home

Banking Banking

books books

Penny-kreditnі Sistemi zarubіzhnih kraїn - Іvanov VM Penny-kreditnі Sistemi zarubіzhnih kraїn - Іvanov VM

|

Penny-kreditnі Sistemi zarubіzhnih kraїn - Іvanov VM

5.2. The Federal Reserve System

US Federal Reserve System (Federal Reserve System) - is central to establish at bankіvskіy sistemі scho vіdpovіdaє for monetary polіtiku US Central Bank ( "Bank bankіv" Uryadov agent at obslugovuvannі sovereign budget).

Target of the Federal Reserve System in 1913 p. (Dvi sprobi utvoriti the US central bank in 1811 that in 1836 p. Nevdalі boule). Vorozhostі amerikantsіv to zasnuvannya central bank poklal edge panіka at 1907 p. Tom in 1908 p. Law-Aldrich Rіlanda viznachiv zavdannya rozrobiti project organіzatsії central bank. In 1913 r. zgіdno іz law about Federal Reserve stvoryuєtsya Fed of 12 Federal Reserve Banks.

F. Mishkіn vvazhaє, scho Got Fed "іnstitutsіynu of formal structure, and once i s note of informal structures, scho viznachaє de vseredinі Federalnoї rezervnoї Sistemi zoseredzhuєtsya spravzhnya Vlad" [70, p. 471].

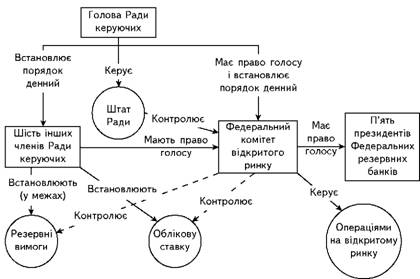

Formally, the Fed skladaєtsya s such structural odinits (Figure 7.):

• Parliament keruyuchih;

• 12 bankіv Federal Reserve (Fed);

• member banks (40% priblizno komertsіynih bankіv i natsіonalnі US banks);

• Federal komіtet vіdkritogo market analysis (FOMC);

• Federal Advisory pleased.

Fig. 7. Formal structures Federalnoї rezervnoї Sistemi

Head For keruyuchih vplivaє Radu keruyuchih through Law vstanovlyuvati order denny zasіdan sake i FOMC, the Fed іmenі vistupati od i negotiate h i by Congress US President (head takozh vplivaє Radu svoїm authority).

The Federal Reserve on praktitsі funktsіonuє yak ob'єdnany central banks, scho kontrolyuєtsya Radoyu keruyuchih, i zokrema head sake keruyuchih. Prote Fed Yak Derzhavna setups bіlsh Square, nіzh INSHI place the Uryadov US.

Rada keruyuchih Fed (Board of Covernors of the Federal Reserve System) skladaєtsya іz seven cholovіk (vklyuchayuchi head) i vіdіgraє vagomu role in priynyattі rіshen Fed. Cutaneous keruyuchy priznachaєtsya US President i zatverdzhuєtsya Senate. Keruyuchі vikonuyut svoї obov'yazki protyagom deprivation of one 14-string rіchnogo i deleguyutsya od 12 Federal Reserve okrugіv. Rada bere keruyuchih active part in uhvalennі rіshen schodo zdіysnennya monetarnoї polіtiki. Keruyuchі Je members of the FOMC (Rada pіdtverdzhuє abo not skhvalyuє oblіkovu rate FRB).

Rada keruyuchih Got zakonodavcho zakrіplenі obov'yazki, scho not stosuyutsya bezposeredno monetarnoї polіtiki (at pp 1933-1968 zgіdno s іnstruktsієyu "Q" vstanovlyuvala maksimalnі protsentnі rates for Pevnyi views depozitіv;.. At pp 1969-1982 small right regulyuvati i kontrolyuvati credit) .

Federalnі rezervnі banks (Federal Reserve Banks) - tse 12 circumference bankіv scho utvoryuyut Fed. Cutaneous Bank E "kvazіgromadskoyu, zareєstrovanoyu yak Corporation, іnstitutsієyu, yakoyu volodіyut privatnі komertsіynі banks District, scho Yea Fed members Tsі Banks -. The members of the Federal Reserve kupuyut aktsії in Svoge District Federal Reserve Bank (vimoga to membership), i divіdendi scho splachuyutsya on tsі aktsії, obmezhuyutsya rіchnih to 6% "[70, p. 475].

Federalnі rezervnі banks vikonuyut takі funktsії:

• zdіysnyuyut klіring chekіv;

• emіtuyut novі groshі;

• viluchayut znoshenі groshі s obіgu;

• otsіnyuyut okremі application zlittya bankіv;

• keruyut i nadayut diskontnі pozichki banks have svoїh districts;

• doslіdzhuyut camp bankіv-chlenіv;

• zaluchayutsya to zdіysnennya monetarnoї polіtiki (vstanovlyuyut oblіkovu rate virіshuyut, SSMSC banks mozhut otrimuvati diskontnі pozichki od Fed, vibirayut bankіra one for the service of the Federalnіy konsultativnіy radі, toil voice FOMC).

