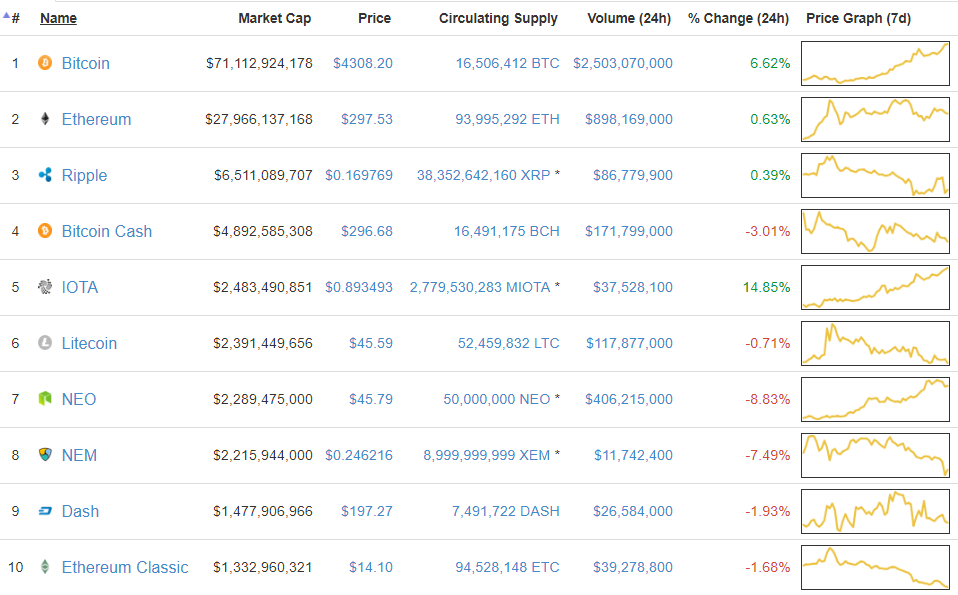

Топ-10 самых популярных криптовалют

Виртуальная валюта или игровая валюта — частные электронные деньги, которые используются для приобретения и продажи виртуальных товаров в различных сетевых сообществах: социальных сетях, виртуальных мирах и онлайн-играх.

Криптовалюта — цифровые счётные единицы, учёт которых децентрализован. Функционирование данных систем происходит при помощи распределённой компьютерной сети. При этом информация о транзакциях обычно не шифруется и доступна в открытом виде. Для обеспечения неизменности базы цепочки блоков транзакций используются элементы криптографии (цифровая подпись на основе системы с открытым ключом, последовательное хеширование).

Термин закрепился после публикации статьи o системе Биткойн «Crypto currency» (Криптографическая валюта), опубликованной в 2011 году в журнале Forbes. Сам же автор биткойна, как и многие другие, использовал термин «электронная наличность» (англ. electronic cash). Для эмиссии разные криптовалюты применяют разные способы: майнинг, форжинг или ICO.

Об экономической сути и юридическом статусе криптовалют ведутся дискуссии. В зависимости от страны криптовалюты рассматриваются как платёжное средство, специфичный товар, могут иметь ограничения в обороте (например, запрет операций с ними для банковских учреждений).

Наибольшим спросом среди трейдеров и криптоинвесторов пользуются цифровые валюты, представленные в первой десятке рейтинга. Это обусловлено различными факторами, и важнейшие среди них — высокая ликвидность, стабильный рост курса, перспективы дальнейшего развития экосистемы и репутация разработчиков.

Также стоит отметить, что в мире криптовалют все очень стремительно меняется. Тем не менее на момент написания данного обзора совокупная капитализация первых десяти криптовалют рейтинга составляет $122,4 млрд. Если это число сопоставить с общей стоимостью всех криптовалют ($138,8 млрд), представленных на данном сервисе, то окажется, что доля рынка десяти самых популярных цифровых валют составит 88%.

Майнинг

Стойка с блоками майнинга Ares256

Стойка с блоками майнинга Ares256

Майнинг, также добыча (от англ. mining — добыча полезных ископаемых) — деятельность по поддержанию распределенной платформы и созданию новых блоков с возможностью получить вознаграждение в форме новых единиц и комиссионных сборов в различных криптовалютах, в частности в Биткойн. Производимые вычисления требуются для обеспечения защиты от повторного расходования одних и тех же единиц, а вознаграждение стимулирует людей расходовать свои вычислительные мощности и поддерживать работу сетей.

Майнинг не единственная технология создания новых блоков. Альтернативами являются форжинг (минтинг) и ICO. Обычно используется только одна технология, но в некоторых криптовалютах используют комбинации из них.

Процесс майнинга заключается в подборе такого значения Nonce, которое позволит получить хеш, числовое значение которого будет не более некоторого заданного числа — Difficulty Target, целевого уровня сложности.

Пример хешей для одной и той же фразы, но с разными дополнительными параметрами (последняя строка в примере имеет наименьшее значение хеша):

«Hello, world!0» => 1312af178c253f84028d480a6adc1e25e81caa44c749ec81976192e2ec934c64

«Hello, world!1» => e9afc424b79e4f6ab42d99c81156d3a17228d6e1eef4139be78e948a9332a7d8

«Hello, world!2» => ae37343a357a8297591625e7134cbea22f5928be8ca2a32aa475cf05fd4266b7

...

