home

Banking Banking

Books Books

Groshovo-credit systems for foreign banks - Ivanov VM Groshovo-credit systems for foreign banks - Ivanov VM

|

Groshovo-credit systems for foreign banks - Ivanov VM

6.4. Special Fіnansovo-Credit Institute

Great group of people behind the nature of the vicarious functions of private, state and cooperative institutions is to become special FKI. Voni nalichuyut 30 інвестиційних компаній (траст-банків), three banks довгострокового credit, 29 company зі страхування життя і 58 компаній зі страхування майна, 283 брокерські компанії, які здійснють операції з цінних паперми, а також лізингові компанії.

Інвестиційні компанії (trust-banks) ordering business plans for business, and takozh дедалі більше втручаються у сфере банківської діяльності. Peps control vikonannya brokerskimi company operations with local papermen. Більшість із them tісно по'яъні з великими комерційними banks країни внаслідок взаємного володіння акціями. Як і комерційні banks, інвестиційні компанії via філії, стрені за cordon at once with commercial banks країни чи чи самостиійно, поширюють діяльність вінших країнах. Characteristically, they have their own laws and functional functions, they are established in the form of business operations, authorities in banks that have investment companies, and in Japan itself, are deprived of their bank account.

Privatny banks of the pre-Novgorod credit to the capital of the Other Bank of Ukraine on the basis of the reorganization of the unpaid banks in the pre-mortgage loan. The main features of the credit resources of the banks are the positions of the banks.

Banks rozmischuyut on the market interestnі paperi (on termіn п'ять років з виплатою проценів двічі на рік) і discount money (in a row, sell for the price, changed to a discount).

Страхові компанії за сумою активів посідають третє місце серед private FKІ і перше - серед спеціальних. The main part of the activity of insurance companies lies in the company із insurance of life.

Broker fіrmi for rozmіrom resources to borrow modestly місце серед фінансово-крединих установ. However, the system of credit is not meant to be a resource for resources, but to a roll, yaku, wongs, yak, participants of the decentralized zinc papern rink, which is actively rooted out by the stock markets.

Лізингові компанії почал по-п|п|п|п|п|п|п|п|п|п|п|, from 1963 onwards. Odnі з them є універсальними, вони пропонують в оренду різні машини й обладнання, інші спеціалізуються на наданні в оренду певного виде машин і обладнання: автомобілів, будівельного обладнання, комп'ютерів тощо.

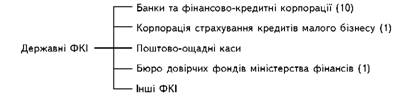

Державні спеціальні ФКІ loans to the important person in the credit system of the world. Prior to them lay down oschadnyi kasi, Bureau of Foreign Funds in the Ministry of Finance, Japanese Bank for Development, Export-Import Bank and Financial and Credit Corporation: National Finance Corporation, Financial Corporation of Small Business, Financial Corporation of Sanitary Eco, Finance Corporation of the Silk Road, Zhitlyovy Pokk, Financial Corporation of Power Holdings, Corporate Development of Hokkaido and Tohokhu, Financial Corporation of the Island of Okinava.

The category of major special FIKI is shown in Fig. eleven.

Fig. 11. Derzhavnі spetsіalnі fіnansovo-kombinіі інститути

Derzhavnyi FKI finance in the sphere of economics, there are no reasons why commercial banks should not be employed. The loan of the ciq has been established by traditionally naibilsh piłgovy zavdyaki to that of the stink of the canary from the office of the Bureau of Housing Funds of the Ministry of Finance of the Republic of Belarus. The low interest and the value of the yak is the organization of finance.

Oshchadnyi kasi functitsionuyut at poshtovih vіddilennya і and nazivayutsya poshtovo-oschadnimi. Залучені кошти ощадні каси переказують у розпорядження Bureau of the foundation of finance of finances.

The Bureau of Public Funds in the Ministry of Finance is one of the great FKI kraїni. Yogi resource is stocked from deposits in the population at the top of the post-soviet areas and in the powerful pension funds and is vikorostovuyutsya yak dzherelo lentuvannya poternnyh pіdpriemstv і credit institutions.

Japanese Bank rozvitku , basing in the quarter 1951 р., Здійснює довгострокове кредитування промисловості. Loan resources to the bank are stored in the capital, given to the yom at the organization, budgetary asynguania, the position of the Bureau of Housing Funds and Resources of the Uriy Uvaroviks. The bank lends itself to loans, loans to some, to the darks of private banks, to the risky.

