home

Finance Finance

Books Books

Finance and Statistics - Ковалева А.М. Finance and Statistics - Ковалева А.М.

|

Finance and Statistics - Ковалева А.М.

2. FINANCIAL SYSTEM

2.1 FORMATION OF THE FINANCIAL SYSTEM

An analysis of the laws of the development of finance in different conditions of social reproduction testifies to the existence of common signs in their content. This is due to the preservation of objective reasons and conditions for the functioning of finance. Among these conditions, as noted earlier, there are two: the development of commodity-money relations and the existence of the state as a subject of these relations. Unlike such cost categories as, for example, money, credit, payroll and others, finances are organically related to the functioning of the state.

However, the common signs of all financial relations do not exclude certain differences between them.

In this regard, the financial system is a set of different spheres (links) of financial relations, each of which is characterized by features in the formation and use of funds of funds, a different role in social reproduction.

The financial system of the Russian Federation includes the following links in the Financial Relations; State budget, off-budget funds, state credit. Insurance funds. Stock market . Finance enterprises of various forms of ownership.

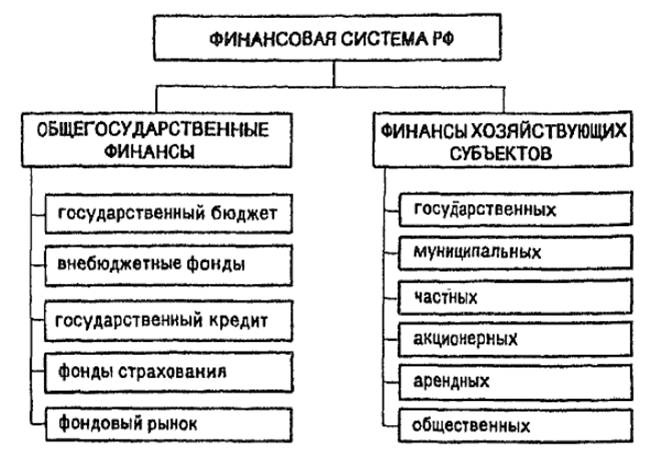

All of the above financial relations can be divided into two subsystems. These are national finances that ensure the needs of expanded reproduction at the macro level, and the finances of economic entities used to provide the reproductive process with monetary funds at the micro level (Fig. 2.1).

The distinction between the financial system and individual links is determined by the differences in the tasks of each link, as well as in the methods for the formation and use of centralized and decentralized funds of funds. National centralized funds of monetary resources are created by the distribution and redistribution of the national income created in the branches of material production.

FINANCIAL SYSTEM OF THE RUSSIAN FEDERATION

Fig. 2.1. Financial System of the Russian Federation

The important role of the state in the field of economic and social development leads to the need to centralize at its disposal a significant part of financial resources. The forms of their use are budgetary and extra-budgetary funds that provide for the state's needs in solving economic, political and social problems. Other forms and methods of formation and use of monetary funds are applied by the credit and insurance links of the financial system. Decentralized funds of money are formed from money incomes and savings of the enterprises themselves.

Despite the differentiation of the sphere of activity and the application of special methods and forms of education and use of money

Funds in each separate link, the financial system is a unified system, since it is based on a single source of resources of all links.

The basis of a unified financial system is the finance of enterprises, since they are directly involved in the process of material production. The source of centralized state funds of funds is the national income created in the sphere of material production.

National finance has a leading role: in ensuring a certain rate of development of all sectors of the national economy; Redistribution of financial resources between sectors of the economy and the regions of the country, production and non-productive spheres, as well as patterns of ownership, separate groups and segments of the population. Effective use of financial resources is possible only on the basis of active financial policy of the state.

State finances are organically linked to the finances of enterprises. On the one hand, the main source of budget revenues is the national income created in the sphere of material production. On the other hand, the process of expanded reproduction is carried out not only at the expense of the enterprises' own funds, but also with the involvement of a nationwide fund of funds in the form of budgetary appropriations and the use of bank loans. If there is a lack of own funds, an enterprise can attract funds from other enterprises on a shareholder basis, and borrowed funds on the basis of operations with securities. Through the conclusion of contracts with insurance companies, business risks are insured.

The interconnection and interdependence of the components of the financial system are due to a single essence of finance.

