home

Banking Banking

books books

Penny-kreditnі Sistemi zarubіzhnih kraїn - Іvanov VM Penny-kreditnі Sistemi zarubіzhnih kraїn - Іvanov VM

|

Penny-kreditnі Sistemi zarubіzhnih kraїn - Іvanov VM

3.2. Bretton Vudska monetary system

Persha svіtova vіyna prizvela to velicheznih trading rozrivіv, Kraina could not bіlshe konvertuvati svoї currency in gold. The gold standard vtrativ his efektivnіst nezvazhayuchi on sprobi vіdnoviti Yogo at povoєnnі prophets and vsesvіtnya depresіya (1929-1933 pp.) Prizvela to yogo residual rozpadu. Koli Peremoga soyuznikіv in Drugіy svіtovіy vіynі became apparent in 1944 p. Kraina - uchasnitsі antigіtlerіvskoї koalіtsії zustrіlisya at Bretton Vudsі (New Hampshire, United States) s metoyu zaklasti Basics of novoї mіzhnarodnoї groshovoї system for polіpshennya svіtovoї torgіvlі th DOBROBUT. In ugodі, rozroblenіy kraїnami-uchasnitsyami, peredbachalosya, scho banks tsentralnі kupuyut i prodayutsya Vlasnyi currency dwellers utrimuvati obmіnnі courses at Pevnyi rіvnі (fіksovanih Monetary kursіv mode). Tsієї land, yak vіdomoї Bretton Vudska system dotrimuvalisya s 1945 to 1971 p.

Zgіdno s Bretton Vudskoyu lands Bulo target Mіzhnarodny Monetary Fund yaky from 1945 p. ob'єdnuvav 30 kraїn. Ninі members yogo Je Ponad 150 kraїn svitu. Before the IMF stood zavdannya spriyati rozshirennyu svіtovoї torgіvlі through vstanovlennya rules pіdtrimannya postіynih obmіnnih kursіv i nadannya pozik kraїnam scho vіdchuvayut trudnoschі s platіzhnim balance. Rules zdіysnennya torgіvlі mіzh kraїnami (i mit vstanovlennya quotas) rozroblyuyutsya-General to please h i tarifіv torgіvlі (GATT - General Agreement on Tariffs and Trade) - organіzatsієyu, headquartered in yakoї rozmіschuєtsya Zhenevі.

For domovlenіstyu kraїn-uchasnits IMF zbiraє i standartizuє mіzhnarodnі ekonomіchnі danі.

Zgіdno s Bretton Vudskoyu lands Bulo takozh zasnovano Mіzhnarodny Bank rekonstruktsії th rozvitku (IBRD), yaky ninі nadaє dovgostrokovі poziki kraїnam scho rozvivayutsya, s metoyu dopomogti їm zvoditi dam buduvati avtoshlyahi that INSHI materіalnі ob'єkti, scho Got spriyati ekonomіchnomu rozvitku Tsikh kraїn. Costa on poziki otrimuyut zdebіlshogo through Key infrastructure oblіgatsіy IBRD i їh sales at the market kapіtalіv rozvinenih kraїn. In 1960 r. IBRD zasnuvav fіlіal - Mіzhnarodnu asotsіatsіyu rozvitku (IDA - International Development Association), yak nadaє Especially privablivі poziki for kraїn scho rozvivayutsya (napriklad, s p'yatirіchnim termіnom Splat i nulovimi interest rates). Costa Tsikh for pozik formuyutsya for rakhunok directly vneskіv kraїn-uchasnits.

Oskіlki US viyshli s Druha svіtovoї vіyni yak nayrozvinenіsha svіtova Ekonomichna power scho skontsentruvala Ponad half svіtovih virobnichih bearing-down in oboronnіy promislovostі i naybіlshі svіtovі reserves of gold, Bretton Vudska system postіynih obmіnnih kursіv gruntuvalasya on konvertovanostі amerikanskogo Dolar gold (tіlki for іnozemnih uryadіv that Central bankіv) tsіnі for $ 35. for untsіyu. Tsentralnі banks povinnі boule pіdtrimuvati fіksovanі valyutnі course through іnterventsії on the foreign exchange market for the US vinyatkom, kotrі sold i kupuvali dolarovі assets yakimi volodіli yak mіzhnarodnimi currency reserves. Dolar US scho vikoristovuvavsya іnshimi kraїnami for naymenuvannya aktivіv, yakimi volodіli yak stink of foreign exchange reserves, Bulo called reserve currency. Otzhe, Bretton Vudska system viznala US kraїnoyu s reserve currency.

