home

Banking Banking

books books

Money and credit - Ivanov VM Money and credit - Ivanov VM

|

Money and credit - Ivanov VM

TOPIC 5. law of money circulation

5.1. Characteristics of law

Money - is the movement of money in cash and cashless forms, serving the sale of goods, as well as non-commodity payments and settlements. Money in its various forms is governed by objective economic law.

The law of value and the form of its manifestation in his address - the law of money circulation - are common to all social formations in which there are commodity-money relations.

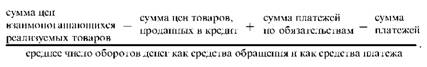

Analyzing the development of forms of value and money circulation, Marx discovered the law of money circulation, the essence of which is expressed in the fact that the amount of money needed to carry out the treatment means of the function must be equal to the sum of the prices of goods sold divided by the speed (velocity of circulation ) of similar units. monetary law expresses the economic interdependence between the mass of circulating commodities, their price level and the rate of circulation of money. Amount of money required for the treatment can be expressed by the formula

In economic science, there is another point of view, which is shared by representatives of the quantity theory of money and supporters of monetarist concept. American economist Irving Fisher formulated the following equation:

where M - money supply; V - velocity of circulation of money; P - the average price of goods and services; Q - quantity of goods sold. of goods sold

monetary law reads as follows: The amount of money needed for treatment is determined by the total amount to be implemented in commodity prices plus the total amount of payments due to the same period of time minus the payments cancel each other by means of redemption.

This law follows the principle of circulation of money - the restriction of the money supply the actual needs of the turnover. Marx analyzed the conditions and laws of maintaining monetary equilibrium is determined by the interaction of two factors: the needs of the economy for money and the actual receipt of money in circulation.

In theory, to determine the value of turnover in the money in a treatment fiat currency can be the amount of money required for the circulation of commodities under the existing shown the level of prices, ie. E. Their real value (purchasing power).

A study of the law requires the repeated monetary analysis. Since the circulation of money services trade, the sum of the prices of goods and services sold for cash and on credit, is an important factor in determining the demand for money. These needs are determined by supply companies, public and private entities on purchasing means of payment, as well as the means of accumulation and savings.

Increased influence of the credit for the circulation of money, due to the prevalence of credit operations and the dominance of credit money. Communication with the movement of currency loan capital is manifested in the fact that money is easy to cross the border credit and monetary sphere, turning into loan capital. The accumulated amount mobilized as a means of circulation and payment for the service of economic turnover.

The need for management in money as determined by the level of prices for goods and services.

The reverse effect on the amount of money needed for circulation, provide:

• The degree of credit (the more goods are sold on credit, the lower the amount of money in circulation is required);

• development of non-cash payments;

• the velocity of money.

With metal handle money spontaneously regulated by means of money in the treasure function; if the need for money was reduced, their surplus (gold coin) went out of circulation in the treasures, if increased - there is the flow of money into circulation of the treasures. Therefore, the amount of money in circulation is maintained at a desired level. Turning swap gold banknotes (free exchange of metal) law precludes a finding in their treatment of excessive amounts. If an appeal is served by banknotes, not bargaining for gold or paper money (treasury notes), the circulation of cash is made in accordance with the law of paper money circulation: specific law of circulation of paper money may arise from their relations to gold only because they represent the last . This law is to ensure that the issue of paper money should be limited to the number of them, in what would really paid a symbolic representation of the gold (or silver).

Therefore, when the amount of paper money is still required to access the theoretical amount of gold, no negative phenomena do not occur - or irredeemable paper money bills will be properly perform the role of banknotes, ie substitutes gold money... This requirement ensures the stability of money and takes place in all social formations where there is circulation.

Unrestricted emission of money leads to a violation of this law, the scope of monetary overflow excessive monetary signs and contributes to their depreciation.

Conditions and laws maintaining money circulation determined by the interaction of two factors: the needs of the economy with money and their actual receipt in hand. If the back more money than you want to pair, then this leads to a devaluation of money - lowering of the monetary unit.

Comments

Commenting, keep in mind that the content and the tone of your messages can hurt the feelings of real people, show respect and tolerance to his interlocutors, even if you do not share their opinion, your behavior in terms of freedom of speech and anonymity offered by the Internet, is changing not only virtual, but real world. All comments are hidden from the index, spam control.