home

Finance Finance

books books

Pricing - Erukhimovich IL Pricing - Erukhimovich IL

|

Pricing - Erukhimovich IL

2.4. Profitability. Economic essence, types, calculation of profitability

Profitability - a relative measure of production efficiency. In general terms, it is calculated as the ratio of income to expenses, ie. E. Is the rate of return. This should provide the indicators used to assess the effectiveness of advances in the production of resources (capital) and operating costs, and performance, which are determined on the basis of profitability and efficiency of the use of property companies (firms).

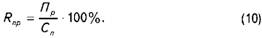

The effectiveness of production and business (commercial) activities of the enterprise reflects the return on the production of, or balance (total) profitability, calculated as the ratio of the balance sheet profit (BOP) to the average value for the period of capital (fixed production assets and current assets):

It should be borne in mind that the margin calculated by this formula will be somewhat overstated, since the balance sheet profit made up of all the activities of the enterprise (company), and not only from the production. Therefore, in the practice of financial analysis is calculated, in addition, the profitability of the total capital (total assets) and return on equity (share) capital.

Return on total assets (Ro) characterizes the efficiency of enterprise assets and is determined by the ratio of the balance sheet profit (BOP) to the average amount of balance sheet assets (Ka):

Return on equity (share) capital (of Rc) characterizes the efficiency of invested in the enterprise (company) equity (Kc) and a rate of return on equity:

where FC - net profits of the enterprise (firm).

This rate of profitability is primarily interested in the shareholders as dividend represents an upper bound.

The effectiveness of the cost of production and sales rate characterizes the profitability of production (Rpr), calculated as the ratio of profits from sales of products (Pr) to the total cost of goods sold (C):

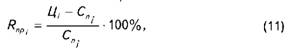

In the production of several types of products, determined by the profitability of each type (Rpri):

where Tsi, Spi - respectively the price and the total cost of the i-th type of product.

With the help of this index is determined by the most favorable for the enterprise (company) type of product. For example, you must choose the most suitable type of products in the following data.

total |

Price for 1 piece. |

||

Type of product |

Quantity, pcs. |

cost price |

(without VAT), |

1 pcs., UAH. |

UAH. |

||

1 |

200 |

140 |

168 |

2 |

300 |

180 |

207 |

3 |

500 |

200 |

226 |

Profitability of the first type of product, calculated by formula (11) is 20%, the second - 15% and third - 13%. Consequently, for the enterprise the most profitable to produce the first type of product. At the same time the total amount of profits from sales of the first type is (168 - 140). • 200 = 560 USD, the second - 810 UAH. and the third - 13 thousand UAH.. However, it depends on the volume of sales. When selling products of the first type in the amount of 500 pieces. profit from its implementation amounted to 14 thousand. UAH. Consequently, the task of marketing service of the enterprise is to find the maximum market for the most favorable for his type of products.

Increasingly used indicator of profitability of sales (Rp), calculated as the ratio of profit from the sale of (Pr) to the cost of goods sold (RP):

From all this we can draw the following conclusion: the profit margin and the level of profitability at a proper understanding of these categories reflect the impact of factors such as the real increase in the competitiveness of products, increase its sales, increased organizational and technical level of production and, as a result, cost reduction.

Comments

Commenting, keep in mind that the content and the tone of your messages can hurt the feelings of real people, show respect and tolerance to his interlocutors, even if you do not share their opinion, your behavior in terms of freedom of speech and anonymity offered by the Internet, is changing not only virtual, but real world. All comments are hidden from the index, spam control.