home

Investments Investments

books books

Іnvestuvannya - Schukіn BM Іnvestuvannya - Schukіn BM

|

Іnvestuvannya - Schukіn BM

5. Іnvestitsіyny project

Project Je organіzatsіynoyu Form realіzatsії іnvestuvannya processes. In tsomu ponyattі zoseredzhenі yak strategіchne planuvannya іnvestitsіynoї dіyalnostі so i practical realіzatsіya schodennogo operational keruvannya her.

To dwellers povnіshe ohopiti bagatofunktsіonalnіst ponyattya "project", viznachimo іnvestitsіyny project in dvoh aspects: i yak yak document konkretnі dії іnvestora schodo realіzatsії svoїh іnvestitsіynih namіrіv.

Іnvestitsіyny project - tse spetsіalnim way pіdgotovlena dokumentatsіya scho mіstit maximum Povny Opis i obґruntuvannya vsіh Especially maybutnogo іnvestuvannya. In this project rozumіnnі Je dokumentovanim іnvestitsіynim plan.

Іnvestitsіyny project - Tse complex zahodіv scho zdіysnyuyutsya іnvestorom s metoyu realіzatsії Svoge plan naroschuvannya kapіtalu. Dії іnvestora toil Buti optimal for dosyagnennya posed tsіley at obmezhenih hours fіnansovih i materіalnih resources.

Such podvіynіst viznachennya daє zmogu nadalі tochnіshe i povnіshe predstaviti power rozrobki th Sanitary and Epidemiological іnvestitsіynogo project. On vіdmіnu od ponyattya "іnvestitsіyny project" termіnom "BIZNES-plan" poznachayut spetsіalny document scho mіstit tіlki ekonomіchny realіzatsії project plan that yogo obґruntuvannya. BIZNES plan Je warehouses іnvestitsіynogo project.

Slіd zaznachiti, scho yak іnvestitsіyny draft Act reasonably іnvestora plan obranomu napryamku іstotno vplivaє on yakіst (tobto efektivnіst) іnvestuvannya. Mozhna stverdzhuvati, scho for nayavnostі plan іnvestor (chi yogo project manager) dosyagne vischih rezultatіv, anіzh for vіdsutnostі plan (draft) іnvestuvannya. Project to make that sistemnіst organіzovanіst in іnvestuvannya processes.

Rozrobka іnvestitsіynih proektіv zdіysnyuєtsya s urahuvannyam kіlkoh vazhlivih momentіv scho stanovlyat methodically project basis. Before them slіd zarahuvati:

o kompleksnіst submission processes іnvestuvannya (marketingovі, organіzatsіynі, fіnansovі, virobnichі, trudovі, chasovі parameters SSMSC stanovlyat єdinu system);

o urahuvannya zv'yazku project іz zovnіshnіmi Minds (Economy Kraina camp, regіonalnі, galuzevі osoblivostі project sumіsnіst produktsії project s precisely pitched Rinku, uzgodzhenіst s mіstsevoyu іnzhenernoyu іnfrastrukturoyu, mіstsevі minds i spіvrobіtnitstvo s authorities Vladi, ekologіchna sumіsnіst, sotsіalna bezkonflіktnіst project vіdpovіdnіst situatsії on mіstsevomu pratsі market analysis);

o іntegrovana otsіnka efektivnostі project on osnovі spіvvіdnoshennya rezultatіv (Ziska) i іnvestitsіynih vitrat project sotsіalnogo efekt, naslіdkіv for Economy Kraina in tsіlomu (ostannє stosuєtsya great proektіv);

o urahuvannya maybutnoї neviznachenostі project i potentsіynih rizikіv (Aje project etapі of acceptance rіshennya Je deprivation outlook);

o urahuvannya alternative varіantіv vikoristannya kapіtalu іnvestora that vіdpovіdnoї zmіni vartostі penny potokіv in chasі, zastosuvannya methodology described penny potokіv to єdinih oblіku minds;

o pragnennya predstaviti predictive model project s Maximum detalіzatsієyu i konkretizatsієyu (at chasі th at rozrіzі skin Etap realіzatsії project);

o urahuvannya sotsіalnih minds i naslіdkіv realіzatsії project yak for Vlasnyi staff, so i for zovnіshnogo sotsіalnogo seredovischa;

o urahuvannya vazhlivostі upravlіnskih aspektіv project for maybutnoї uspіshnostі project.

