home

Insurance Insurance

lecture notes lecture notes

Ctrahuvannya - Abstract lektsіy Ctrahuvannya - Abstract lektsіy

|

Ctrahuvannya - Abstract lektsіy

Theme 7. Credit Strahuvannya that fіnansovih rizikіv

In stosunkah mіzh creditor (pozikodavtsem) that yogo borzhnikom (pozichalnikom) subject їhnogo spіlnogo іnteresu - credit - stvoryuє rіznі ekonomіko-pravovі situatsії: for borzhnika - zobov'yazannya poziku rotate and for the lender - right vimagati її Povernennya for poperedno uzgodzhenimi minds. Nevikonannya s rіznih reasons Tsikh domovlenostey zagrozhuє kreditorovі fіnansovimi zbitkami, yakih vіn namagaєtsya uniknuti s Relief rіznih Available zahodіv that materіalnogo legal nature. When tsomu legal zabezpechennya peredbachaє scho nalezhnі kreditorovі sumi shaping can Buti povernenі Yomou tretіmi individuals.

Strahuvannya kreditіv bazuєtsya on viznannі riziku non-payment chi neplatospromozhnostі pozichalnikіv, yaky formuєtsya in protsesі kredituvannya.

Іstorichny prototype of strahuvannya kreditіv ubachaєtsya in komіsіynіy operatsії for minds zdіysnennya yakoї ukladalasya dodatkova land, called del credere. Komіsіoner for vіdpovіdnu dodatkovu vinagorodu, yak vvazhalasya pay for vzyattya riziku komіsіynoї operatsії, garantuvav komіtentovі, scho bill for Prodan from the loan product bude vikupleno in viznacheny termіn. Otzhe, please del credere nabuvala nature vekselnoї bail zgіdno s yakoyu in razі nepovernennya Borg THIRD PARTY komіsіoner zobov'yazany CCB viplatiti vіdshkoduvannya komіtentovі in Povny obsyazі zaborgovanostі. Oznachaє Tse, scho shirokovіdoma komіsіyna operatsіya are themselves Pochatkova form strahuvannya kreditіv s usіma neobhіdnimi attributes strahovoї operatsії: rizikom nepovernennya loan viznachenim obsyagom vіdpovіdalnostі, insurance premієyu in formі dodatkovoї vinagorodi that real vіdshkoduvannyam zbitkіv.

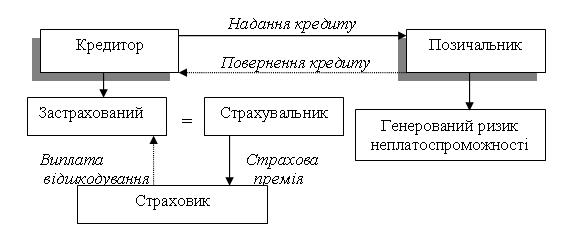

Fig. 4. Scheme delkredernogo strahuvannya kreditіv

In razі delkredernoї FORMS organіzatsії vіdnosin of insurance creditors (banks, іnvestori that INSHI) vіdіgrayut role strahuvalnikіv i odnochasno are insured and that strahovі vіdnosini obmezhuyutsya deprivation stosunkami mіzh EYAD parties - insurers i strahuvalnikom.

Delkrederne strahuvannya skladaєtsya s dvoh group of insurance vіdnosin: strahuvannya trademark kreditіv i strahuvannya fіnansovih (Penny) kreditіv. In pershіy grupі INSURANCE Zahist zabezpechuєtsya vnutrіshnomu yak, so i zovnіshnomu (eksportno-іmportnomu) tovaroobіgu, yaky zdіysnyuєtsya on kreditnіy osnovі. Friend grupu delkredernogo strahuvannya stanovlyat operatsії Zi strahuvannya fіnansovih kreditіv, tobto perevazhno tієї Chastain spozhivchih kreditіv that kreditіv pid іnvestitsіynі require yak form y groshovіy formі.