«Hello, world!4248» => 6e110d98b388e77e9c6f042ac6b497cec46660deef75a55ebc7cfdf65cc0b965

«Hello, world!4249» => c004190b822f1669cac8dc37e761cb73652e7832fb814565702245cf26ebb9e6

«Hello, world!4250» => 0000c3af42fc31103f1fdc0151fa747ff87349a4714df7cc52ea464e12dcd4e9

В других криптовалютах вычисление как хеша, так и целевого уровня сложности может существенно отличаться.

Bitcoin (биржевой тикер — BTC, иногда — XBT)

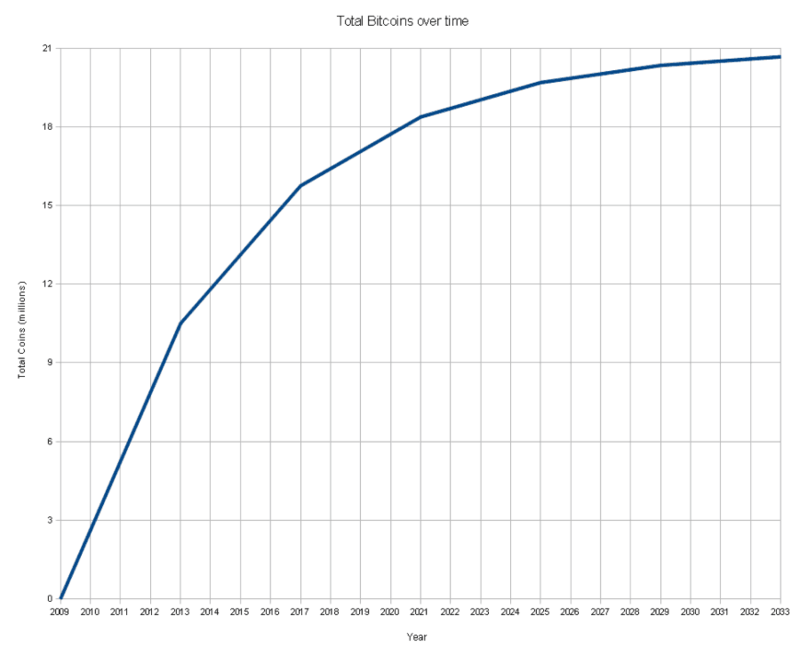

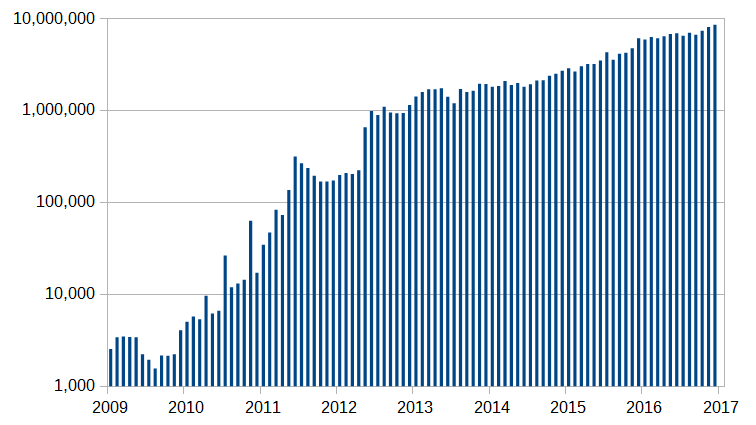

Количество биткойнов с течением времени (годы c 2009 по 2033)

Количество биткойнов с течением времени (годы c 2009 по 2033)

Биткойн (англ. Bitcoin, от bit — «бит» и coin — «монета») — пиринговая платёжная система, использующая одноимённую расчётную единицу и одноимённый протокол передачи данных. Для обеспечения функционирования и защиты системы используются криптографические методы. Вся информация о транзакциях между адресами системы доступна в открытом виде.

Минимальная передаваемая величина (наименьшая величина дробления) — 10−8 биткойна — получила название «сатоши» в честь создателя Сатоси Накамото, хотя сам он использовал в таких случаях слово «цент».

Электронный платёж между двумя сторонами происходит без посредников и необратим — нет механизма отмены подтверждённой операции или принудительного изъятия. Но есть возможность привлечения третьей стороны-гаранта при помощи мультиподписи. Средства никто не может заблокировать (арестовать), даже временно, за исключением самого владельца. Эти и другие умные контракты могут быть реализованы при помощи специального языка сценариев, однако он не доступен из графического интерфейса и не полон по Тьюрингу, в отличие от более новых блокчейновых систем (см. Ethereum).

Разные авторы по-разному классифицируют биткойны. Чаще всего встречаются варианты: криптовалюта, виртуальная валюта, цифровая валюта, электронная наличность.

Биткойны могут использоваться для обмена на товары или услуги у продавцов, которые согласны их принимать. Обмен на обычные валюты происходит через онлайн-сервис обмена цифровых валют, другие платёжные системы или обменные пункты.

