home

Management Management

lecture notes lecture notes

Upravlіnnya special projects (abstract lektsіy NUDPSU) Upravlіnnya special projects (abstract lektsіy NUDPSU)

|

Upravlіnnya special projects (abstract lektsіy NUDPSU)

2. Obґruntuvannya dotsіlnostі project

2.1. Viznachennya design alternatives

2.1.1. Viznachennya kriterіїv Vibor proektіv

Nezvazhayuchi on rozmaїtіst proektіv їhnіy analіz zvichayno vіdpovіdaє pevnіy zagalnіy skhemі scho vklyuchaє spetsіalnі rozdіli, SSMSC otsіnyuyut komertsіynu, tehnіchnu, fіnansovu, ekonomіchnu th іnstitutsіonalnu vikonuvanіst project.

Figure 2.1. Zagalna poslіdovnіst analіzu project.

Organіzatsіynі tsіlі that tsіlі іnvestitsіynogo project can dosyagti deprivation todі, if i require viznachenі Bazhannya tsіlovih rinkіv i znayshli Roads Ahead efektivnіshe for konkurentіv zadovolnyati require klієntіv. W tsієyu metoyu held analіz komertsіynoї zdіysnimostі project (Marketing analіz).

Tehnіchny analіz posіdaє promіzhne Location mіzh analіzom market analysis that fіnansovim analіzom. Tehnіchny analіz poklikany vіdpovіsti on the power yak i mi s yakimi vitratami'll viroblyati produktsіyu project. Won a vіdpovіdі on tsі diet shall never be perehoditi to rozrahunku rіznih fіnansovih pokaznikіv that dokumentіv.

Tehnіchny analіz poklikany Show tehnіko-tehnologіchnu obґruntovanіst Design rіshen.

Rule Vibor tehnologії peredbachaє Complex analіz deyakih alternative tehnologіy i vibіr naykraschogo varіanta on osnovі Pevnyi agregovanogo kriterіyu.

Klyuchovі factorization Vibor Sered alternative tehnologіy zvodyatsya to analіzu the following aspektіv vikoristannya tehnologіy:

- dosvіd vikoristannya obranih tehnologіy in podіbnih scale (scale shaping can Buti zanadto velikі for a specific market analysis);

- dostupnіst sirovini (skіlki potentsіynih postachalnikіv, SSMSC їhnі virobnichі potuzhnostі, yakіst sirovini, yak Quantity іnshih spozhivachіv sirovini, vartіst sirovini method i vartіst delivery rizik in vіdnoshennі navkolishnogo seredovischa);

- komunalnі Hotel i komunіkatsії;

- nayavnіst in organіzatsії scho prodaє tehnologіyu, patent chi lіtsenzії;

- Pochatkova suprovіd virobnitstva owner tehnologії;

- pristosovanіst tehnologії to mіstsevih drain (temperature, etc. vologіst i);

- zavantazhuvalny factor (in vіdsotkah od nomіnalnoї potuzhnostі minds for the project) for i hour at vihodu stіyky camp, scho vіdpovіdaє povnіy produktivnostі;

- bezpeka th ekologіya;

- kapіtalnі i virobnichі vitrati.

In tablitsі 1 Aim the butt of such bagatoalternativnogo Vibor have Money Does Leather factor otsіnyuєtsya on desyatibalnіy shkalі.

Tehnіchny analіz dozvolyaє viznachiti іnvestitsіynih vitrat value of the project is the potochnі vitrati on Key infrastructure produktsії. Tse nadaє zmogu at spіvstavlennі s forward-looking obsyagom prodazhіv zrobiti visnovki schodo mozhlivostі realіzatsії project in danih minds.

Table 2.1.

Butt Vibor maintained upstream tehnіchnogo rіshennya.

