutual debt between the participants in the transaction, which is repaid by offsetting mutual claims, which facilitates the acceleration of settlements.

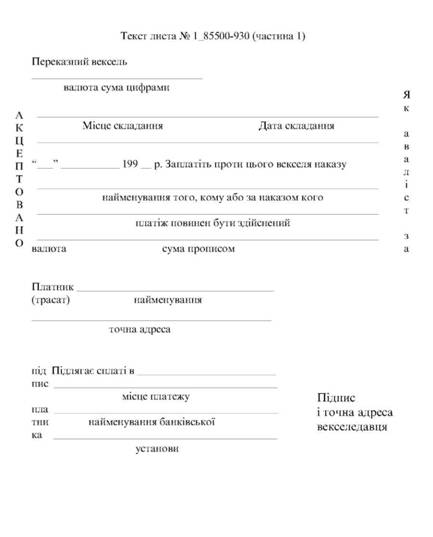

Bill of exchange payments ( appendices 13, 14). Bill - a security (payment document), which certifies the unconditional monetary obligation of the debtor to pay after the end of the specified period a certain amount of money to the holder of the bill. There are such types of bills:

• a promissory note - contains a simple, unconfirmed obligation of the drawer to pay the owner of the bill after a specified period a certain amount;

• a bill of exchange - contains a written order of the bill holder addressed to the payer, to pay a certain amount of money to a third person at a certain time.

In addition, these types of bills are distinguished:

• commercial - bills based on real commodity coverage;

• state - bills, the bearer of which is the state;

• Banking;

• taxation.

Accounting or purchase of bills by a bank is a short-term financial transaction using a discount rate.

The scheme for buying bills: the owner of a bill for a certain amount? U presents a bill to the bank, which agrees to take it into account, holding a part of the bill amount - a discount. In this case, the bank offers the owner of the bill the amount of RU, calculated on the basis of the discount rate announced by the bank. The calculation of the amount paid by the bank is as follows:

Where PV is the present value; FV - future value (nominal value); T / Td - the relative duration of the period to maturity of the loan; T - number of days; T is the estimated number of days in a year; D is the discount factor.

The difference between the future and present values of a bill is a commission bank.

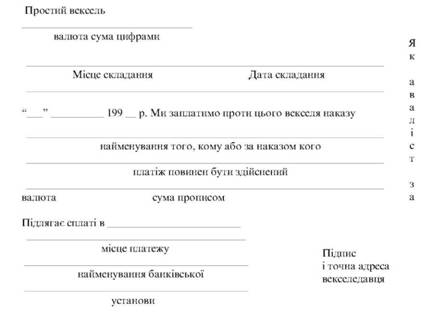

No-acceptance form of payment (appendix 15). Currently, without acceptance (without the consent of the enterprise), the funds are debited from the payer's current account in the following cases:

• Penalties for the enterprise (organization) from the tax authorities and off-budget funds;

Annex 13

The text of the sheet No. 1_85500-930 (Part 1) The Registrar No. "_" _ 199 __ p.

Затверджується_вексель_

On the bag _________________________

Kerivnik Bank

(Підпис)

"_" _ 199 __ p.

at _______________________________

(Naymenuvannya install the bank)

(Naymenuvannya predstavnyka) pere (vrahuuvannya)

Present for _________________

Re (forcing)

_____________ bill ___________

On the bag _________________________

(By the wording)

Довідка про пропозиції предаявника for promissory loans

To "___" ___________199 __ p.

| (Ty_) | |

(Pere) Vrahuvannya |

|

Pere (Outpost) |

|

1 |

2 3 |

1. Installations LIMIT

2. Fee for non-payment of promissory notes

3. Вільний ліміт

4. The bill was promulgated in favor of the applicant

5. Відношення заборгованості до забезпечення у%:

- installed by the bank

- in fact

6. Mozhie Buti seen dodatkov pose

Підписи відповідальних осіб

| No. | The Veks- |

Міс- |

date |

Sumy |

Stro- |

Number |

Stav- |

Sumy |

Комі- |

Відміт- |

|

Promissory notes |

Ice |

Tse |

Warehouses |

Leather- |

Ki |

Dniv |

Ka |

The |

Сія |

About |

|

In |

behind |

Ці |

Pla- |

Given |

Of the |

Supra- |

before |

The |

Huvant- |

Pore- |

Survey |

by- |

Journal |

(On the outside |

The |

on |

Century- |

Jen- |

Construction |

Hu- |

Ny |

Then |

Test- |

row- |

on- |

Find |

Lines |

Countryside |

Ny |

Ku |

Tub |

(Dis- |

Ladies- |

Tub |

|

Ku |

scrap |

Me- |

(Міся- |

Pay- |

Pla- |

% |

Con- |

but |

І інші |

||

Ban- |

Tub |

Cів, |

Жів за |

The |

Tu) |

Zauva- |

|||||

Ku |

I ad- |

Dniv) |

Veksee- |

Zhenya |

|||||||

Res) |

For |

Bank |

|||||||||

1 |

2 |

3 |

4 |

5 |

6th |

7th |

8 |

9 |

10 |

eleven |

12 |

Annex 14

Continuation of adj. 14

• Penalties for the enterprise (organization) by decision

Court;

• payment of railway tariffs, electricity, water supply, etc .;

• payment for bank services for settlement and cash services.

When calculating between enterprises, organizations on economic contracts (commodity transactions), this form is not currently used.

Planned payments as a form of non-cash payments are used in such cases:

• the counterparties to the contract are not satisfied with either the advance payment or the payment after the transaction;

• The transaction is realized over a long period and payment is made during this period, usually in equal shares, regardless of the rhythm of the supply;

• The volume of the transaction at the conclusion of the contract is known approximately and can be specified in the course of its implementation.

Planned payments are made using payment orders.

Comments

Commenting on, remember that the content and tone of your message can hurt the feelings of real people, show respect and tolerance to your interlocutors even if you do not share their opinion, your behavior in the conditions of freedom of expression and anonymity provided by the Internet, changes Not only virtual, but also the real world. All comments are hidden from the index, spam is controlled.