Комиссия за проведение операций назначается отправителем добровольно, размер комиссии влияет на приоритет при обработке транзакции. Обычно программа-клиент подсказывает рекомендуемый размер комиссии. Транзакции без комиссии возможны и также обрабатываются, однако не рекомендуются, поскольку время их обработки неизвестно и может быть довольно велико.

Одна из главных особенностей системы — полная децентрализация: нет центрального администратора или какого-либо его аналога. Необходимым и достаточным элементом этой платёжной системы является базовая программа-клиент (имеет открытый исходный код). Запущенные на множестве компьютеров программы-клиенты соединяются между собой в одноранговую сеть, каждый узел которой равноправен и самодостаточен. Невозможно государственное или частное управление системой, в том числе изменение суммарного количества биткойнов. Заранее известны объём и время выпуска новых биткойнов, но распределяются они относительно случайно среди тех, кто использует своё оборудование для вычислений, результаты которых являются механизмом регулирования и подтверждения правомочности операций в системе «Биткойн».

Первая в истории и самая популярная в мире криптовалюта. Создана на рубеже 2008-2009 гг. Невзирая на столь “почтенный возраст”, криптовалюта активно развивается, на базе блокчейна биткоина ведутся разработки и имплементируются различные решения по его улучшению. Именно появление биткоина послужило причиной столь бурного развития рынка криптовалют и регулярного появления самых различных цифровых активов. В основе биткоина лежит революционная технология блокчейн, которая уже не первый год активно исследуется и развивается крупнейшими компаниями мира, а также применяется во многих индустриях.

Текущая капитализация биткоина составляет $71 млрд, что превышает стоимость многих крупных компаний с мировым именем. Предложение первой цифровой валюты строго ограничено 21 млн BTC. На специализированных сайтах можно увидеть текущий объем предложения биткоина на рынке — 16,506,412 BTC, суточный биржевой объем торгов, а также различные полезные ссылки на официальные источники информации, социальные медиа, обозреватели блоков, биржи, где представлена данная криптовалюта и т. д.

Ethereum (ETH)

Ethereum (от англ. ether [ˈiːθə] — «эфир», Эфириум) — платформа для создания децентрализованных онлайн-сервисов на базе блокчейна (Đapps, Decentralized applications, децентрализованных приложений), работающих на базе умных контрактов. Реализована как единая децентрализованная виртуальная машина. Был предложен основателем журнала Bitcoin Magazine[en] Виталиком Бутериным в конце 2013 года, сеть была запущена 30 июля 2015 года.

Являясь открытой платформой (open source), Ethereum значительно упрощает внедрение технологии блокчейн, что объясняет интерес со стороны не только новых стартапов, но и крупнейших разработчиков ПО, таких как Microsoft, IBM и Acronis. Заметный интерес к платформе проявляют и финансовые компании, включая Сбербанк.

Это цифровая валюта платформы для создания децентрализованных онлайн-сервисов на базе блокчейна (Dapps), работающих на базе умных контрактов. Если биткоин часто называют “цифровым золотом” (за сложность его добычи, ограниченность предложения и отличные инвестиционные качества), то Ethereum иногда именуют “цифровым аналогом нефти”. Все потому, что криптовалюта ETH представляет собой нечто вроде “топлива” для смарт-контрактов и создаваемых на их основе Dapps.

В криптосообществе не утихают споры о том, какой объект инвестирования привлекательнее — биткоин или Ethereum. Несмотря на относительно молодой возраст последнего (сеть Ethereum была запущена 30 июля 2015 года), “эфиру” отдают предпочтение достаточно известные личности мира криптовалют. Они убеждены, что вскоре популярность Ethereum затмит биткоин.

