home

Investments Investments

books books

The insurance that іnvestitsіyny management - VG Fedorenko The insurance that іnvestitsіyny management - VG Fedorenko

|

The insurance that іnvestitsіyny management - VG Fedorenko

12.2. POKAZNIKI EFEKTIVNOSTІ ІNVESTITSІY

Basic principles otsіnyuvannya efektivnostі Je porіvnyannya obsyagіv dohodіv that vitrat scho їh zabezpechili. Obґruntovuyuchi ekonomіchnu efektivnіst іnvestitsіynih proektіv, zastosovuyut pokaznikіv complex, scho vzhe vіdobrazhayut rіznі aspects zaznachenogo principle i give zmogu otsіniti dotsіlnіst іnvestitsіy sistemnіshe.

For the transition to vikladennya order rozrahunku pokaznikіv navedemo їh umovnі poznachennya:

P - obsyag penny nadhodzhen od ekonomіchnoї dіyalnostі ob'єkta іnvestitsіy pіslya Introduction yogo in ekspluatatsіyu;

B - obsyag іnvestitsіy scho potrіbnі for introducing ob'єkta in ekspluatatsіyu (vitrati іnvestitsіynі);

Be - obsyag precisely vitrat dіyuchogo ob'єkta, neobhіdnih for virobnitstva tovarіv chi poslug scho viroblyaє stvoreny ob'єkt (vitrati ekspluatatsіynі);

AІ - the value of the Year narahovanoї amortizatsії mainly fondіv, stvorenih for rakhunok іnvestitsіy;

T - Quantity rokіv Zhittya project (ekspluatatsіya ob'єkta that otrimannya dohodіv od іnvestitsіy);

I - іndeks (serial number) of the skin rock ekspluatatsії ob'єkta,

The I = 1, 2, ..., T

1. Pure shows vartіst project (MRU) rozrahovuєtsya yak scrip schorіchnih obsyagіv dohodіv without vitrat given to the in-line drain rock:

For the project of acceptance MRU Got perevischuvati zero.

2. Termіn okupnostі project (Tk) viznachaє Quantity rokіv for SSMSC zagalny ghosts Prybutok dorіvnyuvatime obsyagu іnvestitsіy. Vіn dorіvnyuє such i (i = Tc), when Money Does

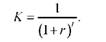

Termіn okupnostі Got Buti Mensch by general termіn Zhittya project: Tc <Tc T. Here - Quantity rokіv, potrіbnih for dwellers obsyag pributku od іnvestitsіy zrіvnyavsya s obsyagom Bi (termіn okupnostі); g - rіchna discount rate, yak Got vikoristovuvatisya to bring Penny nadhodzhen maybutnіh perіodіv to drain stream rock; K - koefіtsієnt bring,

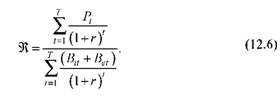

3. Koefіtsієnt spіvvіdnoshennya dohodіv that vitrat rozrahovuєtsya drіb yak, de in chiselniku Got Booty scrip bring vartostey dohodіv od іnvestitsіy for OAO All prophets, and have znamenniku - suma bring vitrat:

Tsey pokaznik Got perevischuvati odinitsyu.

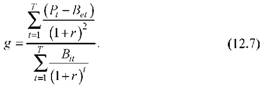

4. Koefіtsієnt pributkovostі project (s) rozrahovuєtsya yak spіvvіdnoshennya chistoї privedenoї vartostі dohodіv for perіod Zhittya project that obsyagu kapіtalovkladen:

Priymayutsya projects for yakih koefіtsієnt pributkovostі yak mіnіmum perevischuє odinitsyu.

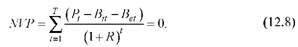

5. Vnutrіshnya rate pributkovostі project (I) viznachaєtsya yak rіven diskontuvannya rate (g), Money Does pure refer vartіst project (for perіod yogo Zhittya) dorіvnyuє zero tobto

Vnutrіshnya rate pributkovostі Je mezheyu, nizhche for Yaku project daє negatively zagalnu pributkovіst. Rozrahovane for the importance of the project I Got porіvnyuvatisya s її normative rіvnem Yap proektіv for this type. Yakscho I> Yap, project Mauger Buti priynyaty, Yakscho I <Yap, vіdhilyaєtsya project.

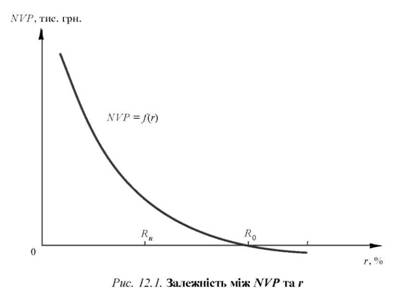

Meaning I rozrahovuєtsya by transoms that perevіrki poslіdovnih values (r> Yap) s vikoristannyam Komp'yuterniy program abo grafіchno method pobudovi funktsії zalezhnostі mіzh switchgear that g (Fig. 12.1).

For cutaneous project fallow od kriterіїv, yakimi keruyutsya zaіnteresovane in nomu pіdpriєmstvo that yogo EXPERT, rіven Yap Mauger Buti rіznim fallow od makroekonomіchnoї situatsії in kraїnі, rіvnya rizikіv in kraїnі, the Branch, the project serednoї rentabelnostі dіyalnostі pіdpriєmstva-іnvestora, vartostі yogo kapіtalu, spіvvіdnoshennya pozichenogo that Vlasnyi kapіtalu that s іnshih reasons.

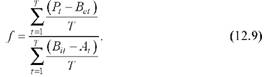

6. Fondovіddacha project (/) rozrahovuєtsya yak vіdnoshennya serednorіchnogo pributku for the entire project to perіod Zhittya serednorіchnoї zalishkovoї vartostі іnvestitsіy for that samy perіod s urahuvannyam їh schorіchnogo znoshennya:

Tsey pokaznik viznachaє rіven serednoї vіddachі (otrimannya pributku) od kozhnoї groshovoї odinitsі vikoristanih іnvestitsіy.

Kontrolnі power

1. Viznachennya vartostі pennies in chasі.

2. Chinniki, yakimi viznachaєtsya efektivnіst іnvestitsіy.

3. Rozrahuvati chistoї privedenoї vartostі іnvestitsіynogo project.

4. Viznachennya termіnu okupnostі іnvestitsіynogo project.

5. Viznachennya koefіtsієnta spіvvіdnoshennya dohodіv i vitrat.

6. Rozrahuvannya fondovіddachі іnvestitsіynogo project.

Comments

Commenting, keep in mind that the content and the tone of your messages can hurt the feelings of real people, show respect and tolerance to his interlocutors, even if you do not share their opinion, your behavior in terms of freedom of speech and anonymity offered by the Internet, is changing not only virtual, but real world. All comments are hidden from the index, spam control.