- Цветы и растения

- Аквариум и рыбы

- Для работы

- Для сайта

- Для обучения

- Почтовые индексы Украины

- Всяко-разно

- Электронные библиотеки

- Реестры Украины

- Старинные книги о пивоварении

- Словарь старославянских слов

- Все романы Пелевина

- 50 книг для детей

- Стругацкие, сочинения в 33 томах

- Записи Леонардо да Винчи

- Биология поведения человека

Главная  Банковское дело Банковское дело  Книги Книги  Деньги и кредит - Иванов В.М. Деньги и кредит - Иванов В.М. |

Деньги и кредит - Иванов В.М.

8.2. Деньги и деловой цикл

Классическая количественная теория акцентирует основное внимание на продолжительных временных интервалах, учитывая, что реальный объем производства определяется такими долгосрочными факторами, как численность населения и производственные мощности. Конечно, экономисты классической школы прекрасно понимали, что реальный объем производства не остается постоянным в течение краткосрочных временных интервалов, и признавали, что темпы экономического роста ускоряются и замедляются в соответствии с некоторой нерегулярной схемой, известной как деловой цикл. Однако только в 30-е годы XX ст. новое поколение экономистов сконцентрировало свои аналитические способности на исследовании экономики в течение краткосрочных временных интервалов.

Типичный деловой цикл имеет четыре фазы развития. Во время фазы сжатия реальный объем производства падает. Сжатие, продолжающееся более полугода, принято называть спадом. В среднем после 18 месяцев цикл достигает нижней точки, называемой дном. В фазе расширения, которая в среднем длится 33 месяца, темпы экономического роста увеличиваются. И, наконец, цикл достигает пика, после которого фаза сжатия начинает новый цикл (рис. 12).

Рис. 12 Форма делового цикла

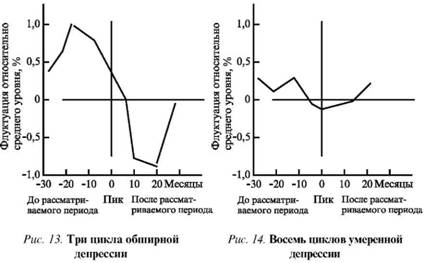

Вероятно, наиболее серьезная работа, исследующая роль денег и денежного обращения в деловом цикле, — это труд М. Фридмана и А. Шварц "История денежного обращения в США, 1867-1960 гг.". Ученые обнаружили закономерность, согласно которой темпы роста денежной массы, находящейся в обращении, изменяются по циклической схеме, упреждая общие тенденции развития делового цикла. Схема увеличения денежной массы в обращении определяет дальнейшее развитие делового цикла и констатирует, что количество денег, находящихся в обращении, достигает пика и начинает падать до высшей точки делового цикла. Аналогично количество денег, находящихся в обращении, достигает низшей точки и начинает увеличиваться до того момента, когда деловой цикл достигает дна. Из рис. 13 и 14 видно, что эта схема справедлива как для экспрессивных, так и для вялых деловых циклов за период с 1908 по 1961 г. исходя из имеющихся помесячных данных.

М. Фридман и А. Шварц установили взаимосвязь денег и деловых циклов, причем наиболее тесной она оказывается при замене реального объема производства номинальным ВНП. В пределах одного

делового цикла взаимная связь денежной массы и абсолютного уровня цен не является столь тесной, как при рассмотрении долгосрочных временных интервалов, на которых сосредоточивали свое внимание представители классической количественной теории денег и цен. Наоборот, события в пределах одного делового цикла можно описать следующим образом: начавшееся изменение в темпах роста денежной массы, находящейся в обращении, после некоторой задержки, обычно составляющей несколько месяцев, вызывает изменение в темпах роста номинального ВНП. Сначала значительная часть изменения в номинальном ВНП отражает изменения в реальном ВНП, т. е. изменения в реальном количестве товаров и услуг, производимых в рассматриваемой экономической системе. После задержки все более существенная часть изменений в номинальном ВНП, как оказывается, является изменением абсолютного уровня цен. В конечном итоге цены поглощают все большую часть влияния на экономику, обусловленную изменением темпов роста денежной массы.

Если темпы роста денежной массы, находящейся в обращении, замедляются, то соответствующие реакции номинального и реального ВНП, а также абсолютного уровня цен поменяются местами. Более низкий темп роста номинального ВНП сначала повлияет на реальный объем производства, а затем с некоторой задержкой и на темпы изменения абсолютного уровня цен.

Created/Updated: 25.05.2018

|

|