Through the financial system, the state influences the formation of centralized and decentralized funds, accumulation and consumption funds, using for this purpose taxes, state budget expenditures, state credit.

The state budget is the main link of the financial system. It is a form of education and use of a centralized fund of funds to ensure the functions of public authorities.

The state budget is the main financial plan of the country, approved by the Federal Assembly of the Russian Federation as a law. Through the state budget, the state concentrates a significant share of the national income for financing the national economy, social and cultural events, strengthening the country's defense and maintaining the state authorities and government. With the help of the budget there is a redistribution of the national income, which creates the possibility of maneuvering in cash and purposefully influencing the pace and level of development of social production. This allows for a unified economic and financial policy throughout the country.

In conditions of transition to market relations, the state budget retains its important role. Only the methods of its impact on social production are changed by creating a different mode of spending budget funds. In modern conditions, the development of social production is not ensured by the methods of budget financing and subsidies, but with the help of economic methods that allow the transition to financial regulation of the economy.

Budget funds should be used to implement investment policy, subsidize enterprises, finance conversion of defense industries. Expenditures of the budget in the field of the economy are called upon to contribute to the formation of a rational structure of social production, the building up of scientific and technical potential, and the renewal of the material and technical base. Applying various forms of influence on the economy, the state is able to significantly change the prevailing national economic proportions, for example, to eliminate unprofitable enterprises or to reorient them.

State regulation of the economy can significantly reduce budget expenditures, change their composition and structure.

The important role of the state budget is not limited to financing the sphere of material production. Budgetary resources are also directed to the non-productive sphere (education, health care, culture, etc.). At the expense of budgetary and extra-budgetary funds, enterprises and institutions of social and cultural direction are financed. Budget expenditure, due to the implementation of social policy of the state, are of great importance. They allow the state to develop a system of public education, finance a culture, meet the needs of citizens in medical care, and carry out social protection.

Budget expenditures for socio-cultural activities are not only social, but also economic, since pre-

Are the most important part of the cost of reproduction of labor and serve to enhance the material and cultural standards of people's lives.

One of the links of the state finances is extrabudgetary funds.

Extrabudgetary funds are funds of the federal government and local authorities related to the financing of expenses not included in the budget.

The formation of extra-budgetary funds is carried out at the expense of mandatory deductions, which for ordinary taxpayers are no different from taxes. The basic amounts of deductions to off-budget funds are included in the cost of production and are set as a percentage of the wage fund.

Organizationally, off-budget funds are separated from budgets and have a certain independence.

Extrabudgetary funds have a strictly designated purpose, which guarantees the use of funds in full.

The separate functioning of extra-budgetary funds allows the operative financing of the most important social activities. Unlike the state budget, the expenditure of extra-budgetary funds is subject to less control by legislative bodies. This, on the one hand, facilitates their use, on the other hand it makes it possible to spend funds not in full. Therefore, in order to strengthen control over the expenditure of extra-budgetary funds, the issue of consolidating some of them in the budget with the focus of their spending focuses.

The state loan reflects credit relations concerning the mobilization by the state of temporarily idle funds of enterprises, organizations and the population on the basis of repayment for financing public expenditures.

Creditors are individuals and legal entities, the borrower is the state in the person of its bodies. The state attracts additional financial resources by selling bonds, treasury bills and other types of government securities on the financial market. This form of credit allows the borrower to direct mobilized additional financial resources to cover the budget deficit without implementing emission for these purposes. The state credit is also used to stabilize the circulation of money in the country. In conditions of inflation, state loans temporarily reduce the effective demand of the population. Excessive money supply is withdrawn from circulation, i.е. There is an outflow of money from circulation for a predetermined period.

The need to use state credit is due to the inability to meet the needs of society at the expense of budget revenues. The temporarily free funds of the population and legal entities that are mobilized are used to finance economic and social programs, i.e. State credit is a means of increasing the financial capacity of the state. At the national level, state loans do not express a specific target, while local authorities can use the mobilized funds for the improvement of urban and rural areas, the construction of health facilities, cultural, educational, housing.

Depending on the borrower, government loans are divided into those placed by central and local governments. At the place of placement, the state loan can be internal and external. Based on the term of raising funds, loans are divided into short-term (up to one year), medium-term (from one to five years), long-term (over five years).