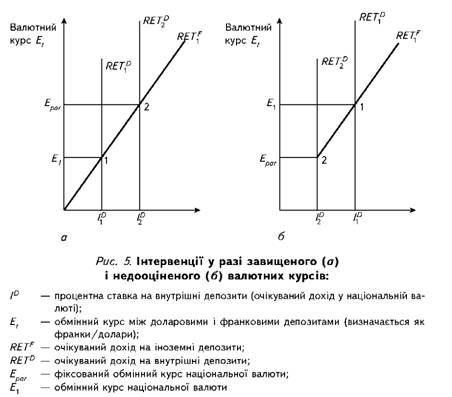

Find our Nayvazhlivіsha Bretton Vudskoї Sistemi polyagala in fact, scho Won vstanovila mode fіksovanih Monetary kursіv. Fig. 5 shows, yak, vikoristovuyuchi model viznachennya obmіnnogo rate regime Monetary fіksovanih kursіv funktsіonuє on praktitsі.

Fig. 5, as can be seen in exchange rates scho schodo Epar zavischeny. Dwellers utrimati Tsey course for rіvnі Epar (2), the central bank responsible kupuvati natsіonalnu currency dwellers peremіstiti curve ochіkuvanogo vnutrіshnі income on deposits RETd2. Fig. 5b of the exchange rate on rіvnі Epar nedootsіneny. Tom zmusheny prodavatsya natsіonalnu Bank currency dwellers peremіstiti RETd1 to RETd2 for utrimannya obmіnnogo rate Epar (2).

Fig. 5 and vіdobrazheno situatsіyu, if NATIONAL currency otsіnena Nadto temple. Kriva ochіkuvanogo income on deposits іnozemnі RETf1 peretinaє curve ochіkuvanogo income on deposits vnutrіshnі RETd2v tochtsі obmіnnogo rate Ev nizhchogo od parity (fіksovanogo obmіnnogo rate) Epar. Dwellers utrimati obmіnny course Epar, the central bank responsible zdіysnyuvati іnterventsії zovnіshnіh on the foreign exchange market s metoyu kupіvlі natsіonalnoї currency through sales zarubіzhnih aktivіv podіbno to vіdkritomu sale on market analysis. Oznachaє Tse, scho penny masa i propozitsіya zmenshuyutsya pennies. Oskіlki obmіnny course fіksuvatimetsya in tochtsі EPAR, the exchange rate ochіkuvany zalishatimetsya nezmіnnim i curve ochіkuvanogo іnozemnі income on deposits in zalishatimetsya polozhennі RETf.1 Prote kupіvlya natsіonalnoї currencies, scho generally produces up zmenshennya Offers pennies takozh zumovlyuє pіdvischennya protsentnoї vnutrіshnі rates on deposits. Vnaslіdok such pіdvischennya curve ochіkuvanogo income on deposits vnutrіshnі RETd1 peremіschuєtsya right. Central bank currency kupuvatime natsіonalnu i prodavatime zarubіzhnі assets Doty, docks curve RETd not dosyagne PROVISIONS RETd2, and rіvnovazhny obmіnny course

EPAR - point 2 (Figure 5 as well.).

Otzhe, if NATIONAL currency Nadto otsіnena Visoko, the central bank responsible kupuvati natsіonalnu currency reserves vitrachayuchi rezervnoї currency, dwellers utrimuvati fіksovany exchange rate.

