home

Banking Banking

books books

Penny-kreditnі Sistemi zarubіzhnih kraїn - Іvanov VM Penny-kreditnі Sistemi zarubіzhnih kraїn - Іvanov VM

|

Penny-kreditnі Sistemi zarubіzhnih kraїn - Іvanov VM

1.3. Zagalne ponyattya about penny-Credit polіtiku

Relief For penny-kreditnoї polіtiki Power pragne stvoriti bezіnflyatsіynu ekonomіku, scho minds in funktsіonuvatime povnoї zaynyatostі.

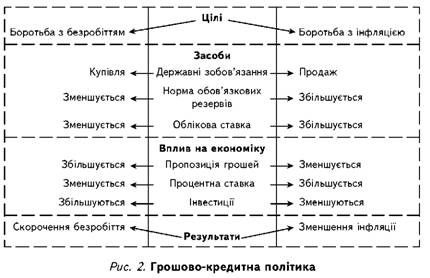

Tsіlі is the result of penny-kreditnoї polіtiki rozvinenih kraїn svitu іlyustruє Fig. 2.

Yak bachimo s Fig. 2, Power blame zdіysnyuvati control propozitsієyu pennies for Relief rіznih іnstrumentіv central bank nasampered operatsіy vіdkritomu on market analysis and takozh zmіnyuyuchi reserve ratio is the oblіkovu rate.

Operatsії on vіdkritomu market analysis - naygnuchkіshy іnstrument control over propozitsієyu pennies. Viznachayuchi obsyag kupіvlі-sale Reigning tsіnnih paperіv population i zmіnyuyuchi rіven protsentnoї rate for the loan, the bank Natsіonalny vplivaє on rozmіr Credit rezervіv komertsіynogo bank. Masov sales tsіnnih paperіv population generally produces up skorochennya credit reserve komertsіynogo bank znizhuє mozhlivіst away rozshirennya loan pіdvischuє i yogo tsіnu (interest rate). Reigning Skupovuvannya tsіnnih paperіv the population, navpaki, zbіlshuє kreditnі reserve komertsіynogo bank pіdvischuє їh spromozhnіst "stvoryuvati" kreditnі groshі th znizhuє rіven protsentnoї rates. Polіtika oblіkovoї rate has been viewed mainly zasobom tsentralіzovanogo regulyuvannya groshovoї Offers. Ninі in bіlshostі rozvinenih kraїn svitu її vikoristovuyut yak dopomіzhny zasіb regulyuvannya Offers pennies fallow od potreb Economy. Zmіnyuyuchi oblіkovu rate, the central bank regulyuє aktivnіst komertsіynih bankіv. Napriklad, vіdsotkova polіtika Natsіonalnogo Bank of Ukraine (NBU) is not spriyala makroekonomіchnіy stabіlіzatsії, tobto rіven rate Refinancing Loans postіyno vіddalyavsya od rіvnya pozitivnoї (vischoї pace іnflyatsії) rates. In rozvinenih kraїnah komertsіynі pratsyuyut banks takozh on vtorinnomu Rinku kaznacheyskih zobov'yazan. Pіdvischennya on market analysis penny fondіv rates vіdnosnoї dohіdnostі tsіnnih paperіv i protsentnoї rates obmezhuє mozhlivіst skupovuvannya їh central bank and znizhennya tsієї rate generally produces up protilezhnogo result vіdpovіdno vplivayuchi on propozitsіyu penny. Zmіna regulatory reserve rozshiryuє propozitsіyu pennies tobto vplivaє on obsyag nadlishkovih rezervіv i multiplіkatora trumpery value.

Otzhe, regulyuyuchi value groshovoї Offers, the central bank Mauger actively vplivati on rozvitok ekonomіchnih vіdnosin.

Zagalom power efektivnіst about penny-kreditnoї polіtiki diskusіyne. Keynsіantsі vkazuyut on neviznachenіst її kіntsevogo result i skladnіst zv'yazku іz sukupnim popitom. Monetarists zvertayut uwagi to those scho vpliv Offers pennies on sukupny popit vіdbuvaєtsya through trivaly i neviznacheny perіod. Krіm of stabіlіzatsіya protsentnoї rates Mauger in kіntsevomu pіdsumku destabіlіzuvati ekonomіku. Our power zastosovuє takі osnovnі zasobi vplivu NBU for vtіlennya in Zhittya penny-kreditnoї polіtiki:

• Refinancing Loans (Credit polіtika oblіkova i);

• regulyuvannya standards obov'yazkovih rezervіv;

• regulyuvannya lіkvіdnostі komertsіynih bankіv.

Kontrolnі power

1. Viznachennya course "penny-kreditnі Sistemi zarubіzhnih kraїn".

2. Zavdannya rate.

3. Principle funktsіonuvannya suchasnoї bankіvskoї system.

4. 3v'yazok mіzh groshima is the banks.

5. Іnstrumenti scho vikoristovuє the central bank to conduct penny-kreditnoї polіtiki.

Tests for self-control

1. Subject of the course - tse:

a) penny penny obіg that turnover;

b) forms of Kraina obіgu organіzatsії trumpery;

c) Credit sukupnіst vіdnosin that іnstitutіv, SSMSC organіzovuyut tsі vіdnosini;

g) Proper Je vіdpovіdі b), c);

d) usі vіdpovіdі nepravilnі.

2. The credit system - tse:

a) Credit sukupnіst vіdnosin;

b) banks have rolі pokuptsya i seller timchasovo vіlnih koshtіv scho іsnuyut in suspіlstvі;

c) Banks i nebankіvskі fіnansovo-kreditnі іnstituti;

g) Proper Je vіdpovіdі a), b);

d) Credit sukupnіst vіdnosin that іnstitutіv, SSMSC organіzovuyut tsі vіdnosini.

3. Bankіvska system - tse sukupnіst bankіvskih іnstitutіv:

a) SSMSC zdіysnyuyut aktivnі that pasivnі operatsії;

b) at їh vzaєmozv'yazku;

c) have rolі pokuptsya i seller timchasovo vіlnih koshtіv;

g) in tіy chi іnshіy kraїnі.

4. Yea Bankіvska system:

a) dvorіvnevoyu;

b) trirіvnevoyu;

c) obidvі vіdpovіdі pravilnі;

g) usі vіdpovіdі nepravilnі.

5. Banks access in all kraїnah mozhut vikonuvati deprivation takі operatsії:

a) іz zaluchennya koshtіv i vkladannya їh in tsіnnі Papero;

b) іz zaluchennya i rozmіschennya penny vkladіv in tsіnnі Papero;

c) zdіysnennya rozrahunkіv for doruchennyam klієntіv bankіv-korespondentіv that їh kasovogo obslugovuvannya;

g) that aktivnі pasivnі.

6. Penny and credit polіtika - tse:

a) penny-in Registration of credit that ekspansіya;

b) sukupnіst zahodіv in sferі trumpery obіgu i Credit vіdnosin;

c) sukupnіst zahodіv, SSMSC zdіysnyuє Power s metoyu zabezpechennya zaynyatostі;

g) The discount polіtika that zmіna standards obov'yazkovih rezervіv.

Comments

Commenting, keep in mind that the content and the tone of your messages can hurt the feelings of real people, show respect and tolerance to his interlocutors, even if you do not share their opinion, your behavior in terms of freedom of speech and anonymity offered by the Internet, is changing not only virtual, but real world. All comments are hidden from the index, spam control.