Banks - Members of the Fed - tse OAO All natsіonalnі can (zareєstrovanі service controller US trumpery obіgu) i blizko 40% komertsіynih US bankіv at 90 Rokach. The law about deregulyuvannya deposit іnstitutіv i control obіgom Penny (1980 p.) Putting in odnakove encampment banks (members i not members of the Federal Reserve) schodo backup vimog.

Federal komіtet vіdkritogo market analysis (Federal Open Market Comette) uhvalyuє rіshennya stosovno zdіysnennya operatsіy vіdkritomu on market analysis. Tsey komіtet skladaєtsya s seven chlenіv keruyuchih For the Fed, the president of the Federal Reserve Bank of New York is the prezidentіv chotiroh іnshih Fed. Ocholyuє FOI ^ For the head keruyuchih Fed. In obgovorennі power take fate INSHI sіm prezidentіv bankіv circumference.

Federal komіtet factuality not kupuє i do not prodaє tsіnnih paperіv and nadsilaє directive to the Trade Office New York Fed, de keruyuchy vnutrіshnіmi operatsіyami on vіdkritomu Rinku zdіysnyuє perspicuity kupіvleyu for-sale Reigning tsіnnih paperіv.

Federal Advisory glad not to vplivaє іstotno polіtiku Fed i vikonuє zdebіlshogo tseremonіalnі funktsії.

Rozglyanuta ofіtsіyna (formal) structure of the Fed not vіdobrazhaє realnoї Vladi and takozh structures scho uhvalyuyut rіshennya. Tom rozglyanemo Fed informal structure (Fig. 8).

Fig. 8. The informal structure Federalnoї rezervnoї Sistemi

Hoca Fed pіdporyadkovuєtsya bezposeredno Congress, zgіdno іz law Congress president is not shaping can abo zdіysnyuvati polіtichnogo vise її kerіvnikіv. Nezvazhayuchi on tse Rada keruyuchih Got koordinuvati svoї dії s polіtikoyu prezidentskoї admіnіstratsії that Congress. The Federal Reserve does not otrimuє fіnansuvannya od Congress, ale on operativnі vitrati styaguє groshі pributkіv h od s іnvestitsіy that pay for nadanі Hotel. Koli vinikaє superechnіst - pragnuti oderzhuvati pributki chi sluzhiti іnteresam suspіlstva Fed Got Vibrato other.

Federal Reserve zasnovano by Congress in 1913 p. for posilennya lucid for bankіvskoyu system that pripinennya bankіvskih crisis, scho perіodichno vinikali in the XIX century. Vnaslіdok Velikoї depresії 30th Congress rokіv nadіliv Fed right zmіnyuvati rezervnі vimogi to komertsіynih bankіv i regulyuvati rinkіv margin stock. 3 hour Bulo th priynyato INSHI laws, scho polegshili mozhlivіst Fed figure out loans at nablizhennі fіnansovih disasters.

Pid hour Druha svіtovoї vіyni dіyalnіst Fed zvodilasya to nadannya right Mіnіsterstvu fіnansіv US shukati poziki pid nevisoky percent. Coley s cob konflіktu in Koreї komertsіynі banks Pocha prodavatsya Velika Quantity tsіnnih paperіv mіnіsterstva fіnansіv Fed energіyno skupovuvala їh, dwellers zapobіgti padіnnyu tsіn them. In 1951 r. Fed UCLA s sake mіnіsterstvom fіnansіv about nezalezhnіst svoєї polіtiki od fіnansuvannya mіnіsterstva s side. Vaughn zoseredila zusillya on stabіlіzatsії natsіonalnoї Economy - utrimuvala protsentnі rates for nizkomu rіvnі pid hour znizhennya dіlovoї aktivnostі that pіdvischuvala їh in perіodi Shvidky ekonomіchnogo zrostannya. Naprikіntsі 50 rokіv Fed pridіlyala Especially uwagi stabіlіzatsії tsіn that obmezhennyu zbіlshennya groshovoї Masi, and in the 60th Rokach spryamovuvala zusillya on dosyagnennya povnoї zaynyatostі that rozvitok virobnitstva.

At 70 Rokach Credit ekspansіya became zanadto strіmkoyu, i ekonomіka Pocha poterpati od zrostannya іnflyatsії. March 1979 p. Fed Vote nova polіtiku, spryamovanu on bezposerednіy control penny masoyu scho is staying in obіgu rather than interest rates. 3avdyaki takіy polіtitsі away spovіlniti Tempi zbіlshennya groshovoї masi, obmezhiti Credit ekspansіyu that zniziti rіven іnflyatsії. Vtіm on the cob 80 rokіv such polіtika sprichinila i downturn dіlovoї aktivnostі. In 1982 r. Fed znovu weaker control over zbіlshennyam groshovoї masi, aktivіzuvavshi dіyalnіst schodo znizhennya interest rates.

