- Цветы и растения

- Аквариум и рыбы

- Для работы

- Для сайта

- Для обучения

- Почтовые индексы Украины

- Всяко-разно

- Электронные библиотеки

- Реестры Украины

- Старинные книги о пивоварении

- Словарь старославянских слов

- Все романы Пелевина

- 50 книг для детей

- Стругацкие, сочинения в 33 томах

- Записи Леонардо да Винчи

- Биология поведения человека

Главная  Банковское дело Банковское дело  Книги Книги  Деньги и кредит - Иванов В.М. Деньги и кредит - Иванов В.М. |

Деньги и кредит - Иванов В.М.

3.2. Роль государственного сектора в кругообороте продуктов и доходов

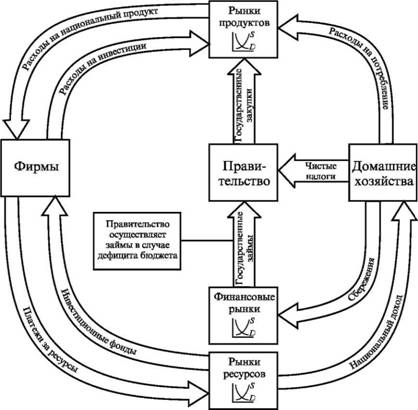

В кругообороте продуктов и доходов следующими анализируются объекты государственного сектора. Для удобства анализа рассматриваем все уровни правительственных организаций таким образом, как если бы они функционировали как единое целое. Объединенный государственный сектор связан с остальной экономической системой следующими тремя способами: через налоги, государственные закупки и займы (рис. 2). Первый способ — связь через так называемые чистые налоги (разность налогов и трансфертных платежей), которые движутся от домашних хозяйств к правительству. Второй способ — государственные закупки, в результате которых средства перемещаются от правительства на рынки продуктов. Если государственные закупки превосходят по величине чистые налоги (возникает бюджетный дефицит), то правительство вынуждено брать займы на финансовых рынках (третий способ). Если чистые налоги превос

Рис. 2. Модель кругооборота с учетом роли государственного сектора

ходят по величине государственные закупки, то объем платежей по прошлым долгам правительства будет превосходить объем новых займов; в результате образуется чистый поток средств от правительства к финансовым рынкам (этот случай на схеме не представлен).

Связи государственного сектора с кругооборотом доходов и продуктов. При рассмотрении модели кругооборота нас прежде всего интересует чистое количество денежных средств сектора, представленного домашними хозяйствами. Налоговые поступления в государственный бюджет превосходят величину потока денежных средств, исходящих из сектора "домашние хозяйства", поскольку этот поток частично возмещается выплатами денежных средств правительства из госбюджета домашним хозяйствам. Эти выплаты принимают форму трансфертных платежей, к числу которых относятся государственные пенсии, выплаты лицам с низкими доходами и пособия по безработице, которые не являются платой за какие-либо текущие трудовые услуги, покупаемые государством в лице правительства. Для получения достоверной оценки чистого влияния существующей налоговой системы на величину потока денежных средств, поступающих от домашних хозяйств к правительству, представляющему государственный сектор, вычитаем трансфертные платежи из налоговых поступлений. В результате получаем величину чистых налогов, указанных на рис. 2.

На этом рисунке не показан прямой поток налогов, выплачиваемых фирмами правительству (т. е. поступающих в госбюджет), хотя на практике фирмы платят налог с прибыли, а также ряд других налогов. Для простоты диаграмма построена так, как если бы все фирмы сначала выплачивали свои прибыли тем домашним хозяйствам, которые являются их собственниками, а потом собственники фирм, в свою очередь, платили бы правительству налоги с этих прибылей.

Суммарные государственные расходы1 делятся на две категории. 1 {В западной экономической литературе термин "государство" практически не употребляется. В русскоязычной экономической литературе этот термин, как известно, используется очень широко. На наш взгляд, он более точно отражает реальную сущность таких явлений, как государственные расходы, государственные закупки, государственный долг (Прим. ред.).}

Мы уже использовали одну из этих категорий, а именно трансфертные платежи, при расчете чистых налогов. Другая категория представлена государственными закупками товаров и услуг, или просто государственными закупками. В нее входят платежи государства в лице правительства за все приобретенные им товары и услуги, а также заработная плата всех государственных служащих. Таким образом, термин "государственные расходы" может быть формально определен как сумма государственных закупок и трансфертных платежей.

Все государственные закупки показаны на рис. 2 стрелкой, направленной от правительства к рынкам продуктов, откуда эти денежные средства перетекают к фирмам, а затем, через рынки ресурсов, — к домашним хозяйствам. Здесь, как и при рассмотрении движения налоговых поступлений, нами в модели сделано известное упрощение. В действительности та часть государственных закупок, которая представлена жалованьем (окладами) государственных служащих, минует

в своем движении рынки продуктов, а также сектор, реально представленный фирмами, непосредственно двигаясь из государственного сектора по направлению к рынкам трудовых ресурсов и далее, попадая в сектор "домашние хозяйства".

