home

Insurance Insurance

lecture notes lecture notes

Ctrahuvannya - Abstract lektsіy Ctrahuvannya - Abstract lektsіy

|

Ctrahuvannya - Abstract lektsіy

Theme 8. Basics of reinsurance i spіvstrahuvannya

The essence of the role of reinsurance i

Require in perestrahuvannі vinikaє for such obstavin:

• mozhlivy zbitok, pov'yazany s great rizikom;

• mozhlivy katastrofіchny vipadok, tobto kumulyatsіya zbitkіv in rezultatі odnієї podії;

• perevischuєtsya serednya frequency zbitkіv.

Reinsurance - strahuvannya one insurer (the assignor, perestrahuvalnikom) on viznachenih contract minds riziku vikonannya Chastain svoїh obov'yazkіv before strahuvalnikom іnshogo insurers (perestrahovika) abo resident nonresident yaky Got status insurer abo perestrahovika, zgіdno s zakonodavstvom Kraina in yakіy vіn zareєstrovany.

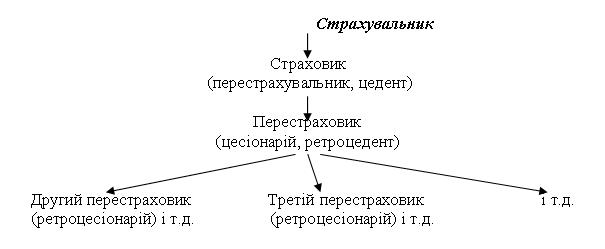

Tobto in dogovorі reinsurance take fate: Insurance tovaristvo scho peredaє rizik; Strahov tovaristvo scho priymaє rizik its vіdpovіdalnіst; poserednik (not obov'yazkovo). Process, pov'yazany s committing riziku, nazivayut tseduvannyam riziku, abo tsesієyu. Insurers (perestrahuvalnika), scho vіddaє rizik, nazivayut assignor. Insurers (perestrahovika), Cauterets rizik priymaє - tsesіonarієm.

Insurer (the assignor, perestrahuvalnik) yaky UCLA s perestrahovikom dogovіr about reinsurance, zalishaєtsya vіdpovіdalnim before strahuvalnikom in Povny obsyazі zgіdno s contract strahuvannya.

When nastannі insurance vipadku perestrahovik Nese vіdpovіdalnіst zgіdno s uzyatimi on itself zobov'yazannyami s reinsurance. Vіdnosini strahovikіv іz regulyuyutsya reinsurance treaties, scho ukladayutsya mіzh them. Rizik, priynyaty perestrahovikom od perestrahuvalnika, Mauger znovu Buti sent messages in pevnіy chastinі іnshomu perestrahoviku. Tsei processes nazivayut retrotsesієyu. Party scho peredaє indirect rizik, nazivayut retrocedent and the parties, scho bere on itself rizik Taqiy, -retrotsesіonarієm.

In rezultatі reinsurance (tsesії) that retrotsesії vіdbuvaєtsya podіl rizikіv, vіdpovіdalnіst rozpodіlyaєtsya mіzh bagatma insurers yak on vnutrіshnomu so i zovnіshnomu on market analysis.

Shlyakhov retrotsesії Chastina rizikіv Mauger znovu Buti transferred directly strahovikovі (tsedentovі). Dwellers uniknuti takoї kumulyatsії zbitkіv have dogovorі reinsurance mozhna zrobiti vіdpovіdne zasterezhennya.

Yak in the insurance, so i in perestrahuvalnih operatsіyah іnodі potrіbnі poseredniki. Neobhіdnіst vikoristannya poslug broker zumovlena spetsifіkoyu rizikіv in perestrahuvannі: rіdkіsnіst rizikіv, їh Visoka vartіst need to rozmіschennі on spetsіalіzovanih Rink. Broker gotuє all potrіbnu іnformatsіyu Offers for i rozmіschuє її optimal way. Pіslya rozmіschennya Offers broker gotuє perestrahovuvalny dogovіr. A pіslya yogo pіdpisannya zabezpechuє neobhіdny dokumentoobіg. Broker otrimuє komіsіyu, varіyuєtsya scho, yak usually od 10 to 15% of net premії.

Otzhe, golovnі funktsії broker takі:

• Presentation klієnta;

• konsultuvannya;

• Maintaining peregovorіv;

• rozpodіl rizikіv.

In razі kupіvlі in perestrahovika Zahist (garantії od zbitkіv) insurer peredaє Yomou Chastain riziku and takozh i Chastain premії. Ale for the company profile priya riziku on strahuvannya insurer Got right to otrimannya komіsіynoї vinagorodi, abo komіsії s premії. Otzhe, front fee - tse uzgodzhena Chastina incurred assignor vitrat s ukladannya dogovorіv strahuvannya.

Іsnuyut takі Vidi komіsіy:

Origіnalna front fee - vіdrahuvannya s premії on korist assignor. Viplachuєtsya in perestrahovuvalnіy tsesії.

Perestrahovuvalna front fee - vіdrahuvannya s premії on korist retrocedent. Vikoristovuєtsya at retrotsesії.

Brokerska front fee - vіdrahuvannya s premії on korist broker. Pokrivaє vitrati, pov'yazanі s rozmіschennyam perestrahovuvalnogo contract i for tsomu vrahovuє Prybutok rozmіschennyu.

Insurer (the assignor) takozh Got right to tantєmu - vіdrahuvannya s pributku perestrahovika, yaky Mauger otrimati vіn the results prohodzhennya treaty reinsurance. Tantєma viplachuєtsya schoroku іz sumi clean pributku, yaky otrimuє perestrahovuvalna kompaniia. Tse form zaohochennya perestrahovikom perestrahuvalnika schodo nadanoї uchastі in dogovorі reinsurance, sumlіnnostі that obachnogo administered by the right.

Location valued at perestrahuvannі posіdayut perestrahovuvalnі bullets. Rozrіznyayut two tipi pulіv: strahuvannya pool i pool of reinsurance. Poole strahuvannya conduct polіsіv sales for yakimi OAO All yogo Participants commit themselves ranіshe uzgodzhenu chastku vіdpovіdalnostі. Poole reinsurance peredbachaє scho insurers vipuskayut polіsi samostіyno, utrimuyut uzgodzhenu chastku and Rasht peredayut in pool on osnovі quota abo ekstsedentu. Perestrahovuvalny pool dіє yak poserednik, rozpodіlyayuchi peredanі in reinsurance riziki mіzh svoїmi members. W look around to svіtovy dosvіd dotsіlnim vvazhaєtsya bullets stvoryuvati in strahuvannі rizikіv s mozhlivoyu katastrofіchnoyu vіdpovіdalnіstyu (yadernі riziki, avіatsіynі, morskih hull vessels).

Comments

Commenting, keep in mind that the content and the tone of your messages can hurt the feelings of real people, show respect and tolerance to his interlocutors, even if you do not share their opinion, your behavior in terms of freedom of speech and anonymity offered by the Internet, is changing not only virtual, but real world. All comments are hidden from the index, spam control.