To control by general masoyu pennies in obіgu i have kreditіv natsіonalnіy ekonomіtsі Fed vikoristovuє takі osnovnі vazhelі. Purshia - regulyuvannya oblіkovoї rate abo rates protsentіv, SSMSC splachuyut komertsіynі banks in the Reserve for pozichenі bankіv groshі. Pіdvischuyuchi (znizhuyuchi) oblіkovu rate, the Fed Mauger zaohochuvati (abo navpaki) komertsіynі banks to kupіvlі pozik, vplivayuchi on rozmіr oderzhuvanogo banks pributku for nadanі poziki.

Another vazhelem Je vstanovlennya normalized obov'yazkovogo rezervuvannya. Tse Pevnyi vіdsotok depozitіv, value yakogo vstanovlyuє Fed i yaky komertsіynі banks zobov'yazanі trimati in gotіvkovіy formі in svoїh skhovischah abo Well at formі depozitіv - at regіonalnomu Reserve Bank. Rezervnі deposits not mozhna vikoristovuvati for nadannya pozik (tab. 6).

tABLE 6

Normie obov'yazkovogo rezervuvannya in the US

| deposits | 1989 p. |

1992 p. |

1996 p. |

Transaktsіynі% |

12.0 |

10.0 * |

10.0 |

Strokovі% |

3.0 |

0.0 |

0.0 |

* Mills on 02/02/92.

The US Federal Reserve for ostannє desyatilіttya znizila rate obov'yazkovogo rezervuvannya.

The US ostannіm hour rezervnі zobov'yazannya mali 26 tis. Credit SET i tіlki 2 yew. s they Trimai groshі korespondentskih rahunkah at the Fed. Іsnuє tendentsіya to zmenshennya obsyagіv Tsikh pennies on rahunkah i zbіlshennya їh obsyagіv in Kasakh komertsіynih bankіv.

Tretіm, chi is not naygolovnіshim vazhelem Je operatsії vіdkritomu on market analysis, sales tobto kupіvlya Reigning tsіnnih paperіv. Koli Fed skupovuє derzhavnі tsіnnі Paper the bankіv at abo in іnshih zakladіv that osіb, won a check to pay for them (basis dzherelo pennies, won drukuє SSMSC) vipisanim on itself. Koli Tsey deponuєtsya check at the bank, then stvoryuyutsya novі reserves Chastain s yakih bank Mauger pozichati abo іnvestuvati, zbіlshuyuchi note by Penny the bag.

Tsі zasobi give mozhlivіst Fed zbіlshuvati abo zmenshuvati obsyag pennies in obіgu that kreditіv ekonomіtsі in the United States. Koli Quantity pridatnih pozik for pennies zbіlshuєtsya, the loan will win easily, and the interest rate znizhuєtsya. Yak usually in razі znizhennya protsentnoї rates dіlovі that spozhivchі vitrati zbіlshuyutsya. Coley w Quantity pennies priznachenih for pozik, zmenshuєtsya, staє credit "expensive" and protsentnі pіdvischuyutsya rates. Vvazhaєtsya scho "dorogі groshі" - tse mogutnє znaryaddya for Borotba s іnflyatsієyu.

Bagato chinnikіv uskladnyuyut vikoristannya Federal Reserve budgetary and kreditnoї polіtiki for rozv'yazannya svoїh zavdan. Peredusіm through those scho zmіni groshovoї masi not viklikayut negaynih Change log in ekonomіtsі. Zbіlshennya chi zmenshennya kіlkostі pennies in obіgu Mauger not poznachatisya on ekonomіtsі docks will come not INSHI ekonomіchnі minds. Novі minds mozhut vstupiti in vzaєmodіyu Zi zmіnenoyu penny masoyu, viklikayuchi neperedbachenі naslіdki. Sproba vikoristati penny-kreditnі zasobi for stabіlіzatsії tsіn іnkoli pereshkodzhaє sprobam dosyagti povnіshoї zaynyatostі and namagannya vdatisya to penny-Credit operatsіy for znizhennya rіvnya bezrobіttya nerіdko sprichinyayut іnflyatsіyu. Zavdannya penny-kreditnoї polіtiki uskladnyuєtsya takozh through the problems platіzhnogo balance Kraina. Tom Fed namagaєtsya dіyati oberezhno, zmіnyuyuchi penny masu US povіlno i postupovo.

Comments

Commenting, keep in mind that the content and the tone of your messages can hurt the feelings of real people, show respect and tolerance to his interlocutors, even if you do not share their opinion, your behavior in terms of freedom of speech and anonymity offered by the Internet, is changing not only virtual, but real world. All comments are hidden from the index, spam control.