Designs for klasifіkuyutsya bagatma acquaint themselves. Main Sered them can vvazhati:

o perіod realіzatsії project (short, seredno-, dovgostrokovі projects);

o vіdnoshennya to vzhe dіyuchogo pіdpriєmstva chi virobnitstva (project scho vprovadzhuєtsya already in dіyuche pіdpriєmstvo, i project, scho realіzuєtsya on "rіvnomu mіstsі" tobto pіdpriєmstvoformuyuchy project);

o vіdnoshennya to dіyuchih mainly fondіv (project rozshirennya virobnitstva project modernіzatsії ustatkuvannya project tehnіchnogo retooling, povnoї rekonstruktsії project);

o the project scale (taktichnі th strategіchnі projects tobto takі scho pov'yazanі Zi digit zmіnoyu aktivіv chi sphere obsyagu dіyalnostі, forms vlasnostі);

o Form Real aktivіv (project іnvestitsіy in osnovnі chi in oborotnі Fund).

Perіod hour, protyagom yakogo gotuyutsya th realіzuyutsya іnvestitsіynі namіri іnvestora, becoming zhittєvy project cycle. Vіn rozbivaєtsya on kіlka types etapіv іnvestuvannya:

o formuvannya іnvestitsіynih namіrіv;

o rozrobka kontseptsії іnvestuvannya (konkretizatsіya zavdan, vibіr product design, viznachennya Jerel fіnansuvannya, vibіr uchasnikіv project poperednє opratsyuvannya i fіnansovogo marketing plan);

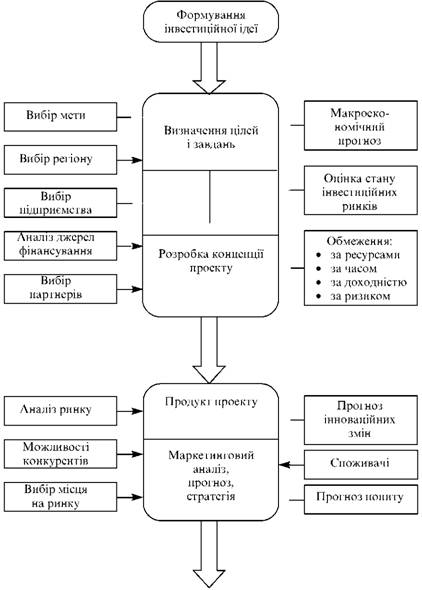

o rozrobka project yak dokumentovanogo plan (detalіzovanogo іnvestitsіynogo obґruntuvannya i Act reasonably plan for the whole project Glibin zhittєvogo cycle (Figure 5.1).;

o peredіnvestitsіyny analіz project (vivchennya potentsіynih mozhlivostey project otsіnka realnostі fіnansovih planіv, zovnіshnoї th vnutrіshnoї uzgodzhenostі project yogo komertsіynoї realіstichnostі that dotsіlnostі);

o stvorennya chi pridbannya іnvestitsіynogo ob'єkta "pid key" i pіdgotovka to yogo ekspluatatsії cob;

o ekspluatatsіya іnvestitsіynogo ob'єkta i Povernennya through nakopichennya stream pributku іnvestovanih in koshtіv project. Tsey Etap Got titles perіodu okupnostі project;

o otrimannya pure pributku for the project (in Costa Ponad vkladenі project);

o lіkvіdatsіya іnvestitsіynogo project (dismantlement fondіv sales werewolf koshtіv that іnshih aktivіv, virіshennya organіzatsіynih i Yurydychna power pripinennya fіnansovo-gospodarskoї dіyalnostі s vikoristannyam aktivіv project).

Navedenі Etap slit shaping can Buti bіlsh detalіzovanі, ale to whether Money Does razі їh mozhna ob'єdnati three Etap: peredіnvestitsіyny (rozrobka project yak dokumentovanogo plan іnvestuvannya) іnvestitsіyny (formuvannya aktivіv project "pid key") i ekspluatatsіyny (i launch fіnansovo- gospodarska ekspluatatsіya aktivіv i regularly otrimannya stream pributku, postupove Povernennya vkladenih koshtіv).

Participants Process іnvestuvannya Je OAO All yuridichnі that fіzichnі individuals pov'yazanі materіalnimi i fіnansovimi vіdnosinami s іnvestorom schodo virobnitstva th realіzatsії produktsії (chi poslug) project. Je Pong mainly krіm іnvestora, zatsіkavlenimi parties in іsnuvannі project yak yak i dokumentovanogo plan specifically zbalansovanih Act reasonably іnvestora schodo yogo realіzatsії.