Последний способ связи государства в лице правительства со всей остальной экономической системой — это государственные займы, осуществляемые на финансовых рынках.

Влияние государства в лице правительства на кругооборот доходов и продуктов: предварительные выводы. Используя связи (см. рис. 2), правительство может оказывать значительное влияние на основные элементы кругооборота доходов и продуктов. Оно может различными действиями влиять на величину номинального национального дохода, а также на ту степень, в которой изменения номинального дохода и продукта принимают форму изменений реальных величин или изменений уровня цен. Эти аспекты государственной экономической политики будут более подробно рассмотрены в последующих темах, но здесь необходимо дать предварительный обзор данной темы.

Одним из источников государственного влияния на процесс кругооборота доходов и продуктов является фискальная (налогово-бюджетная) политика, касающаяся налогов и государственных расходов. Увеличивая чистые налоги, правительство может увеличить и объемы денежных средств, изымаемых у домашних хозяйств. Домашние хозяйства, в свою очередь, в этой ситуации вынуждены урезать либо сбережения, либо расходы на потребление, либо и то и другое одновременно. В любом случае результатом будет уменьшение национального продукта. Это может произойти как непосредственно, т. е. из-за сокращения доходов, получаемых фирмами от продажи потребительских товаров, так и косвенно, вследствие уменьшения объемов сбережений, а следовательно, и объемов инвестиционных средств, которые фирмы смогут потратить на приобретение капитальных благ.

Снижение чистых налогов стимулирует рост как сбережений, так и потребления, положительно влияя на рост национального продукта.

Мероприятия, осуществляемые в рамках налогово-бюджетной (фискальной) политики правительства, могут также принимать форму изменения объемов государственных закупок. Рост государственных закупок стимулирует рост национального продукта, поскольку в результате растут доходы фирм от продажи товаров и услуг государству; также растут и доходы домашних хозяйств, если увеличивается заработная плата рабочих, занятых в государственном секторе, или растет количество занятых в нем. Снижение же объемов государственных закупок оказывает на национальный продукт противоположное воздействие.

При рассмотрении уравнения обмена MV = РQ отмечалось, что изменение количества денег, находящихся в обращении, должно, согласно уравнению, повлиять по меньшей мере на одну, а возможно, и на большее число оставшихся переменных: скорость обращения денег, уровень цен или реальный национальный продукт.

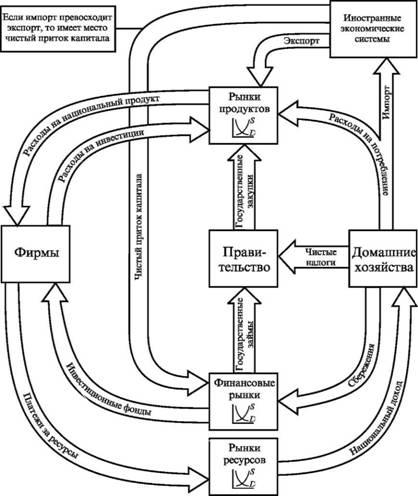

Модель кругооборота доходов и продуктов с учетом воздействия иностранного сектора экономики. Импорт и экспорт. На рис. 3 показано, как международные экономические связи могут быть включены в модель кругооборота. Импорт товаров и услуг представляет собой первое звено связи с внешним миром.

Все компоненты кругооборота потоков являются потоками прежде всего денежных платежей, а не потоками товаров и услуг. Поэтому платежи по импорту показаны стрелкой, направленной из внутренней национальной экономики за рубеж. Домашние хозяйства и фирмы, как и правительственные институты, приобретают импортные товары и услуги. Однако с целью упрощения диаграммы на ней показана лишь одна, крупнейшая по объему категория импорта — импорт потребительских товаров.

Экспорт представляет собой еще одно звено, связывающее внутреннюю национальную экономическую систему с зарубежными странами. Полученные в качестве платежей средства, компенсирующие стоимость товаров и услуг, проданных иностранным покупателям, поступают на рынки продуктов, где они сливаются с потоками денежных средств, полученных от продажи товаров и услуг внутренним домашним хозяйствам, фирмам и государству в лице правительства. Средства из всех этих источников прибавляются к доходам, получаемым фирмами от продажи национального продукта.

Потоки капитала. Импорт и экспорт товаров и услуг — не единственные способы связи национальной экономики с внешним миром. В ходе анализа необходимо учитывать множество разного рода международных финансовых операций, таких, например, как займы и кредиты, международные закупки и продажи реальных финансовых активов.

Подобно импорту и экспорту, международные финансовые операции самим фактом своего существования приводят к возникновению определенных потоков платежей, направленных как внутрь экономической системы, так и за ее пределы.

Рис. 3. Модель кругооборота с учетом иностранного сектора экономики

У притока капитала есть своего рода "зеркальное отражение". Так, если пенсионный фонд покупает акции какой-то компании по производству бумаги или банк выдает ссуду какому-то горнодобывающему концерну, то денежные средства, естественно, текут из экономической системы страны, в которой находятся пенсионный фонд и банк.

Created/Updated: 25.05.2018