Все о едином налоге (инфографики), Ставки единого налога в 2018 году

Налоговый кодекс Украины (укр. Податковий кодекс України) — украинский закон, который регулирует отношения, возникающие в процессе установления, изменения и отмены налогов и сборов на Украине, определяет исчерпывающий перечень налогов и сборов, взимаемых на Украине, и порядок их администрирования, плательщиков налогов и сборов, их права и обязанности, компетенцию контролирующих органов, полномочия и обязанности их должностных лиц при осуществлении налогового контроля, а также ответственность за нарушение налогового законодательства.

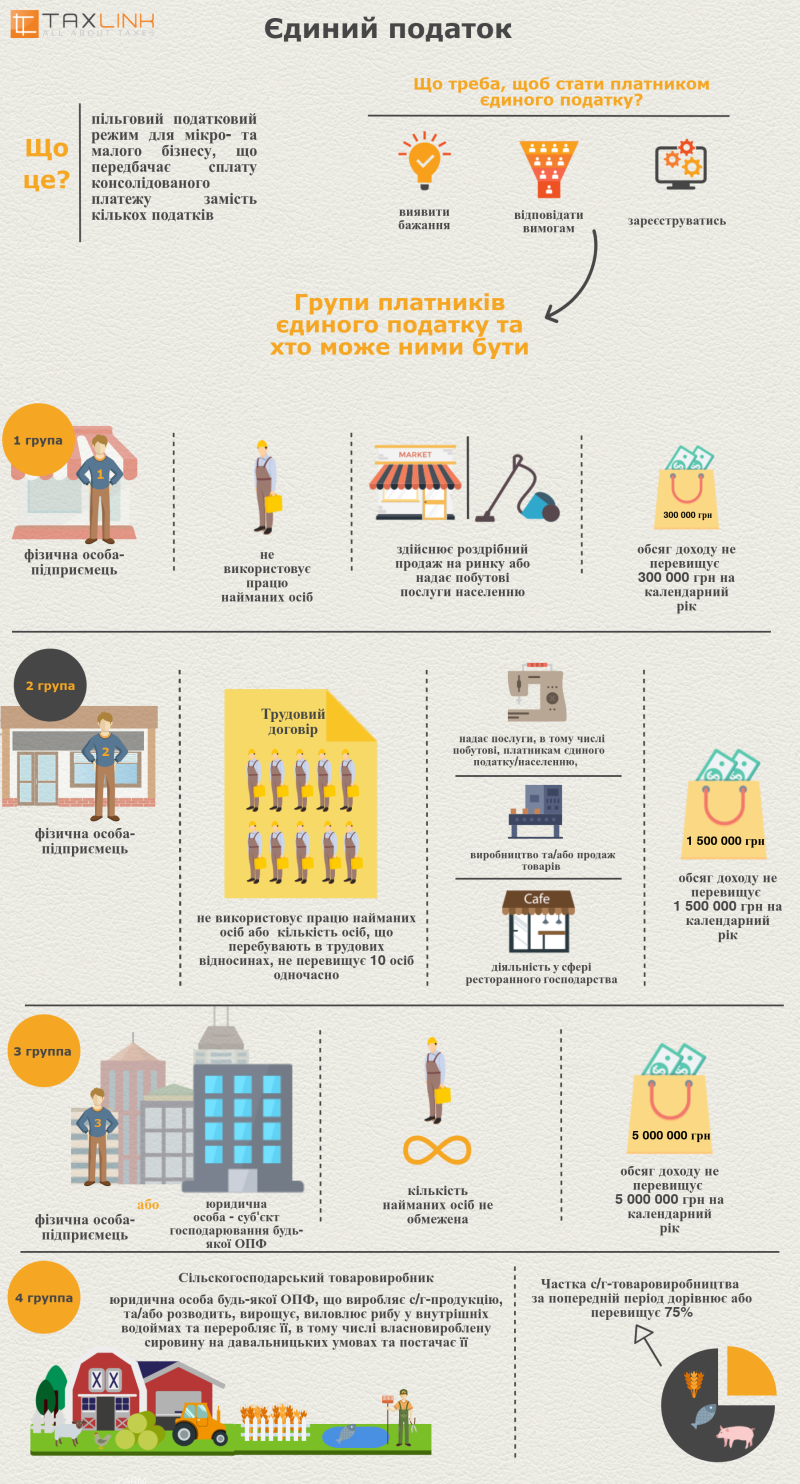

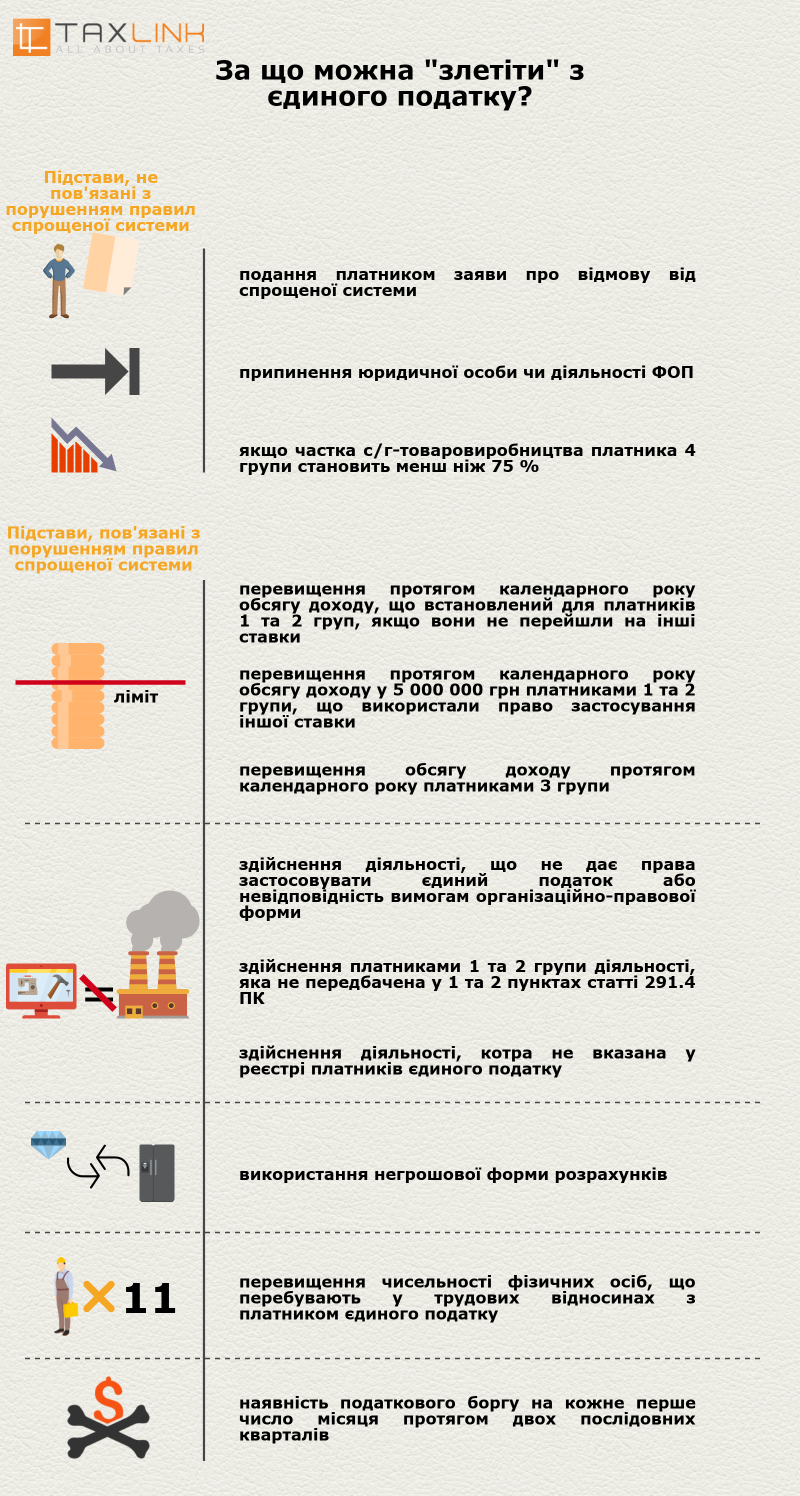

С принятием Налогового кодекса полностью меняется система налогообложения на Украине. Количество налогов уменьшается почти в два раза. Предусмотрено поэтапное, в течение нескольких лет, снижение базовых ставок по основным налоговым платежам. Вводится дополнительная ставка по налогу на доходы физических лиц, тем самым создается подобие прогрессивной шкалы налогообложения. Изменены «правила игры» для плательщиков единого налога. Так, из их числа с принятием налогового кодекса исключаются юридические лица, сужается круг видов деятельности, которыми позволено заниматься плательщиков единого налога, увеличиваются ставки налога. Также утрачивают силу нормативные документы, регулирующие порядок обложения налогами и сборами, которые вошли в налоговый кодекс, а также Закон № 2181, определяющий порядок администрирования налогов.

Против принятия налогового кодекса протестовали предприниматели, требования которых не были учтены при принятии документа. 22 ноября 2010 года в День свободы на Площади Независимости в Киеве предприниматели провели многотысячный митинг (по оценкам организаторов протестующих насчитывалось до 100 тысяч), который был объявлен бессрочным. Акцию поддержали во многих областных центрах (В том числе в Крыму, Донецке, Луганской области, Харькове).

Ставки единого налога в 2018 году

Проект бюджета Украины на 2018 год уже обнародован. И хотя он еще не утвержден, заложенные в документе социальные стандарты вряд ли изменятся.

«Минфин» посчитал, сколько и каких налогов нужно будет заплатить единщикам в 2018 году.

В проекте бюджета на 2018 год с 1 января предусмотрен прожиточный минимум для трудоспособных лиц на уровне 1762 грн, а минимальная зарплата (МЗП) – 3723 грн. Эти показатели важны, поскольку именно на их базе рассчитывается сумма единого налога.