The Export-Import Bank was struck in 1950. Kapital bank I hang on. Vlasny resources to the bank are stored in the yogo capitalit і asiniguvan from the state budget. Obliged resources become positions in the established institutions and positions of non-terrestrial creditors. The ovals and structure of the active and passive operations are praised with parliament. Діяльністю банку керує міністерство фінансів.

The lines of credit for loans become six months before the beginning of the rock, in 15-15 rockies, in the vipacks.

The bank lends credit for the export of the promyshlennoye obladnannya, chornikh і kolorovihh metalov ta інших товарів. Zazvichay tse nekredome lentuuvannya іmporterіv, sho zdіysnyuetsya v vyglyadі obliku vekselіv, vidnih nіzemnimi importerami japonskikh rasproduktov. In addition, the bank without a middle age nadaє lend to the spoilers of the Japanese goods, the contract to the banks of other banks, and such to the Japanese companies for their landed unincorporated investments. Vitrati on investment in a vidobuvnu galuz kraїni, scho rozvivayetsya, lend on pyhlovyh umovah. In active operations, the bank is steadfast in becoming a loan to Japanese importers of sirovini and materi- als, which is important for the economy. Bank takozh nada credit for financing the import of finished products. Thus, starting from 1987/88 the financial bank, the bank lends credit to export and stimulates credit to the import of trade-promislovoe products with the method of speeding up the great positive balance of the trade balance. Zaznachennye zmіni at klinnnіy polіtіtsі bank zumovіtіtіkom the USA і great zahіdnoevropeyskikh kraїn, yakі not vitrimalі competitії з Japanією.

Imports of Japanese goods bank, yak rule, lend at once with commercial banks. The yogo part in the fatal loan is transferred to 50%. Such practice is the role of the yak in the knowledge of the Japanese economy.

Fіnansovo-kreditny korotecії spetsіalizuyutsya kredytuvannі okremih galuzey gosdarstva (sylskogo gosdarstva, lisovoi promyslovost rybalstva, zhitlovogo budivnitskva ta.), Regionis, scho vidstayuyut in ekonomichnomu rozvitku, and takozh pіdpriemstv i і mostsevih organіv vladi. Їх budgeting and planning are to be confirmed by the parliament, and disability is overcome by the control of public ministries. Loans to the corporate corporation are lent to private bank loans, to rely on the bias of political instincts and to play an important role in the minds of the minds for the economic growth of the social disparity of social superstitions. Vodnochas on the ears of the 80's rock'av ADMINISTRATIVE-FINANCIAL REFORM was carried out, yak pobachala obmezhennia part of the state in the process of the Suspilny vistvitrennia, rozshirennya spheri gospodarskoi diyalnosti private capitals and postavovu privatization tsikh khortsitsy.

Credit cooperatives are specialized in the so-called self-sufficiency, financial and credit institutions. Behind the warehouse, the members of the credit cooperative are subordinated to the sylvskospodarsky miski.

The members of the Silesian cooperative society are Mayzhe vs Selyani. Місцеві кооперативно об'єднані при префектурні асоціації, якими керує The Central Cooperative Bank of the Silesian State.

Analogical structure of the organization of the loan, co-operation with credit, members of the bankruptcy authorities, those medium-term promises and trade receivables, as well as creditworthiness. At the beginning of the year, the Central Bank of Trade and Promises of Cooperatives. Capitals of the central bank are privately stocked from the top kostyiv. Control over money banks and the entire system of co-operative credit is subject to sovereignty.

The order for national credit institutions in Japan is large, the number of non-terrestrial banks. On the 1st quarter of 1995 p. В країні мали свої відділення 93 іноземні банки. Pitoma Vaga poskikh tsentr bankov has become close to 3% zagalnoy sumi posk, seen by usim Japanese banks. Sphere діяльності іноземних банків у Японії більш обмежен на відміну від spheres діяльності іноземних банків у таких, наприклад, країнах, як United Kingdom and the United States.

Comments

When commenting on, remember that the content and tone of your message can hurt the feelings of real people, show respect and tolerance to your interlocutors even if you do not share their opinion, your behavior in the conditions of freedom of expression and anonymity provided by the Internet, changes Not only virtual, but also the real world. All comments are hidden from the index, spam is controlled.