- Цветы и растения

- Аквариум и рыбы

- Для работы

- Для сайта

- Для обучения

- Почтовые индексы Украины

- Всяко-разно

- Электронные библиотеки

- Реестры Украины

- Старинные книги о пивоварении

- Словарь старославянских слов

- Все романы Пелевина

- 50 книг для детей

- Стругацкие, сочинения в 33 томах

- Записи Леонардо да Винчи

- Биология поведения человека

Главная  Банковское дело Банковское дело  Книги Книги  Грошово-кредитні системи зарубіжних країн - Іванов В.М. Грошово-кредитні системи зарубіжних країн - Іванов В.М. |

Грошово-кредитні системи зарубіжних країн - Іванов В.М.

6.3. Розвиток кредитної системи країни

Перші банки в Японії з'явилися ще до буржуазної революції 1868 р. Це були приватні контори обміну, які поєднували обмін з банківською справою. Але тільки після революції починає формуватися капіталістична кредитна система Японії.

Банківська система створювалася на основі законів про національні банки 1872 і 1897 р., згідно з якими організовувалися комерційні банки за типом банків європейських країн. Разом з приватними банками було створено державний емісійний банк та інші державні і напівдержавні кредитні інститути.

Вже до Першої світової війни одночасно зі збільшенням кількості банківських інститутів відбулося зосередження основної маси позикових капіталів у руках невеликої кількості банків. Після Першої світової війни процес концентрації банків посилився, особливо у зв'язку з банківською кризою у 1927 р. У результаті банкрутств і поглинання великими банками малих кількість банків у 1928 р. порівняно з 1918 р. зменшилася удвічі.

У подальшому процес концентрації банків відбувався відносно повільно, а в роки Другої світової війни різко активізувався внаслідок посилення державного контролю. Загальна кількість банківських інститутів з 327 у 1941 р. скоротилася до 125 у 1945 р.

Після Другої світової війни кредитна система розвивається по лінії як розширення кількості державних кредитних інститутів (крім державних кредитних інститутів, що існували раніше, — емісійного банку, ощадних кас, Бюро довірчих фондів міністерства фінансів, засновано два спеціальні банки — Японський банк розвитку та Експортно-імпортний банк, а також 10 фінансово-кредитних корпорацій), так і державного регулювання діяльності приватних інститутів, надання їм державою різноманітних послуг.

Однією з таких послуг є державне страхування кредитів, що їх надавали експортерам японських товарів приватні японські банки, промислові й торгові компанії. У Японії страхування таких кредитів покладено на міністерство зовнішньої торгівлі та промисловості. Безпосередньо функцію страхування виконують страхові компанії та комерційні банки за рахунок коштів держави, які надає їм назване міністерство. Японські експортери страхуються від усіх видів ризиків: політичних, комерційних, фінансових.

Кредитна система Японії складається з приватних, державних і кооперативних інститутів. За характером виконуваних функцій вони поділяються на емісійний (Банк Японії), комерційні банки і спеціальні ФКІ.

Банк Японії, заснований у 1882 р. як акціонерна компанія, є центром кредитної системи, емісійним банком країни; основним його акціонером є держава. Приватні акціонери не мають права брати участі у формуванні ради банку. Всі його члени призначаються урядом. Банк є державною установою.

Банк Японії здійснює всі властиві емісійним банкам функції, хоча в його діяльності на відміну від банків інших країн спостерігаються певні особливості. Характерним, наприклад, є те, що протягом 50— 60-х років його основним позичальником була не держава, а комерційні банки. Частка державних зобов'язань і кредитів уряду в активах Банку Японії скоротилася з 72,2 % у 1949 р. до 37,4 % у 1970 р., частка обліково-позикових операцій відповідно збільшилася. Така зміна в активах банку в цей період означала більш тісний зв'язок між його емісійно-кредитною діяльністю і процесом розширеного відтворення, що було викликано політикою обмеження інфляції в країні за рахунок усунення великого дефіциту державного бюджету в перші повоєнні роки.