Klyuchovі factorization |

heaver kriterіyu |

alternatives |

|||

A |

AT |

FROM |

D |

||

Kolishnє vikoristannya |

3 |

6 |

3 |

2 |

0 |

Dostupnіst sirovini |

5 |

3 |

4 |

6 |

9 |

Komunalnі Hotel i komunіkatsіya |

2 |

5 |

3 |

2 |

6 |

Nayavnіst patent chi lіtsenzії |

1 |

0 |

0 |

10 |

10 |

Pristosovanіst tehnologії to mіstsevih minds |

2 |

7 |

5 |

4 |

7 |

Zavantazhuvalny factor |

3 |

7 |

4 |

6 |

8 |

Bezpeka th ekologіya |

4 |

10 |

8 |

5 |

3 |

Kapіtalnі i virobnichі vitrati |

5 |

5 |

4 |

8 |

6 |

The value zvazhenogo kriterіyu |

143 |

109 |

136 |

147 |

|

Rozrahunok uzagalnenogo kriterіyu held on formulі:

G = W1G1 + W2G2 + ... + WnGn

de W - Wagga kriterіyu, G - the value kriterіyu.

Naykraschim priymaєtsya tehnіchny project, scho Got naybіlshe kriterіyu values. Zokrema have rozglyanutomu prikladі tehnіchnі Alternatives A and D mayzhe odnakovі, ale mozhna vіddati perevagu D.

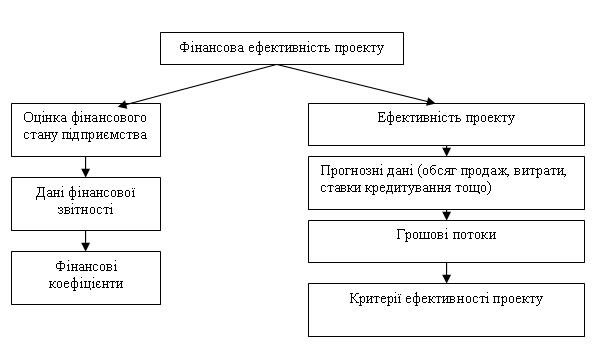

Fіnansovy analіz іnvestitsіynogo project - tse sukupnіst priyomіv that metodіv otsіnki efektivnostі project for all rows in Zhittya vzaєmozv'yazku s precisely dіyalnіstyu pіdpriєmstva.

Fіnansovy analіz peredbachaє virіshennya such zavdan:

- dati otsіnku fіnansovogo i'm fіnansovih rezultatіv pіdpriєmstva "without project" i "s project";

- otsіniti needful in fіnansuvannі project i zabezpechiti koordinatsіyu vikoristannya fіnansovih resursіv in chasі;

- viznachiti dostatnіst ekonomіchnih stimulіv for potentsіynih іnvestorіv;

- otsіniti, optimіzuvati th zіstaviti vitrati that Vigoda project kіlkіsnomu vimіrі.

Figure 2.2. Driving fіnansovogo analіzu

Ekonomіchny analіz skladaєtsya in otsіntsі vplivu vnesku project zbіlshennі bagatstva powers (natsії).

For great іnvestitsіynih proektіv krіm otsіnki їhnoї fіnansovoї efektivnostі priynyato analіzuvati ekonomіchnu efektivnіst i ekonomіchnu privablivіst (tobto stupіn vіdpovіdnostі natsіonalnim prіoritetnim project tasks).

Vimіr ekonomіchnoї efektivnostі held s urahuvannyam vartostі mozhlivoї zakupіvlі resursіv i gotovoї produktsії, vnutrіshnіh tsіn (SSMSC vіdrіznyayutsya od svіtovih), i bagato chogo іnshogo scho Yea vіdmіnnoyu risoyu Kraina i do not zbіgaєtsya Zi svіtovimi rules i roztsіnkami (napriklad, minds robots s currency іnshih kraїn ).