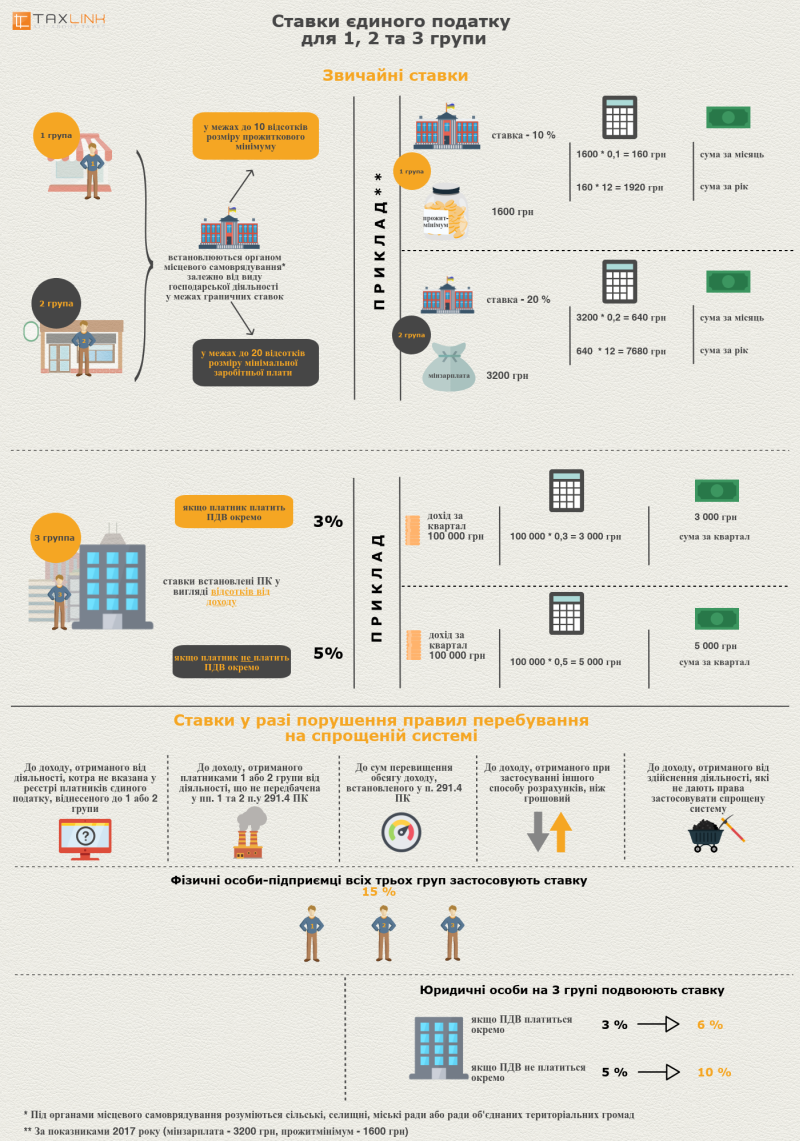

Ставки единого налога установлены п. 293.1 НКУ:

- для первой группы плательщиков единого налога - в процентах (фиксированные ставки) к размеру прожиточного минимума для трудоспособных лиц, установленного законом на 1 января налогового (отчетного) года (1762 грн);

- для второй группы – в процентах (фиксированные ставки) к размеру минимальной заработной платы, установленной законом на 1 января налогового (отчетного) года (3723 грн);

- третьей группы – в процентах к доходу (процентные ставки).

То есть фиксированные ставки единого налога устанавливаются сельскими, поселковыми и городскими советами для физических лиц – предпринимателей, осуществляющих хозяйственную деятельность, в зависимости от вида хозяйственной деятельности, из расчета на календарный месяц (п. 293.2 НКУ):

- для первой группы плательщиков единого налога – в пределах до 10% размера прожиточного минимума (то есть в 2018 году ставка единого налога будет не более 176,20 грн (1762 грн х 10%));

- для второй группы плательщиков единого налога – в пределах до 20% размера минимальной заработной платы (до 744,66 грн (3723 х 20%)).