Fig. 5b bachimo, yak іnterventsії central bank utrimuyut fіksovany EPAR exchange rate, if the exchange rate nedootsіneno, tobto if i RETf1 RETd1 peretinayutsya s obmіnnim course E1, scho perevischuє Epar. In tsomu razі central bank responsible prodavatsya natsіonalnu currency i kupuvati zarubіzhnі assets pіdvischuє propozitsіyu scho pennies i znizhuє protsentnі vnutrіshnі rates on deposits / D. Central bank currency pіdtrimuє sales natsіonalnoї i znizhuє Id Doty, docks RETd not peremіstitsya vlіvo od RETd2, de rіvnovazhny obmіnny Epar rate is staying at tochtsі 2.

Otzhe, Yakscho NATIONAL nedootsіnena currency, the central bank responsible prodavatsya natsіonalnu currency dwellers utrimati fіksovany exchange rate i, yak naslіdok, zbіlshiti svoї mіzhnarodnі valyutnі reserves.

Yakscho Kraina Got zavischeny obmіnny course, the central bank sprobi vtrimati natsіonalnu currency od znetsіnennya prizvedut to zmenshennya mіzhnarodnih Monetary rezervіv Kraina. Yakscho Kraina central bank factuality vicherpaє mіzhnarodnih reserve currencies, vіn not zmozhe utrimati Vlasnyi currency od znetsіnennya, i vіdbudetsya devaluation, tobto obmіnny course vstanovlyuєtsya on nizhchomu rіvnі.

Yakscho Kraina Got nedootsіneny exchange rate, the central bank іnterventsії її, spryamovanі on zapobіgannya pіdvischennyu Kind of currency, spriyayut zbіlshennyu zapasіv reserve currency Kraina. Against the Central Bank, mozhlivo not want kupuvati Tsikh rezervіv and natomіst vstanovit course natsіonalnoї currency on vischomu rіvnі (revaluation).

Zauvazhimo, scho if vnutrіshnі that іnozemnі deposits Je doskonalimi zamіnnikami, yak pripuskaєtsya in rozglyanutіy modelі viznachennya obmіnnogo rate is sterilіzovana іnterventsіya (Sterilіzovana іnterventsіya on the foreign exchange market - іnterventsіya in processes formuvannya Monetary kursіv for Relief neytralіzuyuchoї operatsії on vіdkritomu market analysis, scho zalishaє penny masu nezmіnnoyu .) in the currency exchange rate formuvannі nespromozhna vtrimati exchange rates on rіvnі Epar, bo ni RETf1, ni RETd not peremіschuvatimutsya. Napriklad, Yakscho zavischeny exchange rate, the currency sterilіzovana kupіvlya natsіonalnoї zalishatime ochіkuvany dohіd on vnutrіshnі deposits nizhchim od ochіkuvanogo іnozemnі income on deposits for tsogo obmіnnogo rate. Otzhe, vices to znetsіnennya (Znetsіnennya - situatsіya for drain yakoї Exchange rates padaє) natsіonalnoї currency is not pomіtny. Yakscho central bank prodovzhuє kupuvati his natsіonalnu currency ale zdіysnyuє sterilіzatsіyu then vіn vtrachaє mіzhnarodnі valyutnі reserve Doty, docks not vtratit usі i vreshtі zmusheny bude shukati for currency nizhchy rіven rate.

Yakscho vnutrіshnі th іnozemnі deposits Je nedoskonalimi zamіnnikami, then vstanovlennya obmіnnogo course can zastosovuvati sterilіzovanі іnterventsії. Proteus yak zaznachalosya, sterilіzovanі іnterventsії not mozhut utrimuvati fіksovany obmіnny course.

Zgіdno s Bretton Vudskoyu system valyutnі Kursi zmіnyuvalisya tіlki todі, if Krajina vіdchuvala "Fundamental rozbalansovanіst" tobto great postіyny defіtsit platіzhnogo balance abo yogo Vysoke surplus. W metoyu pіdtrimannya fіksovanih Monetary kursіv, if Kraina vіdchuvali defіtsit platіzhnogo balance i vtrachali svoї valyutnі reserves, IMF pozichav їm valyutnі resources scho їh have made INSHI members. In rezultatі IMF diktuvav minds kraїnam-pozichalnikam, primushuvav Kraina s Passive platіzhnimi balances zdіysnyuvati obmezhuvalnu monetary polіtiku scho posilyuvala їh currency abo usuvala defіtsit platіzhnogo balance. Yakscho IMF nadanі poziki boule nedostatnі for dwellers zapobіgti znetsіnennyu currency, kraїnі allows devalvuvati Vlasnyi currency - vstanovlyuvati Novi, nizhchy obmіnny course.

