home

Finance Finance

books books

Pricing - Erukhimovich IL Pricing - Erukhimovich IL

|

Pricing - Erukhimovich IL

2.2. Types of income

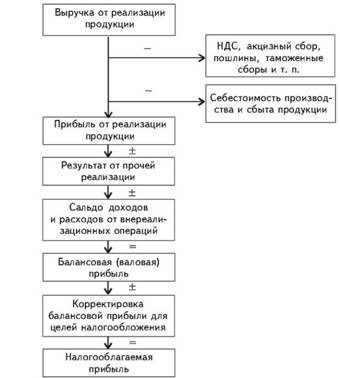

The main share in the profits of the enterprise takes profit from the (Ex) products sales, which depends on the volume of produced (sold) goods (B), its cost (C) and prices (C):

The more the company will produce and sells the product, the greater the amount of profit it will receive, ceteris paribus; the lower the costs of production and marketing, the higher profits at the same price. If the products are of higher quality analog features, it can be sold at a higher price. At the same time the price index Its = Cn / ahead of the Central Bank should іndeks costs Ic = CH / Sat

However, the economic activity of the enterprises is not limited to the manufacture and sale of commercial products. Many companies have on their balance car fleet, subsistence agriculture, proprietary network maintenance and sale of products of own production and other supporting non-industrial sector. Revenues from the production of non-industrial production (works, services), released on the side as well as from the sale of materials, work equipment and intangible assets (rights to use objects of industrial property - inventions, trademarks, service marks, industrial designs and TP, as well as intellectual property - PC software, knowledge banks, know-how, innovation proposals, etc.) are not included in cost of sales, and accounted for separately in "Other sales"... The excess of income over expenditure of this article constitutes income from other sales (CPD).

In addition, the Company carried out extraordinary operations which are not related to the sale of goods (works, services). These include private limited participation in joint ventures, placing on deposit accounts of banks temporarily free funds, income previously written off debt, the payment or receipt of penalties, fines, penalties, as well as changes in exchange rates and so on. N. The difference between the amount of funds received by the enterprise from the non-operating operations, and the amount of expenditure on these operations forms a non-operating profit from operations (PVN).

The total amount of profits earned by the enterprise as a result of production and business activities, or the overall financial reform

result is determined by balancing the total amount of profits and losses of all. This result is called the overall financial balance profit (BOP) and calculated by the formula

It would be wrong to assume that all the profits of the enterprise is its employees on private consumption. In any society, it is a major part of the revenue budget in the form of tax revenues.

The balance sheet profit after tax is called a net profit, which is spent on the social and economic objectives of the enterprise: investing in the development of production, the creation of a financial reserve, the financing of socio-cultural sphere, contributions to the fund of a payment in excess of wages, the establishment of charitable foundations, etc...

The scheme of formation of business profits is shown in Fig. 2.

Fig. 2. Scheme of the formation of the company's profit (company)

The mechanism of formation of the carrying amounts and the calculation of net income clearly seen from the following example.

Index |

Profit, UAH. |

|

1. |

Proceeds from sales (Cost of sales products) excluding VAT and excise duty |

12500 |

2. |

Cost of sales |

10500 |

3. |

Gain on sale of products (p 1 - p. 2). |

2000 |

4. |

Profit from other sales |

650 |

5. |

Profit from extraordinary operations |

350 |

6. |

Balance (gross) profit (p. 3 + p. + 4 p. 5) |

3000 |

7. |

Tax |

900 |

8. |

The net profit remaining at the disposal companies (Page 6 - p. 7). |

2100 |

How to use the net profit determines the owner of the enterprise or its authorized body in accordance with the Charter of the Company. However, common for enterprises of all forms of property is the payment from the net profit of debts and interest on long-term loans. The remaining profit is called distributed.

Comments

Commenting, keep in mind that the content and the tone of your messages can hurt the feelings of real people, show respect and tolerance to his interlocutors, even if you do not share their opinion, your behavior in terms of freedom of speech and anonymity offered by the Internet, is changing not only virtual, but real world. All comments are hidden from the index, spam control.