Sze times pіdkreslimo scho ekonomіchny analіz zvichayno performed to great іnvestitsіynih proektіv scho rozroblyayutsya of order for Uryadov i poklikanі virіshiti natsіonalno significant problems. Yakscho pіdpriєmstvo rozroblyaє іnvestitsіyny project on svoїy vlasnіy іnіtsіativі, samostіyno zaluchayuchi іnvestora, vono in residual pіdsumku fokusuє zagalny іnteres project on Vigoda yogo uchasnikіv, headaches rank quiet fіzichnih i Yurydychna osіb scho Nadali fіnansovі resources for the project. Yakscho in the I number Tsikh osіb not include power, ekonomіchny analіz project can not Robit.

Іnstitutsіonalny analіz otsіnyuє mozhlivіst uspіshnogo vikonannya іnvestitsіynogo project s vrahuvannyam organіzatsіynoї, pravovoї, polіtichnoї th admіnіstrativnoї situation. Otsіnka vnutrіshnіh faktorіv zvichayno conducted for the following schemes.

Analіz mozhlivostey virobnichogo management. Analіzuyuchi virobnichy management pіdpriєmstva, neobhіdno sfokusuvatisya on the following meals:

- dosvіd i kvalіfіkatsіya menedzherіv pіdpriєmstva,

- їhnya motivatsіya under the project (in napriklad vidі chastki od pributku)

- sumіsnіst menedzherіv s tsіlyami project th main upmost i tsіnnostyami cultural project.

Analіz resursіv of labor. Trudovі resources scho planuєtsya zaluchiti for realіzatsії project povinnі vіdpovіdati rіvnyu vikoristovuvanih in proektі tehnologіy. Dana power staє expired at vipadku vikoristannya printsipovo novoї for pіdpriєmstva zakordonnoї chi vіtchiznyanoї tehnologії. Mauger sklastisya situatsіya, if culture virobnitstva on pіdpriєmstvі simply not vіdpovіdaє rozroblyuvalnomu project i todі neobhіdno navchati robіtnikіv abo, abo naymati novih.

Analіz organіzatsіynoї structure. Priynyata on pіdpriєmstvі organіzatsіyna structure is not guilty galmuvati rozvitok project. Neobhіdno proanalіzuvati, yak vіdbuvaєtsya on pіdpriєmstvі processes of acceptance rіshen i yak zdіysnyuєtsya rozpodіl vіdpovіdalnostі for їhnє vikonannya.

Osnovnі prіoriteti in planі analіzu zovnіshnіh faktorіv bunt rank obumovlenі EYAD the following aspects.

Polіtika powers have yakіy vidіlyayutsya for detailed analіzu nastupnі position:

- Minds іmportu th eksportu sirovini i tovarіv,

- mozhlivіst for іnozemnih іnvestorіv vkladati Costa d eksportuvati goods,

- law about Prace,

- osnovnі PROVISIONS fіnansovogo i bankіvskogo regulyuvannya.

Danі power naybіlsh vazhlivі for quiet proektіv scho pripuskayut zaluchennya zahіdnogo strategіchnogo іnvestora.

Shvalennya powers oyu. Danian factor Varto rozglyadati bunt rank for great іnvestitsіynih proektіv, spryamovanih on rіshennya velikoї zadachі-wide Economy Kraina in tsіlomu. Here naybіlsh vazhlivim Je factor for skhvalennya hour. Naybіlsh nebezpechnoї viglyadaє situatsіya, if the project in bezdoganny tehnіchnih, fіnansovih i ekonomіchnih vіdnosinah, Je іnvestori, gotovі infections uklasti groshі the project, ale rіshennya powers zatrimuєtsya chi vіdkladaєtsya 1-2 Rocky. In rezultatі іnvestor vkladaє groshі in Inshyj project.

Comments

Commenting, keep in mind that the content and the tone of your messages can hurt the feelings of real people, show respect and tolerance to his interlocutors, even if you do not share their opinion, your behavior in terms of freedom of speech and anonymity offered by the Internet, is changing not only virtual, but real world. All comments are hidden from the index, spam control.