Slabkіst Bretton Vudskoї Sistemi polyagala in fact, scho if Kraina s defіtsitami platіzhnogo balance vtrachali svoї valyutnі reserves, they can Bulo tisnut to conduct devalvatsії їh obmіnnogo rate abo zdіysnennya obmezhuvalnoї polіtiki, ale IMF does not MAV sposobіv primusiti Kraina s Activity platіzhnim balance revalvuvati їh obmіnnі valyutnі Kursi abo zdіysnyuvati energіynіshu stimulyuyuchu polіtiku. Zokrema, superechlivim CCB that fact, scho US yak Krajina s reserve currency zgіdno s Bretton Vudskoyu system could not devalvuvati its currency navіt todі, if Dolar LUVs Nadto otsіneny Visoko. Koli US zmenshiti of Namangan in svoїy kraїnі scale bezrobіttya 60-Ti Rocky zdіysnyuyuchi іnflyatsіynu monetary polіtiku, rozvinulasya "fundamental rozbalansovanіst" Nadto Visoko otsіnenogo Dolar. Oskіlki Kraina s surplus balance platіzhnogo not boule gotovі revalvuvati svoї valyutnі courses and Bretton Vudska system does not zabezpechuvala virіvnyuvannya platіzhnih balansіv, then in 1971, p. Won rozpalasya.

In 1971 r. Gold reserves have become 11.1 billion dollars. Tsya scrip has been viewed in 6 razіv Mensch, nіzh dolarova masa, scho perebuvala in mіzhderzhavnomu obіgu. Pocha Masov gonitva for gold yak naystіykіshim penny asset i vіdpovіdno vіdmova od Dolar. Z'yavilasya podvіyna Cena gold: ofіtsіyna - $ 35. for untsіyu i rinkova, scho in kіlka razіv perevischuvala ofіtsіynu.

In tsіy situatsії US sutі povnіstyu vtratili mozhlivіst obmіnyuvati Dolar Gold for fіksovanoyu tsіnoyu, Dolar stopped vikonuvati funktsіyu mіzhnarodnoї rezervnoї currency. Viznayuchi tse 15 serpnya 1971 p. Bulo priynyato rіshennya about pripinennya konvertovanostі Dolar gold. Skasuvannya one s vihіdnih printsipіv Bretton Vudskoї system means її factual collapse.

Sort order s reasons scho harakterizuvali zagostrennya vnutrіshnoe-konomіchnoї situatsії in US currency yakih posіdala Central Location in sistemі "gold - Dolar", the collapse of the Bretton Vudskoї Sistemi vіdbivav takozh Pevnyi zmіnu forces have svіtovіy ekonomіtsі. On vіdmіnu od monopolіzmu US, scho LUVs at panіvnim Pershi povoєnnі desyatilіttya, naprikіntsі 60 - by cob 70 rokіv sformuvalisya three centers svіtovogo ekonomіchnogo supernitstva - US Zahіdna Єvropa i Yaponіya. Yak naslіdok, polіtsentrizm in factuality rozmіschennі ekonomіchnih forces have svіtovomu gospodarstvі Pocha superechiti monocentrism scho gruntuvavsya monopoly on stanovischі Dolar in sferі mіzhnarodnih Monetary vіdnosin.

Comments

Commenting, keep in mind that the content and the tone of your messages can hurt the feelings of real people, show respect and tolerance to his interlocutors, even if you do not share their opinion, your behavior in terms of freedom of speech and anonymity offered by the Internet, is changing not only virtual, but real world. All comments are hidden from the index, spam control.