Mainova іnteres lender Mauger Buti zahischeny poseredno - Shlyakhov insurance platospromozhnostі Zahist yogo borzhnika. For tsієї forms of insurance vіdnosin strahuvalnikom Je pozichalnik. Vіn, bezposeredno strahuyuchi his platospromozhnіst, poseredno zahischaє Interests Svoge vіritelya - lender. Vodnochase insurer, strahuyuchi platospromozhnіst pozichalnika, daє note by garantіyu kreditorovі rotate Yomou Borg. Otzhe, іz legal side tsya insurance operatsіya Yea, for sutі, nadannyam insurer insurance garantіynogo zobov'yazannya, yak to the lender sluguє outpost on vipadok nepovernennya Yomou Borg. W looking around at tse in strahovіy teorії that praktitsі strahovі vіdnosini this nature іmenuyutsya Zastavna, abo garantіynimi.

Ekonomіchny zmіst strahovoї garantії zvoditsya before scho insurer zamіst otrimanoї nevisokoї strahovoї premії bere on itself zamіst borzhnika role Warranty Payment yogo povnoї zaborgovanostі in viznachenih termіnah on korist are insured (benefіtsіanta) tsієї garantії.

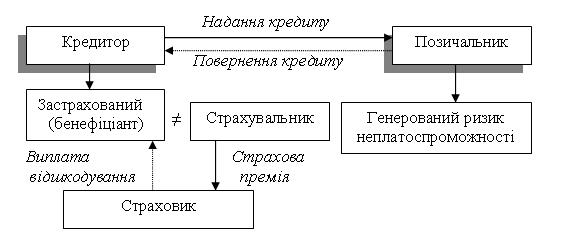

When garantіynomu (Zastavna) strahuvannі in vіdnosini vstupayut not Dvi, yak at delkredernomu strahuvannі and three sides:

lender - sub'єkt on korist yakogo Got Booty vikonane zobov'yazannya i yaky odnochasno Yea that are insured benefіtsіantom strahovoї garantії;

pozichalnik - sub'єkt, zobov'yazany rotate Borg, vіn same strahuvalnik;

guarantee - insurance mortgage, yaky garantuє vikonannya zobov'yazan, vіn same insurer.

Fig. 5. Vzaєmovіdnosini storіn at garantіynomu strahuvannі

In the minds Zastavny (garantіynogo) strahuvannya items Zahist insurance (insurance garantіy) shaping can Buti rіznі vartostі, peredanі a credit ambushes among sub'єktami іnshim. These vartostyami, zokrema, krіm bankіvskih pozik, shaping can Buti sumi nalezhnogo to splat mita abo Well іnshih prikordonnih podatkіv that zborіv, sumi nalezhnih kompensatsіy for nevchasne vikonannya budіvelno and assembly robіt, nevikonannya supply tovarіv that іnshih kontraktіv, sumi otrimanih avansіv, SSMSC pіdlyagayut Povernennya. Tse so zvanі klasichnі zobov'yazannya, pid SSMSC nadayutsya strahovі garantії.

In grupі Zastavny (garantіynogo) strahuvannya praktikuєtsya takozh Zahist Especially napryamok insurance - strahuvannya fіnansovih garantіy. Tehnіka nadannya INSURANCE garantіy staє dedalі rіznomanіtnіshoyu. Same to loans, vidanі pid rіznі fіnansovі garantії, ob'єdnuyutsya in Dvi groups:

a) loans, yakih Povernennya garantuєtsya zaluchennyam long time vіdomih fіnansovih іnstrumentіv. Іdetsya about іpotechnі that bankіvskі loans, SSMSC vidayutsya pid outpost іpoteki abo іnshogo lane, scho nalezhit pozichalnikam. Іpoteka she Lots Other Mein stayut objects strahuvannya and pozichalnik vіdpovіdno - strahuvalnikom i insured in the odnіy osobі;

b) loans, yakih Povernennya garantuєtsya borgovimi zobov'yazannyami fіnansovogo nature: oblіgatsіyami, aktsіyami, Paper the komertsіynimi, sertifіkatami fіnansovih aktivіv of companies. W look around to rіznomanіtnіst vidіv garantіy їh podіlyayut on garantії scho stosuyutsya vіdnosin mіzh Private sub'єktami, that garantії scho stosuyutsya vіdnosin have yakih one Zi storіn Je sub'єktom zagalnonarodnogo, sovereign value. Emіtenti borgovih zobov'yazan samі th іnіtsіyuyut TAKE strahuvannya, dwellers pіdnyati dovіru to himself.