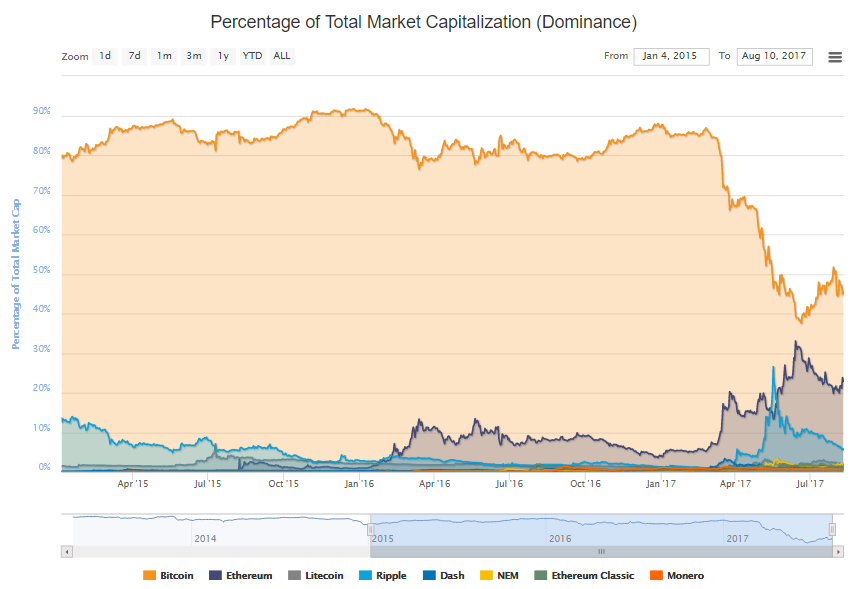

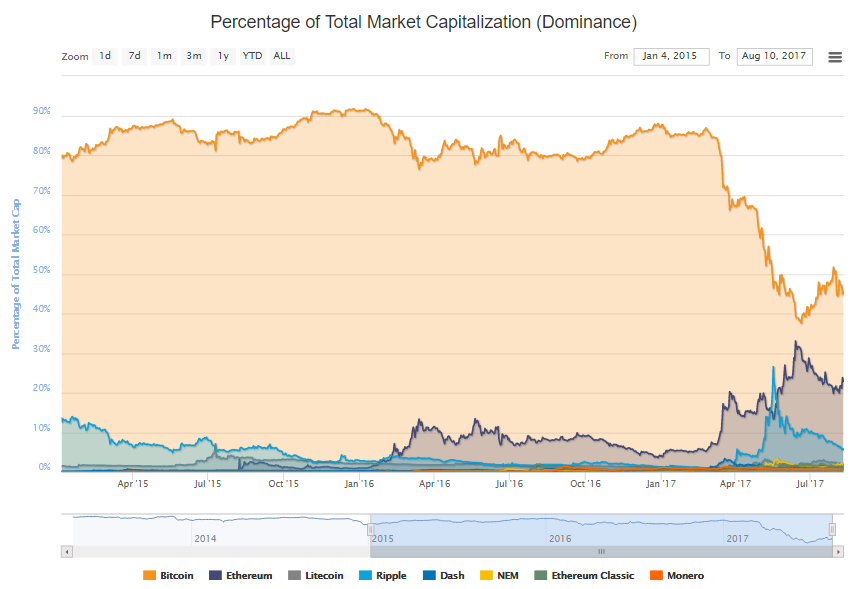

О стремительном росте популярности Ethereum свидетельствуют данные следующего графика, которые отражает удельный вес самых популярных криптовалют на рынке:

Пока что объем рыночной капитализации “цифровой нефти” ($28 млрд) меньше соответствующего показателя биткоина примерно в два с половиной раза.

В то же время потенциал Ethereum высок и привлекает внимание крупнейших разработчиков ПО, таких как Microsoft и IBM. На платформе Ethereum проводится множество ICO (Initial Coin Offering), а на базе лежащего в ее основе стандарта ERC-20 создается множество криптотокенов.

Ripple (XRP)

Ripple — система валовых расчётов реального времени, обмена валют и денежных переводов, разработанная компанией Ripple. Также именуется протоколом сделок ripple (Ripple Transaction Protocol; RTXP) или протоколом ripple. Построен на распределённом интернет-протоколе с открытым исходным кодом, консенсусном реестре (ledger) и собственной криптовалюте, именуемой XRP. Запущенный в 2012 году, Ripple направлен на то, чтобы обеспечить «безопасные, мгновенные и почти бесплатные глобальные финансовые операции любого размера без возвратных платежей». Он поддерживает токены, представляющие фиатную валюту, криптовалюту, товар, или любую другую единицу величины (value), такие как мили часто летающих пассажиров или мобильные минуты. По своей сути, Ripple базируется на открытой разделённой базе данных или реестре, который использует процесс согласования, что позволяет делать платежи, обмен и перевод денежных средств в распределённом процессе.

В 2014 году, Ripple защитили безопасность своего алгоритма консенсуса против соперника — Stellar Networks. По состоянию на 2017 год Ripple является четвертой криптовалютой по величине рыночной капитализации, уступая лишь Биткойну и Эфириуму.

Используемый такими компаниями, как «UniCredit», UBS или Santander, протокол Ripple всё шире используется банками и платёжными сетями в качестве расчётной инфраструктурной технологий, Издание American Banker, объясняет это тем, что «с точки зрения банков, распределённые реестры, такие как система Ripple, имеют ряд преимуществ перед криптовалютами как биткойн», в том числе по цене и безопасности.

Эта криптовалюта используется в системе валовых расчетов в реальном времени, а также для обмена валют и денежных переводов. Протокол Ripple запущен в 2012 году. Его целью является обеспечение «безопасных, мгновенных и почти бесплатных глобальных финансовых операций любого размера без возвратных платежей». По мнению некоторых криптоэнтузастов, платежная система Ripple может в перспективе стать “альтернативой SWIFT”.

С компанией Ripple сотрудничают крупнейшие компании и банки мира, включая BBVA, Mizuho, Mitsubishi UFJ, UniCredit, UBS и Santander. Среди инвесторов Ripple такие имена, как Accenture, Andreessen Horowitz, Google Ventures и Seagate.

Стремительный взлет цены Ripple (XRP) пришелся на первую половину текущего года и позволил криптовалюте уверенно закрепиться в тройке лидеров рейтинга Coinmarketcap. На текущий момент капитализация криптовалюты XRP приближается к отметке в 7 млрд. Бывали времена, когда капитализация Ripple превышала совокупную рыночную стоимость цифровой валюты Ethereum.