Широке використання комерційними банками кредитів Банку Японії дає йому змогу ефективніше застосовувати при регулюванні грошового обігу і кредиту такий метод, як зміна ставки облікового відсотка. Система обов'язкових резервів, яку використовують з 1959 р., та операції на відкритому ринку теж відіграють важливу роль у механізмі грошово-кредитного регулювання.

Скасування в 1965 р. заборони на використання державних позик для покриття дефіциту державного бюджету відкрило шлях для фінансування дефіциту за рахунок емісії облігацій державних позик і сприяло тому, що основним позичальником Банку Японії знову стала держава. У 1982 р. облігації державних позик в його активах становили 78 %.

Функції Банку Японії визначено спеціальним законом у 1942 р., який у 1979 та 1998 р. модернізовано. Згідно із законом основний капітал банку встановлено у розмірі 100 млн єн (55 % капіталу належить державі, 45 % — приватним акціонерам: приватним особам, фінансовим інститутам, страховим компаніям та ін.). Акціонерам гарантовано дивіденди у розмірі 4 %. Решта прибутку надходить до державного бюджету.

Згідно із законом 1998 р. загальне та оперативне керівництво покладається на правління банку (за законом 1979 р. на чолі банку стояла політична рада), що складається з дев'яти осіб (до складу політичної ради входило сім членів), а політична рада скасовується. Голова та два його заступники призначаються Кабінетом Міністрів за згодою обох палат парламенту. Шість членів правління призначає Кабінет Міністрів з осіб, що мають певний досвід і знання у сфері економіки та фінансів (за законом 1979 р. — керуючий Банку Японії, уповноважені урядом міністр фінансів, представник планово-економічного управління та чотири представники найбільших монополій). Термін їхніх повноважень становить п'ять років (було чотири). На засіданнях правління в разі необхідності можуть бути присутні представники уряду (вони мають право подавати на розгляд правління свої пропозиції).

Банк Японії, штаб-квартира якого розташована в Токіо, має 45 філій і відділень у Японії, а також представництва у Нью-Йорку, Лондоні, Парижі, Франкфурті-на-Майні та в Гонконгу.

Банк має необмежену монополію на випуск банкнот. Основне його завдання — підтримувати цінову стабільність, щоб сприяти збалансованому розвитку національної економіки. Цього досягають завдяки розробці та проведенню відповідної грошово-кредитної політики, випуску готівки.

Банк Японії також забезпечує ефективне функціонування системи розрахунків між кредитними організаціями (інститутами).

Міністр фінансів затверджує бюджет банку. Двічі на рік банк через міністра фінансів звітує перед парламентом про грошово-кредитну політику, однак розробляє і проводить її як незалежна інституція, що передбачено законодавством.

У табл. 9 наведено сальдо основних рахунків Банку Японії у 1995— 1997 рр.

Таблиця 9

Сальдо основних рахунків Банку Японії *

млн єн

| Стаття | 1995 р. |

1996 р. |

Січень 1997 р. |

Лютий 1997 р. |

|

Активи Грошові позики |

23905 |

19834 |

19871 |

108400 |

|

Векселі куплені (у тому числі комерційні) |

104338 |

90407 |

57269 |

63066 |

Облігації державної позики (ОДП) |

375358 |

463422 |

424113 |

423856 |

Короткострокові урядові цінні папери |

162741 |

189596 |

150270 |

145135 |

Рахунки закордонних активів |

25309 |

29227 |

29440 |

29679 |

|

Пасиви Емісія банкнот |

462440 |

506710 |

436264 |

443712 |

Вклади фінансово-кредитних установ (інститутів) |

33101 |

34626 |

32718 |

34716 |

|

Поточні рахунки уряду |

497 |

744 |

832 |

554 |

* Вісник НБУ. — 1998. — № 4.

Виокремлюють такі основні напрямки діяльності Банку Японії:

• облік комерційних та інших векселів і боргових зобов'язань;

• надання позик під забезпечення векселів, боргових зобов'язань, державних облігацій та цінних паперів;

• купівля-продаж комерційних та інших векселів і боргових зобов'язань, державних облігацій та цінних паперів, а також інших облігацій;

• виписування векселів на отримання;

• приймання вкладів;

• операції у національній валюті;

• приймання на зберігання цінностей, купівля-продаж золота та срібла у зливках.

