home

Banking Banking

books books

Money and credit - Ivanov VM Money and credit - Ivanov VM

|

Money and credit - Ivanov VM

TOPIC 3. MONEY AND FINANCIAL MARKETS The circuit PRODUCTS AND REVENUE

3.1. Money and circuit products and revenues

The circuit is characterized by products and quantitative indices of income, called statistical quantities or stocks. These metrics are used to measure quantities available at some given time. Such quantities are expressed without considering temporal interval. Of all the statistical values of the most important is money.

There is a definite relationship between the statistical amount of money and the flow of the national product. This dependence is similar between the water pipes in a closed system and the flow of water flowing through the pipes. The cash this dependence can be expressed by the following equation, known as the exchange equation:

where M - the statistical amount of money (money supply); V - velocity of circulation of money; PQ - nominal national product; P - price level; Q - the real national product.

The equation of exchange - it is purely design dependent, which must be carried out always and is quite convenient framework for addressing many of the most important problems of economic theory. It is crucial to the influence exerted by changes in the quantity of money in circulation, the price level and the size of the real national product.

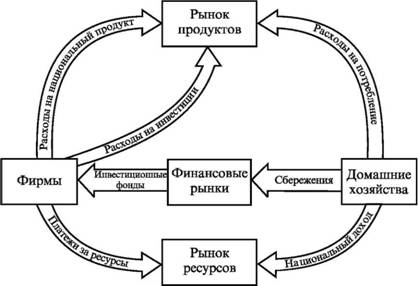

Since most of the savings accumulate households, and most of the investment company are investing, it requires a set of mechanisms by which the flow of funds transferred from the former to the latter. These mechanisms are created due to the functioning of financial markets. Financial markets are shown in the center of the circuit diagrams of products and revenue in Fig. 1.

Fig. 1. Financial markets are in circulation model

When added to the turnover of savings and investment, there are two ways in which funds can "travel" from household products to the market - one straight-through the consumption expenditure; the other - indirect, in which agents move through savings, financial markets and investments. On the diagram shows only the cash flows. Financial markets are composed of a variety of different channels through which money "flow" from the owners of savings to borrowers. These channels can be divided into two main groups.

The first group - the so-called channels of direct financing, for which funds are transferred directly from the owners of savings to borrowers.

two subgroups of direct financing methods can be distinguished.

• Capital financing - any agreement under which the company receives money for investment in exchange for the right to share in ownership of this company. The most famous example - sale of ordinary corporations ( "simple") shares. Common stock - a certificate of equity ownership in a corporation that gives its owner the right to a share of the profits earned by the corporation.

• Financing by borrowing - any agreement under which the company receives money for investment in exchange for a commitment to pay these funds in the future with the specified percentage, the right to a share ownership of the company does not get the lender. In this case, a well-known example is the sale of bonds, t. E. The certificates representing the obligation to pay the debt within a certain number of years, with interest, and to do so in accordance with pre-agreed schedule. Ordinary shares, bonds, as well as certain other financial instruments commonly called securities.

The second group - the so-called indirect channels of financing. When indirect financing means moving from households towards firms going through special institutions, such as banks, mutual funds, and insurance companies; These organizations are called financial intermediaries.

Comments

Commenting, keep in mind that the content and the tone of your messages can hurt the feelings of real people, show respect and tolerance to his interlocutors, even if you do not share their opinion, your behavior in terms of freedom of speech and anonymity offered by the Internet, is changing not only virtual, but real world. All comments are hidden from the index, spam control.