Bitcoin Cash

Bitcoin Cash — криптовалюта, форк Биткойн, отделившийся от него. Разветвление произошло 1 августа 2017.

Размер блока в блокчейне Биткойна ограничен в 1 мегабайт. Когда транзакций было не слишком много такое ограничение почти ни на что не влияло, но существенно ограничивало возможности DDoS-атаки. С ростом популярности Биткойна, число транзакций увеличилось, но из-за ограничения максимального размера блоков не все транзакции «помещались» сразу, периодически возникала очередь. В мае 2017 года ситуация сильно ухудшилась. Некоторые пользователи жаловались, что им приходится ждать подтверждения несколько дней. Для ускорения обработки пользователь может назначить повышенную комиссию. Но это делает использование биткойнов достаточно дорогим, особенно для небольших платежей — исчезает смысл использовать их, например, в кафе и барах.

Bitcoin Cash — это появившаяся в результате хардфорка “альтернатива биткоину”. Так, 1 августа блокчейн биткоина разделился на две цепи и появился новый цифровой актив — Bitcoin Cash (иногда — Bcash), который обладает общей историей с биткоином, но торгуется под другим тикером – BCC (реже — BCH).

После хардфорка, многие биржи и кошельки подарили держателям “цифрового золота” прекрасную возможность — получить некоторое количество токенов Bitcoin Cash, которое должно соответствовать балансу биткоина в пропорции 1:1. Например, если у пользователя на кошельке есть 1 BTC, то он получает после хардфорка 1 BCC.

Сразу после своего появления на биржах новая криптовалюта оказалась на третьем месте по капитализации, оставив позади таких “ветеранов” рынка, как Litecoin и Ripple. Однако вскоре после того, как биржи сделали доступным ввод-вывод Bitcoin Cash, “альтернатива биткоину” начала резкое падение в цене. Так, если 2 августа цена BCC достигала на бирже Bittrex отметки в 0,485 BTC (примерно $1300), то уже спустя два дня ее средневзвешенная цена немногим превышала $250.

Далеко не все складывается благополучно с новой криптовалютой. Bitcoin Cash не столь привлекательна для майнинга, как “обычный” биткоин, а сеть ее то и дело испытывает различные проблемы. По всей видимости, своей капитализации в $4,8 млрд новая криптовалюта пока обязана лишь популярности биткоина, не более.

IOTA

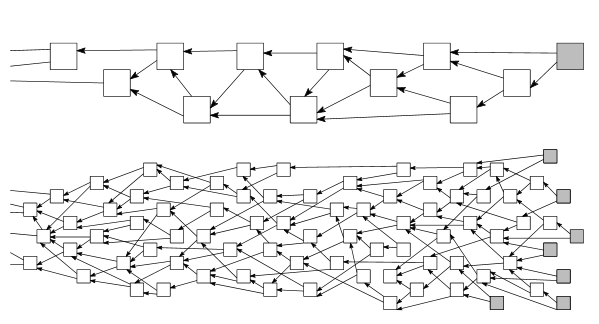

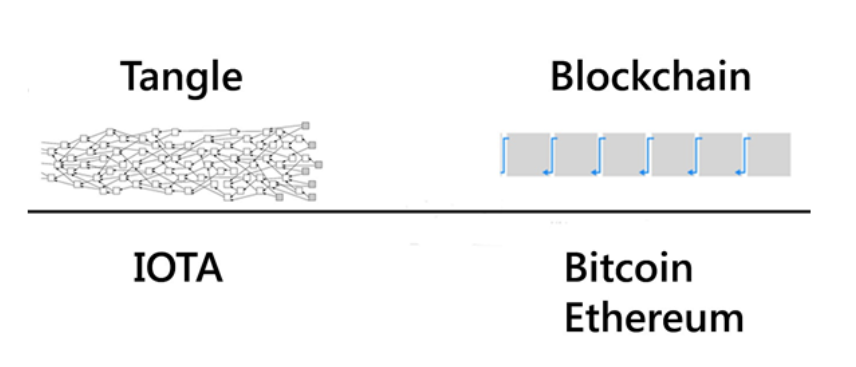

IOTA – новая криптовалюта, разработанная для Интернета Вещей (IoT), анонсированная в конце 2015 года. Она основана на новой концепции распределенного учетного журнала Tangle. IOTA, по словам своих создателей, обладает рядом преимуществ перед блокчейном в том, что касается большого числа микроплатежей - например, в 1 цент.

Микроплатежи в классических криптовалютах сталкиваются с высокими комиссиями и достаточно длительным временем подтверждения транзакций. В блокчейне верификация полностью отделена от пользователей, поэтому за подтверждение транзакций надо платить комиссии майнерам или держателям доли. В IOTA нет такого разделения, это полностью самоподдерживающаяся сеть, в которой нет майнеров, а пользователи сами подтверждают транзакции других пользователей.

Комиссии за транзакции внутри сети отсутствуют, что позволяет проводить микроплатежи в реальном времени, кроме того система бесконечно масштабируема.