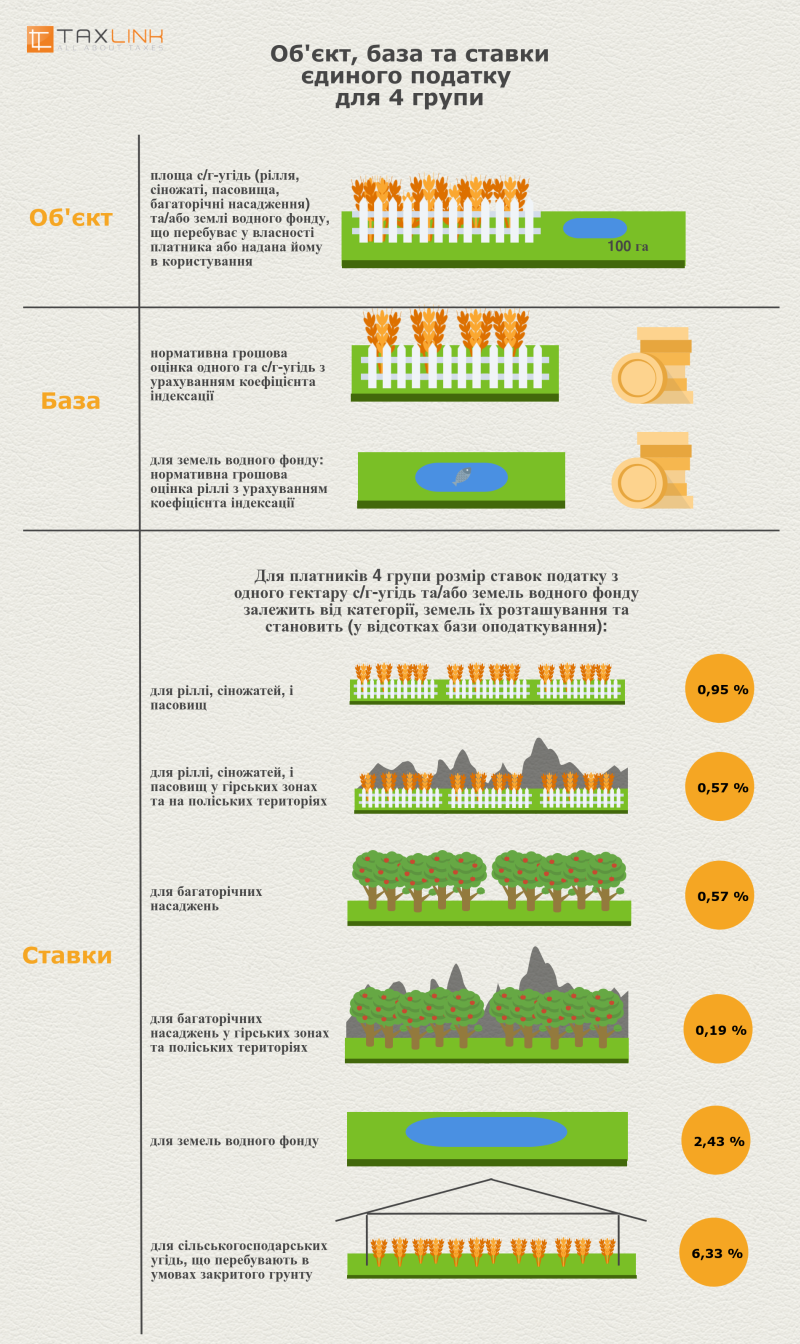

Ставки единого налога для четвертой группы установлены:

- для пашни, сенокосов и пастбищ (кроме пашни, сенокосов и пастбищ, расположенных в горных зонах и на полесских территориях, а также сельскохозяйственных угодий, находящихся в условиях закрытого грунта) размер ставок налога с одного гектара будет устанавливаться на уровне 0,95;

- для пашни, сенокосов и пастбищ, расположенных в горных зонах и на полесских территориях, – 0,57;

- для многолетних насаждений (кроме многолетних насаждений, расположенных в горных зонах и на полесских территориях) – 0,57;

- для многолетних насаждений, расположенных в горных зонах и на полесских территориях, – 0,19;

- для земель водного фонда ставка останется на уровне 2,43;

- для сельскохозяйственных угодий, находящихся в условиях закрытого грунта, – 6,33.

Единый социальный взнос

Размер минимального страхового взноса, как и ранее, будет зависеть от размера минимальной заработной платы (на 2018 год — 3723 грн).

То есть минимальный страховой взнос с 01.01.2018 г. будет составлять – 819,06 грн (3723 х 22%). А это означает, что с 1 января 2018 года, налоговая нагрузка еще увеличится:

- единщикам — работодателям придется не только пересмотреть оклады работников, но и осуществлять доплату по ЕСВ в размере не менее минимального страхового взноса (819,06 грн) при начислении зарплаты и других выплат работникам;

- увеличится и нагрузка на физических лиц – предпринимателей (ФОП), ведь со следующего года минимальная ежемесячная сумма ЕСВ «за себя» для них вырастет почти на 120 грн ежемесячно (в 2017 году эта сума составляла 704 грн).