Банк Японії як фінансовий агент уряду управляє від його імені державними фондами, займається валютно-фінансовою діяльністю, спрямованою на стабілізацію валютного курсу єни. Кредити урядові надаються через підписку та андеррайтинг випусків державних позик і короткострокових державних цінних паперів.

Банк за згодою міністра фінансів може здійснювати купівлю-продаж валюти, надавати кредити або виконувати операції від імені іноземних центральних банків та інших організацій з метою розвитку співробітництва з ними, приймати від цих організацій вклади і здійснювати виправдані єнові інвестиції.

Банк Японії здійснює контроль за кредитною сферою і забезпечує стабільне функціонування системи платежів і розрахунків, надаючи кредитним організаціям кредити на обмежений строк.

Комерційні банки поділяються на міські та місцеві (регіональні). їх операції законодавчо регламентовані. Банк не має права розпочати свою діяльність без спеціальної ліцензії міністерства фінансів (умови реєстрації: відповідність капіталу, активів та пасивів, необхідний досвід роботи адміністрації, її певний соціальний статус). Банк повинен бути організований у формі акціонерного товариства і мати статутний капітал не менший 1 млрд єн. У його назві має бути слово "банк". Для відкриття відділень банку необхідний дозвіл міністерства фінансів.

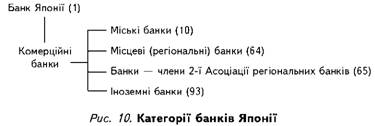

Категорії банків згідно із законодавством 90-х років наведено на рис. 10.

Міські банки — це 10 найбільших банків Японії. Вони зосередили понад 1/4 загального обсягу залучених депозитів. Ці банки надають близько 30 % позик. Міські банки мають розгалужену мережу філій (175 установ) у Японії та за кордоном. Кожен з них тісно пов'язаний з промисловими і торговельними компаніями. Вони є основними учасниками валютного ринку, постачальниками коштів у галузі економіки, що розвиваються швидкими темпами. Під їх контролем перебуває діяльність інших ФКІ.

Важливою ознакою японської економічної системи є наявність кейрецу, або промислової групи. Кожна кейрецу складається із стрижневої групи ФКІ (основа — міські банки та інші ФКІ), пов'язаної з групою промислових фірм, багато з яких торгують між собою. Кожний учасник групи є власником звичайних акцій інших членів. Міські банки підтримують фірми їх кейрецу при наданні позик і володіють значною часткою боргових зобов'язань цих фірм. Фінансова система Японії спрямовує кошти на найпродуктивніші інвестиції.

До 1990 р. до десяти найбільших банків світу входили сім міських японських банків, a "Dai-Ichi Kahguo" був першим у світі. Проте у 1997 р. "Bank of Tokyo Mitsubishi" (капітал 18585 млн дол.) посідав п'яте місце, "Sumitomo Bank' (14737 млн дол.) — дев'яте, a "Dai-Ichi Kahguo" (капітал 14458 млн дол.) — 10 місце.

Для міських банків характерні високий рівень перекредитування і залежність від Банку Японії, який здійснює урядову грошово-кредитну політику.

Місцеві (регіональні) банки — це здебільшого малі та середні за масштабом здійснюваних операцій банки, які можуть відкривати відділення та філії тільки в тій префектурі, де розміщується їх головна контора.

Отже, на основі досвіду розвитку банківської системи Японії можна виокремити такі характерні особливості комерційних банків:

• тісний зв'язок з промисловими і торговельними компаніями по лінії кредитування (частка позичкових ресурсів у сукупному капіталі японських компаній становить понад 80 %, у яких переважають кредити комерційних банків);

• високий ступінь концентрації капіталу і великі суми активів. (Станом на 1996 р. серед 100 найбільших банків світу — 26 японських, близько третини загальної суми депозитів 500 найбільших банків світу становить частка банків Японії.)

Created/Updated: 25.05.2018

|

|