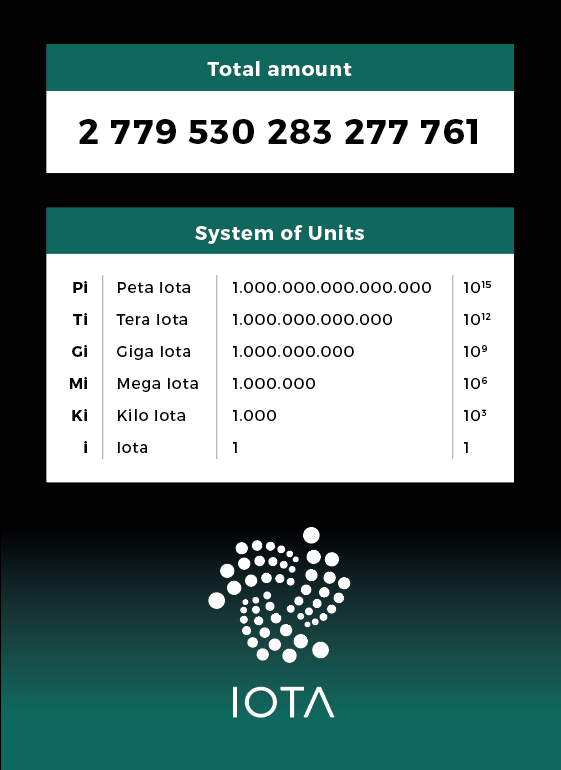

Все токены IOTA сгенерированы одновременно, всего в обращение запущено (3^33-1)/2 токена (около 2.78 квадриллионов). Такое количество обусловлено тем, что в первую очередь токены будут использоваться для проведения микротранзакций, к тому же такое число сочетается с величиной MAX_SAFE_INTEGER в Javascript.

Описание криптовалюты IOTA:

- Основана в октябре 2015 года как решение проблемы для Интренета Вещей - Internet-of-Things (IoT), т.к цена транзакций в блокчейне довольна большая и он не подходит для интернета вещей (от машины до лампочки)

- Комиссии за транзакции внутри сети отсутствуют, что позволяет проводить микроплатежи в реальном времени.

- Вместо блокчейна использует DAG – направленный ациклический граф.

- Всего в системе 2,779,530,283,277,761 Iota

- ICO / Crowdsale было в декабре 2015 года, собрали 1,337 bitcoin на разработку.

- Основатели David Sonstebo, Sergey Ivancheglo, Dominik Schiener, and Dr. Serguei Popov. Попов придумал, Сергей и Доминик закодили, Дэвид продвигает.

- Чем больше транзакция - тем быстрее они подтверждаются.

- С Марта по Июнь торговалась на своей бирже. в>

Криптовалюта проекта обменной сети для Интернета вещей. В ее основе лежит уникальный метод консенсуса Tangle. Основной особенностью последнего является отсутствие майнеров. Кроме того, в сети нет комиссий за транзакции — последние взаимно подтверждаются узлами сети.

Уникальность IOTA также заключается в том, что участники сети не делятся на пользователей и валидаторов транзакций. Каждый узел и отправляет, и подтверждает транзакции, которые не упаковываются в блоки (что отличает токены IOTA от подавляющего большинства остальных цифровых валют). Пропускная способность сети IOTA пропорциональна числу узлов и их активности.

Токены IOTA торгуются преимущественно на популярной гонконгской бирже Bitfinex. Примечательно, что другие торговые площадки пока не спешат включать в листинг эту инновационную криптовалюту. С другой стороны, постепенно IOTA завоевывает всеобщее признание. Так, в прошлом месяце специализирующийся на микроплатежах сервис SatoshiPay заявил о намерении отказаться от использования биткоина в пользу криптовалюты IOTA.

Если рассматривать глобальные перспективы новой криптовалюты, то они представляются достаточно интересными. Так, согласно исследованиям компании TechNavio, с 2017 по 2021 гг. совокупный среднегодовой темп роста глобального рынка интернета вещей (Internet of Things, IoT) будет составлять 4%. Это означает, что объем глобального рынка IoT достигнет 1,37 млрд долларов к 2021 году, при этом 81% процент прироста рынка обеспечат самые различные электронные гаджеты.

В последнее время криптовалюта IOTA демонстрирует уверенный рост и цена одного токена достигла $0,88. Рыночная капитализация IOTA преодолела отметку в $2 млрд.

Litecoin (LTC)

Litecoin (от англ. lite — «легкий», англ. coin — «монета») — форк Bitcoin, пиринговая электронная платёжная система, использующая одноимённую криптовалюту. После того, как на Litecoin была активирована поддержка Segwit решилась проблема масштабирования присущая Bitcoin(на данный момент в сети Bitcoin возможно произвести максимум 7 транзакций в секунду), что может вывести Litecoin на первое место по популярности среди криптовалют мира.

Litecoin является вторым после Namecoin форком Bitcoin и имеет лишь небольшие отличия от него. По состоянию на 19 мая 2017 года, 1 LTC эквивалентен 42 USD на бирже BTC-E и являлся шестой по величине суммарной стоимости криптовалютой.

Litecoin могут использоваться для обмена на Bitcoin или общепринятые деньги в обменниках, а также для электронной оплаты товаров/услуг у продавцов, готовых их принимать.

Для обеспечения функционирования и защиты системы используются криптографические методы.