Соответственно, можем посчитать, что минимальная сумма единого социального взноса (ЕСВ), которую нужно будет заплатить плательщикам единого налога в 2018 году – 9828,72 грн (обязательная ежемесячная сумма ЕСВ 819,06 грн х на 12 месяцев).

Напоминаем, что:

Все четыре группы, а также критерии пребывания на едином налоге остаются в 2018 году неизменными.

- Налогоплательщик не может быть плательщиком единого налога первой – третьей групп, если на день подачи заявления о регистрации плательщиком единого налога у него есть налоговый долг. Исключение — безнадежный налоговый долг, возникший вследствие действия обстоятельств непреодолимой силы (форс-мажорных обстоятельств) (пп. 291.5.8 НКУ).

То есть в случае подачи заявления о переходе на упрощенную систему налогообложения с даты госрегистрации для вновь созданного субъекта хозяйствования наличие налогового долга по любому другому налогу станет препятствием для получения статуса плательщика единого налога;

- при расчете общего количества наемных лиц у плательщика единого налога – физического лица не нужно учитывать работников, призванных на военную службу во время мобилизации, на особый период (пп. 291.4.1 НКУ);

- не могут быть плательщиками единого налога четвертой группы субъекты хозяйствования, осуществляющие деятельность по производству подакцизных товаров, кроме исключений указанных в пп. 291.51.2 НКУ.

Via taxlink.ua & wiki & minfin.com.ua

Created/Updated: 25.05.2018

|

|