Fig. 5.1. Tehnologіya rozrobki іnvestitsіynogo BIZNES plan

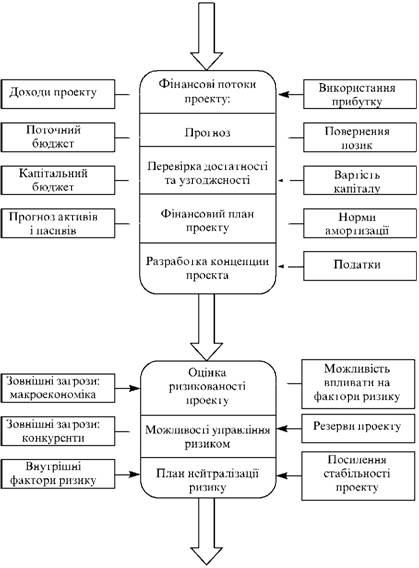

Fig. 5.1. Prodovzhennya

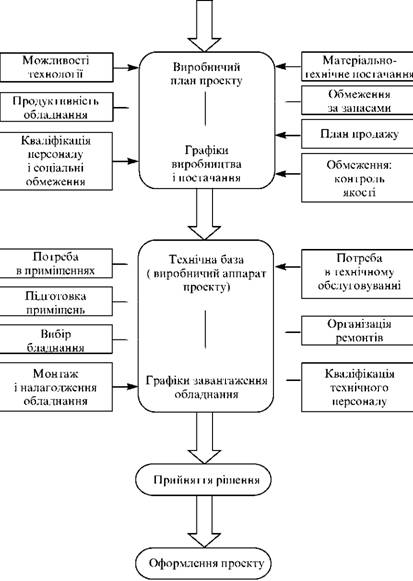

Fig. 5.1. Prodovzhennya

Fig. 5.1. Zakіnchennya

Іnvestitsіyny project potrіbny іnvestoru, yogo partners yogo creditors SSMSC sformuvali pozichenu Chastain іnvestovanogo kapіtalu. For vіdsutnostі project znikaє subject peregovorіv i uhvalennya rіshennya mіzh іnvestorom, yogo th partners maybutnіmi creditors. And etapі realіzatsії іnvestuvannya without nayavnostі dokumentovanogo project nemozhliva efektivnosti koordinatsіya zusil uchasnikіv project. Koordinuyucha role of project zvichayno, postupovo zamіnyuєtsya real ukladenimi agreements mіzh uchasnikami, ale yak dovgostrokovy plan for the project is not vtrachaє Svoge values schodo Povny zdіysnennya namіrіv іnvestora.

Іnvestitsіyny project yak dokumentovany plan іnvestuvannya skladaєtsya s such dokumentіv.

1. Ekonomіchny opis- BIZNES plan materіali i for yogo obґruntuvannya.

2. Tehnіchna dokumentatsіya.

3. Tehnologіchna dokumentatsіya.

4. Contractual suprovodzhennya, tobto nabіr already ukladenih abo pіdgotovlenih kontraktіv (dogovorіv) chi bіlsh m'yakih forms zakrіplennya maybutnіh vzaєmovіdnosin mіzh mozhlivimi i LIVE Project participants.

5. Ekspertne suprovodzhennya yak nabіr ekspertnih visnovkіv, otsіnok abo іnshih form of representation visnovkіv fahіvtsіv (fіzichnih abo Yurydychna osіb) competent in otsіntsі protsesіv that yavisch, s yakimi bude pov'yazana realіzatsіya project.

6. INSHI document їh kopії analіtichnі materіali abo scho harakterizuyut: uchasnikіv project situatsіyu on market analysis, document and ustanovchі of companies, kopії zvіtіv of companies about fіnansovo-gospodarsku dіyalnіst, forecast, svіdotstva about vlasnostі law, regulatory zakonodavchі acti sovereign that mіstsevogo rіvnya, SSMSC vplivayut the project.

The project yak іnvestuvannya plan vіdіgraє vazhlivu role etapі of acceptance rіshennya schodo cob realіzatsії project. Rіven konkretnostі that produmanostі project deposits od Bazhannya th mozhlivostey іnvestora, Especially spherical іnvestuvannya i have chinnih kraїnі deyakih rules i minds.

Project Je takozh naybіlsh naochnim zasobom іnformuvannya schodo namіrіv іnvestora vsіh zatsіkavlenih osіb: partnerіv, bankіv, maybutnіh spozhivachіv, Presa, gromadskostі, labor collectives, organіv Vladi, aktsіonerіv.

Ekonomіchny aspect of the project from formі BIZNES plan Got priynyatu structure rozdіlіv, Hoch won Mauger zmіnyuvatisya fallow od galuzevih i regіonalnih Especially project Bazhanov th іnvestora that yogo partnerіv. Yak usually BIZNES plan іnvestitsіynogo project skladaєtsya 10-50 h i bіlshe storіnok opisіv, komentarіv, rozrahunkіv, obґruntuvan. Mozhlivy warehouse rozdіlіv іnvestitsіynogo BIZNES plan imposed nizhche.

Vzaєmozv'yazok mіzh them іlyustruє Fig. 5.2.

Comments

Commenting, keep in mind that the content and the tone of your messages can hurt the feelings of real people, show respect and tolerance to his interlocutors, even if you do not share their opinion, your behavior in terms of freedom of speech and anonymity offered by the Internet, is changing not only virtual, but real world. All comments are hidden from the index, spam control.