Популярный форк биткоина, часто именуемый “цифровым серебром”. Лайткоин одним из первых активировал поддержку протокола SegWit. Впрочем, Litecoin и до активации Segregated Witness отличался значительно более быстрым временем подтверждения транзакций, чем тот же биткоин. В настоящее время проект продолжает активно развиваться под началом своего знаменитого создателя Чарли Ли.

На протяжении нескольких лет Litecoin находился “в тени” биткоина и других криптовалют, торгуясь в районе 3-4 доллара за монету. В марте текущего года, в преддверии имплементации SegWit начался стремительный рост цены “цифрового золота”. Сейчас цена Litecoin приближается к отметке в $50 за монету и, по мнению многих аналитиков, это далеко не предел. Криптовалюта представлена на большинстве бирж и обменных платформ, а также принимается многими компаниями в качестве платежного средства.

Максимальный объем предложения Litecoin ограничен 84 млн токенов и в данный момент на рынке обращается 52,4 млн LTC.

NEO

В ходе мероприятия в штаб-квартире Microsoft в Пекине в четверг, 22 июня, платформа цифровых активов Antshares, которую иногда также называют «китайским Ethereum» объявила о полном ребрендинге, а также представила амбициозные планы по дальнейшему развитию.

Antshares является первой блокчейн-платформой с открытым исходным кодом, разработанной в Китае, но теперь это название становится достоянием истории. Отныне проект будет известен как NEO [от греч. neos новизна, молодость].

Разработчики также подчеркнули преимущества своего кода смарт-контрактов, который будет поддерживать децентрализованную коммерцию, цифровую идентификацию и цифровизацию различных активов.

Символ ANS будет изменен на NEO в третьем квартале 2017 года, когда будет завершена работа над новым клиентом и пользовательским интерфейсом. В настоящий момент держатели ANS могут в своих кошельках автоматически генерировать Antcoins (ANC), которые будет использоваться в качестве газа.

Как отметил в своей презентации основатель NEO Да Хунфэй, будущее блокчейн-технологий подразумевает, что каждый актив будет программироваться при помощи смарт-контрактов. Представив концепции «умной экономики» и новой системы смарт-контрактов, Да Хунфэй также заявил, что в рамках платформы создается совместимый с другими блокчейнами протокол.

Платформу цифровых активов NEO (ранее известную как Antshares) часто называют «китайским Ethereum». Недавно представители проекта завершили о полном завершении ребрендинга. В частности, китайский стартап сообщил об апгрейде блокчейн-нод, обновлении технической документации, социальных медиа, официального сайта, изменении биржевого тикера, а также об успешном переходе к системе смарт-контрактов NEO 2.0.

Монета NEO уже длительное время демонстрирует впечатляющий рост, который позволил криптовалюте за небольшой промежуток времени занять 7-е рейтинга Coinmarketcap. Всего за последние три месяца цена криптовалюты выросла примерно в 20 раз и сейчас NEO торгуется в районе $45. Объем предложения NEO фиксирован и ограничен ста миллионами токенов, из которых в обращении на рынке находится 50 млн монет. Объем рыночной капитализации “китайского Ethereum” превышает $2 млрд.

Стоит также отметить, что проект очень активно развивается и уже наладил сотрудничество с известными блокчейн-стартапами, включая Bancor, Coindash и Agrello. Китайский блокчейн-стартап Red Pulse анонсировал создание платформы для финансовых исследований, которая будет построена на системе смарт-контрактов NEO 2.0. Также в сотрудничестве с проектом NEO разрабатывается операционная система на блокчейне под названием Elastos. Согласно заявлениям разработчиков, она предназначена для “изучения технологической ценности от применения блокчейн-приложений в новых интернет-ОС и дальнейшего развития Smart Economy”.

NEM (XEM)

NEM is a peer-to-peer cryptocurrency and blockchain platform launched on March 31, 2015. Written in Java, with a C++ version in the works, NEM has a stated goal of a wide distribution model and has introduced new features to blockchain technology such as its proof-of-importance (POI) algorithm, multisignature accounts, encrypted messaging, and an Eigentrust++ reputation system. The NEM blockchain software is used in a commercial blockchain called Mijin, which is being tested by financial institutions and private companies in Japan and internationally.

Это цифровая валюта получила известность в начале 2015 года. От многих других цифровых валют ее отличает оригинальный открытый код и ряд интересных новшеств. Например, в основе криптовалюты XEM лежит алгоритм POI (Proof Of Importance), модификация “proof-of-stake”. Однако в отличие от PoS, в POI помимо доказательства хранения некоторой суммы средств учитывается также активность пользователя — количество осуществленных им транзакций. Получение награды за блок в сети NEM называется «харвестинг».

В текущем году ожидается крупное обновление под названием Catapult, в ходе которого NEM перейдет с Java на C++. Новая версия приватной сети протестирована на устойчивую работу со скоростью до 3000 транзакций в секунду. Обновление произойдет сначала в приватном блокчейне Mijin, а затем в публичной цепи NEM.