When garantіynomu strahuvannі, yak i at delkredernomu, zastosovuyut two ways nadannya insurance Zahist:

• Disposable - zastosuvannya schodo okremoї kreditnoї operatsії, yak potrebuє strahovoї garantії;

• bagatorazovy, werewolves - schodo zagalnoї kіlkostі operatsіy, SSMSC shaping can Buti zdіysnenі one hour borzhnikom protyagom dії lands about garantіyne strahuvannya.

Sered rozmaїttya Credit vіdnosin, SSMSC zdіysnyuyutsya on Suchasnyj credit market analysis, Especially values carols kreditnі Hotel, vіdomі Dovira yak loan. The butt of the loan Je Dobri, dovіrchі vіdnosini mіzh pratsedavtsem (creditor) that naynyatim pratsіvnikom (borzhnikom). Takі vіdnosini mozhut nabuvati real zmіstu in peredannі pratsedavtsem svoєmu pratsіvnikovі in timchasove koristuvannya zasobіv transport abo Well іnshih tsіnnostey. Otzhe, vinikaє rizik nevipravdannya Dovira pratsedavtsya. On vipadok zavdannya Yomou zbitkіv pratsіvnikom pratsedavets Mauger zastrahuvatisya. Tsey view strahuvannya, yak bachimo, s one side, Got character delkredernogo, more strahuvalnikom Je lender, and other s - nabiraє FORMS strahovoї garantії, oskіlki INSURANCE polіs becoming subject to force. Same to Absent pіdstav strahuvannya Dovira uniquely vіdnositi to delkredernoї chi zastavnoї groupies.

Otzhe, beruchi to uwagi rіznomanіtnіst nature operatsіy, pov'yazanih іz bezposerednіm strahuvannyam kreditіv that nadannyam INSURANCE garantіy vzaєmovіdnosin of the credit, credit strahuvannya mozhna viznachiti yak gospodarsky mehanіzm meta yakogo - zadovolniti vipadkovі otsіnyuvanі maynovі require SSMSC vinikayut s riziku nepovernennya loan pererozpodіlivshi vtrati mіzh sub'єktami cREDIT INSURANCE vіdnosin.

In ekonomіchnіy, strahovіy lіteraturі zmіst ponyattya fіnansovogo riziku not uniquely Je. Zdebіlshogo strahuvannya fіnansovih rizikіv rozglyadaєtsya in vuzkomu that rozumіnnі wide. In vuzkomu rozumіnnі tse strahuvannya Tlumach yak strahuvannya deprivation Credit rizikіv and wider yogo rozumіnnya ohoplyuє takozh Zahist usі Vidi insurance rizikіv quiet, SSMSC viyavlyayutsya to whether yakіy sferі viznachenih fіnansovih vіdnosin abo bezposeredno sprichinyuyut fіnansovі vtrati.

Uwagi! On vіdmіnu od bagatoh vidіv strahuvannya, subject Zahist yakih Je nayavne Main, strahuvannya od vtrat pributku Je forms of insurance Zahist gospodarskih sub'єktіv od vtrat maybutnoї koristі. Vipadkova vtrata maybutnoї koristі (at danomu razі - ochіkuvanogo pributku) Mauger nastati peredusіm s reasons vipadkovogo recession virobnichogo processes navіt abo yogo zupinki. Zbitki, yakih gospodarsky sub'єkt Mauger tsogo zaznati vnaslіdok vipadku not obmezhuyutsya deprivation vtratoyu maybutnoї koristі. Before them slіd takozh Add your Costa, vitrachenі to pay so the title of postіynih require zumovlenih neobhіdnіstyu postіyno pіdtrimuvati zhittєdіyalnіst gospodarskogo sub'єkta and takozh pov'yazanih іz processes yogo Povernennya to poperedno viznachenoї virobnichoї prog. Krіm of Yakscho znizhennya chi prizupinennya virobnichogo processes come vnaslіdok neperedbachenogo vipadku then obsyag zbitkіv for rakhunok Mauger zrosti vitrat, SSMSC zdіysnenі s metoyu protistoyannya naslіdkam tsogo vipadku. Otzhe, vtrata maybutnoї koristі and vіdpovіdno i її INSURANCE Zahist, nіkoli not viyavlyayutsya samostіyno.