The mobilization of huge financial resources as a consequence gives a large public debt. The size of the state loan is included in the state debt of the country.

The public debt is the entire amount of issued but outstanding government loans with interest accrued on them for a certain date or for a certain period.

The state domestic debt of the Russian Federation means the debt obligation of the Government of the Russian Federation, expressed in the currency of the country, before legal and physical persons. Forms of promissory notes are loans received by the Government of the Russian Federation, government loans carried out through the issuance of securities on its behalf, other debt obligations guaranteed by the Government of the Russian Federation.

The state external debt is the debt on outstanding external loans and unpaid interest on them.

Internal debt consists of debts of past years and newly arising debts. Any debt obligations of the Russian Federation are repaid in terms that can not exceed 30 years,

Servicing of public debt is expressed in the implementation of operations for the placement of debt obligations, their repayment and payment of interest on them. These functions are carried out by the Central Bank of the Russian Federation. Expenditures for servicing the public debt are made at the expense of the federal budget. To service the public debt of Russia in 2000 will be allocated 220 billion rubles. Budgetary funds1.

Russia's huge public debt, both internal and external, reflects the economic and financial crisis in the country. Under these conditions, Russia can use the refinancing of public debt, i. Repayment of old state debt by issuing new loans.

Control over the state of the state internal and external debt and the use of credit resources is assigned to the Accounts Chamber of the Russian Federation.

The insurance fund provides compensation for possible losses from natural disasters and accidents, and also helps to prevent them.

Until 1990, insurance in Russia was built on the basis of the state monopoly. This meant that only the state could perform insurance transactions and give guaranteed obligations to compensate for damage suffered by organizations or citizens as a result of a natural disaster or an accident. All insurance operations in the country were conducted by the State Insurance of the USSR, which carried out its work on the basis of economic calculation. The state monopoly on property and personal insurance allowed centralizing the money resources provided for these purposes on a nationwide scale,

In connection with the development of market relations, it became possible to abandon the monopoly of the state in the insurance business. The market encourages state insurance organizations to change the structure and activities in accordance with the new economic conditions. At present, along with state insurance organizations, insurance is carried out by non-state insurance companies that have received licenses for carrying out insurance operations.

Insurance in a market economy is increasingly becoming a sphere of commercial activity, but many insurance companies do not have a clear specialization in the areas of insurance. The Russian newspaper. - 2000. - Jan. 18 - P. 15.

For example, the well-known joint-stock company "ASKO" produces more than 40 types of insurance.

With a developed insurance system, insurance companies specialize in carrying out certain types of insurance services,

Among the links in the financial system, the stock market holds a special place. It can be separated into an independent link, as the stock market is a special kind of financial relations that arise as a result of the purchase and sale of specific financial assets - securities.

The task of the stock market is to ensure the process of capital flow in the industry with a high level of income. The stock market serves to mobilize and effectively use temporarily free cash. Its peculiarity is that the participants of the stock market expect to receive a higher income compared to investing money in the bank. However, the reverse side of increased income is an increased risk. The principles of using financial resources in the stock market depend on the types of securities in which they are invested, and on the types of transactions with securities.

Finances of enterprises of various forms of property, being the basis of the single financial system of the country, serve the process of creation and distribution of social product and national income.

From the state of enterprise finance depends on the provision of centralized monetary funds with financial resources. At the same time, the active use of enterprise finance in the production and sale of products does not exclude participation in this process of the budget, bank credit, insurance.

In a market economy on the basis of economic and financial independence, enterprises operate on the basis of commercial calculation, the purpose of which is to make a profit. They independently distribute the proceeds from the sale of products, form and use production and social funds, and seek the means they need to expand production, using credit resources and the financial market opportunities. The development of entrepreneurial activity contributes to the expansion of the independence of enterprises, their release from petty tutelage by the state and, at the same time, increased responsibility for the actual results of the work.

Comments

When commenting on, remember that the content and tone of your message can hurt the feelings of real people, show respect and tolerance to your interlocutors even if you do not share their opinion, your behavior in the conditions of freedom of expression and anonymity provided by the Internet, changes Not only virtual, but also the real world. All comments are hidden from the index, spam is controlled.