Также на базе NEM разрабатывается новая платформа COMSA, которая предназначена для поддержки проектов в проведении ими прозрачных и упорядоченных ICO. По мнению представителей проекта, новое решение в значительной мере оптимизирует процесс привлечения инвестиций в цифровой валюте.

Капитализация XEM превышает $2 млрд. Монета популярна не только в своей родной Японии, но также активно торгуется на ряде крупнейших бирж, среди которых Poloniex и Bittrex.

Dash

Dash (ранее известная как Darkcoin и XCoin) — открытая децентрализованная платёжная система, использующая механизм под названием «Darksend» для того, чтобы сделать транзакции анонимными.

В 2015 году по рыночной капитализации у Dash было пятое место среди всех криптовалют.

Запуск криптовалюты, которая в то время называлась Xcoin, произошел 18 января 2014 года. С 28 января 2014 по 25 марта 2015 года криптовалюта носила имя Darkcoin.

Основные особенности криптовалюты Dash:

- транзакции анонимизированные благодаря механизму Darksend;

- используется комбинация из нескольких криптографических алгоритмов;

- майнинг Dash требует меньших, нежели у биткоина энергозатрат;

- решения о развитии системы принимают не отдельные программисты, а все члены сети Dash через механизм децентрализованного управления.

В сети DASH работают так называемые мастерноды — специальные узлы, обеспечивающие работу механизма перемешивания транзакций PrivateSend. Для стимулирования работы мастернод предусмотрено вознаграждение, которое составляет 50% от награды майнера за найденный блок. Также в системе DASH реализован сервис мгновенных транзакций InstantSend. Другой особенностью DASH является использование алгоритма хеширования X11.

У криптовалюты DASH есть множество сторонников. С момента своего цена криптовалюты выросла в несколько сотен раз и в настоящее время Digital Cash торгуется в районе $200.

Ethereum Classic (ETC)

Ethereum Classic (ETC) — блокчейн-криптоплатформа разработки децентрализованных приложений на базе смарт-контрактов с открытым исходным кодом. Представляет из себя децентрализованную Тьюринг-полную виртуальную машину, Виртуальную Машину Эфириума (EVM), которая может исполнять программы на публичных узлах сети. Ethereum Classic предоставляет валюту «Эфир» (Классический Эфир, Classic Ether, ETC), который может передаваться от одного участника сети другому и используется для оплаты вычислений, производимых публичными узлами сети, а также возможность создавать собственные цифровые активы (токены) на блокчейне Ethereum Classic. Эфир, оплаченный за произведенные вычисления, называется «Газ» (Gas). Газ служит не только для оплаты за произведенные вычисления, но и предотвращает DDOS-атаки на сеть.

Ethereum Classic появился как результат несогласия с принятым Ethereum Foundation «The DAO» хард-форком. Он объединил членов сообщества Ethereum, которые отвергли DAO Hard Fork на философских основаниях, которые были изложены в Декларации независимости Эфириум Классик. Люди, которые имели на балансе ETH до момента ДАО хард-форка (1900000 блок) получили столько же ETC после совершения хард-форка.

Ethereum Classic прошел техническую хард-форк, чтобы скорректировать внутренние цены для различных опкодов Виртуальной Машины Эфириума (EVM) 25 октября 2016, аналогично хард-форку, совершенному Ethereum неделей ранее. Целью хард-форка было более рациональное распределение оплаты ресурсоемких вычислений, что привело к ликвидации благоприятствующих условий для проведения атак, которые в течение месяца проводились на ETH и ETC. Хард-форк, проведенный в начале 2017 успешно отложил «бомбу сложности», заложенную в коде Ethereum с сентября 2015 с целью экспоненциально повышать сложность майнинга, процесса рассчета новых блоков сети. Следующий хард-форк запланирован на конец 2017 с целью изменить монетарную политику с неограниченной эмиссией на аналогичную биткойну.

Появившийся в 2016 году результате хардфорка “брат-близнец” Ethereum (ETH). Другими словами, эта криптовалюта представляет собой тот самый Ethereum, до хардфорка. Цель проекта заключается в сохранении оригинального Ethereum, децентрализованного, неизменного и неподвластного цензуре.

Год назад многие считали Ethereum Classic “мертворожденным”, однако это оказалось далеко не так. ETC до сих пор находится в списке топ-10 криптовалют по рыночной капитализации. Ярым сторонником Ethereum Classic является широко известный в мире криптоэнтузиаст и глава Digital Currency Group Барри Силберт. Во многом благодаря его усилиям криптовалюта ETC появилась в профессиональной компьютерной системе Bloomberg Terminal.

В целом же рост Ethereum Classic сильно активизировался весной 2017 года, после запуска Ethereum Classic Investment Trust. Дальнейший рост Ethereum Classic ожидает быть стабильным хотя бы благодаря взвешенной монетарной политике проекта, в которой предусматривается ограничение эмиссии и снижение награды за блок. В частности, общее число монет составит примерно 210 млн, но не более 230 млн; что касается награды за добытый блок, то она будет снижена на 20% после блока под номером 5 000 000 и будет снижаться на 20% в дальнейшем после каждых последующих 5 млн блоков.

Via forklog.com & wiki

Какойто крутой график с кучей информацией

Created/Updated: 25.05.2018

|

|