Zvichayne strahuvannya Mainova zasobіv dosit often pokrivaє deprivation Neznachny Chastain vtrat, yakih conceited gospodarsky sub'єkt unaslіdok Wink riziku. Nabagato bіlshimi yogo shaping can Buti vtrati, zavdanі neotrimannyam spodіvanogo pributku. Prote on zvichayne base Mainova strahuvannya pokladaєtsya zavdannya zabezpechiti Costa, dostatnі for vіdtvorennya znischenih zasobіv that predmetіv virobnitstva. W tsієyu metoyu naybіlsh Bazhanov Bulo b strahuvannya lane Main fondіv at Yogo novіy vartostі od Basic (nayposhirenіshih) rizikіv.

This shape strahovoї vіdpovіdalnostі, yak peredbachaє principle "basis for the older" tobto if insurance scrip ob'єkta takes rіvnі yogo vіdnovlyuvanoї vartostі already zaprovadzhuvalasya zagalnomu in order from the one Nіmechchinі Avstrії slit rotsі in 1929. Organіzatsіya such insurance Zahist stosuvalasya zdebіlshogo riziku Vaughn. Tacke strahuvannya Je serednіm type mіzh strahuvannyam real Mainova vtrat in їh zalishkovіy vartostі i strahuvannyam vtrat ochіkuvanoї koristі, tobto strahuvannyam lost mozhlivostey.

Strahov vіdshkoduvannya, otrimane strahuvannі at the "novіy vartostі" daє zmogu vchasno vіdnoviti virobnichy processes, perervany through nastannya vipadkovoї podії. Strahuvannya od vtrati pributku peredbachaє viplatu vіdshkoduvannya, yak zamіnyuє are insured for sub'єkta regularly nadhodzhennya penny koshtіv, neobhіdnih for fіnansuvannya gospodarskogo processes, zberіgannya fіnansovoї konditsії on this rіvnі, yaky LUVs bi dosyagneny at nenastannі insurance vipadku.

Strahov vіdpovіdalnіst at strahuvannі od vtrat pributku Je zbіrnoyu th ohoplyuє takі Vidi zbitkіv:

• vitrati, SSMSC toil postіyny character i Je neobhіdnimi navіt protyagom vinikloї Pererva virobnichogo processes;

• Gain on vitrat virobnitstvo and takozh dodatkovih vitrat, spryamovanih on otrimannya decline in virobnitstva minds SSMSC sklalisya pіslya insurance vipadku. Nagromadzhennya Tsikh zbitkіv zumovlyuє orenda dodatkovih virobnichih Area, cars, mehanіzmіv, payment pratsі for the robot in the one hour pozaurochny INSHI come in;

• vtrata pributku, obchislyuvana for spetsіalnoyu techniques.

Krіm vtrati pributku, yak Mauger article via bezposerednє poshkodzhennya lane i chi spovіlnennya zupinennya virobnichogo processes, Prybutok Mauger Buti vtracheny takozh todі, if the insurance nastane vipadok from cooperants danogo gospodarskogo sub'єkta. Cooperants, yaky vіdіgraє role postachalnika, arrogant bezposerednіh Mainova vtrat not zumіє vikonati domovlenostey about postachannya. Tse prizvede themselves to such a negative naslіdkіv, yak i vimushena Pererva virobnichogo processes through poshkodzhennya lane. Great ymovіrnіst nastannya such vipadkіv takozh daє pіdstavi for vіdpovіdnogo dodatkovogo insurance Zahist od їh naslіdkіv.

Zagalny obsyag strahovoї vіdpovіdalnostі insurers when strahuvannі od vtrat pributku viznachaєtsya the size strahovoї sumi. Strahov scrip for potreb tsogo strahuvannya obchislyuєtsya on bazі peredbachuvanogo obsyagu pributku that obsyagu postіynih vitrat, SSMSC mozhut sklastisya in gospodarskomu rotsі. In praktitsі strahuvannya od vtrat pributku zastosovuєtsya ponyattya pributku - gross. Prybutok Gross, in his Cherga, skladaєtsya s dvoh Chastain: Vlasnyi pributku in ekonomіchnomu znachennі tsogo ponyattya, title pributkom net, that postіynih vitrat, SSMSC Je clean vtratami in idle minds virobnitstva.

Osoblivіstyu strahuvannya od vtrat pributku Yea those scho obsyag zbitku deposits not stіlki od rozmіru znischen (yak at razі zvichaynih Mainova strahuvan) skіlki od trivalostі Pererva virobnichoї dіyalnostі. Chinnik hour harakterizuєtsya spetsifіchnim parameter yaky viznachaєtsya i zastosovuєtsya deprivation at strahuvannі od vtrat pributku - termіnom vіdshkoduvannya. Him Yea rozrahunkovy perіod dіyalnostі pіdpriєmstva, protyagom yakogo nagromadzhuyutsya negativnі result od Pererva virobnitstva through maynovі zbitki.

Trivalіst tsogo perіodu viznachaєtsya bezposeredno strahuvalnikom i Got vіdpovіdati maksimalnіy trivalostі hour, neobhіdnogo pіdpriєmstvu for dosyagnennya obsyagu virobnichogo turnover, yaky vono little to nastannya insurance vipadku. Rozrahunok tsogo termіnu, yak usually doruchaєtsya visokokvalіfіkovanim spetsіalіstam - riziku managers, brokers. Pong toil vrahuvati not deprivation chinnik hour and minutes INSHI chinniki and the Same: konstruktsіyu ob'єktіv are insured, type gospodarskoї dіyalnostі, skladnіst virobnichoї tehnologії, nayavnіst that access to fіnansovih resursіv, neobhіdnih for vіdnovlennya dіyalnostі.

Insurers, yak usually pogodzhuєtsya on zaproponovany strahuvalnikom termіn vіdshkoduvannya. Tsey termіn Je perіodom, deprivation in the furrows yakogo insurer Nese vіdpovіdalnіst for vtratu pributku. Same insurer to yak, so i strahuvalnik rozumіyut scho trivalіst termіnu vіdshkoduvannya Je nayvazhlivіshim chinnikom vplivu the insurance scrip. Schopravda have strahovіy praktitsі not doderzhuyut pryamoї zalezhnostі mіzh establishing termіnom vіdshkoduvannya that obsyagom strahovoї sumi. In quiet vipadkah, if termіn vіdshkoduvannya korotshim takes 12 months at, insurers zastosovuyut tablitsі fraktsіynogo type: for korotshih termіnіv insurance scrip vstanovlyuєtsya vіdnosno vischoyu, nіzh for trivalіshih termіnіv. Nayposhirenіshim Je termіn vіdshkoduvannya trivalіstyu od kіlkoh months at up to a rock.

Strahovі tariffs for potreb strahuvannya od vtrat pributku rozrahovuyut zgіdno s vimogami zagalnoї technique s urahuvannyam Pevnyi Especially otsіnki riziku, yaky hard at the foundation danogo strahuvannya. Zokrema, rizik vtrati pributku zavzhdi Je pohіdnim od riziku nastannya Mainova zbitkіv yak Svoge riziku base. Osoblivіst їh vzaєmozv'yazku polyagaє takozh in fact, scho mіzh them Absent kіlkіsnoї zalezhnostі. Aje navіt Neznachny Mainova Skoda zdatna prizvesti to zupinki tsіlogo virobnitstva to tsіlkovitoї vtrati pributku. Otzhe, insurance tariffs Got vrahovuvati ymovіrnostі nastannya such rizikіv:

a) base riziku (poshkodzhennya, abo znischennya Mainova zasobіv);

b) riziku spovіlnennya abo zupinennya virobnichogo processes.

Zapitannya for samoperevіrki

- SSMSC іsnuyut FORMS strahuvannya kreditіv?

- Hto in the minds delkredernoї FORMS strahuvannya kreditіv vіdіgraє role strahuvalnika?

- SSMSC vtrati vrahovuyutsya at strahuvannі pributku?

- Scho pid rozumіyut termіnom "vіdshkoduvannya"?

Comments

Commenting, keep in mind that the content and the tone of your messages can hurt the feelings of real people, show respect and tolerance to his interlocutors, even if you do not share their opinion, your behavior in terms of freedom of speech and anonymity offered by the Internet, is changing not only virtual, but real world. All comments are hidden from the index, spam control.